US retailers are renegotiating with their Chinese suppliers to take advantage of lower manufacturing costs after China devalued the yuan. Earlier this month, China devalued its tightly controlled currency in an effort to boost growth and help flagging exports. The nearly two per cent cut will make imports from China cheaper. The Chinese currency is down 3.2 per cent versus the dollar so far this year.

Cheaper yuan gives retailers a chance to buy more with dollars, with a knock-on effect in other supplier nations eager to remain competitive. After China’s move, Vietnam devalued its currency by one per cent. Most US retailers have dollar-denominated annual contracts with provisions that allow them to renegotiate if the currency moves outside a pre-established range. Some retailers will reap benefits immediately by exercising those clauses while others expect to enter next year’s contracts with a stronger bargaining position.

Mexico, one of the largest trading partners of the US which rivals China in the global sourcing game, stands to benefit substantially more than others from the Chinese devaluation. Because the Mexican peso is down more than the yuan, buyers are more likely to start sourcing more from Mexico. Peso has depreciated 12.5 per cent so far this year. The Canadian dollar has fallen 12.1 per cent while the euro has slipped seven per cent year-to-date against the dollar.

China attractive for sourcing with yuan devaluation

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

CMAI FAB Show 2024 wraps up successfully, boosting textile industry

The Fabrics, Accessories & Beyond Show 2024 (FAB Show 2024), organized by the Clothing Manufacturers Association of India (CMAI), concluded... Read more

US retail sales on the rise, but fashion sector growth murky

American consumers are opening their wallets again, with retail sales experiencing a modest uptick in recent months. According to the... Read more

The Fast Fashion Conundrum: Profits soaring, sustainability stalling

The story of Shein's soaring profits in 2023 presents a fascinating paradox. While a growing number of consumers, particularly millennials... Read more

Wall Street and the Seduction of Sexy Calvin Klein Ads: Hype or performance boos…

The recent Calvin Klein campaign featuring Jeremy Allen White in his skivvies has set the fashion world abuzz. But can... Read more

Looming Iran-Israel conflict threatens to unravel global apparel trade

The already fragile global garment industry faces fresh challenges as tensions escalate between Iran and Israel. This adds another layer... Read more

Fabric Stock Services: A rising trend but not a replacement

The fashion industry is notorious for waste. Unsold garments and excess fabric often end up in landfills. Fabric stock services... Read more

CMAI’s FAB Show 2024 inaugurated with industry giants

The 4th edition of the Fabrics Accessories & Beyond Show 2024 (FAB Show), hosted by the Clothing Manufacturers Association of... Read more

Asian Apparel Exports: A tale of four tigers, one lagging behind

The apparel industry in Asia presents a fascinating picture of contrasting fortunes. While Bangladesh, Vietnam, and Sri Lanka have seen... Read more

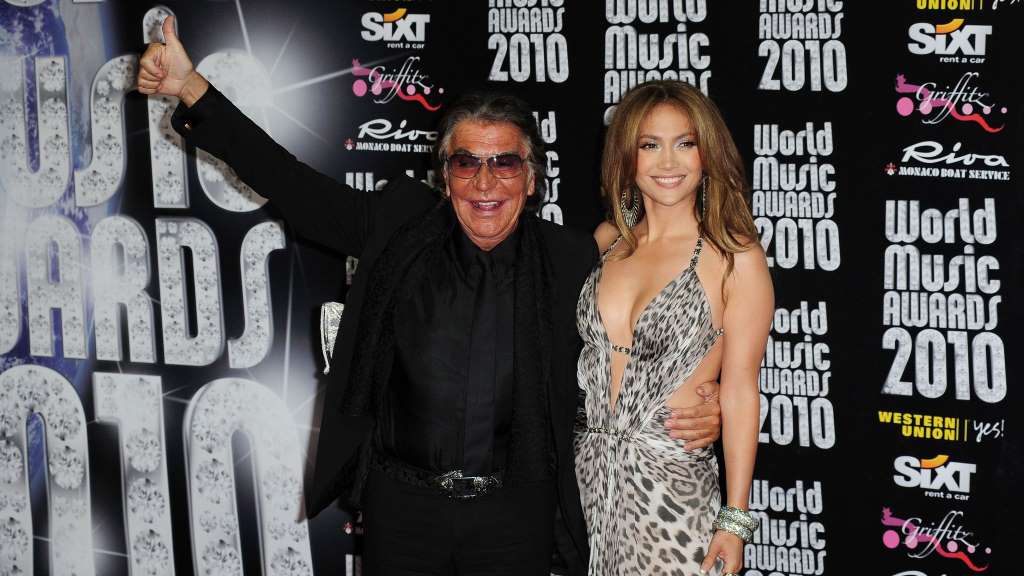

Roberto Cavalli: A legacy of bold prints and unbridled glamour

Roberto Cavalli, the iconic Italian designer who passed away on April 12, 2024, leaves behind a rich legacy. Cavalli was... Read more

Candiani & Madh unveil first regenerative cotton jeans

In a move towards sustainable fashion, Swedish denim brand Madh has partnered with Italian producer Candiani Denim to introduce the... Read more