The three day 2024 edition of Intertextile Shanghai Apparel Fabrics concluded on March 8th, marking a successful three-day run at the National Exhibition and Convention Center (NECC) in Shanghai. The event served as a premier platform for the apparel fabrics and accessories industry, attracting a global audience of professionals eager to explore the latest trends and forge new business partnerships.

A celebration of fabrics and fashion

The event kicked off with a grand opening ceremony, setting the tone for the bustling trade days ahead. Industry dignitaries, along with representatives from Messe Frankfurt (HK)., the event organizer, delivered speeches highlighting the importance of the exhibition as a platform for international collaboration and fostering the future of textiles.

Across the vast exhibition halls, attendees were treated to a comprehensive showcase of apparel fabrics and accessories. From classic materials like cotton, wool, and silk to cutting-edge technical textiles, the show offered a diverse range of options for Spring/Summer collections. Visitors were also introduced to the latest trends in color, texture, and embellishment, gaining valuable insights for the upcoming season. Visitors, including designers, buyers, and fashion professionals, were treated to a diverse range of products encompassing apparel fabrics, yarns, trims, and accessories.

Fringe events spark inspiration

Beyond the trade show floor, Intertextile offered a vibrant program of fringe events designed to inspire and educate attendees. Seminars featuring industry experts explored upcoming trends, sustainability initiatives within the textile industry, and the ever-evolving world of fashion technology. Additionally, live demonstrations and interactive workshops provided valuable insights into various textile techniques and design processes.

The events included trend forums where leading experts presented their insights on the upcoming Spring/Summer season's hottest trends in fabrics, colors, and textures. Seminars and workshops with educational sessions delving deeper into specific aspects of the textile industry, such as sustainable practices, advancements in fabric technology, and design processes. Networking events offered opportunities for attendees to connect with industry peers, build relationships, and explore potential collaborations. Awards ceremonies recognized excellence in fabric design, innovation, and sustainability within the textile industry.

The Intertextile Shanghai Apparel Fabrics concluded with a sense of optimism and excitement for the future of fashion. The event provided a valuable platform for trend discovery, business development, and fostering connections within the global textile industry. The next edition of Intertextile Shanghai Apparel Fabrics will be held in August 2024, showcasing the latest trends and innovations for the Fall/Winter season.

Pakistani textile manufacturers left their mark at the recently concluded Yarn Expo 2024, held in Shanghai from March 6th to 8th, showcasing their prowess in yarn production and innovation. The event served as a platform to showcase the country's prowess in yarn production and explore new business opportunities in the Chinese market.

Pakistani innovation on display

As many as 18 Pakistani textile companies made a strong impression at the Yarn Expo Spring 2024. The Pakistani contingent, representing a diverse range of textile manufacturers and suppliers, showcased their latest products and innovative technologies, attracting significant interest from global buyers. These companies unveiled their latest innovations in yarn production, with a focus on sustainability and high-performance fibers. For instance, Feroze 1888 Mills, in collaboration with a Danish firm, presented their eco-friendly yarn and fabric derived from corn. This bio-engineered product aligns with the growing global demand for sustainable textiles.

Positive impact on Pakistan-China trade

Pakistan's participation in Yarn Expo is expected to have a positive impact on its cotton and cotton yarn trade with China, a crucial market. The expo provided a platform for Pakistani manufacturers to connect with potential Chinese buyers and showcase the quality and diversity of their yarns. This can lead to increased export opportunities.

The event fostered interaction between Pakistani and Chinese businesses, potentially leading to new partnerships and collaborations. This could enhance technology transfer and improve production efficiency in the Pakistani yarn sector. In fact, Pakistan's cotton yarn exports to China have been steadily increasing. Yarn Expo 2024 is likely to further accelerate this growth.

Here's a glimpse into the recent trade trends

| Year | Pakistan Cotton Exports to China (million $) | Pakistan Cotton Yarn Exports to China (million $) |

| 2020 | 650 | 1200 |

| 2021 | 820 | 1550 |

| 2022 | 1020 | 1800 |

Hussain Haider, Consul General of Pakistan in Shanghai, while talking to China Economic Net highlighted the importance of Pakistan’s presence at the expo. He stated that it was a testimony to the rich textile heritage of the country and its commitment to innovation and quality. Pakistan’s textile industry has emerged as a leading exporter, generating $1.9 billion in annual exports, consolidating its position as the largest industry in the country, the Consul General pointed out. Pakistani textiles are known for their competitive pricing, making them an attractive option for buyers seeking quality products at affordable prices. This competitiveness is backed by the country’s skilled workforce, efficient manufacturing processes, and strong supply chain network.

Rohit Dev Sethi, Managing Director, ColossusTex

In the dynamic landscape of modern industry, the textile sector stands as a testament to human innovation and ingenuity. The evolution of textile machinery has been marked by continuous advancements that have not only revolutionized the production processes but also elevated the quality and efficiency of textile products. From the spinning jenny of the industrial revolution to the sophisticated automated systems of today, the textile industry has embraced innovation to meet the ever-growing demands of the global market.

The roots of innovative textile machinery can be traced back to the Industrial Revolution, a period characterized by the transition from manual labor to mechanized production. In the late 18th century, inventions like the spinning jenny and power loom paved the way for mass production, changing the face of the textile industry. The quest for increased productivity and efficiency became a driving force, setting the stage for a relentless pursuit of innovation in the centuries to come.

Revolutionizing spinning

One of the key areas where innovative ingenuity has made a significant impact is in the realm of spinning technology. Traditional spinning wheels have given way to state-of-the-art spinning frames equipped with advanced features like automatic doffing, electronic yarn clearers, and even artificial intelligence-driven quality control systems. These advancements not only enhance the speed and precision of the spinning process but also contribute to resource conservation and waste reduction.

Automation and robotics

In recent years, automation and robotics have become integral components of textile machinery. Automated systems handle tasks ranging from yarn processing and fabric cutting to stitching and finishing. The integration of robotics not only reduces labor costs but also ensures unparalleled accuracy and consistency in production. Robotic arms equipped with advanced sensors and machine learning algorithms are capable of performing intricate tasks, contributing to the overall efficiency and quality of textile manufacturing.

Digitalization and Industry 4.0

The advent of Industry 4.0 has brought about a paradigm shift in the textile manufacturing landscape. Digitalization and connectivity have given rise to smart factories where machines communicate with each other, providing real-time data and insights. Sensors embedded in textile machinery collect information on machine performance, production rates, and quality metrics. This data is then analyzed using artificial intelligence and machine learning algorithms to optimize processes, predict maintenance needs, and minimize downtime.

3D weaving and printing

In the realm of fabric production, 3D weaving and printing technologies have emerged as revolutionary innovations. Traditional flat weaving methods are being replaced by three-dimensional weaving techniques that allow for the creation of complex and customizable textile structures. 3D printing enables the production of intricate textile designs with minimal material waste, opening up new possibilities for fashion and technical textiles. These technologies not only offer creative freedom but also contribute to sustainable practices in the textile industry.

Environmentally conscious innovations

As sustainability becomes a focal point for industries worldwide, textile machinery manufacturers are developing innovations with a strong focus on environmental conservation. Energy-efficient machines, water-saving technologies, and eco-friendly materials are now at the forefront of textile manufacturing. Innovations such as dyeing processes that require less water, recycled fibers, and closed-loop systems for chemical management showcase the industry's commitment to reducing its environmental footprint.

Challenges and future outlook

Despite the remarkable strides in textile machinery innovation, the industry faces challenges such as high initial costs for adopting advanced technologies, the need for skilled technicians to operate complex machinery, and the potential displacement of traditional manufacturing jobs. However, these challenges are opportunities for further innovation and adaptation. The future of textile machinery holds the promise of even more sophisticated, sustainable, and interconnected systems that will shape the industry for years to come.

Innovative ingenuity has been the driving force behind the evolution of textile machinery, transforming the industry from its humble origins to a powerhouse of technological advancement. The integration of automation, robotics, digitalization, and sustainable practices has not only increased efficiency and productivity but has also positioned the textile sector as a leader in embracing cutting-edge technologies. As the industry continues to evolve, it is clear that the synergy between human creativity and technological innovation will shape the future of textile machinery, creating a world where precision, sustainability, and quality coexist in perfect harmony.

World's largest fashion retailer and owner of brands like Zara, Pull&Bear, and Massimo Dutti, Inditex reported its highest-ever profits in 2023. The retailer’s net profit surged by 30 per cent from the previous year’s €4.1 billion to €5.4 billion this year. This remarkable achievement was attributed to robust sales and the company's strategy of implementing price hikes.

Oscar Garcia Maceiras, attributes this rise in profit to the company's ability to capitalise on growth opportunities while maintaining profitability. During the year, Inditex’s sales grew by 10.4 per cent to €35.9 billion.

Inditex's stellar performance translated into impressive stock market gains, with its shares surging more than 40 per cent over the past year to reach €40. This surge in share value boosted the company's market capitalisation to over €127 billion.

Over the past decade, apparel imports by the United States from Bangladesh increased by 3.95 per cent despite a slight decline of 0.25 per cent in America's overall global sourcing, as reported by Bangladeshi apparel exporters.

During a recent virtual hearing held by the United States International Trade Commission (USITC), Faruque Hassan, President, BGMEA, stated, Bangladesh has experienced a 0.99 per cent increase in unit price over the past decade, whereas the global average unit price paid by the US has decreased by 0.04 per cent. This underscores Bangladesh's competitive edge in the market.

Chaired by David S. Johanson, Chairman, USITC, the hearing focused on various aspects including labor rights, labor laws, worker productivity, and wages in Bangladesh.

Tapan Kanti Ghosh, Senior Commerce Secretary briefed the hearing on the government's initiatives to improve workers' rights, particularly through amendments to labor laws. Initiated by a fact-finding investigation by the USITC, the hearing aimed to assess the export competitiveness of apparel industries in Bangladesh, Cambodia, India, Indonesia, and Pakistan, major clothing suppliers to the US market.

During the session, Hassan highlighted, while overall US apparel imports had declined by 2.45 per cent, imports from China had also dropped significantly by 4 per cent, creating an opportunity for Bangladesh to fill the gap. Bangladesh's apparel exports to the US market surged from $5.0 billion to $7.3 billion during this period. Moreover, despite a 0.20 per cent decline in global imports by the US in terms of quantity, Bangladesh experienced a growth of 2.93 per cent.

Acknowledging the challenges posed by rising production costs, particularly due to energy price hikes, Hassan explained Bangladesh's strategic shift towards investing in technology, machinery, and worker skills to enhance productivity and competitiveness. Despite a recent decline of over 36 per cent in Bangladesh's exports to the US in January 2024, the industry remains focused on optimising resources and reducing costs, he added.

Regarding imports of raw materials, Hassan mentioned that Bangladesh sources man-made fibers (MMF) from various countries including India, China, and Korea, but does not import cotton from China. H, Bangladesh's labor productivity is lower than that of some other countries like China, Vietnam, and Indonesia.

The recent resurgence in local cotton crop output during the outgoing kharif season by nearly 80 per cent bodes well for Pakistan's denim industry, which has been struggling in recent years.

Once a formidable force in global denim exports, Pakistan has seen a drastic decline in its denim export ranking, slipping from the fifth largest category to not even featuring among the top 15 by 2023.

Historically, Pakistan's denim exports have been vital to its textile and garment value chain, with major players like Soorty, Artistic, US Apparel, Siddiqsons, Sapphire, and Crescent dominating the landscape. These firms not only contribute significantly to denim manufacturing but also support a broader upstream value chain encompassing weaving, dyeing, finishing, spinning, and cotton farming.

However, the past five years have witnessed a staggering collapse in Pakistan's denim fabric exports. Between 2018-19 and 2022-23, export volumes plummeted nearly tenfold, from a peak of 492 million sq m to just over 62 million sq m. This decline was exacerbated by factors such as global trade disruptions due to lockdowns and a surge in raw material yarn exports driven by rising commodity prices.

While there was a brief shift towards exporting higher value-added denim garments directly to consumer destinations in the EU and North America, this did not offset the overall decline in denim exports. In fact, export earnings of the top 15 denim units dropped to $1.8 billion in 2022-23, marking a 17 per cent decrease from the previous year and the lowest in at least five years.

The dismal performance of the denim industry in 2022-23 is largely attributed to the catastrophic impact of the 2022 monsoon floods on the local cotton crop, resulting in the lowest output levels in half a century. This disaster severely hampered the industry's ability to meet demand and disrupted the entire supply chain.

Despite the challenges, the recent recovery in cotton crop output offers a glimmer of hope for Pakistan's denim industry. With concerted efforts to address supply chain disruptions and enhance competitiveness, there is potential for the industry to regain its footing and reclaim its position as a global denim exporter.

The Directorate General of Foreign Trade (DGFT) has granted an exemption to certain imported goods from quality control orders (QCOs) under the advance authorisation scheme. This exemption applies to items such as viscose staple fibre, but only on being used in products destined for export, not for the domestic market.

Initially covering QCOs from the Ministry of Steel and DPIIT, the exemption has now been extended to include those from the Ministry of Textiles. This decision follows a meeting where the Ministry of Commerce and Industry rejected a blanket exemption, opting instead for a sector-wise analysis and the formation of small committees to address concerns.

The recent notification specifies that the exemption is conditional on the imported goods being used solely for manufacturing export products. Export-oriented units (EOUs) and units in Special Economic Zones (SEZ) are also eligible for this exemption, provided they meet the pre-import conditions.

This move aims to alleviate the challenges faced by exporters in accessing specific input materials. Some buyers stipulate the source of materials, leaving exporters with limited options. Exemption from QCOs ensures smoother import processes, benefiting both exporters and suppliers.

The exemption process involves consultation with relevant ministries and the Bureau of Indian Standards (BIS), with safeguards in place to prevent misuse, such as penalties for non-compliance.

Earlier concerns raised by industry associations, particularly regarding the VSF QCO affecting viscose staple fiber imports, have prompted action. The recent notification is welcomed by textile industry representatives who believe it will enhance textile exports.

However, calls for similar exemptions for other products covered by QCOs, such as polyester fibre, highlight ongoing industry needs. The rationale behind QCOs is to regulate the import of inferior quality goods, primarily from specific countries like China and ASEAN nations.

Under the advance authorisation scheme, exporters must utilise imported input goods within 18 months, with penalties for non-compliance. Unutilised goods beyond this period must be destroyed, with additional financial obligations imposed on the authorisation holder.

Analysis of data from the US Office of Textiles and Apparel (OTEXA) indicates, Honduras emerged as the leading contributor among the top ten apparel suppliers to the US market in 2023. It was also the only top supplier to witness an increase in shipment value.

According to OTEXA, apparel imports by the US for the year ending January 2024 totaled 24.2 billion sq m equivalent (SME), marking a 21.0 per cent decrease compared to the previous year. Despite this, Honduras registered the most substantial increase of 27.5 per cent to 42 million SME in shipment volume compared to January 2023.

Furthermore, Honduras also experienced a 22.4 per cent rise in shipment value from $124 million in the year ending January 2023 to $152 million in the year ending January 2024. This positive trend positions the country as a noteworthy player in the apparel market, especially considering its small market share of 2.1 per cent in 2023, which had grown from 1.5 per cent in 2022.

Patricia Figueroa, Executive Director, Central America–Dominican Republic Apparel and Textile Council (CECATEC-RD), emphasised the significance of even a 1 per cent growth rate for sourcing countries in the Central American region. This growth is attributed to factors such as the proximity to the US market and the benefits derived from the Central America-Dominican Republic Free Trade Agreement (CAFTA-DR).

The attractiveness of Central American countries, including Honduras, as sourcing alternatives to China is reinforced by their speed to market advantage. With close proximity to the US and efficient transportation routes, these countries offer agility in supply chain operations, aligning with the preferences of fashion brands and retailers.

Renowned German sportswear giant, Adidas encountered a significant setback as it posted its first annual loss in over three decades. This downturn is largely attributed to challenges in the North American market, where sales are anticipated to decline once more due to high inventories plaguing sportswear retailers.

The company has been grappling with the aftermath of severing ties with Kanye West in October 2022, a move that led to the suspension of sales for the highly lucrative Yeezy sneaker line. However, under Bjorn Gulden's CEO leadership, Adidas initiated the clearance of remaining Yeezy stock while focusing on revitalising popular products such as the Samba and Gazelle shoes, along with efforts to strengthen partnerships with retailers. This strategy led to a recovery in Adidas' shares, outperforming competitors like Nike and Puma since Gulden assumed his role.

Expressing cautious optimism, Gulden acknowledges, though Adidas’ performance fell short of expectations in 2023, the brand showed improvement over the course of the year. Yet, its sales in North America are projected to decline by approximately 5 per cent this year, reflecting ongoing challenges with demand and inventory management in the region.

In 2023, Adidas managed to reduce its inventories by €1.5 billion, marking a 24 per cent decrease primarily through clearance sales at outlet stores. However, the company faces additional hurdles such as shipment delays caused by the Red Sea crisis, which could potentially impact working capital if disruptions persist.

Despite the broader decline in consumer interest in sportswear, Adidas remains optimistic about reclaiming market share from competitors. Excluding the Yeezy line, the company anticipates an improvement in its underlying business in 2024, targeting a growth rate of at least 10 per cent in the latter half of the year.

A shift towards low-rise suede sneakers like the Samba and Gazelle has contributed to Adidas' resilience, with footwear sales growing by 8 per cent in the fourth quarter despite a 13 per cent decline in apparel sales. Notably, the company has observed a reduction in the need for discounted sales, indicating a strengthening brand appeal under Gulden's leadership.

In China, Adidas expects sales to to grow at a double-digit rate following an 8 per cent increase in 2023. However, the fate of the remaining Yeezy products remains uncertain, as the company adopts a cautious approach by selling them.

The 2024 F/W Seoul Fashion Week, held at both Dongdaemun Design Plaza (DDP) and Seongsu S Factory from Feb 01-05, 2024 concluded with 1,179 negotiations resulting in contracts totaling $5.63 million. Several significant business meetings took place for K-fashion brands at the fashion week, laying the groundwork for their expansion overseas.

According to the Seoul Metropolitan Government, this is a notable 9.5 per cent increase compared to the previous season. The city government credits this success to its focused approach on three main objectives: enhancing the potential for global expansion, increasing overseas order intake, and diversifying venues.

Looking ahead, the 2025 S/S Seoul Fashion Week is scheduled from Sep 03-07. 2025. Building upon the insights gained from the recent event, the SMG aims to better prepare for the latter half of the fashion week, aiming to provide even more valuable sales opportunities for K-fashion brands looking to penetrate the global market.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

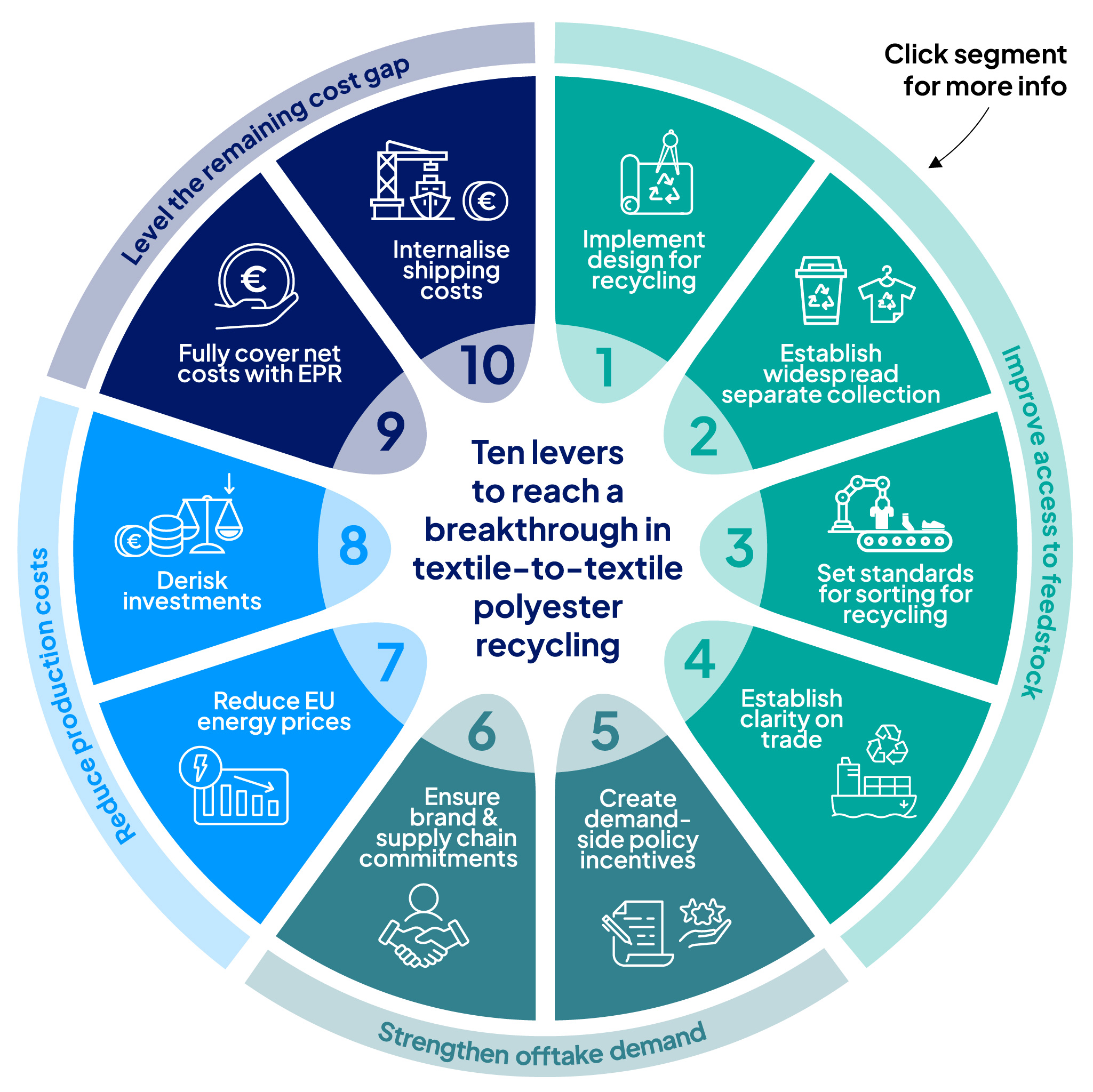

Europe's Textile Waste Mountain: New report reveals 10-Point plan, sparking deba…

Europe is grappling with a colossal textile waste problem. Over 125 million tonnes of raw materials are devoured by the... Read more

China Weaponizes Subsidies: A strategic play for textile dominance amidst global…

Despite the narrative of a global apparel pivot away from China, the reality on the ground paints a different picture.... Read more

Shift in fashion's value proposition, can speed and sustainability coexist?

Expanding on the recent LinkedIn post by Lubomila Jordanova, CEO & Founder of Plan A and Co-Founder of Greentech Alliance,... Read more

Gartex Texprocess India 2025 kicks off in Mumbai with global focus

The 2025 Mumbai edition of Gartex Texprocess India opened its doors at the Jio World Convention Centre on May 22,... Read more

EU Horizon T-REX project data reveals challenges for textile-to-textile recyclin…

A new report from the EU Horizon T-REX (Textile Recycling Excellence) Project, while focused on piloting a data model to... Read more

Source Fashion to showcase global ethical sourcing solutions in July 2025 editio…

Source Fashion, the UK’s leading responsible sourcing show, is set to return from 8-10 July 2025 at The Grand Hall,... Read more

CHIC September 2025 to return in Shanghai with ‘Fashion Picnic’ theme

China’s leading fashion trade event, CHIC 2025 (September), will return to the National Exhibition and Convention Center in Shanghai from... Read more

US consumer confidence dips amidst economic uncertainty

In April 2025, the US consumer sentiment recorded a shift as confidence levels dipped, indicating potential headwinds for the economy.... Read more

Secondhand on the rise in Europe as it readies for a €26 bn fashion revolution b…

Across Europe, pre-owned garments are shedding their ‘used’ label and stepping into the spotlight as a mainstream force. A new... Read more

India-Bangladesh Trade in Turmoil: Retaliatory measures threaten regional commer…

The burgeoning trade relationship between India and Bangladesh has hit a turbulent patch, marked by a series of retaliatory trade... Read more