With the courtesy of the Fashion Design Council of India's (FDCI) international designer initiative, "Measure”, Lakme Fashion Week stage witnessed a groundbreaking showcase on Day 4." Hailing from the Republic of Dagestan, Russia, designer Zainab Saidulaeva, captivated the audience with her collection titled "TOi."

Dagestani heritage meets modern fashion on the runway

Saidulaeva's collection served as a bridge between centuries, drawing inspiration from the rich tapestry of Dagestani wedding customs and historical attire. This unique blend of tradition and modern design translated into exquisite pieces that incorporated layering, rich textures, and a captivating play on black and white tones using luxurious silks. The collection wasn't just about fashion; it was a celebration of Dagestani culture, with many models gracefully adorned in traditional headwear.

Measure: A rising star in Modest Fashion

Beyond "TOi," Saidulaeva's label, Measure, is making waves in the world of modest fashion. The brand, known for its focus on cultural harmony and a balance between heritage and contemporary style, has already garnered significant recognition. Measure boasts its own multi-brand concept store, "Others," in Moscow, and has graced the prestigious Moscow Fashion Week runways. Their designs have also been featured in prominent global fashion publications.

"A mesmerizing journey into the heart of culture"

Saidulaeva expressed her delight at showcasing "TOi" at Lakme Fashion Week, highlighting her inspiration from Dagestan's rich customs and garments. She emphasized the beauty of multi-layered silhouettes and the versatility of silk in her creations.

FDCI fosters global collaboration

Sunil Sethi, Chairman of FDCI, echoed the sentiment of a remarkable convergence. He lauded the participation of Measure in this international initiative, acknowledging their valuable contribution to pushing the boundaries of fashion. The Lakme Fashion Week presentation marked a significant moment, not just for Saidulaeva and Measure, but also for the growing prominence of modest fashion on a global scale.

A Finnish company specialising in the production of recycled textile fibers, Infinited Fiber Company has successfully concluded a significant €40 million series B financing round. This funding is pivotal for the company as it aims to expand the production of its innovative Infinna fiber, which is derived from cotton-rich and cellulose-containing waste materials.

Demonstrating their commitment to sustainability, notable fashion brands joined the funding round as new investors. Some of these included, Inditex Group, the parent company of renowned brands like Zara, and TTY Management, a private asset management firm owned by Tadashi Yanai, the founder and president of Fast Retailing, which includes brands such as Uniqlo and Comptoir des Cotonniers.

Additionally, two prominent outdoor and sports clothing producers, Youngone and Goldwin, participated in the second part of the financing round, contributing to a total raise of €27 million for Infinited.

The initial phase of the financing round was completed in September 2023, attracting investments from existing backers such as H&M Group, Adidas, Bestseller, and Zalando. Following the conclusion of the second part of the round, major shareholders in Infinited now include Inditex, TTY Management, and H&M Group.

Falk Müller-Veerse, Partner, Bryan, Garnier & Co who spearheaded the financing round, emphasised the significance of this deal against the backdrop of impending changes in the fashion and textile industry. He pointed out, with the introduction of new European regulations the demand for sustainable fibers in Europe is projected to triple by 2030.

Bryan, Garnier & Co. led the financial transaction, with analysts foreseeing a substantial increase in global demand for sustainable textiles by 2030, estimating the addressable core market to be approximately €66 billion.

Developed at its Espoo headquarters, Infinited Fiber's solution revolves around chemical recycling. By utilising textile waste and cellulose-rich materials like paper, board, and certain agricultural residues, the company transforms them into 100 per cent circular textile fibers that mimic the look and feel of cotton.

The quality and market potential of these fibers have been validated through long-term purchase agreements, with Inditex alone committing to a contract exceeding €100 million.

After a strong year in 2022, China's fashion industry suffered in 2023 due to weak domestic consumption. This is a double blow for China, which has been shifting its textile industry focus from exports to the domestic market in recent years. The country’s textile and apparel industry is facing several headwinds especially in the export market.

Challenges in the export market

Increased competition: Chinese manufacturers are facing more and more competition from each other domestically, as well as from countries like Vietnam. This is due to a combination of factors, including rising labor costs in China and trade tensions between China and the United States. This competition extends to raw materials like cotton, with almost all Chinese cotton coming from Xinjiang, a region facing controversy over alleged forced labor practices.

Rising shipping costs: The ongoing Red Sea crisis has led to higher shipping costs for Chinese companies exporting to Europe. While the impact is less severe than during the pandemic, it still adds an additional burden to exporters.

Shein's disruption: The rise of Shein, a major online fashion retailer known for its low-cost clothing, has captured market share from traditional Chinese manufacturers. While Shein's focus on small and medium-sized runs differs from traditional manufacturing processes, it raises concerns about the perception of Chinese-made clothing.

Trade tensions: The US-China trade war over allegations of forced labor in Xinjiang, a major cotton-producing region in China, have led to boycotts of Xinjiang cotton and concerns about the ethical sourcing of materials.

However, the Chinese government is prioritizing industrial development, allocating funds to support manufacturing and technological innovation to manage the challenges. This shift in focus away from the struggling real estate sector could benefit the textile industry. Also, Chinese manufacturers are now focusing on new markets. China is strengthening trade ties with Russia and other emerging markets, which could help offset some of the decline in exports to Western countries.

Trends that emerged at Intertextile Shanghai Apparel Fabrics

Interestingly, the just concluded Intertextile Shanghai Apparel Fabrics, threw up some interesting trends on the Chinese market. It highlighted, the sportswear sector is a bright spot in the Chinese textile and apparel industry, with growing demand for functional outdoor and sportswear fabrics . This trend is reflected in the increased focus on sportswear fabrics at trade fairs like Intertextile. Also, different Chinese cities are competing with each other to attract investment in the textile industry, with some regions specializing in certain products.

In short, the Chinese textile and apparel industry is facing a number of challenges, both domestically and in the export market. However, the government is taking steps to support the industry, and there are some positive trends, such as the growth in sportswear. The future of the industry will likely depend on China's ability to address these challenges and adapt to changing market conditions.

Textile company Spinnova anticipates a downturn in revenues for the year 2024, with operating profits expected to remain in the negative territory.

In the preceding year of 2023, the company experienced a significant decline in profits, dropping by 59 per cent Y-o-Y to €20.9 million, while total investments plummeted by 47 per cent Y-o-Y to €8.96 million.

The latter half of 2023 was particularly challenging, with a 89 per cent decrease in revenue to a mere €1.82 million, coupled with an operating loss of €9.93 million, marking a 34.5 per cent decrease. Total investments by the company also nosedived by 67 per cent to €2.9 million.

By the end of 2023, Spinnova boasted a workforce of 76 employees, adding one member throughout the year. Notably, the company successfully completed the construction of the inaugural factory dedicated to producing wood-based Spinnova fiber, a venture undertaken in collaboration with Woodspin.

During the year, Spinnova underwent significant leadership changes, with Kim Poulsen stepping down as CEO and Tuomas Oijala assuming the role.

Expressing his perspective on the challenges and opportunities ahead, Oijala emphasised the company's ongoing efforts to escalate production volumes of Spinnova fiber and introduce it into various market applications through collaborative efforts with supply chain partners and brands. He highlighted the significance of prevailing macroeconomic trends, global fiber supply chain limitations, and the imperative for the textile industry to meet sustainability targets as driving forces propelling Spinnova forward.

The Cotton Association of India (CAI) has increased its export projections for the current season to 22 lakh bales, with the potential to reach 25 lakh bales. This uptick in estimates underscores India's growing influence in the global cotton trade, driven by competitive pricing and heightened demand from key markets such as Bangladesh, China, and Vietnam.

During the initial five months of the season, India’s cotton exports matched the entirety of the previous marketing season, totaling 15 lakh bales. The primary destinations for these shipments are Bangladesh, China, and Vietnam.

Indian cotton prices were notably lower by approximately Rs 4,000-5,000 per candy compared to international prices, particularly from December to February, which attracted overseas buyers. Cotton imports amounted to 4 lakh bales, while consumption was estimated at 137.50 lakh bales by the end of February. Projections for stocks with mills and various entities indicate a relatively tight balance sheet.

CAI has revised the cotton production estimates for the ongoing 2023-24 marketing season upwards by approximately 5 per cent to 309.70 lakh bales, although still below the previous season's production of 318.9 lakh bales.

Adjustments in crop estimates across various states including Rajasthan, Gujarat, Maharashtra, Telangana, and Karnataka have contributed to this increase.

Estimates for cotton consumption for the 2023-24 season has been raised by 6 lakh bales to 317 lakh bales due to increased offtake by domestic mills.

Closing stocks for the season ending September 2024 are forecasted at 20 lakh bales, signaling a very tight balance sheet.

The substantial growth in Indian cotton exports for the 2023-24 season, fueled by competitive pricing and robust demand, represents a significant milestone for the country's textile industry.

Turkish denim brand Mavi's latest collection pays homage to the iconic '90s era and the laid-back Californian style. The Spring/Summer 2024 collection embodies the natural beauty and relaxed lifestyle of Los Angeles, says Alissa Friedman, Senior Marketing and PR Manager, Mavi.

Focusing on responsibility in design, the All Blue sustainable collection is meticulously crafted with a deep-seated regard for both people and the planet. The range features various denim styles and wardrobe essentials. Mavi has embraced more recycled and natural fibers and repurposed fabrics for the collection to minimise its ecological footprint, elaborates Friedman.

Committed to elevating its ecological efforts, Mavi has established sustainability targets across four pillars (people, planet, product, and community) as part of its strategic vision. The brand aims to achieve a fully inclusive and responsible value chain by 2030, become a climate-positive entity by 2050, ensure all denim collections consist of sustainable All Blue products by 2030, and drive impactful and measurable social change within communities.

For the S/S '24 season, the brand expands its Recycled Blue collection to include men's styles. Utilising Tencel with Refibra technology, Recycled Blue fabrics breathe new life into pre- and post-consumer cotton textiles by upcycling them. Mavi had introduced this collection for women last year, with men now offered new styles like the Jake slim and Marcus slim straight.

In alignment with utilising the most sustainable materials, Mavi's Well Blue collection incorporates a bamboo and cotton blend, offering a soft hand feel while maintaining the classic denim's lightweight structure. Additionally, another collection utilises recycled linen, a low-impact natural flax fiber that requires no additional irrigation to grow and is biodegradable, providing gentle wear on the skin.

Introducing a natural approach to color, Mavi's new No-Dye Colored Cotton collection features cotton grown using eco-friendly regenerative farming techniques, resulting in fibers that naturally retain color. Available in a sandy hue, this cotton is fashioned into styles like the Paloma wide-leg for women and Jake slim leg for men.

These new sustainable collections blend mindful materials with thoughtful designs, says Friedman. They range from $118 to $168 and are currently available on Mavi's website.

Exporters spanning various sectors have united to appeal for exemption from a recently introduced regulation mandating payment of pending bills to micro and small units within 45 days.

Approximately 150,000 exporters, encompassing 15 export promotion councils including the influential Federation of Indian Export Organisations, have raised concerns regarding the potential liquidity strain this regulation may impose.

Exporters argue that their payment cycle, with an average lag time of 120 days, clashes with the newly imposed 45-day deadline. They contend that this longer payment duration is necessary for international competitiveness, especially considering that other countries often offer more lenient credit terms. The Reserve Bank of India's allowance of up to nine months to realiSe export proceeds underscores the complexities involved.

Section 43B(h) of the Income Tax Act, slated to take effect on April 1, necessitates payments to UDYAM-registered micro and small entities within the 45-day timeframe, ostensibly to tackle the issue of delayed payments encountered by such units. However, exporters are lobbying for an extension to 120 days and propose that transactions with micro, small, and medium enterprises (MSMEs) be excluded from this provision.

Defined by investment and turnover thresholds, micro and small units are pivotal in the supply chain for many exporters. The new rule would necessitate interest payments in the event of delayed payments to these units, further exacerbating exporters' liquidity challenges. Some exporters even fear losing business and facing returns due to the added financial strain.

Acknowledging the need to enhance liquidity for micro and small companies, exporters advocate for a phased reduction in the payment timeframe. They argue that this would strike a balance between the interests of both exporters and MSMEs.

Moreover, they stress the importance of exempting export-related transactions from this regulation to maintain competitiveness on the global stage.

In 2023, the total clothing imports by EU member countries declined by 16.22 per cent to €83.19 billion compared to €99.29 billion in 2022.

According to the data from the Statistical Office of the European Union, this downturn in imports can be attributed to a slowdown in apparel retail sales across EU countries, largely influenced by high inflationary trends.

Specifically, garment imports by the EU from China decreased by 21.54 per cent, to €22.73 billion in 2023 compared to €28.98 billion in 2022. Similarly, apparel imports from Bangladesh dropped by 20.65 per cent to €17.39 billion in 2023, from €21.91 billion in the previous year.

In terms of volume, EU’s clothing imports from Bangladesh reached 11.14 billion kg in 2023, slightly surpassing China's exports, which stood at 11.10 billion kg.

Furthermore, apparel imports from Turkey experienced declined by 13.23 per cent, to €9.93 billion in 2023 compared to €11.45 billion in 2022. Imports from India also decreased by 13.12 per cent to €4.04 billion in 2023 while apparel imports from Vietnam fell by 14.68 per cent to €3.78 billion in 2023 compared to €4.43 billion in 2022.

Gucci-owner Kering has forecasted a significant drop of approximately 20 per cent in Gucci's sales for the first quarter, citing a sharper decline than anticipated in the Asia-Pacific region. This setback further widens the gap between the French luxury conglomerate and its primary competitors.

Owned by the billionaire Pinault family, Kering has grappled with staying abreast of competitors like LVMH and Hermes International, particularly as luxury sales cooled off in the past year, notably in China. LVMH's diverse brand portfolio and Hermes's enduringly long waiting lists for coveted handbags have bolstered these companies' resilience.

According to analysts at Vital Knowledge, Gucci has been facing internal challenges for several quarters, but this latest update will amplify concerns regarding consumer spending and the state of China's economy.

Overall, Kering’s comparable sales are anticipated to decline by about 10 per cent i across its portfolio. This includes esteemed labels such as Balenciaga and Saint Laurent.

Gucci's sales declined during the closing months of the previous year as the brand grappled with attracting more affluent shoppers to its high-priced Double G belts and Princetown slippers. A year ago, Sabato De Sarno was appointed as the brand's new designer.

The Cellulose Fibres Conference 2024 held in Cologne on 13-14 March, emerged as a testament to the remarkable strides in the cellulose fibre industry, showcasing innovative projects and scale-ups across various sectors. Hosted against the backdrop of an evolving policy landscape geared towards reducing single-use plastics, the event spotlighted the pivotal role of cellulose fibres in addressing sustainability challenges within the textile industry.

Exploring the innovation landscape

The conference featured 40 international speakers who delved into the latest market trends and highlighted the vast innovation potential of cellulose fibres. Discussions encompassed diverse applications ranging from textiles and hygiene products to construction and packaging. Notably, experts introduced cutting-edge technologies for cellulose-rich raw material recycling and shed light on circular economy practices.

Interactive sessions and networking opportunities

Attendees actively engaged in panel discussions, fueling insightful exchanges and fostering collaboration. The event, attended by 214 participants and 23 exhibitors from 27 countries, provided a dynamic platform for networking and forging new industry connections. Asta Partanen from the nova-Institute, which curated the conference content, expressed satisfaction with the positive feedback received, underlining the event's comprehensive focus and conducive atmosphere.

The highlight of the conference was the presentation of the "Cellulose Fibre Innovation of the Year" Award, an accolade celebrating innovative advancements in sustainable fibre solutions. The award, sponsored by GIG Karasek, showcased exceptional innovations poised to drive the industry towards sustainability.

Innovation Award winners

First - DITF & Vretena (Germany): The straw flexi-dress - Design meets sustainability

The winning innovation, the Straw Flexi-Dress, epitomizes the fusion of design and sustainability. Crafted from HighPerCell filaments derived from unbleached straw pulp, the dress embodies a circular fashion ethos. Its versatile design allows it to be worn in multiple styles, showcasing the potential of cellulose fibres in fashion.

Second - Honext material (Spain): Honext Board FR-B (B-s1, d0) – Flame-retardant Board from upcycled fibre waste

Honext's flame-retardant board, derived from upcycled industrial waste fibres, represents a leap towards sustainable building materials. With its high mechanical performance and fire safety credentials, the product offers a viable alternative for interior applications, underscoring the value of cellulose in fostering a circular economy.

Third - TreeToTextile (Sweden): A new generation of bio-based fibre

TreeToTextile's innovative fibre combines sustainability with performance, offering a compelling alternative to traditional textiles. With a low environmental footprint and biodegradability, this fibre presents a promising solution for reducing reliance on conventional materials like cotton and polyester.

Future outlook and collaboration

Looking ahead, the Cellulose Fibres Conference remains a vital forum for collaboration and innovation within the cellulose fibre ecosystem. With industry support from leading sponsors and partners, including Andritz, Lenzing, and Fashion for Good, the conference serves as a nexus for industry associations, research institutions, and interest groups. Mark your calendars for the next conference on 12-13 March 2025, promising further advancements in sustainable textile solutions.

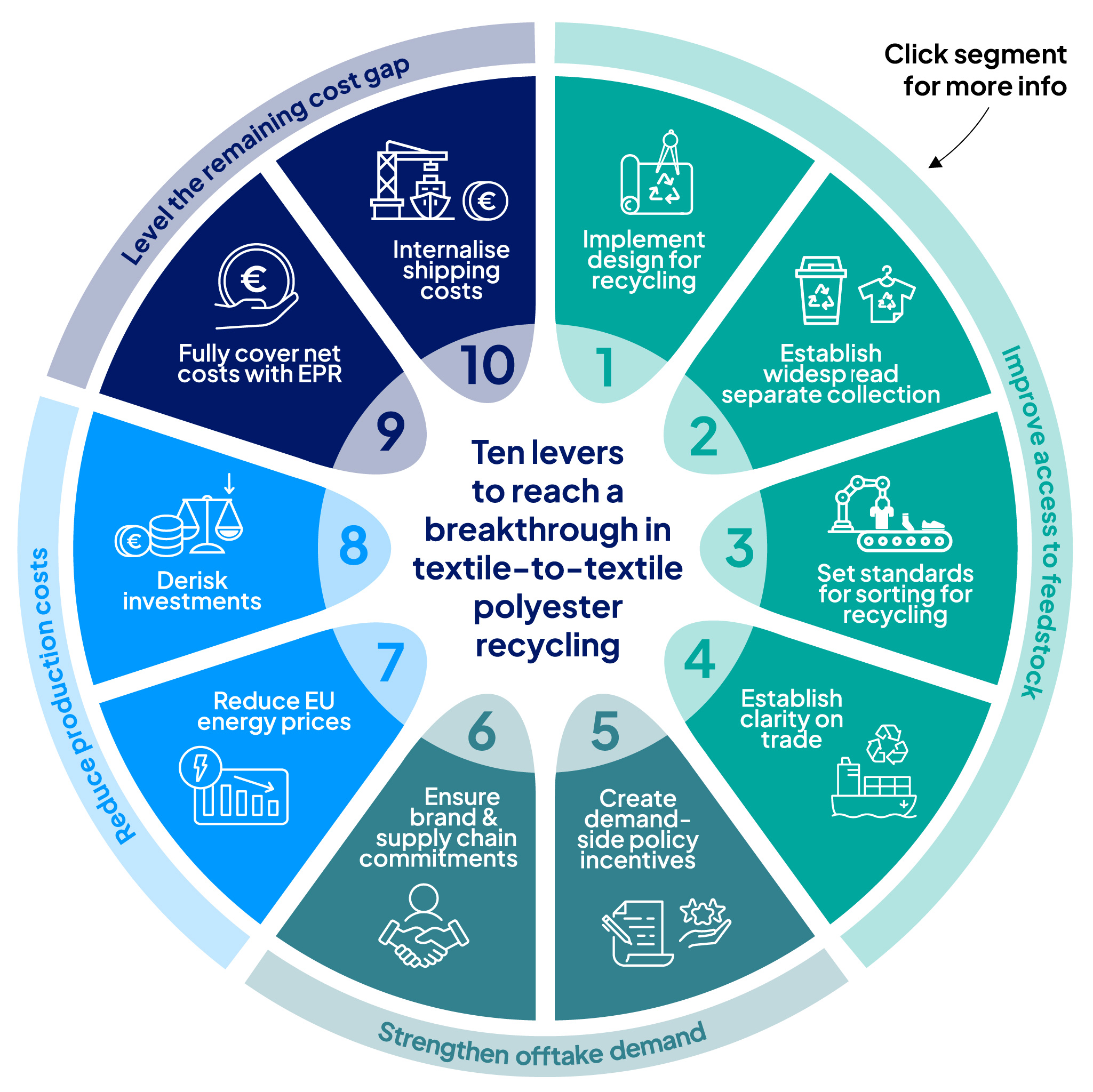

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Europe's Textile Waste Mountain: New report reveals 10-Point plan, sparking deba…

Europe is grappling with a colossal textile waste problem. Over 125 million tonnes of raw materials are devoured by the... Read more

China Weaponizes Subsidies: A strategic play for textile dominance amidst global…

Despite the narrative of a global apparel pivot away from China, the reality on the ground paints a different picture.... Read more

Shift in fashion's value proposition, can speed and sustainability coexist?

Expanding on the recent LinkedIn post by Lubomila Jordanova, CEO & Founder of Plan A and Co-Founder of Greentech Alliance,... Read more

Gartex Texprocess India 2025 kicks off in Mumbai with global focus

The 2025 Mumbai edition of Gartex Texprocess India opened its doors at the Jio World Convention Centre on May 22,... Read more

EU Horizon T-REX project data reveals challenges for textile-to-textile recyclin…

A new report from the EU Horizon T-REX (Textile Recycling Excellence) Project, while focused on piloting a data model to... Read more

Source Fashion to showcase global ethical sourcing solutions in July 2025 editio…

Source Fashion, the UK’s leading responsible sourcing show, is set to return from 8-10 July 2025 at The Grand Hall,... Read more

CHIC September 2025 to return in Shanghai with ‘Fashion Picnic’ theme

China’s leading fashion trade event, CHIC 2025 (September), will return to the National Exhibition and Convention Center in Shanghai from... Read more

US consumer confidence dips amidst economic uncertainty

In April 2025, the US consumer sentiment recorded a shift as confidence levels dipped, indicating potential headwinds for the economy.... Read more

Secondhand on the rise in Europe as it readies for a €26 bn fashion revolution b…

Across Europe, pre-owned garments are shedding their ‘used’ label and stepping into the spotlight as a mainstream force. A new... Read more

India-Bangladesh Trade in Turmoil: Retaliatory measures threaten regional commer…

The burgeoning trade relationship between India and Bangladesh has hit a turbulent patch, marked by a series of retaliatory trade... Read more