The South Korean home textile market is poised for substantial growth, as outlined in the latest report by IMARC Group titled ‘South Korea Home Textile Market: Industry Trends, Share, Size, Growth, Opportunity, and Forecast 2024-2032.’

The market is projected to grow at a compound annual growth rate (CAGR) of 5.3 per cent during the period from 2024 to 2032.

Driving this expansion is the escalating disposable income among South Koreans, fueling increased expenditure on home adornment and enhancement. With economic prosperity, consumers are prioritising comfort, quality, and aesthetics within their living spaces, spurring a surge in demand for top-notch home textiles.

Moreover, a shift towards more opulent and personalised home environments is influencing consumer preferences towards premium and tailor-made textiles. South Korea's robust manufacturing and technological prowess further bolster this trend, facilitating the creation of innovative textiles that seamlessly blend functionality with visual appeal.

The proliferation of retail outlets and online shopping platforms has simplified access to a diverse array of home textile products, contributing to market growth.

Additionally, South Korea's traditional emphasis on maintaining a pristine and healthy home environment translates into heightened demand for home textiles promoting hygiene and comfort, such as antimicrobial towels and bedding.

Furthermore, a burgeoning eco-conscious consumer segment is driving demand for sustainable and environmentally friendly home textile products in the country. This escalating awareness is prompting manufacturers to adopt green practices and materials, shaping the future trajectory of the South Korean home textile market.

British clothing retailer Next has maintained its sales and profit outlook in the ongoing fiscal year following the release of its 2023-24 financial report, which reveals a modestly better-than-expected 5 per cent increase in profits.

Considered a barometer of British consumer sentiment, Next affirmed its forecast of achieving a pre-tax profit, excluding exceptional items, of £960 million ($1.23 billion) for the fiscal year 2024-25, with a projected 2.5 per cent rise in full-price sales.

Exceeding its guidance, Next secured a profit of £918 million for the fiscal year ending January 27, 2024. The retailer surpassed the projected £915 million. Total sales for the period climbed by 5.9 per cent to reach £5.84 billion.

Despite potential disruptions from stock delays attributed to the Suez Canal's shipping disruptions, Next indicated no immediate anticipation of significant adverse impacts.

Mango has once again selected Antoine Griezmann as the brand ambassador for its menswear range for the Spring/Summer 2024 season.

This collaboration sees Mango Man presenting a campaign captured by photographer Scott Trindle, drawing inspiration from the remarkable journey of the acclaimed athlete.

The campaign once again carries the slogan 'Move Forward', offering a captivating visual journey through Griezmann's achievements and personal growth, conveyed through photographs and video. Alongside, the images showcase Mango Man's Spring/Summer collection, featuring a palette dominated by neutral tones, grays, and browns, alongside materials like linen and knitwear, and versatile designs inspired by relaxed tailoring and summer shirts.

Before enlisting Antoine Griezmann as its ambassador, Mango has collaborated with other notable figures including Andrés Velencoso, Gerard Piqué, Zinedine Zidane, and Adrien Brody.

Mango's menswear division is currently present in over 550 retail outlets across more than 90 countries and is distributed online in 75 markets.

Celebrating its four decades in 2024, Mango recently revealed its 2023 fiscal year results, boasting record-breaking sales with revenue exceeding €3.1 billion and a net income of €172 million.

The company also unveiled its new strategic plan for 2026, built on four key pillars (Elevate, Expand, Earn, and Empower). Mango aims to achieve a turnover of €4 billion and open 500 new stores during that period, expanding its existing portfolio of 2,700 boutiques across 115 markets.

Nike, Inc.unveiled its fiscal 2024 third-quarter financial results today, showcasing a nuanced picture of the sportswear giant's performance. Despite slight revenue growth, the company grappled with restructuring charges, impacting its bottom line.

In the third quarter, Nike's revenues edged up to $12.4 billion on both reported and currency-neutral bases. Notably, Nike Direct revenues saw a modest increase to $5.4 billion, while wholesale revenues climbed to $6.6 billion, reflecting a three percent uptick. However, the digital sales for the Nike brand experienced a downturn of three percent on a reported basis and four percent on a currency-neutral basis.

The company reported a gross margin increase of 150 basis points to 44.8 percent. However, restructuring charges dampened the overall performance, with selling and administrative expenses rising by seven percent to $4.2 billion, inclusive of $340 million attributed to restructuring.

John Donahoe, President & CEO of Nike, Inc., acknowledged the necessity of adjustments to propel the company's growth trajectory forward. He expressed optimism about the ongoing innovation cycle and collaborative efforts with wholesale partners to enhance the marketplace.

Matthew Friend, Executive Vice President & CFO, echoed similar sentiments, emphasizing the company's focus on efficiency and maximizing the impact of new innovations.

Despite the challenges, Nike's balance sheet showed resilience, with inventories declining by 13 percent to $7.7 billion and shareholder returns remaining robust. The company continued its trend of increasing dividend payouts, marking 22 consecutive years of such growth. In the third quarter alone, Nike returned approximately $1.4 billion to shareholders through dividends and share repurchases.

As Nike navigates through its restructuring phase, the spotlight remains on its ability to sustain growth momentum amidst evolving market dynamics and operational adjustments.

During its fourth quarter, Guess Inc registered a 9 per cent increase in revenues to reach $891.1 million. The US fashion giant also reported a single-digit rise in sales for the full year. The company’s revenues grew by 9 per cent in US dollars in Europe while its revenues in Asia surged by 18 per cent surge during the quarter ending February 3, 2024.

However, Guess retail revenues in the US grew by only 1 per cent, as the company recorded 1 per cent decrease in retail comparable sales, including e-commerce. On the other hand, its wholesale revenues in the US skyrocketed by 44 per cent, and licensing revenues climbed by 15 per cent.

For the fiscal year, Guess Inc’s total revenues rose by 3 per cent to $2.78 billion, fueled by growth across Europe and Asia. However, this was somewhat offset by declines in US retail and wholesale revenues.

Elaborating on the company’s financial health, Carlos Alberini, CEO, Guess Inc, said, disciplined management enabled the company to deliver $330 million in operating cash flow and $248 million in free cash flow. Guess Inc. ended the year with a cash position of $360 million, exceeding expectations. As a result, the board declared a special dividend of $2.25 per share to be paid in May, aligning with the commitment to return capital directly to shareholders.

In the upcoming fiscal year, Alberini, anticipates revenues will surpass $3 billion for the first time in the company's history.

Cotton prices are on a roll again globally, defying expectations and leaving everyone scratching their heads. After a seemingly stable post-pandemic period, prices surged in February 2024, reaching $1 per pound – a level last seen a year ago. This is happening despite stagnant global consumption and high stockpiles.

Prices defy expectations

Production and consumption projections by country paint a mixed picture. "Major producers like China and India are expected to maintain or slightly higher output," another analyst noted, "However, consumption is forecast to remain subdued globally, hovering near a four-year low. This should ideally lead to lower prices, but that's not the case."

Table: Production and consumption projections 2023-24

|

Region |

Production (million bales) |

Change from 2022-23 |

Consumption (million bales) |

Change from 2022-23 |

|

World |

113.0 |

-3% |

113.0 |

+2% |

|

China |

35.0 |

Stable |

55.0 |

Stable |

|

India |

28.0 |

+5% |

23.0 |

-2% |

|

United States |

15.8 |

+6% |

N/A |

N/A |

|

Other Countries |

34.2 |

Varied |

35.0 |

Varied |

As shown in the table, global production is expected to be slightly lower than the previous year, with major declines in the US and Australia offset by increases in Pakistan and Brazil. Consumption is projected to inch up slightly, driven by growth in Pakistan, Vietnam, and Bangladesh. However, major consumers like China and India are expected to see a decline.

China: Stockpiles high, imports soar

In fact, China, the world's largest cotton producer, holds record stockpiles but faces a new reality due to the Xinjiang ban. "Despite flat domestic consumption," an analyst explained, "China's import estimates have skyrocketed by 107 per cent year-on-year to compensate for the ban. This rise offsets the decline in import demand from other major players like Bangladesh, Pakistan, and India."

In the US meanwhile, despite lower planted area, cotton production is expected to rise in 2023-24. However, recent news suggests increased supply expectations and lower mill demand might put downward pressure on prices.

Price surge, speculation or new normal?

The price increase has analysts baffled. "Cotton consumption is at a four-year low, and the stock-to-use ratio is at its pandemic peak," one analyst said. The USDA forecasts the Cotton A Index to average 97 cents per pound in 2024, a significant drop from the highs of 2022 but still above pre-pandemic levels.

The current rise could be partly speculative, due to China's uncertain buying despite record stockpiles. China, the world's largest cotton importer, has significantly increased import forecasts for the current year. This could be due to a shift away from Xinjiang cotton due to the forced labor ban, analysts speculate.

To an extent, the rise suggests a post-pandemic "new normal" for cotton prices is yet to be established. Moreover, global cotton consumption is projected to remain low, with major consumers like India facing sluggish demand. Also, the current stock-to-use ratio is at its highest level since the pandemic's beginning, indicating ample supply.

A complex situation with geopolitical tensions

What's more, despite the weak demand outlook, some factors could be driving speculation. China's increased import forecasts, despite high stockpiles, could be seen as an attempt to manipulate prices, some analysts say. Geopolitical tensions are another factor, as the ongoing trade war and wars in Europe and the Middle East could disrupt cotton production or trade flows, leading to price volatility.

"Indeed, the global cotton market is in a complex situation," one analyst concluded. "With China's import surge and potential geopolitical motives, the 'new normal' for cotton prices remains elusive. While the recent rise might benefit some producers like Pakistan, consumers might face the brunt of higher prices in the near future."

On the occasion of World Water Day, Jeanologia, an eco-efficient textile technology company, advocates for tangible actions over greenwashing in the textile sector. With a three-decade-long journey, Jeanologia has pioneered sustainable practices, demonstrating that fashion can align with environmental responsibility without compromising quality or profitability.

Jeanologia's innovative technologies have significantly reduced water consumption, minimized chemical usage, and eliminated harmful emissions in textile production. Their recent environmental achievements include saving over 20 million cubic meters of contaminated water and reducing nearly 100 million kilograms of carbon dioxide emissions, emphasizing the company's commitment to sustainability.

Central to Jeanologia's success is the integration of eco-efficient technologies across all production stages. For instance, their garment finishing process now consumes merely one liter of water per garment, down from 70 liters, while maintaining quality and design standards. Additionally, their hydrogen zero effluent recycling plant recovers 95 per cent of water used in production, contributing to a closed-loop system and minimal water wastage.

Recognizing the urgency of the global water crisis, Jeanologia calls for collective action. Amidst UNESCO's warnings and increasing water scarcity affecting billions worldwide, Jeanologia's CEO Enrique Silla emphasizes the company's focus on water impact, aiming to minimize resource consumption, eliminate waste, and preserve marine ecosystems by removing microfibers from production processes.

Since its establishment in 1994, the company has been committed to fostering an ethical, sustainable, and eco-efficient textile sector. Collaborating closely with brands, retailers, and suppliers, Jeanologia offers innovative technologies, software, and operational strategies to drive transformation.

In 2024, Jeanologia marks the 25th anniversary of its pioneering laser technology, introduced in 1999, which revolutionized denim finishing by eliminating harmful practices and hazardous substances. Continuing with this ethos, Jeanologia now tackles the challenge of minimizing the environmental impact of the garment dyeing process—a notorious source of pollution—through its innovative ColorBox technology.

Bangladesh-based fashion brand, Trendz has unveiled its eagerly anticipated Eid collection.

Renowned for its contemporary apparel, Trendz captures the essence of youth fashion while incorporating global trends, setting itself apart in the country's fashion landscape.

With a keen eye on the seasons and cultural festivities, Trendz consistently delivers designs that resonate with the vibrant spirit of Bangladeshi youth. The brand’s new Eid collection seamlessly blends seasonal elements, climate considerations, and the latest fashion trends, promising a truly captivating range.

Crafted with precision using state-of-the-art machinery, Trendz offers an exclusive range for both men and women. From traditional Panjabis to formal and casual shirts, trousers, t-shirts, and fusion tops, every garment reflects meticulous attention to detail and a commitment to staying ahead of the curve.

For men, the collection boasts a versatile array of formal attire suitable for both office wear and social gatherings. Meanwhile, casual outfits feature trendy designs and vibrant hues, appealing to the fashion sensibilities of the younger demographic.

For women, color takes center stage, with a palette carefully curated to complement seasonal changes. From crisp whites to bold reds and elegant blacks, Trendz offers a spectrum of choices designed to dazzle.

Embellishments such as Karchupi and machine embroidery add an extra layer of sophistication, elevating each garment to a work of art. Innovatively designed Panjabis and contemporary silhouettes crafted from premium fabrics are sure to capture the imaginations of fashion-forward individuals.

In Feb 2024, India’s textile exports grew by 19.54 per cent Y-o-Y while apparel exports surged by 4.88 per cent Y-o-Y during the same timeframe.

As per data released by the Confederation of Indian Textile Industry (CITI), cumulative exports of textiles and apparel by India increased by 12.49 cent Y-o-Y during Feb 2024 while exports of cotton yarn, fabrics and made-ups grew by 17 per cent Y-o-Y in February 2024.

Over 11 months, exports of these products surged by 6.7 per cent compared to the corresponding period in the previous year.

However, the overall textile exports by India from Apr’23 to Feb ‘24 grew by 1.75 per cent Y-o-Y, while apparel exports recorded a notable decline of 11.42 per cent during the same timeframe.

The combined exports of textiles and apparel during this period declined by 4.25 per cent compared to the corresponding period in the previous fiscal year.

Industry experts attribute this positive trajectory in cotton yarn and fabric exports to India’s competitive cotton prices throughout the current financial year, which have bolstered demand in international markets.

The surge in demand, particularly from countries like Bangladesh and China, has driven this growth.

Conversely, the apparel segment has faced challenges, experiencing a decline primarily due to heightened input costs and subdued demand in various countries amidst soaring inflation.

Bharat Chhajer, Former Chairman, Powerloom Development and Export Promotion Council (PDEXCIL), says, the ongoing conflict between Russia and Ukraine, coupled with the Red Sea crisis, has compounded the situation, resulting in increased business costs and pricing pressures. Moreover, stiff competition from nations like Vietnam and Bangladesh, coupled with the reduction in cotton prices, has decreased the value of apparel exports from India.

The sports inspired clothing market is witnessing a transformation as it merges the worlds of athletics and fashion. As per study by Persistence Market Research, the global sports inspired clothing market is expected to grow at a CAGR of 5.3 per cent from $315.03 billion in 2023, to $452.2 billion by the end of 2030.

This dynamic segment within the fashion industry offers consumers a blend of performance features and fashion-forward designs, catering to the growing demand for comfortable and versatile attire suitable for both active pursuits and everyday wear.

Growth triggers

Athleisure’s popularity: The rising preference for athleisure and casual wear is a catalyst for expansion of the sports-inspired clothing market. Consumers seek comfort and style, driving the demand for apparel that seamlessly transitions from the gym to daily activities.

Collaborations and innovation: Partnerships between sportswear brands, fashion designers, and celebrities drive market growth and product innovation. Limited-edition collections and exclusive releases combining athletic performance with fashion aesthetics capture consumer attention and loyalty.

Textile technology advancements: Investments in textile technology and sustainable materials shape market dynamics. Performance fabrics with moisture-wicking properties and sustainable materials like recycled polyester meet consumer demand for functionality and eco-conscious fashion choices.

Redefining fashion with active lifestyle trends

The sports inspired clothing market offers opportunities to meet the demand for athleisure apparel that blends style, comfort, and performance. Brands can capitalize on this trend by offering athleisure collections featuring innovative materials and designs that appeal to consumers seeking both functionality and aesthetics.

Market trends

One major trend is athleisure combines activewear features with trendy silhouettes and streetwear aesthetics. Brands offer a range of clothing options suitable for various occasions, driving the demand for fashionable and functional sportswear.

Then there is the whole issue of endorsements and collaborations. Sports celebrities and influencers collaborate with brands to design exclusive collections, driving brand visibility and consumer engagement. These collaborations create excitement and appeal to diverse consumer segments.

However, this lucrative market also needs to combat many challenges.

Sustainability concerns, competition major challenges

The environmental impact, textile waste, and supply chain transparency pose challenges for sportswear brands. Addressing sustainability requires investments in eco-friendly materials and responsible sourcing practices.

Moreover, the market is highly competitive, requiring brands to differentiate through innovation and customer experience. Unique brand identities, personalized shopping experiences, and digital marketing are essential for maintaining relevance.

The way forward in this highly diverse and competitive market is for manufacturers to invest in innovative materials and sustainable manufacturing processes. Recycled polyester and bio-based fabrics offer eco-friendly alternatives, promoting circular fashion principles.

Brands need to leverage e-commerce platforms and digital technologies to enhance customer engagement. Integration with social commerce and AR technologies will drive online sales and brand loyalty.

To sum up, the sports inspired clothing market continues to evolve, driven by the convergence of athletics and fashion. With the popularity of athleisure and collaborations between brands and influencers, the market offers opportunities for innovation and sustainability. However, challenges such as sustainability and competition necessitate continuous adaptation and differentiation to meet consumer demands in this dynamic industry.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

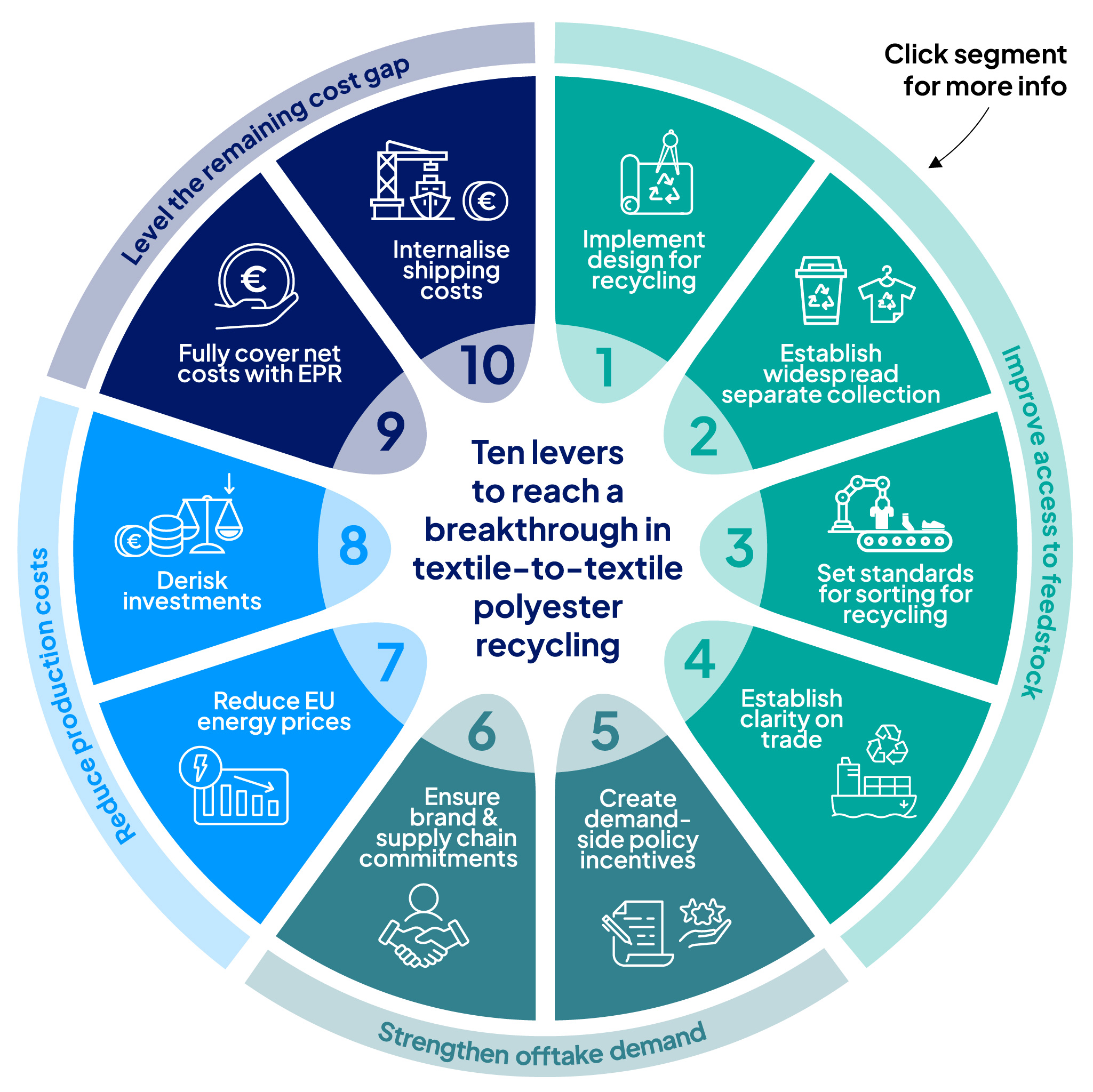

Europe's Textile Waste Mountain: New report reveals 10-Point plan, sparking deba…

Europe is grappling with a colossal textile waste problem. Over 125 million tonnes of raw materials are devoured by the... Read more

China Weaponizes Subsidies: A strategic play for textile dominance amidst global…

Despite the narrative of a global apparel pivot away from China, the reality on the ground paints a different picture.... Read more

Shift in fashion's value proposition, can speed and sustainability coexist?

Expanding on the recent LinkedIn post by Lubomila Jordanova, CEO & Founder of Plan A and Co-Founder of Greentech Alliance,... Read more

Gartex Texprocess India 2025 kicks off in Mumbai with global focus

The 2025 Mumbai edition of Gartex Texprocess India opened its doors at the Jio World Convention Centre on May 22,... Read more

EU Horizon T-REX project data reveals challenges for textile-to-textile recyclin…

A new report from the EU Horizon T-REX (Textile Recycling Excellence) Project, while focused on piloting a data model to... Read more

Source Fashion to showcase global ethical sourcing solutions in July 2025 editio…

Source Fashion, the UK’s leading responsible sourcing show, is set to return from 8-10 July 2025 at The Grand Hall,... Read more

CHIC September 2025 to return in Shanghai with ‘Fashion Picnic’ theme

China’s leading fashion trade event, CHIC 2025 (September), will return to the National Exhibition and Convention Center in Shanghai from... Read more

US consumer confidence dips amidst economic uncertainty

In April 2025, the US consumer sentiment recorded a shift as confidence levels dipped, indicating potential headwinds for the economy.... Read more

Secondhand on the rise in Europe as it readies for a €26 bn fashion revolution b…

Across Europe, pre-owned garments are shedding their ‘used’ label and stepping into the spotlight as a mainstream force. A new... Read more

India-Bangladesh Trade in Turmoil: Retaliatory measures threaten regional commer…

The burgeoning trade relationship between India and Bangladesh has hit a turbulent patch, marked by a series of retaliatory trade... Read more