FW

The Aid by Trade Foundation (AbTF) is seeking public feedback on its updated Cotton made in Africa (CmiA) standard, a key framework for sustainable cotton production. Interested parties have until November 17, 2025, to provide comments on the draft of Version 5.0, helping to shape one of the world's largest standards for sustainable cotton.

This latest version focuses on three main areas: increasing clarity, reprioritizing objectives, and aligning with new corporate reporting requirements. The standard aims for greater precision by reducing and simplifying indicators, making them easier to understand and implement. Objectives are being reprioritized to strengthen key areas like biodiversity, climate resilience, and cooperation between companies and farmers. Finally, the update ensures that indicators for human rights and risk management meet the growing demands for corporate due diligence and sustainability reporting.

Alexandra Perschau, Head- Standards & Outreach Department, AbTF, encourages public participation, calling it an excellent opportunity to actively participate in shaping our approach to supporting small-scale farmers producing cotton in Africa, to protecting biodiversity, and to giving companies access to the sustainable resources they need to fulfill their due diligence obligations.

The revision process began in spring 2025 with input from partners and stakeholders in Côte d’Ivoire, as well as an analysis of past verification results and new findings in sustainable cotton cultivation. After the public consultation closes and a technical advisory group provides its feedback, the draft will be submitted to the AbTF Board of Trustees for approval. If approved, Version 5.0 will be implemented in 2026.

Cotton made in Africa (CmiA) is an internationally recognized standard that provides transparent traceability for sustainably produced cotton. Over 30 per cent of African cotton is CmiA-verified, and the standard is GMO-free, with a strong focus on protecting human rights, biodiversity, soil, and water. More than 60 textile companies and brands use CmiA cotton, supporting around 800,000 small-scale farmers and their communities.

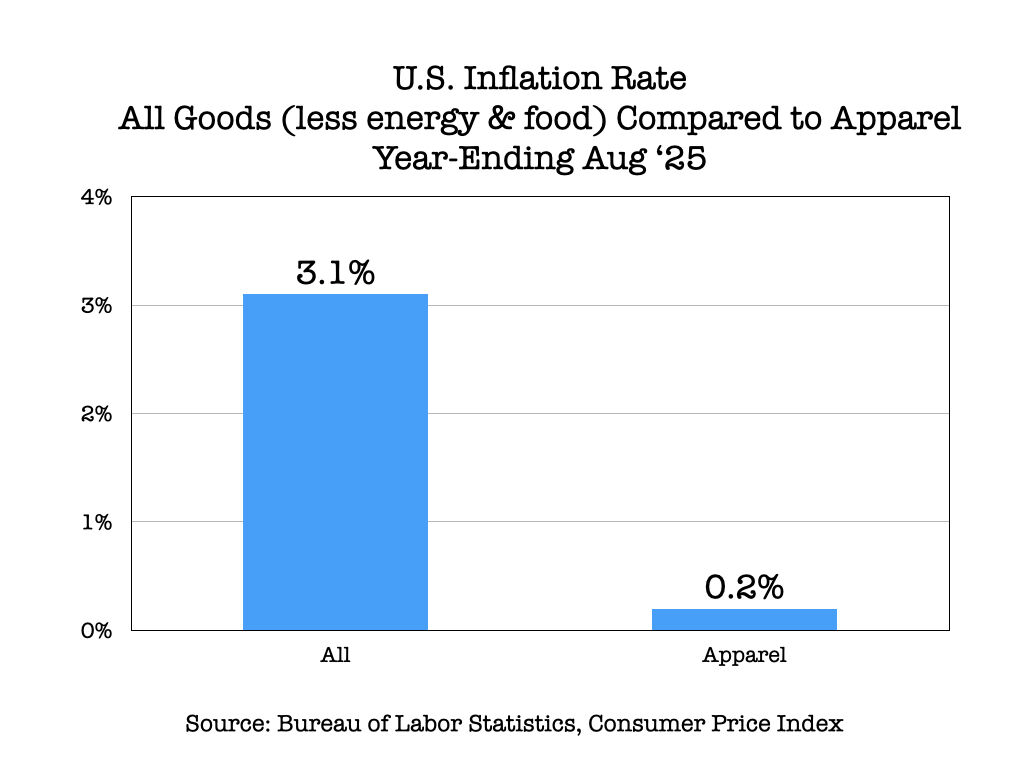

The latest data from the Bureau of Labor Statistics (BLS) indicates that while overall US inflation remains high, the apparel sector continues to give a welcome break to consumers. However, a closer look at the data suggests that this period of stability may be nearing an end. According to the BLS Consumer Price Index (CPI), the inflation rate for all goods (less energy and food) stood at a robust 3.1 per cent for the year ending in August 2025. In stark contrast, apparel prices rose only 0.2 per cent over the same period. This gap highlights a continuing trend where the clothing industry is absorbing costs rather than passing them on to shoppers.

August records a jump

Despite the low annual figure, the monthly data reveals a critical change: apparel inflation jumped sharply by 0.5 per cent in August, its highest monthly increase since February. This sudden rise suggests that the cumulative effects of market uncertainties and import tariffs may finally be affecting clothing prices at the consumer level.

The monthly volatility in the apparel index is a well-established pattern, often influenced by seasonal sales and new product releases. However, the August spike is particularly noteworthy, hinting that a more sustained upward trend may be on the horizon.

Table: US monthly apparel index

|

Month |

Seasonally adjusted change from preceding month |

|

February |

+0.6% |

|

March |

+0.4% |

|

April |

-0.20% |

|

May |

-0.40% |

|

June |

+0.4% |

|

July |

+0.1% |

|

August |

+0.5% |

Fed's dilemma

The difference between overall inflation and apparel inflation puts the Federal Reserve in a precarious position. The central bank has a stated inflation target of 2 per cent, and with core inflation running at 3.1 per cent, the Fed is under pressure to maintain a tight monetary policy.

However, the situation is complicated by a softening labor market. Typically, a weakening job market would provide a case for the Fed to cut interest rates to stimulate economic activity. The combination of persistent inflation and a slowing labor market creates a difficult and politically charged environment for the Fed. A decision to cut rates to support employment could risk further fueling inflation, while maintaining high rates could deepen a labor market downturn.

The recent jump in apparel prices a category that has been a deflationary force for much of the past year adds another layer of anxiety to the Fed's upcoming decision. It raises the question of whether the recent increase is a blip or the beginning of a broader pass-through of costs to consumers, which would make the Fed's inflation fight even more challenging.

Toray Industries and MAS Holdings have launched a new joint venture company (JVC), Toray MAS Apparel India, to produce apparel within and for India's rapidly growing market. Formally signed in June, the partnership will include the establishment of a new manufacturing facility at the MAS Apparel Park in Odisha.

Operations at this facility are slated to begin in early 2026. The plant aims to serve both current and future customers in the region, meeting the rising demand for high-quality, innovative textile solutions.

Highlighting the goals of this venture, Teruo Funahashi, Managing Director, Toray Hong Kong, describes the new company as a ‘garment stronghold’ that will strengthen the partnership between Toray and MAS by leveraging their respective capabilities.

Suren Fernando, Group CEO, MAS Holdings, terms this collaboration a ‘significant step forward’ in strengthening the company's global supply network. The Odisha facility will be crucial in supporting customer needs, driving innovation, and fostering regional economic development, he notes.

The collaboration brings together MAS Holdings' extensive apparel manufacturing expertise and Toray Industries' advanced material technologies. The new facility is also being designed with a strong focus on sustainability. It will incorporate renewable energy solutions like rooftop solar panels, energy-efficient technologies, and advanced water and wastewater management systems. The facility is also being built to ensure universal accessibility and integrate environmentally responsible waste and chemical management practices, aligning its future operations with both environmental stewardship and social responsibility.

At its recent Extraordinary General Meeting, the shareholders of Rieter Holding approved all proposals from the Board of Directors.

They agreed to reduce ordinary capital by lowering the nominal value of shares, as well as increasing it through a rights issue and a private placement. They also approved the Board of Directors’ proposal to reintroduce the capital band and amend the company’s Articles of Association. The meeting was attended by 176 shareholders, their representatives, and an independent proxy.

A leading global supplier for manufacturing yarn from staple fibers in spinning mills, Rieter develops and manufactures machinery, systems, and components used to efficiently convert natural and man-made fibers into yarns. The company’s advanced spinning technology supports sustainability in the textile industry by minimizing resource use. The company has been in business for 230 years, operates 18 production sites in ten countries, and employs a global workforce of around 4,560 people, with approximately 15 per cent located in Switzerland.

To create new revenue streams as well as ease pressure on its retail business due to the US tariffs, Shein Group is opening its Chinese apparel manufacturing network to other fashion brands.

Known as Xcelerator, the company's new initiative allows brands to tap into Shein's supply chain- known for its ability to turn around new designs in as little as 5 to 7 days. This service is available to brands on the condition that they open a store on Shein's online marketplace.

Shein has been formally recruiting brands for the program over the past two months after nearly two years of preparation and testing. Currently, about 20 brands, including French fashion label Pimkie and Filipino designer Jian Lasala, are using the service, which is being promoted through a new website launched in August.

Beyond manufacturing, Xcelerator also offers a suite of services that smaller brands often can't access at low costs, including sample development, warehousing, sales, and order fulfillment.

According to a Shein spokesperson, the program is designed to help brands overcome value-chain challenges by offering direct-to-consumer services, on-demand production, and global sales access to scale their creativity worldwide.

By selling access to its supplier network, Shein is building a new growth pillar to counter the impact of recent US policy changes. The removal of tax exemptions for small parcels from China has created uneven sales trajectories for Shein's core business of selling low-cost apparel. While Shein's US sales have been stronger than those of rival PDD Holdings' Temu platform, the company is still grappling with a volatile trade environment.

Unlike open-access platforms like Alibaba and 1688.com, Shein's model links supplier access to participation on its marketplace. This strategy aims to both leverage its extensive manufacturing network and attract more fashion brands to its platform, which is an important step as it faces increased competition and ongoing hurdles with its planned initial public offering. Shein, which is now headquartered in Singapore, has confidentially submitted a draft prospectus for a listing in Hong Kong.

A leading online marketplace, the Carousell Group is expanding into physical retail with the launch of its first branded brick-and-mortar store, Carousell Luxury. Located on Singapore's renowned Orchard Road at The Centrepoint, the 1,400-sq-ft store is set to officially open on September 23. It offers second-hand luxury handbags and accessories from top brands like Louis Vuitton, Chanel, and Yves Saint Laurent.

According to Tresor Anne Tan, Director - Client Relations, Carousell Group, the new store addresses a growing trend among luxury consumers who are more conscious of a product's economic value and sustainability. Buyers can purchase high-end items at a fraction of their original cost, often in excellent condition, she notes. A physical presence also offers a key advantage over online sales: it allows buyers to inspect products in person and rely on the store's in-house authentication team. A team of five appraisers meticulously checks each item's materials, stitching, and embossing to ensure authenticity.

For sellers, the store offers a ‘net-earnings model,’ where they agree on a specific payout amount upfront. Carousell takes a 25 to 30 per cent cut of the consignment price, which covers services like digital marketing and photography. This model ensures sellers are not affected by any sales or promotions the store might run, Tan explains. The store also provides a direct buy-out option, allowing sellers to get paid upfront at a slightly lower rate, as Carousell assumes the risk if the item doesn't sell, she adds.

Since its soft launch, Louis Vuitton has been the top-selling brand, accounting for one in four bags sold, followed by Chanel and Gucci. The store's clientele consists mainly of professionals, managers, executives, and technicians aged from their mid-20s to late 50s. While most sellers are local, the store has also drawn overseas buyers from countries like South Korea and China.

The Supervisory Board of Lenzing AG has extended the management board mandate of Christian Skilich, Chief Pulp & Chief Technology Officer by three years, through May 31, 2029. Skilich has been a member of the company's management board since June 2020. His responsibilities include Pulp Commercial and Operations, Co Products & Wood, Global HSE, Purchasing, and Innovation.

According to Patrick Lackenbucher, Chairman, Supervisory Board, Skilich's leadership has been key to the company's success. The pulp business under his leadership is an important and successful profit driver and underpins the company's integrated business model, Lackenbucher says. Skilich's work on the innovation portfolio will be crucial for Lenzing AG's future, he adds.

Meanwhile, Nico Reiner, CFO has decided not to renew his contract, which is set to expire on December 31, 2025. The Supervisory Board thanked Reiner for his outstanding achievements, including significant improvements in earnings and the successful completion of major refinancing projects. His prudence and expertise have contributed significantly to the stability and future of the company in a challenging macroeconomic environment, notes Lackenbucher.

Mathias Breuer will take over as the new Chief Financial Officer on January 1, 2026. Breuer joined Lenzing AG's management team in 2023 and was instrumental in developing and implementing the company's performance program. Before joining Lenzing, he was CFO of the Adapa Packaging Group and the Sempermed division of Semperit AG Holding.

Lackenbucher states, filling the position internally with an experienced Lenzing manager and financial expert speaks to the quality of the company's management team. With the appointment of Breuer, the company ensures a continued focus on the implementation and further development of the ongoing performance measures to further strengthen the profitability and competitiveness of Lenzing AG in the global market, he adds.

Rohit Aggarwal, CEO notes, with Mathias Breuer, the company gains an outstanding financial expert who is deeply familiar with the company and industry. Having played a central role in the company’s transformation process, Breuer is ideally suited to shape the next phase of our financial strategy, he adds.

Held from September 16-18, 2025, the 13th edition of OSH India Expo-South Asia’s largest occupational safety and health event attracted over 170 exhibitors from more than 300 leading brands.

Organized by Informa Markets, the exhibition showcased over 1,500 products from 13 countries, and attracted over 9,000 visitors, 150 delegates, and more than 50 speakers.

The expo serves as a timely platform to showcase cutting-edge technologies, integrated solutions, and product innovations shaping the future of workplace safety.

The Expo was inaugurated in the presence of eminent dignitaries, including Dr Pramod Sawant, Chief Minister, Government of Goa & Executive Member, The National Integrated Medical Association (NIMA) India as the Chief Guest. The Guest of Honour was Anant Pangam, Chief Inspector, Inspectorate of Factories & Boilers, Government of Goa.

Expressing his views on occupational safety and health, Sawant said, occupational safety and health are not just legal obligations but moral responsibilities that directly impact productivity and national growth. Valued at $2,7 billion in 2024, India’s personal protective equipment (PPE) market is projected to grow at a CAGR of 5.86 per cent to $4.7 billion by 2033. The market is growing at nearly 6 percent annually, reflecting rising awareness and stronger regulatory frameworks.

Under the leadership of Prime Minister Narendra Modi, India has introduced crucial reforms such as the OSH Code 2020, Shram Suvidha Portal, and Pradhan Mantri Suraksha Bima Yojana, which are driving compliance and improving worker welfare. The citizens of Goa are committed to this vision through initiatives including factory health camps, worker safety training and digital reforms. A culture of safety is essential for sustainable growth.

Ram Dahiphale, Joint Director, DISH, Mumbai, Government of Maharashtra, added, the Directorate of Industrial Safety & Health enforces the Factories Act, 1948, to ensure the safety, health, and welfare of workers across Maharashtra. In factory environments where people, machines, and materials interact, risks are inherent.. Platforms like OSH India play a vital role in spreading awareness, sharing knowledge, and driving action. The presence of NGOs like READ India adds further value by highlighting the broader social impact of safety and empowerment. Safer factories lead to safer states and ultimately a safer India.

Yarn Expo Autumn 2025 has concluded, solidifying its reputation as a cornerstone of the global textile industry. Held from September 2-4 at the National Exhibition and Convention Center (Shanghai), this year’s edition was lauded as the "most comprehensive yet," successfully weaving together a diverse array of exhibitors, a robust fringe program, and a powerful emphasis on sustainability. With nearly 500 exhibitors from 16 countries and regions spanning a vast 27,000 sqm in Hall 8.2, the fair served as a vital global gathering point, fostering international business and showcasing the latest advancements in yarn and fiber technology. As one of the co-located fairs, Yarn Expo complemented Intertextile Shanghai Apparel Fabrics, which hosted 3,700 exhibitors from 26 countries across nine halls and over 240,000 sqm.

A comprehensive showcase across seven dynamic zones

The fair's structure, meticulously designed to facilitate targeted sourcing, was a key to its success. Seven distinct zones provided a detailed look into the most critical segments of the industry, from natural fibers to cutting-edge synthetics.

● Chemical Fibre Zone: This zone was a powerhouse of innovation, featuring over 240 exhibitors. Key players like Fujian Eversun Jinjiang Co Ltd, Huafon Chemical Co Ltd, and Shandong Nanshan Fashion Sci-Tech Co Ltd showcased the latest trends in high-quality Chinese synthetic fibers, highlighting advancements in performance, functionality, and sustainable production. The focus here was on the fundamentals of quality production, demonstrating China's leadership in this sector.

● Fancy Yarn Zone: With over 120 exhibitors, this zone was a hub of creativity and trend-setting designs. Companies such as Fortune Tech Co Ltd, Jiangyin Tianhe Printing and Dyeing Co Ltd, and Zhangjiagang Yinlong Textile Co Ltd displayed their latest collections, providing buyers with an abundance of on-trend options for the upcoming autumn season.

● Linen Yarn, Silk Yarn, and Wool Yarn Zones: These three zones, with nearly 30 dedicated suppliers, celebrated the timeless appeal of natural fibers while also highlighting modern innovations. Exhibitors like Dashiqiao Silk Spinning Factory, Hubei Jinghua Textile Group Co Ltd, and TongXiang Yide Textile Co Ltd presented new developments in silk, linen, and wool, demonstrating how tradition and technology can coexist to create superior products.

● Cotton Yarn Zone: A major focus was placed on sustainability and technology within this zone, which hosted over 70 quality cotton spinning exhibitors. Companies such as Suzhou City Yishuang New Material Co Ltd, Suzhou Jingyi Textile Import and Export Co Ltd, and Wuhu Fuchun Dye and Weave Co Ltd showcased products with a renewed focus on eco-friendly materials and processes, aligning with the global push for a more circular economy.

Country pavilions and the expanding global footprint

One of the most significant highlights of Yarn Expo Autumn 2025 was the strong international participation, particularly through its dedicated country pavilions. This year’s event not only saw the return of established delegations but also welcomed a new, highly anticipated addition, further enriching the global sourcing experience.

● The India Pavilion: Organized by The Cotton Textiles Export Promotion Council (TEXPROCIL), the pavilion was a key attraction.

It brought together nearly 20 notable Indian suppliers, including Excel Enterprise, Manan Textech Global Private Limited, and Square Textile Ventures Pvt Ltd. Their offerings were a diverse spectrum of cotton yarns, encompassing everything from pure cotton and combed yarns to organic, recycled, and blended options. This presence underscores India's growing influence in the global cotton market, which is projected to reach USD 55.57 billion by 2033.

Akshay Buchade, Assistant Director for Kasturi Cotton Bharat, noted the success of their participation, highlighting "engaging discussions with leading global brands and sourcing companies including Lindex, H&M, LC Waikiki, and Fuzhou Siemei Trade Co. Ltd." These interactions, he added, were crucial for "positioning Indian cotton on the global stage and building long-term partnerships."

● The Pakistan Zone: A strong showing from Pakistan highlighted the country's textile strength. As per a report by Taurus Securities, Pakistan’s textile exports saw a remarkable 32% year-on-year increase in July 2025, reaching USD 1.7 billion. This momentum was palpable at the fair, where well-known exhibitors like Abtex International (Pvt) Ltd and Xiamen Naseem Trade Co showcased a wide range of blended and cotton yarns, including a focus on organic cotton.

Muhammad Abdullah Tanvir, Deputy Marketing Manager at Diamond Fabrics Limited, an exhibitor at the concurrent Intertextile event, emphasized the value of the platform, stating, "We met several serious international buyers…it attracts the right audience and gives us an excellent opportunity to showcase our products."

● The debut Taiwan Zone: A major new feature of this year’s fair was the dedicated Taiwan Zone, organized by the Taiwan Spinners' Association. The zone provided a unified platform for suppliers like Tah Lee Textile Co Ltd and Tah Yao Textile Co Ltd to showcase their diverse range of open-end yarns, including cotton, CVC, and TC. This new addition reflects the fair's commitment to broadening its scope and offering buyers a more complete overview of Asian textile production.

● Bangladesh's Growing Influence: The presence of four Bangladeshi companies—Square Textiles PLC, Amanat Shah Fabrics Ltd., M/S AH Traders, and Nur Trading Corporation—further demonstrated the fair's importance as a gateway to the Asian market. Their participation, which drew significant interest from international buyers, highlights Bangladesh's burgeoning role in the global textile sector.

Luthfor Rahman Munna, Sr. Manager (Marketing) at Square Textiles PLC, shared his positive experience: "It was truly a remarkable experience, receiving overwhelming responses and interest from partners and visitors across the globe. This exposure has opened new doors of opportunity, and we are optimistic about building strong business relationships."

Fringe events and a focus on future trends

Beyond the main exhibition hall, a series of informative fringe events provided crucial insights into the future of the industry. These sessions transformed the fair from a simple sourcing event into a platform for knowledge exchange and professional development.

● Tongkun • China Fibre Fashion Trends Display Zone: This display, organized by the China Chemical Fiber Association, was a visual feast, showcasing over 300 samples of new fiber products. It offered a forward-looking perspective on the latest fashion trends and the material innovations driving them.

● New Fibre New World – Textile Materials Innovation Forum: This forum brought together an impressive lineup of university professors, company executives, and industry experts. The discussions centered on critical topics such as the development of intelligent textiles and the latest trends in new fiber development, providing attendees with a deeper understanding of the technological forces shaping the market.

● Product launches: The event also served as a launchpad for new products, with 11 presentations held at the seminar area. Leading exhibitors used this platform to explain the merits of their featured yarns and fibers, offering a direct and detailed look at their latest offerings.

Synergy and the "Most Comprehensive Edition Yet"

The synergy was designed to create an immersive, comprehensive experience. Exhibitors leveraged the combined fair to showcase not just products, but a commitment to future-focused solutions.

For instance, The LYCRA Company's open-concept pavilion, an "ALL IN" statement on collaboration, showcased a variety of denim innovations and was joined by four key industry partners.

Similarly, companies like Lenzing Group showcased their new digital platform, Lenzing Pro, which consolidates technical knowledge and streamlines collaboration for partners across the value chain, a prime example of the digital transformation highlighted at the fair.

Hyosung TNC, the largest manufacturer of spandex by market share, also had a significant presence with two booths, showcasing its latest CREORA and regen Spandex innovations, including odor-neutralizing CREORA Fresh and recycled regen Spandex.

Tessellation Group, for instance, presented its brands Exponent Envirotech and Compass Greentech at Intertextile, highlighting how innovation and sustainability are shaping the global market. Their showcase included Exponent Envirotech's ECOHUES Waterless Dyeing Technology, now expanded to wool, and a model of an upcoming plant. Compass Greentech, meanwhile, showcased biodegradable and eco-friendly accessories, combining function and design.

Similarly, Naia from Eastman and its partners Xinmin Textile and Colorful presented a new, higher-tenacity biodegradable diacetate fiber, emphasizing its premium performance and sustainability benefits.

Aksa, a leading modacrylic fiber producer, used the platform to introduce Armora®, an advanced flame-resistant fiber, to global partners. These presentations were a testament to the fair’s role in launching and showcasing cutting-edge materials and technologies.

Wilmet Shea, General Manager of Messe Frankfurt (HK) Ltd, captured the spirit of collaboration that defined the fair, noting, "Shanghai is an industry hub in its own right, but during this show it really serves as the global industry's gathering point." The true power of Yarn Expo Autumn 2025 lay in its co-location with several other major industry events: Intertextile Shanghai Apparel Fabrics – Autumn Edition, CHIC, and PH Value. This "super-event" model created a unique synergy, bringing together the entire textile supply chain under one roof, from fibers and yarns to finished garments. The concurrent Cinte Techtextil China, focusing on technical textiles, further expanded the opportunities for business and networking.

Yarn Expo Autumn 2025 was more than a trade show; it was a vibrant, dynamic reflection of the global textile market. It was a fair that not only connected buyers and suppliers but also inspired, educated, and propelled the industry towards a more innovative and sustainable future. The success, measured in the volume of exhibitors, the diversity of international pavilions, and the palpable business optimism, confirms its place as a leading force in shaping the threads of tomorrow.

For years, a statement has been echoed across fashion panels, sustainability forums, and viral social media posts: “We already have enough clothes on earth to dress the next four to seven generations.” It’s a catchy claim, easy to remember and powerful enough to spark conversations about fashion’s overproduction problem. But like many soundbites, it doesn’t stand up to scrutiny. When the math is done, the numbers reveal a different truth one that highlights not an abundance of clothing, but the fragility of garments and the urgency of rethinking how we produce, use, and value them.

The numbers don’t add up

At first glance, the claim seems plausible. Global clothing production currently stands at 150 billion garments annually, as per industry estimates. That is nearly 20 pieces for every single person on earth each year. But does this mean we can simply stop producing and still clothe humanity for generations to come? The reality is far more complex.

Analysts calculate that to sustain just one global generation roughly 8 billion people for their lifetimes, we would need around 5 trillion garments. Stretching that across four to seven generations translates to almost 20-35 trillion garments. At today’s rate of production, that equals about 33 years of nonstop manufacturing not the supposed “excess” that headlines suggest.

Table: Clothing production vs generational needs

|

Figures |

Value |

|

Annual global garment production |

150 billion |

|

Estimated garments needed for one generation (8B people) |

5 trillion |

|

Estimated garments for 4–7 generations |

20–35 trillion |

|

Equivalent years of current production |

33 years |

“The math makes it very clear the idea that we’re already sitting on enough stock to last multiple generations is a myth,” says Hélène Dubois, a sustainability researcher at the London College of Fashion. “Garments degrade, fashion is unevenly distributed, and consumption patterns vary dramatically across regions. Numbers don’t lie.”

The reality of clothing longevity

Even if we did have those trillions of garments, there’s another problem: clothes don’t last forever. A cotton T-shirt might survive 30-40 washes before thinning, while polyester fast-fashion dresses often lose shape within a year. On the other end of the spectrum, a handwoven wool coat or a tailored denim jacket might last for decades if cared for properly.

On average, research shows that most garments are worn 50-100 times before disposal. In reality, fast fashion trends and declining fabric quality mean that many clothes never reach even half that potential. Fashion entrepreneur and sustainability advocate says, “Durability is the missing link in the conversation,” says Anita Dongre. “We obsess over recycling and resale, but unless we design with longevity, the cycle keeps spinning faster.”

Few industry voices have challenged the “enough clothes” myth as effectively as Patrick Grant, the British designer behind Community Clothing. Grant built the company around seasonless, well-made essentials jeans, T-shirts, coats produced locally in UK factories using responsibly sourced fabrics. His model not only creates sturdy garments designed for repeated wear, but also sustains British manufacturing skills at a time when global supply chains dominate.

“The myth was useful as a wake-up call,” Grant has said in interviews. “But the truth is, most of what we produce isn’t built to last, and most of what we consume isn’t treated with respect. We need to shift both mindsets.” Community Clothing’s sales data shows that customers who invest in higher-quality basics tend to extend garment use significantly, often doubling or tripling the average number of wears compared to fast-fashion items.

Focus on quality, wearability, and transparency

The sustainability conversation often zeroes in on recycling technologies or resale markets. But experts agree that the most immediate solution is deceptively simple: make clothes that last. This means focusing on:

Quality: durable fabrics, reinforced stitching, timeless silhouettes.

Wearability: versatile designs that fit across occasions and seasons.

Transparency: supply chains that consumers can trust.

Table:

|

Garment type |

Number of wears |

|

Fast-fashion polyester dress |

10–30 |

|

Standard cotton t-shirt |

30–50 |

|

Mid-quality denim jeans |

70–100 |

|

Tailored wool coat |

200+ |

“If every garment produced today lasted twice as long, the fashion industry’s footprint could be cut almost in half,” notes Ellen MacArthur Foundation’s 2023 Circular Fashion Report.

Beyond the myth

The viral claim that “we already have enough clothes” may have been effective in sparking outrage, but it obscures a more urgent truth: we don’t have too many clothes, we have too many poorly made clothes. The difference matters. Piles of discarded fast fashion in Ghana’s Kantamanto market or Chile’s Atacama Desert don’t represent abundance; they represent inefficiency and waste. As brands, policymakers, and consumers grapple with fashion’s environmental toll, the real challenge lies not in reducing the sheer number of garments alone, but in extending their value, wear, and life span.

Thus the myth of excess clothing is just that a myth. What the world truly needs is a shift in perspective: from disposable trends to long-lasting essentials, from opaque supply chains to transparent practices, and from passive consumers to active stewards of our wardrobes.

“Fashion is not about having enough clothes,” says Grant. “It’s about having the right clothes that last, that matter, and that we love.” If the industry embraces that mindset, the future of clothing won’t be measured in trillions of garments, but in billions of better ones.