FW

A denim manufacturer based in Pakistan, Artistic Milliners has acquired a majority stake in the iconic American denim company, Cone Denim from its parent company, Elevate Textiles.

The new combined entity will operate globally under the Cone Denim brand name, while Artistic Milliners' operations in Pakistan will continue to function independently. This acquisition is seen as a way to create a global powerhouse in the denim industry, combining Cone Denim's long-standing heritage with Artistic Milliners' innovation and global manufacturing network.

Steve Maggard, President, Cone Denim, will lead the new entity. The deal is expected to be finalized in Q1, FY26. This acquisition will allow the newly restructured Cone Denim to offer a ‘fully vertical, end-to-end’ solution, providing everything from premium denim fabric to finished garments. It will also expand its global footprint, with operations in North America, Asia, and potentially North Africa. Additionally, there are plans to revive US production capabilities.

The recent Intertextile Shanghai Apparel Fabrics, Autumn Edition, held from September 2-5, 2025, served as a powerful platform to validate a significant shift in the global textile landscape: the strategic partnership between China and the ASEAN bloc. The exhibition and its related forums, particularly the key session on "Opportunities in ASEAN in a Changing Trade Environment", underscored China's evolving strategy to solidify its dominance not by being the sole producer, but by controlling the upstream textile supply chain and leveraging ASEAN as its primary manufacturing hub. This is the core of the "China + ASEAN" alliance, a more accurate representation of the "China +1" strategy in action.

A strategic alliance born from economic realities

With rising domestic labor costs, China has shifted its focus to the production of high-quality fibers, yarns, and fabrics. This move is a strategic plan to maintain control over the global textile value chain. ASEAN, with its cost-competitive labor and growing manufacturing capacity, is the perfect partner for this strategy.

The data and related reports confirm this symbiotic relationship. An expert at the Intertextile forum articulated the new paradigm: " China plus one is ASEAN, rather being endorsed and supported by China itself with the large investments and supplies of raw material?" This context highlights a central theme: the bloc's emergence is not coincidental but a result of deliberate support from China.

China's Textile (Fibers, Yarns, Fabrics) Exports: Top Destinations

|

Destination |

2022 Export Value (USD Billions) |

2023 Export Value (USD Billions) |

2024 Export Value (USD Billions) |

|

ASEAN Bloc |

$58.00 |

$53.18 |

$54.9 (Est.)* |

|

United States |

$52.03 |

$49.40 |

$48.10 |

|

European Union |

$35.87 |

$30.76 |

$30.8* (Est.) |

|

Japan |

$19.57 |

$15.40 |

$15.40 |

|

Bangladesh |

$9.37 |

$9.22 |

$9.22 |

Note: 2024 figures are projections based on recent trends.

The data clearly illustrates this strategic plan in action. ASEAN has emerged as the number one export destination for China's textile goods, surpassing traditional markets like the U.S. and the E.U. This is a direct result of China's strategy to provide the inputs that fuel ASEAN's manufacturing machine.

Xu Yingxin, Vice President of the China National Textile and Apparel Council, presented compelling data during the event, noting that in 2024, China's and the "East China Sea countries'" (a direct reference to the ASEAN bloc) textile and clothing export trade totaled $596.5 billion, a 6.7% growth rate. This is faster than the overall Chinese textile industry's global trade increase of 4.2%, showcasing the strategic prioritization of the ASEAN partnership.

China's Investment Footprint in ASEAN: Securing the alliance

To ensure the success of this strategic move, China has become a top foreign investor in the ASEAN textile and apparel sector, creating a ready and reliable market for its textile exports.

● Strategic relocation: Chinese companies are investing heavily in ASEAN to bypass tariffs and leverage lower labor costs. In some cases, this investment is overwhelming. According to the forum interaction, a large number of garment factories in Cambodia are owned by Chinese companies or investors. This level of ownership ensures that China's textile exports have a ready and reliable market.

● Upstream control: As Xu mentioned, "According to available statistics, since 2013, China's textile industry has accumulated direct investment of more than $5.6 billion in the East China Sea". This investment in spinning, weaving, and dyeing facilities helps to build a vertically integrated supply chain within ASEAN, solidifying China's control.

● A Frontrunner in FDI: While the U.S. is the largest overall investor in ASEAN, China's manufacturing FDI in the bloc has been growing at a rapid pace. This is not just about capital; it's about supply chain control.

ASEAN's Emergence: The resilient "China +1" bloc

The data below shows that while ASEAN produces the finished goods, it exports them primarily to Western markets, completing the global value chain cycle orchestrated by China. This win-win situation was highlighted in the forum, with a speaker noting that "China has created a win-win situation with ASEAN growing as a bloc".

Leading destinations for ASEAN's apparel exports

|

Destination Country |

Estimated Share of ASEAN's Apparel Exports (2022) |

|

USA |

~49% |

|

Japan |

~10.1% |

|

China |

~2.05% |

|

France |

~1.78% |

|

Others |

Remaining share |

By leveraging China's inputs and investments, ASEAN has become a powerful apparel manufacturing hub. This collective strength makes it a more resilient and strategic alternative to any single country like Bangladesh.

ASEAN (as a Bloc) vs. Bangladesh as "China +1"

|

Feature |

ASEAN (as a Bloc) |

Bangladesh |

|

Diversification & Resilience |

A network of countries with different strengths, providing flexibility and reducing risk. |

A single-country model with a high concentration of risk. |

|

Trade Agreements |

Benefits from the expansive RCEP, offering extensive market access to both China and other global economies. |

Relies on a limited number of FTAs and preferential access tied to its LDC status. |

|

Vertical Integration |

Growing capacity for both upstream and downstream production, making the bloc less dependent on external suppliers over time. |

Primarily a downstream manufacturer, highly dependent on imported textiles. |

|

Strategic Interdependence |

A symbiotic relationship with China, where China supplies materials and ASEAN handles manufacturing. |

A key customer for Chinese textiles, but lacks the strategic, bloc-wide integration of ASEAN. |

China not ceding its dominance; it is simply evolving its strategy

China is not ceding its dominance; it is simply evolving its strategy. By providing the materials and investing in the infrastructure of ASEAN's manufacturing, China maintains a powerful, albeit indirect, control over the global apparel supply chain. The collaboration has created a resilient, interconnected, and highly efficient ecosystem that is reshaping the future of textile and apparel trade.

The events at Intertextile Shanghai were a testament to a new era in global textiles. Messe Frankfurt's decision to organize VIATT (Vietnam International Trade Fair for Apparel, Textiles and Textile Technologies) in Vietnam is a clear endorsement of the China-ASEAN alliance. Olaf Schmidt, Vice President of Textiles & Textile Technologies at Messe Frankfurt, stated that Vietnam is "definitely a relevant market" for the textile business. He added that the launch of VIATT was aimed at "connecting the entire textile supply chain". This move is a direct acknowledgment of the evolving supply chain. As Schmidt noted, the company is carefully observing what's happening in these regions to "react" and provide the necessary platforms for collaboration.

The Hong Kong Polytechnic University (PolyU) has received a donation from the GS Charity Foundation to support a new research project focused on integrating AI and digital platforms to advance sustainable fashion. Titled ‘From Tradition to Tech: A Holistic Approach to Sustainable Fashion Design and Brand Ecosystem Management in the Age of AI and Digital Platforms,’ the project will be led by the School of Fashion and Textiles (SFT).

The project commencement ceremony was attended by Jin-Guang Teng, President, PolyU and Yeung Fan, Vice-chairman and General Manager, Glorious Sun Group. The two leaders exchanged a commemorative souvenir, a unique piece created by PolyU’s SFT and Industrial Centre. It features PolyU's architecture crafted with weaving techniques and an inscription that thanks the foundation while highlighting the university's commitment to innovation in fashion.

Teng expressed his gratitude for Glorious Sun Group and the GS Charity Foundation's long-standing support. He emphasized, AI is a core technology for Hong Kong's development and this collaboration will help produce a new generation of talent for the textile sector, equipped with both industry knowledge and AI expertise. This will help Hong Kong leverage its regional advantages and solidify the Greater Bay Area’s position as a hub for fashion innovation, he noted.

Highlighting the decades-long partnership between Glorious Sun Group and PolyU, Fan stated, the company's support for the research reflects its confidence in PolyU’s excellence. He also affirmed their shared commitment to nurturing talent and driving innovation and sustainability in the apparel industry.

Providing an overview of the research, Professor Joanne Yip, Associate Dean and Professor of SFT, explained, the fashion industry is undergoing a major transformation, adopting new technologies like AI and digital platforms to enhance efficiency, improve customer experience, and integrate sustainable practices. The research will focus on seven key areas to create innovative solutions that merge traditional design with advanced technology, ultimately boosting the industry's competitiveness.

Indian textile manufacturer Gokaldas Exports is ramping up shipments to the European Union and the United Kingdom, while increasing production in Africa, as rising US tariffs threaten profitability.

Generating roughly 75 per cent of its standalone sales from the United States and supplier to major retailers including Walmart, Gap and JCPenney, Gokuldas Exports expects its quarterly core profit margin to fall to single digits, compared with around 12 per cent in Q1, FY26.

The company produces approximately 90 million garments annually, exporting primarily to the US, Canada, the UK and France. These markets accounted for the bulk of its Rs. 38.64 billion ($438.97 million) in operating revenue during fiscal 2025.

To maintain client relationships, Gokaldas has been offering discounts and absorbing part of the additional costs linked to the higher tariffs. However, the company cautions this practice could only be sustained for a short period.

India’s $38 billion textile export industry has been hit hard by steep US tariffs, which are significantly higher than those imposed on competing countries such as Bangladesh and Vietnam, both facing a reciprocal duty of 20 per cent.

In response, Gokaldas has begun shifting portions of its production to Kenya and Ethiopia, where tariffs remain lower at a baseline of 10 per cent, following requests from clients to source from Africa.

The company is also increasing exports to the UK and EU, targeting a doubling of their combined revenue share from 10 per cent within two years, aided by the rollout of the UK-India Free Trade Agreement.

In the cavernous halls of the National Exhibition and Convention Center, a quiet but decisive shift in the textile industry’s vocabulary — and vision — was on display. Exhibitors unveiled vivid fabrics, innovative fibres, and recycling technologies, but the buzzword binding it all together was new: “Econogy.”

Coined by Messe Frankfurt, the organiser behind Intertextile Shanghai Apparel Fabrics, Econogy fuses ecology and economy. It signals that sustainability is no longer a feel-good extra but the engine of competitiveness in global textiles. “Sustainability is no longer a bonus — it’s a must,” said Olaf Schmidt, Vice President of Textiles & Textile Technologies at Messe Frankfurt, in his keynote address. “A product, however green, won’t survive if it isn’t economically viable. Econogy is about aligning those imperatives.”

From Ecology to Econogy: A strategic pivot

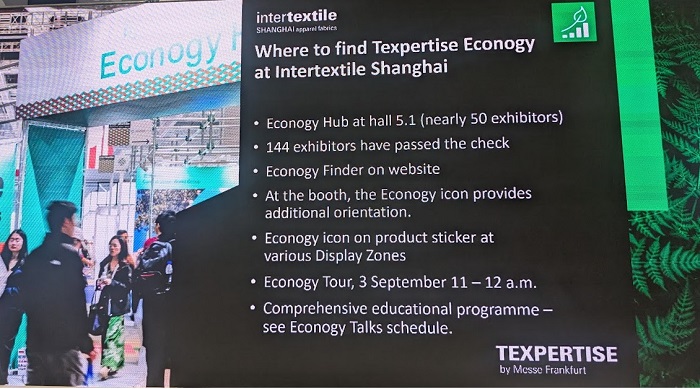

Messe Frankfurt’s sustainability work dates back years through its Texpertise Ecology initiatives. But 2025 marked the acceleration of a new phase: Texpertise Econogy, an umbrella framework uniting eco-driven exhibitors, certification schemes, and educational content across its global textile fairs.

At the heart of this strategy are tools designed to embed credibility and traceability:

At the heart of this strategy are tools designed to embed credibility and traceability:

● Econogy Check – an independent audit aligned with over 100 global standards, allowing exhibitors to validate claims and showcase sustainable credentials.

● Econogy Finder – an online sourcing directory for buyers seeking verified eco-friendly materials or processes.

● Econogy Hub – a dedicated show zone where suppliers, certifiers, and technology providers meet to display innovations and certifications.

● Econogy Talks & Tours – curated seminars, panels, and guided walks, translating sustainability into business practice.

The footprint of these initiatives is expanding fast. The Econogy Hub at Intertextile Shanghai grew by 70% over its debut, hosting nearly 50 exhibitors, including certification heavyweights Bureau Veritas, GOTS, TESTEX, Hohenstein, and Control Union.

Innovation takes centre stage

The fair floor revealed a surge of material and process innovation aimed at balancing environmental stewardship with commercial scale:

The fair floor revealed a surge of material and process innovation aimed at balancing environmental stewardship with commercial scale:

● Pyrus Biotech showcased bio-leather and plant-fibre textiles made from agricultural residues.

● Florence Biochem introduced microbial dyeing technology, replacing chemical-intensive processes with bio-based pigments.

● HKRITA’s “Green Machine” demonstrated a hydrothermal system for recycling blended fabrics.

● Alternatives such as Piñatex (pineapple-leaf leather), Kelsun (seaweed fibre), and Seawool (oyster-shell and PET yarn) underscored how waste streams can fuel high-performance textiles.

Digital solutions also drew attention, with platforms streamlining supply chains and cutting resource use.

Pressures driving the shift

Behind the showcase lies an urgent reality. Stricter legislation — from EU green-claims directives to global supply-chain due diligence rules — is compelling brands to prove sustainable sourcing and labour standards. Consumers, particularly younger demographics, are demanding transparency and responsible production.

Yet the path is complex:

● Verification and data remain uneven, especially for small and mid-sized manufacturers in loosely regulated regions.

● Cost pressures often clash with sustainability investments, demanding creative business models.

● Cultural and technical skills must evolve, from dye-house workers learning low-impact processes to designers adopting circularity.

Without credible tools, greenwashing risks erode trust, making verification platforms like Econogy Check vital.

Numbers that tell the story

Intertextile’s Autumn 2025 edition drew over 3,700 exhibitors from 26 economies, with a notable surge in space devoted to sustainable materials and traceable supply chains. Certified labels such as Made-in-Green and GOTS featured prominently, reflecting growing buyer demand for verifiable sustainability.

Messe Frankfurt’s own efforts mirror the ethos: a corporate code to cut energy and waste, partnerships with the UN Office for Partnerships since 2019, and reports like Texpertise Econogy Insights, which maps challenges from fibre impact to recycling solutions.

Building the future of “Econogy”

Schmidt acknowledged that scaling Econogy will take time: extending audits to more suppliers, ensuring global supply chains comply, and embedding sustainability metrics (carbon, water, labour) into decision-making. But he argued the opportunity outweighs the hurdles.

Firms that align ecology with profitability stand to gain:

● Brand value through credible eco-claims.

● Risk mitigation against regulation or raw-material shocks.

● Operational savings via reduced water, energy, and waste.

● Market access in regions where traceable eco-products are now standard.

A turning point

Intertextile Shanghai 2025 felt less like a trade fair and more like a blueprint for textiles’ next chapter. By putting structure — and economic rationale — behind sustainability, Messe Frankfurt is signalling that “Econogy” is here to stay.

As Schmidt put it, the industry is no longer talking about sustainability as a slogan. It is building systems, skills, and incentives to make it measurable, credible, and profitable. The task ahead is to scale these models globally — but the direction is clear: a textile economy where ecology is not sacrificed for growth, but drives it.

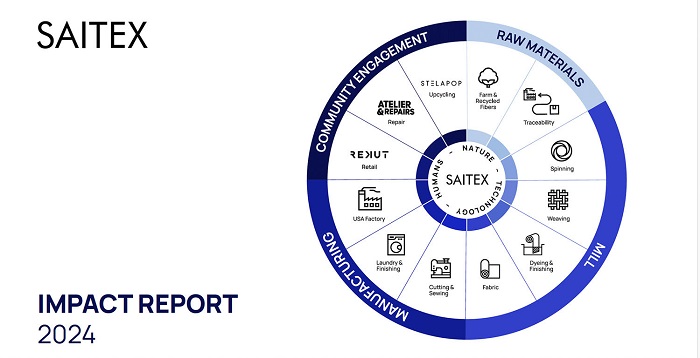

Saitex, a leader in sustainable apparel and denim manufacturing, has released its 2024 Impact Report, showcasing significant progress in its journey toward net-zero operations and a more circular and socially responsible manufacturing model. The company's vertically integrated ecosystem, which includes apparel manufacturing in Vietnam and the USA, a fabric mill, and upcycling initiatives like STELAPOP, reported double-digit production growth while simultaneously reducing its environmental footprint.

A commitment to sustainable growth

In 2024, Saitex's apparel manufacturing division increased its production output by 25% compared to the previous year.Despite this growth, the company achieved a 6.8% decrease in electricity usage per garment and an 18% reduction in emissions per garment, from 5.56 kg CO2e in 2023 to 4.56 kg CO2e in 2024.This was largely due to the implementation of rooftop solar panels and targeted process optimization. Similarly, at the Saitex Fabric Mill, production more than doubled with a 124% increase, while electricity use per meter of fabric dropped by 16% and total CO2 emissions per meter decreased by 18%.

Expanding renewable energy and carbon offsetting

Saitex is actively expanding its use of renewable energy. The company's apparel manufacturing facilities achieved a 35% CO2 emission offset in 2024, an increase of 7.1% from 2023.This was a result of rooftop solar installations, which accounted for 4% of the total offset, and the Gaia tree planting initiative, which contributed 3.1%.Since 2020, Saitex has partnered with Gaia Nature Conservation, and this collaboration has been extended through 2027 with a cumulative goal of planting 139,783 trees, which is projected to offset 5,681.2 tCO2. The company's long-term goal for its apparel manufacturing division is to run entirely on renewable energy by 2027.

At the Saitex Fabric Mill, the current energy mix is 70% renewable, with 34% coming from the mill's own solar rooftop installation and the remaining 36% from the industrial park. The mill has a goal to reach net-zero operations by 2030, with a longer-term ambition of becoming carbon-positive.

Innovations in water management and circularity

Saitex has made significant strides in water stewardship. The company's laundry facility has operated as a closed-loop water system since 2016, recycling and reusing 98% of its water. In 2024, the mill's total water consumption remained consistent with the previous year, despite the substantial increase in production. The mill plans to begin construction on a closed-loop wastewater treatment system in mid-2025, which is targeted to be operational by November 2025. This system will enable near-zero water discharge and significantly reduce the need for fresh water in industrial processes.

Circularity is also a key focus for Saitex. The company successfully repurposed 40% of the sludge generated at its apparel manufacturing premises into bricks and concrete blocks for garden walkways and retaining walls. Additionally, Saitex continues to collaborate with its sister company, STELAPOP, to transform textile waste into high-performance wood alternatives. At the mill, 92% of waste is recycled, with recycled fabric being converted into carpets and fiber and yarn waste transformed into new yarns.

Social and community engagement

Saitex's community impact reach increased by 60% in 2024, reaching 13,245 people. This was driven by initiatives such as the "Every Drop Counts" program, which distributes daily meals and essential supplies to vulnerable communities, and the "Clean Water Project - Anh Chị Em (Brothers & Sisters)," which provides access to clean water in the Tra Bong district. The company also continued its support for the 4Ps program for orphanages and the REKUT program, which promotes equal employment opportunities for people with disabilities.

A new employee initiative, the "Gaia x Saitex Employee Project," engaged 4,000 employees in collecting unwanted items to be sold online to fund tree planting. The initiative demonstrated the power of collective responsibility, with 4,039 products extending their life and enabling 123 trees to be planted.

|

Impact Area |

Saitex Apparel Manufacturing |

Saitex Fabric Mill |

|

Production Growth (2024) |

+25% |

+124% |

|

Electricity Usage per Unit (2024) |

-6.80% |

-16% |

|

Emissions per Unit (2024) |

-18% |

-18% |

|

Water Usage per Unit (2024) |

+7.29% |

Unchanged |

|

Wastewater Discharge per Unit (2024) |

+21.4% |

Unchanged |

|

Waste per Unit (2024) |

+1.1% |

-8% |

Areas for improvement and future goals

The report also highlights areas needing improvement. In 2024, gas usage per garment at the apparel manufacturing facility increased by 16% due to demand for 3D fashion and coating processes. Saitex plans to address this by replacing gas-powered ovens with more energy-efficient alternatives and transitioning to solar power for this operation once the solar roof project is fully implemented.

Water and wastewater figures at the apparel facility saw a temporary increase due to scheduled maintenance for the Reverse Osmosis (RO) system's filters, which are replaced every three years. The next filter replacement is scheduled for June 2025, with a phased approach planned to minimize disruption.

An internal audit revealed 27 cases of undeclared Sunday work at the finishing unit between September and November 2024. Saitex has responded by implementing an online overtime registration system, reinforcing training, and introducing quarterly compliance audits. All affected workers were fully compensated.

Looking ahead, Saitex is committed to its strategic goals. The apparel manufacturing division aims for 100% renewable energy by 2027 and anticipates 35% on-site solar coverage by the end of 2026. The denim mill's goal is to achieve a closed-loop wastewater system with minimal fresh water input by the end of 2025. The company's ultimate ambition is to move beyond carbon neutrality and become carbon positive.

Daniel Connolly outlines £62bn sector’s sustainability drive, trade pivots and China links at Intertextile Shanghai 2025

The United Kingdom’s fashion and textile industry is positioning itself for robust global growth while embedding sustainability and circularity into every layer of its supply chain, according to Daniel Connolly, Senior Executive at the UK Fashion & Textile Association (UKFT). Addressing international buyers and suppliers at Intertextile Shanghai Apparel Fabrics – Autumn Edition 2025, Connolly portrayed a sector blending heritage craft with forward-looking innovation. “We are the largest network for fashion and textiles in the UK,” he said. “Our mission is to deliver sustainable growth across the entire value chain — from brands and designers to mills, educators and retailers.”

A £62 billion economic powerhouse

Research commissioned by UKFT and Oxford Economics pegs the industry’s gross value added at £62 billion, supporting 4.3 million jobs — one in every 25 in Britain — and generating £23 billion in annual tax revenues. Britons buy more than 4 billion fashion items a year, underscoring the sector’s weight in domestic retail as well as exports.

Trade flows and shifting markets

UK textile exports have stabilised since the pandemic, with Europe still dominant, though clothing shipments dipped after 2020 amid Brexit and global disruptions. Imports remain diverse: Bangladesh and China lead non-EU supply, while Italy, France, Spain and Germany stay strong.

Connolly flagged tariffs and geopolitical frictions as 2025 headwinds but said new agreements are widening horizons. The UK’s accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) signals intent to engage markets from Canada to Vietnam, while a free-trade pact with India is nearing completion.

China: Partner in sourcing and sales

China remains central to UK sourcing and a fast-growing consumer base. Latest figures show £6.3 billion in UK apparel and textile imports from China, versus £284 million in exports. “Our industry depends on Chinese manufacturing for quality as much as price,” Connolly noted. “But we’re also intent on serving China’s expanding premium market.”

Circular economy & compliance

A highlight of Connolly talk was the sector’s pivot to a circular economy. Through its Circular Fashion Innovation Network, UKFT is building infrastructure for recycling, sustainable manufacturing and fibre-to-fibre technologies.

A flagship study shows Britons discard 700,000+ tonnes of non-reusable textiles annually. Pilots with heritage firms such as Begg & Co have turned waste fibres into luxury blankets from recycled wool and cashmere. “The challenge is scaling commercially viable recycling,” Connolly stressed, adding that compliance with new environmental rules is becoming mission-critical for UK operators.

Expanding the global footprint

UKFT has ramped up overseas promotion post-pandemic, sending delegations in 2025 to Vietnam, Tokyo, Atlanta and New York, alongside regular showings at Milano Unica, Première Vision, Pitti Uomo and Paris Fashion Week. Partnerships with Messe Frankfurt and the Worshipful Company of Clothworkers are helping British mills and designers gain traction abroad.

Visitors to Hall 5.1, Stand G84 at Intertextile Shanghai can view samples from 20+ UK companies ranging from luxury woollens to advanced technical fabrics.

Outlook for resilience, innovation and sustainability

Despite trade frictions and slow Brexit aftershocks, Connolly struck an optimistic note. “The EU will remain vital, but Asia, the Americas and the Pacific are just as exciting,” he concluded. “Our focus is resilience, innovation and sustainability — ensuring the UK thrives in an increasingly competitive global textile landscape.”

These efforts, combined with a focus on compliance and innovation, show an industry determined to not only survive but thrive in a complex global environment. UKFT's presence at international events like the one in Shanghai underscores their commitment to finding new partners and solidifying the UK's reputation as a leader in quality, creativity, and sustainable practice.

Greenext Expo 2025 will be held as a major response to ongoing global climate crisis. The event is scheduled to take place from September 26–27, 2025, at the Shanghai Exhibition Center.

Themed ‘A Journey to Sustainability,’ the event is poised to be China’s leading cross-industry summit and exhibition dedicated to sustainable development. It will bring together global sustainability leaders and innovators to forge new solutions for regenerative business practices.

Operating under the guiding principle of ‘Sustain Every Business,’ Greenext Expo 2025 is built on four core pillars: Sustainability, Innovation, Cross-Sector Collaboration, and Business. This year's event will feature an upgraded program that blends showcases, executive dialogues, and public engagement across key sectors like fashion, food and beverage, energy, education, and investment.

Building on a successful debut

Following its successful launch in 2024, the Greenext Expo received widespread praise from both industry leaders and the public. The inaugural event attracted over 4,300 visitors and featured more than 100 brands and businesses. It hosted 23 keynote speeches, 17 panel discussions, and 8 workshops on critical topics, including ESG reporting, climate action, and green consumerism. The event also marked the launch of several landmark publications, such as the China ESG White Paper and a Sustainability Trends Report. Public programs, including a photography exhibition and a collaborative sustainable fashion show, reinforced the expo's mission to merge commerce, creativity, and community.

Thematic zones and flagship initiatives

In 2025, the expo will introduce six curated thematic zones designed to provide clear pathways for sustainable transformation. These include

• Fashion Forward: This zone will highlight a full-chain approach to innovation in fashion, from materials to design.

• Living Earth: This zone will focus on sustainable connections within regenerative agriculture, eco-beauty, and local culture.

• Green for Next: It will present robust solutions for carbon management, green manufacturing, and circular business models.

• Global Navigation: This zone is designed to help Chinese companies build international compliance and sustainable branding capabilities.

• Pulse of Vitality and Art Awakens: These two zones will create immersive spaces that blend lifestyle aesthetics with cultural co-creation.

The expo will also feature a rich array of flagship initiatives. A highlight will be the 15th Anniversary Showcase of the Redress Design Award, which will spotlight emerging sustainable voices in fashion. The Greenext Co-creation Lab will host collaborative sessions in cities like Paris, Hangzhou, and Shanghai to bridge local practices with international dialogue. Other special programs, including the Green Venture Hub and Future Leaders Academy, are designed to foster long-term strategic change across various industries.

Shaping the future

This year's expo will also develop its public engagement efforts through an enlarged EcoLife Neighborhood, interactive art installations, and gamified sustainability experiences. An urban ‘green passport’ initiative will integrate the event with commercial venues across Shanghai, aiming to make green living more accessible and appealing to a wider audience.

Reflecting on the future, Dr Hong Zheng, Founder, Greenext, emphasizes on the importance of the event as a catalyst for change. The event was launched in 2024 in Shanghai with humility and curiosity, he says. The energy from thousands of attendees and the resonance across industries affirmed that sustainability is no longer a distant vision but a shared imperative, he adds.

Dr Zheng concludes by stating, the event continues to explore how sustainable ideas can be developed in 2025, under the theme 'A Journey to Sustainability. It also explores how industries can collaborate, and how culture can amplify impact. The event is thus set to be a stage for connection, a space for experimentation, and a movement of purpose.

With over 650 exhibitors showcasing their products across 60,000 sq m, the China International Fashion Fair (CHIC) Autumn 2025, consolidated its position as Asia’s premier fashion trade show. The fair was held from September 2-4, 2025 and attracted more than 60,000 visitors. The event served as a critical platform for business, innovation, and networking.

Based on the theme, ‘New Intelligence, New Products, New Scenes,’ the trade fair highlighted the Chinese apparel industry's shift toward technology, sustainability, and sophisticated supply chains. The ‘Autumn Picnic’ metaphor set a relaxed, welcoming tone, fostering a sense of community and collaboration that blended business with creativity.

According to Chen Dapeng, President, China National Garment Association, more than just an exhibition; CHIC is a strategic hub where the future of the fashion economy is shaped. The event provides international brands with essential access to partners, distribution channels, and market opportunities in China, he asserted

Showcasing industry innovation and trends

The fair's exhibitors presented a comprehensive view of the industry, from intelligent manufacturing and digital supply chain solutions to production processes aligned with ESG (environmental, social, governance) criteria. Over 100,000 product variants, or SKUs, were on display, ranging from outdoor and streetwear to avant-garde designer collections.

A major highlight was the global recognition of Chinese designer labels. Brands that had previously shown at prestigious international events like Pitti Uomo in Florence showcased their collections, demonstrating that Chinese design is now a major force on the international stage. Labels such as May D. Wang exemplified a new creative generation that blends traditional craftsmanship with innovative concepts and cultural identity.

Other key trends included the growth of lifestyle-oriented apparel and sportswear from market leaders like Zhangzhen Jeans and Muye Zhanfang. The ‘Guo Feng’ or national style, a prominent expression of cultural pride among younger generations, was also well-represented by brands such as Shang Jiu Kai and Jixiang Yijia. Technological innovations were a major draw, with companies like PSAI and Feiliu Tech presenting smart production equipment, 3D printing, and AI solutions that highlight the industry's digital edge.

A gateway for international brands

CHIC Autumn 2025 underscored China's evolution from a manufacturing hub to a global innovation leader, creating unique opportunities for international brands. Authenticity and quality, particularly for products ‘Made in Europe,’ remain highly valued. A strong digital presence on platforms like Tmall, JD.com, and Douyin is now considered essential for market success. The fair also emphasized the importance of agile supply chains, flexible production, and cultural sensitivity to strengthen brand acceptance.

Despite a decline in international exhibitors since the pandemic, CHIC remains a vital bridge for global companies. Italian delegations with brands like Franco Giazzi and Cinzia Caldi, as well as German brand Studio Ayasse, expressed unanimous satisfaction with the event.

The fair attracted 60,977 professional visitors from 83 countries, with a significant majority from within China. The visitor list included global retail giants like Shein and Galeries Lafayette, leading Chinese brands like JNBY and Ellassay, and major e-commerce platforms such as Tmall and Taobao.

Sustainability and innovation at the forefront

Sustainability was a central theme at CHIC, with a dedicated Sustainable Innovation Zone and the 2025 Circular Stewardship Fashion Conference. The event brought together experts from organizations like the National Development and Reform Commission and the Delegation of the European Union to discuss building a closed-loop textile industry and implementing ESG best practices.

Ashwin Chandran has been appointed the new chairman of the Confederation of Indian Textile Industry (CITI), effective September 18, 2025. He takes the leadership position from Rakesh Mehra, whose term concluded after CITI's 67th Annual General Meeting (AGM).

A seasoned industry leader, Chandran is the Chairman and Managing Director of Precot, a prominent cotton mill with operations across several Indian states. He previously served as the chairman of the Southern India Mills Association (SIMA).

The new leadership team also includes Dinesh Nolkha as the new deputy chairman and Shreyaskar Chaudhary as the new vice chairman.

An eminent figure in the textile sector, Nolkha is the Chairman and Managing Director of Nitin Spinners., a leading manufacturer of cotton yarn and knitted fabrics. He is a certified Chartered Accountant and a former president of the Mewar Chamber of Commerce and Industry.

Known for his focus on sustainability, Chaudhary is the Managing Director of Pratibha Syntex The company is a pioneer in ethical and sustainable practices, holding certifications as India's first Fair Trade Certified and ZDHC Certified Apparel Manufacturer.

Outlining the two essential priorities for the Indian textile and apparel sector, Chandran says, the most urgent task is to address the severe challenge posed by a new 50 per cent tariff imposed by the United States on Indian products starting on August 27, 2025.

The longer-term goal is to ‘futureproof’ the Indian textile and apparel industry, primarily composed of small and medium-sized businesses (MSMEs). The strategy focuses on improving the industry's ability to compete on the world stage; placing a greater emphasis on new technologies, ethical practices, and environmental stewardship, investing in skill development and knowledge sharing to help businesses grow both domestically and internationally and enabling companies to fully capitalize on existing and future free trade agreements (FTAs), he adds