In Europe, many technical textiles companies are facing takeovers. Why?

Takeovers are driven by two main reasons. One, large global players for example, US-based Polymer Group Inc (PGI), which is the largest producer of non-wovens has taken over non-woven producers like Fibertechs, and TEX and others. This is because on their customer side, they have global brands such as Procter & Gamble, Kimberley Clarke, Johnson & Johnson who ask suppliers to have a global presence. That’s a change driver. In the auto industry too customers are asking for global suppliers. And for many suppliers it is faster for them to become global if they make an acquisition.

The other driver is business. There many technical textiles companies in the world that report good results. EBIDTA, is a professional measure that financial investors talk about. In technical textiles we talk about EBIDTA levels between 12 and 25 per cent of sales, which is way above traditional textiles. And that attracts investors and family hoardings. So, the largest transaction that we’ve seen this year is Henkel in Germany, which is a large family hoarding, with a couple of billions in equity capital. They bought Bekaert, in Belgium. It is headquartered in Belgium, but is a global player in metra sticking. It is one of the the largest producer of metra sticking in the world. Then there are a lot of smaller transactions like, Innova, they buy smaller companies. The margins are so good that investors are attracted. Therefore, it’s either strategy driven, where one has to become global, and to expand they buy a company because it’s faster than building up a business yourself, or it’s financial reasoning.

Asia is in the forefront of technical textiles. Besides Vietnam and China, which other countries are emerging strong?

China is well-known. They have the advantage of being a centralised state, where the government decides and regions and private industries execute. They had an easy time to implement norms for the Olympic Games, to implement new textiles for the road, because it’s just a government decree. They also monopolised the world in certain raw materials, so, for eg, polyester yarn, which is one of the core raw materials for technical textiles is completely in their hands. However, they have reached their limit. In future, this can’t go on.

Korea is already doing well because of hi-tech fibres, a lot hi-tech companies, etc. However, Korea has only 40 million people. It’s half of Germany, which is a tiny country. They have done a good job of penetrating hi-tech or hi-end technical textiles, but with such a small domestic market, they cannot become a global player. Therefore, the only country that can become a global player is India because there are more than 1 billion people with at least 300 billion middle-class. And all these people will start buying cars and diapers for their babies, and visit private hospitals for treatment and surgery, which is by itself a huge market.

Globally, what is the share technical textile in total textile exports?

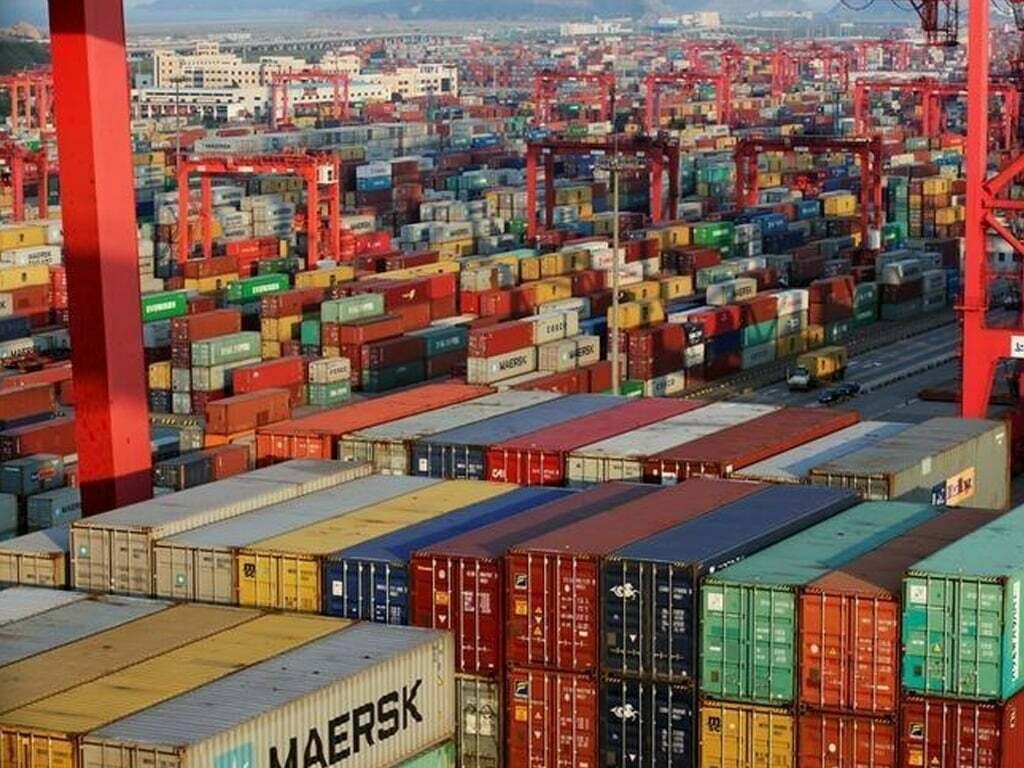

One of the difficulties in technical textiles is that it is not exported easily, other than, for e.g., if one makes cotton fabric for fabric printing in Indian dress fabric, which is a global commodity, which is easily exported. However, in technical textiles, there are a lot of trade- and non-tariff barriers, which make potential customers become wary of losing their product, but once this is overcome, they are fabulous export successes.

Turkey is going down, and India constantly goes up. There are many reasons for Turkey’s performance. The currency has appreciated and Turkish infrastructure for exports is bad, because from Turkey to go to European markets, one has to go by truck. Trucking costs are higher than shipping a container from Mumbai to Europe or from Mumbai to the US. Therefore, transport costs from and to Turkey, are much higher than India exporting to Europe or US. The other reason is appreciation of the Euro. The third reason is specifically for FIBCs. The world market leader that also owns two largest producers in Turkey has been taken over by US GREIF, and they are now shifting production to Middle East, which has created unrest in the personnel and the market has gone down. India is on the verge of becoming world number one.

Emerging and developed markets are doing well. How does progress in emerging markets affect the developed markets?

One thing is the local market aspect, as the GDP grows, middle-class grows—they want cars, medical treatment in decent hospitals, they want hygiene, proper environment, etc. As middle-class grows, it becomes an important vote share, it has higher disposable incomes, and technical textiles grow. Therefore, there is an almost automatic formula. It is not affecting the markets in Europe and US. On the contrary, lots of people buying Mercedes Benz in India is good for Europe. Exports from emerging countries to developed countries are growing, or imports to US and Europe from Asia are growing.

For example, laminated fabrics for digital prints, a lot of these fabrics come from Asia, especially China. It’s better for everybody because Asian rules demand western technology, so they buy machinery from Europe, US or Japan. Big brands such as Proctor & Gamble and Kimberley Clarke, etc., like it if there are more private hospitals such as the Apollo chain in India and if they have to buy certain staple technical textiles from India and China, it’s alright since it’s an exchange. There is no conflict in this industry as it was in the fashion industry, where textile for fashion has almost vanished in Europe or US. In technical textiles it’s a win-win situation.

What are the challenges and opportunities for technical textiles today?

The prospects are good for large domestic market. As Prime Minister Modi said that car production should go from three million to 10 million three fold growth. A car takes an enormous amount of textiles. Safety, fitting, tyres, etc., there’s textiles all over the car. Therefore, if that aim is achieved, the market will triple. If private hospitals do well, great opportunities open up in the domestic market. Exports, are slower as there is a prejudice and the prejudice has to be overcome in daily life But, some sectors have done it and we have role models, such as Welspun, this shows others we can do it.

The challenge is the need to import key raw materials from China. China has monopolised the world in certain raw materials. So, for a lot of raw materials you have to depend on China and that is not a happy situation. Therefore, it’s important to build competitive raw material bases like Korea.