"Rising trade aberrations are proving to be detrimental for Chinese and American textile and apparel organisations. Expressing resentment, Xu Yingxin, VP, China National Textile and Apparel Council, stated tariff increases are not just a tax on consumers, they will also bring uncertainty to the stable global supply chain for top brands. Neither American consumers or fashion brands, nor Chinese textile and apparel manufacturers will benefit from the conflict, he added. He was speaking on the sidelines of 2018 China Textile and Apparel Trade Show New York with Messe Frankfurt North America. About 1,000 exhibitors from 17 countries attended the event, with more than 600 from China. Close to 1,000 types of products listed in the textile and apparel categories are a part of the $200 billion in Chinese imports potentially subject to 10 per cent tariffs imposed by the Office of the US Trade Representative. Hearings will be held Aug 20-23 before a final decision will be made at the end of August. The products, mainly raw materials such as yarns and fabric, range from silk to cotton, to lace to embroidery, and total about $4 billion, said Xu."

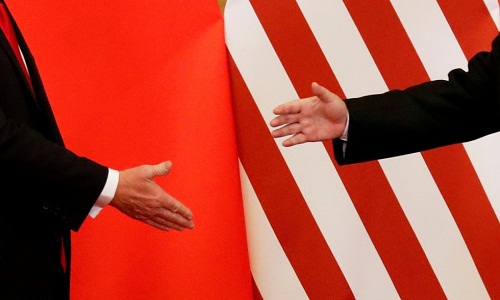

Rising trade aberrations are proving to be detrimental for Chinese and American textile and apparel organisations. Expressing resentment, Xu Yingxin, VP, China National Textile and Apparel Council, stated tariff increases are not just a tax on consumers, they will also bring uncertainty to the stable global supply chain for top brands. Neither American consumers or fashion brands, nor Chinese textile and apparel manufacturers will benefit from the conflict, he added. He was speaking on the sidelines of 2018 China Textile and Apparel Trade Show New York with Messe Frankfurt North America.

Rising trade aberrations are proving to be detrimental for Chinese and American textile and apparel organisations. Expressing resentment, Xu Yingxin, VP, China National Textile and Apparel Council, stated tariff increases are not just a tax on consumers, they will also bring uncertainty to the stable global supply chain for top brands. Neither American consumers or fashion brands, nor Chinese textile and apparel manufacturers will benefit from the conflict, he added. He was speaking on the sidelines of 2018 China Textile and Apparel Trade Show New York with Messe Frankfurt North America.

About 1,000 exhibitors from 17 countries attended the event, with more than 600 from China. Close to 1,000 types of products listed in the textile and apparel categories are a part of the $200 billion in Chinese imports potentially subject to 10 per cent tariffs imposed by the Office of the US Trade Representative. Hearings will be held Aug 20-23 before a final decision will be made at the end of August. The products, mainly raw materials such as yarns and fabric, range from silk to cotton, to lace to embroidery, and total about $4 billion, said Xu.

Julia Hughes, President of Washington-based United States Fashion Industry Association (USFIA), also opposed tariff hikes. As per the association's annual survey, for the second year in a row, a protectionist trade agenda in the US is the top concern for the American fashion industry. Companies are concerned about broader implications of protectionism for the US economy, consumers and the global economy, Hughes said in an interview at the trade show.

Impact on sourcing

Hughes says one strategy for American companies is to find other sourcing opportunities but most sourcing executives say there aren't enough viable options to replace China. Companies are sourcing from other countries for many reasons, Everyone has some sourcing in China; many have some sourcing in Vietnam. And Bangladesh, India and Indonesia are the sources, as well as countries in the Western Hemisphere. She further added that there isn’t enough sourcing in the world to replace China and especially not the quality sourcing that American brands and retailers want.

options to replace China. Companies are sourcing from other countries for many reasons, Everyone has some sourcing in China; many have some sourcing in Vietnam. And Bangladesh, India and Indonesia are the sources, as well as countries in the Western Hemisphere. She further added that there isn’t enough sourcing in the world to replace China and especially not the quality sourcing that American brands and retailers want.

Hughes believes the Trump administration has heard her association's message, so in order to not hurt consumers; the tariffs have been focused on manufacturing inputs rather than clothing, footwear and home textiles. The association will continue its opposition to consumer products its members import and sell in the US and are not on the tariff list. Pan, deputy general manager of Hong Gang Textile, a supplier of upscale warp-knitted fabrics, whose business with US companies accounts for less than 20 per cent, added only through innovation can you avoid being replaced.

For the past 40 years, China’s textile industry has been integrated into the global textile and apparel supply and value chains. China and US textile and apparel trade hit more than $44 billion in 2017 compared with $4.9 billion in 2001. China remains the biggest textile exporter to the US, while the US is the No. 1 export market for China's textile industry, accounting for 17 per cent of China’s exports in the industry. On the prevailing situation, Xu highlighted that Chinese companies will continue to be the most stable and reliable suppliers of American brands, and a long-term mutually beneficial partnership between China and the US textile industries will remain unchanged.