"The RMG sector in Bangladesh has witnessed tremendous growth over the last one decade. The country has emerged as the second largest RMG exporter to the world with around 85 per cent of its export earnings achieved through this sector. This growth in the country’s RMG sector has created many new employment opportunities in the country with around 4 million Bangladeshi people currently being employed in the sector reveals an exclusive study by Wazir Analysis and Textile Magazine."

The RMG sector in Bangladesh has witnessed tremendous growth over the last one decade. The country has emerged as the second largest RMG exporter to the world with around 85 per cent of its export earnings achieved through this sector. This growth in the country’s RMG sector has created many new employment opportunities in the country with around 4 million Bangladeshi people currently being employed in the sector reveals an exclusive study by Wazir Analysis and Textile Magazine.

The RMG sector in Bangladesh has witnessed tremendous growth over the last one decade. The country has emerged as the second largest RMG exporter to the world with around 85 per cent of its export earnings achieved through this sector. This growth in the country’s RMG sector has created many new employment opportunities in the country with around 4 million Bangladeshi people currently being employed in the sector reveals an exclusive study by Wazir Analysis and Textile Magazine.

The textile and apparel exports of Bangladesh increased at a CAGR of 8 per cent from $25 billion in 2012 to $36 billion in 2017. The country, which enjoys preferential access in the European Union (EU) under the ‘Everything but Arms’ (EBA), gained around 61 per cent market share in the region for textile products. Other than the EU and US, Japan and Russia are the other flourishing countries with their market share growing at a CAGR of 36 per cent and 28 per cent, respectively. Through its export competitiveness and duty free access, Bangladesh has attracted many international brands in recent years, reveals the study. The country’s apparel exports have grown at a CAGR of 14 per cent since 2005. These are further likely to grow at a CAGR of 12.5 per cent to reach $100 billion by 2025.

Fragmented textile value chain hampers growth

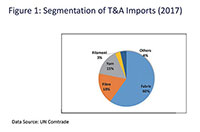

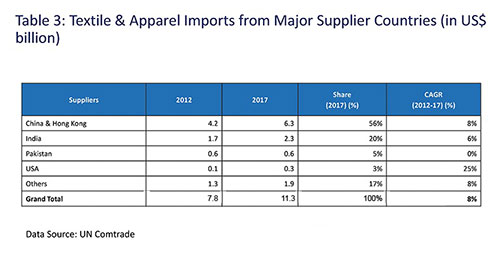

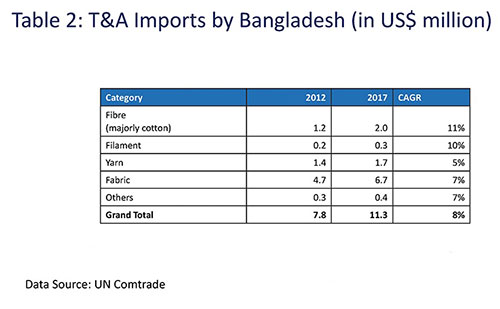

The Wazir Analysis and Textile Magazine study also reveals, Bangladesh faces many challenges that affect its export growth. Firstly, the country has a fragmented textile value chain which is highly dependent on import of raw material for textile and apparel commodities. Also, issues like increasing wages, lower output, low product quality, etc plague export growth in the country. To counter these issues and remain competitive in the global market, Bangladesh needs to focus on the following aspects:

Integration of operations to enhance market power, position

Backward & forward integration could help Bangladesh companies to control not only their buyers but also their suppliers, distributors and customers. It can also enhance their market power and position, reduce import of fabric and yarn and internal consumption of products, increase value-addition at all stages of the textile value chain, reduce in costs, lead times, increase employment avenues for local population and better margins for the manufacturers.

suppliers, distributors and customers. It can also enhance their market power and position, reduce import of fabric and yarn and internal consumption of products, increase value-addition at all stages of the textile value chain, reduce in costs, lead times, increase employment avenues for local population and better margins for the manufacturers.

Dealing with quality, design and delivery issues

Another area that Bangladesh needs to focus on is offering superior quality products with innovative designs, customisation, on-time delivery, technology innovations and after-sales service. This can be achieved through major transitions in manufacturing set-up and workforce development. The main components of this transition include Streamlined manufacturing process can help Bangladesh deliver high variety, low volume orders

Reducing mishaps through concepts like Right First Time, Zero Defect, Quality Control can help the country to improve its products and processes Operaters need to take ownership of their equipment and also simply their processes to increase their capacity and also improve the quality of their offerings.

The manufacturing units should adopt information systems like Business Process Management (BPM) to improve their capacity. They should also involve their employees in their production processes

Companies need to adopt market intelligence to keep up with the latest trends and developments along with competitor analysis. They need to introduce low-volume high fashion products. They also need to create a proper work culture in their companies by training their labor as well as middle management.

Lastly, Bangladeshi apparel manufacturers should focus on catering to the demand of Indian market which is expected to grow at 12 per cent CAGR by 2025.