FW

GHCL Textiles, a leading manufacturer of premium yarn and fabrics, is set to exhibit its latest innovations at Bharat Tex 2025 from February 14-17 at Bharat Mandapam, New Delhi. The company will display its diverse product range at Stall E19, Hall 1F, reinforcing its commitment to sustainability, advanced technology, and market excellence.

Legacy of excellence and sustainable growth

With a strong 95-year legacy, GHCL Textiles has established itself as a leader in the spinning industry. The company operates two state-of-the-art manufacturing units in Tamil Nadu, with a production capacity of 44,000 MTPA. Focused on cutting-edge technology and sustainable business practices, GHCL serves both domestic and international markets with high-quality yarns, including synthetic fibre, double yarn, open-end, and cotton yarn in counts ranging from Ne 24s to 120s. The company specializes in premium yarn varieties such as Giza, Supima, and Australian cotton, catering to evolving industry demands.

GHCL Textiles aligns with the Indian government’s vision for a robust textile ecosystem. Honourable Prime Minister Narendra Modi Ji inaugurated the first edition of Bharat Tex last year, emphasizing the 5F approach - Farm to Fibre to Factory to Fashion to Foreign, to strengthen India’s global position. GHCL supports this vision by integrating sustainable processes, investing in infrastructure, and ensuring quality-driven production to meet global standards.

Participation at Bharat Tex 2025

GHCL Textiles sees Bharat Tex 2025 as a key opportunity to connect with domestic and international buyers, industry veterans, and policymakers. Balakrishnan R, CEO of GHCL Textiles, stated, “We are excited to participate in Bharat Tex 2025, India’s largest global textile event. Our focus on innovation and sustainability, backed by integrity and reliability, ensures the highest customer satisfaction. The event will be a great platform to network, explore new market trends, and showcase our commitment to the future of textiles.”

Bharat Tex 2025 will feature over 5,000 exhibitors, 20,000+ exhibits, and 70 sessions covering eco-friendly practices, technical textiles, and ethical sourcing. The event will include exhibitions, B2B meetings, MoUs, product launches, and knowledge-sharing sessions, attracting top policymakers and global CEOs.

Established in 1927 as Sree Meenakshi Mills, GHCL Textiles has evolved into a forward-looking company that values innovation, sustainability, and workforce development. With a strong foundation and a vision for long-term growth, GHCL Textiles remains dedicated to strengthening India’s textile sector through continuous advancements in technology and sustainable manufacturing.

The British Textile Machinery Association (BTMA) is alerting apparel brands, retailers, and suppliers about a major shift as the EU and UK officially ban fluorescent lighting from February 24, 2025. This phase-out, aimed at eliminating mercury-containing lamps, impacts designers, fabric manufacturers, and retail displays.

BTMA CEO Jason Kent explains that while mercury-based lamps were banned for general use in August 2023, an exemption for specialist applications, such as colour assessment, ends this month. The legislation is expected to be adopted globally.

This means specialist manufacturers, including VeriVide, will no longer sell new fluorescent-based light booths. Colour consistency across the textile supply chain is crucial, notes VeriVide Sales Director Adam Dakin, as fluorescent-based colour matching may appear different under LED store lighting, leading to costly returns and recalls.

VeriVide has spent a decade perfecting its all-LED UltraView technology, ensuring accurate digital colour assessments. The system, adopted by retailers like H&M, NEXT, and Marks & Spencer, replaces traditional fluorescent booths while improving energy efficiency and sustainability.

“We’ve future-proofed colour assessment with UltraView,” says Gary Timmons, fabric technologist at NEXT. VeriVide still holds replacement stock for existing fluorescent booths but urges a transition to UltraView.

Kent emphasizes that LEDs, being mercury-free and energy-efficient, are the ideal alternative. “With a complex supply chain, precision in lighting conditions is essential,” he says, urging the industry to adapt swiftly.

A new report by Fashion for Good and BCG highlights the urgent need for fashion brands to adopt next-generation materials, which could reshape the industry’s environmental impact and cost structure. Materials account for 92 per cent of fashion’s emissions and nearly 30 per cent of cost of goods sold (COGS).

While next-gen materials currently make up only 1 per cent of the fiber market, they could reach 8 per cent or 13 million tons by 2030. However, achieving this growth requires overcoming financial, technical, and operational barriers amid regulatory pressures, supply chain disruptions, and shifting consumer preferences.

The report, Scaling Next-Gen Materials in Fashion: An Executive Guide, outlines three key levers to accelerate adoption: demand, cost, and capital. Stable demand signals, demand pooling, and transition financing can ease adoption challenges. Cost engineering and supply chain optimization will make these materials more affordable.

Strategic financing, aligned with different adoption phases, is essential for long-term scaling. Brands that integrate next-gen materials into core strategies can reduce COGS by 4 per cent over five years, ensuring competitiveness in an evolving market.

Industry leaders stress the urgency of action. “Next-generation materials are no longer just an opportunity but a business imperative,” said Katrin Ley, managing director at Fashion for Good. BCG’s Sebastian Boger emphasized that scaling these materials is critical for staying relevant, while Catharina Martinez-Pardo noted that brands embedding them into their strategies now will lead the future of fashion.

The report calls for both individual brand efforts and industry-wide collaboration to drive adoption and secure long-term resilience.

The Hong Kong Research Institute of Textiles and Apparel (HKRITA) has signed Memoranda of Understanding (MoUs) with China Textile Academy (CTA) and ANTA Sports Products Group Co Ltd (ANTA) to advance textile innovation and industrial transformation.

The collaboration brings together Hong Kong and mainland China's expertise to accelerate technology transfer, commercialization, and sustainable development. CTA, a leading national research institute, will work with HKRITA to scale laboratory technologies into pilot tests and industry applications. Meanwhile, ANTA, a top sportswear brand, will focus on athlete-driven innovation and sustainable solutions to enhance product performance and competitiveness.

HKRITA CEO Jake Koh highlighted the strategic importance of these partnerships, stating, “R&D requires a multitude of brilliant ideas to succeed. These memoranda create a large pool of innovative exchanges between Hong Kong and the mainland, allowing us to tackle industry challenges and stay ahead of the competition.”

CTA General Manager Ma Yongmei emphasized the institute’s strong innovation chain, covering material development, fibre applications, equipment, and certification. “This collaboration will drive technological breakthroughs and accelerate the integration of R&D with industrialization,” she said.

ANTA Vice President Li Su echoed the excitement, stating, “We look forward to creating an innovation platform with HKRITA to enhance the sportswear industry’s value chain.”

The partnerships will focus on cutting-edge areas, including new fibre materials, functional textiles, smart manufacturing, and sustainable regenerated textiles. By combining research and industrial expertise, the initiatives aim to accelerate product development, strengthen market competitiveness, and promote eco-friendly practices.

Bluesign is accelerating sustainability in footwear with bold initiatives, including expanding its Bluesign Finder database and partnering with Vibram. These efforts support the industry's shift toward cleaner, safer, and more sustainable manufacturing amid growing environmental regulations.

Last week, Bluesign announced a major update to its Bluesign Finder, a digital platform for certified chemical products. The addition of Safe Polymers provides manufacturers with a wider selection of eco-friendly, high-performance materials that meet strict environmental and safety standards. This expansion simplifies access to verified sustainable polymers, helping brands minimize waste, enhance efficiency, and comply with evolving regulations.

Bluesign is also strengthening its footwear sustainability initiative through a partnership with Vibram, a global leader in high-performance rubber soles. Leveraging its input stream management system, Bluesign ensures that harmful chemicals are eliminated at the start of production, reducing environmental impact while maintaining strict safety standards.

The collaboration aligns with stringent EU regulations, including the EU Green Deal, setting a science-backed blueprint for responsible footwear manufacturing. By integrating sustainability at the foundation of production, Bluesign and Vibram are driving a major industry shift toward cleaner, regulation-compliant processes.

With these advancements, Bluesign is reinforcing its leadership in sustainable chemistry, helping footwear brands transition to a more responsible future.

Being held from February 13-15, 2025, at the Cairo International Convention Centre in Nasr City, the 76th edition of Egypt’s leading clothing and textile exhibition, Cairo Fashion & Tex features 750 Egyptian and international brands.

The event is being held under the guidance of the Ministries of Industry and Investment and showcases the latest industry trends and innovations. Organized by Pyramids Groups for International Exhibitions and Conferences, the exhibition is supported by the Ready-Made Garments and Textile Chamber It is Egypt’s largest fashion and textile industry event and attracts over 30,000 visitors annually.

Cairo Fashion & Tex provides a valuable opportunity to Egyptian companies to showcase their products while staying updated on global market trends, emphasizes Mohamed El-Sherif, Chairperson, Pyramids Group. The exhibition plays a vital role in fostering collaboration among companies, facilitating trade, and securing export and investment deals, he highlights.

According to El-Sherif, this year’s event has drawn significant participation from exhibitors representing Egypt, Turkey, China, Germany, Italy, and other countries. He expects the number of export deals secured by Egyptian companies to increase to approximately $200 million from the $60 million in agreements signed during the previous edition.

Pyramids Group also plans to launch several upcoming exhibitions in 2024, including Egy Fashion in April, which will feature over 500 brands and attract 1,500 international buyers, and Syria Fashion & Tex, set to be held in Syria at the end of August.

Mohamed Atef, Director, Pyramids Group, notes, the strong participation of exhibitors, visitors, and international buyers reflects their growing confidence in Egypt’s textile industry. The company successfully coordinated the attendance of a 1,000-member international buyers’ delegation from Bahrain, Iraq, Jordan, Lebanon, Morocco, Oman, Palestine, Saudi Arabia, and Yemen, he confirms.

The exhibition will boost Egypt’s textile and apparel exports, thus positioning the country as a regional hub for the industry, with over 30,000 local and international visitors expected to attend the event, Atef affirms.

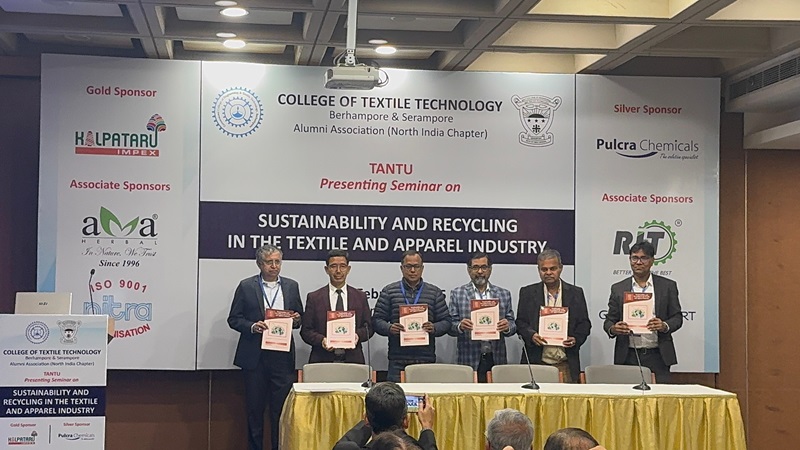

TANTU Seminar at India International Centre brought together experts, policymakers, and industry leaders to address sustainability and recycling in the textile and apparel industry. The event focused on waste reduction, circular economy practices, product life cycle analysis, and sustainable manufacturing.

Eight distinguished speakers shared insights on sustainable practices, technological advancements, and policy initiatives shaping the industry’s future.

Ashok Kumar, Deputy Director General, Bureau of Energy Efficiency, New Delhi, delivered the keynote address, emphasizing immediate action on sustainability. He reminded attendees of the Paris Agreement’s goal to limit global warming to below 2 degrees Celsius and achieve net-zero emissions by mid-century. He stressed that the time for research and discussion had passed, and the industry must act now.

Innovations in recycling and performance textiles

Gaurav Seth, Head of Strategic Partnership at Indo-German Yarn and Fibre LLP, highlighted the challenges of recycling technical textiles. He discussed successful methods for re-engineering performance fibers like para-aramid, meta-aramid, and carbon fibers. These recycled products are now being supplied to manufacturers, reducing waste and environmental impact.

Ajitesh Upadhyaya, Senior Section Expert at BEE India, outlined India’s Carbon Market Framework, Carbon Credit Trading Scheme (CCTS), and its alignment with international carbon tax regulations. He detailed how the Perform, Achieve, and Trade (PAT) scheme is helping the textile sector achieve energy efficiency goals.

Compliance and the role of LCA

Chinky Tyagi Khare of Green Story spoke about sustainability regulations and product life cycle assessment (LCA). She warned that manufacturers risk losing business and damaging their reputation if they fail to provide environmental footprint data, as responsibility shifts up the supply chain. Green Story’s tools are aiding companies in assessing and improving their sustainability credentials.

Independent sustainability consultant Pankaj Kapoor discussed climate change's impact on the textile industry. He outlined key sustainability metrics and ESG regulatory deadlines, emphasizing that the industry must prepare for stricter compliance by 2025.

Abhijit Majumder of IIT Delhi shared research on post-consumer textile recycling. His team has successfully regenerated yarns for fully fashioned apparel, demonstrating the potential for closed-loop recycling in fashion.

Industry’s role in sustainability

Sutanu Goswami, Senior General Manager at TUV SUD South Asia, urged the fashion industry to rethink its environmental impact. “By adopting responsible sourcing, ethical production, and recycling initiatives, we can move towards a more sustainable future,” he said.

Sanya Arora, Engagement Officer at CDP, emphasized the growing need for disclosure, particularly for SMEs. Transparency in environmental reporting is now a business necessity, she noted.

Arindam Basu, Director General at NITRA, and Lalit Goswami, Senior Scientific Officer at NITRA, presented research on optimizing process parameters for using recycled cotton in yarn production. They noted limitations in blending recycled cotton, with a maximum of 20 per cent for ring spinning and 30 per cent for rotor spinning to maintain quality.

The seminar concluded with a collective commitment from stakeholders to improve transparency, invest in recycling infrastructure, and support policies that drive sustainability. The discussions reinforced the urgent need for industry-wide collaboration to create a greener, more responsible textile sector.

For the third consecutive year, Turkey’s synthetic or artificial staple fiber yarn exports declined by 4 per cent to 106,000 tons in 2024. While overall export trends remained relatively flat, synthetic yarn exports had increased by their highest levels of 36 per cent Y-o-Y to 131,000 tons in 2021. Since 2022, however, export growth has struggled0 to regain momentum.

In value terms, in 2024, Turkey’s synthetic yarn exports declined to an estimated $605 million. Similar to volume, the overall export trend has been relatively flat. A significant growth spurt occurred in 2021 with a 58 per cent increase, reaching $759 million in 2022. However, exports have remained lower from 2023 to 2024.

The top destinations for Turkey's synthetic yarn exports in 2024 included the United States with exports of 13,000 tons, Italy with 13,000 tons exports, and Russia with 9,000 tons, Together, these three countries constituted 31 per cent of total exports. These were followed by Belarus, the UK, Georgia, Iran, Spain, and Germany, accounting for an additional 28 per cent.

Over the past decade, spanning 2014-2023, Georgia experienced the most significant export growth rate of +79.6 per cent, while other major destinations saw more moderate growth. In value terms, the leading markets were the United States ($100 million), Italy ($79 million), and the UK ($45 million), making up 34 per cent of total exports. Georgia again led in value growth with a CAGR of 82.5 per cent, with other destinations showing more modest increases.

Yarn (other than sewing thread) of synthetic staple fibers, not put up for retail sale, dominated exports at 69,000 tons. This category significantly outweighed yarn (not sewing thread) of man-made staple fibers, put up for retail sale. From 2014 to 2024, the volume of exports in this leading category increased by 3.0 per cent annually. Exports of other categories showed varying growth. For instance, exports of yarn, man-made staple fibers, put up for retail sale increased by 2.0 per cent annually, and exports of yarn (other than sewing thread) of artificial staple fibers, not put up for retail sale increased by -11.1 per cent per year.

In value, the top exported yarn types included yarn (other than sewing thread) of synthetic staple fibers, not put up for retail sale ($346 million); yarn (not sewing thread), of man-made staple fibers, put up for retail sale ($211 million); and yarn (other than sewing thread) of artificial staple fibres, not put up for retail sale ($48 million). The leading category saw the highest value growth (CAGR of +2.9 per cent from 2014-2024.

The average synthetic yarn export price in 2024 was $5,872 per ton (FOB, Turkey), a 2.1 per cent decrease from the previous year. While prices remained relatively flat overall, 2021 saw a 16 per cent increase in prices, peaking at $5,999 per ton in 2022 before declining slightly. Prices varied by destination, with the US having the highest price ($7,688 per ton) and Uzbekistan the lowest ($3,481 per ton). Brazil saw the highest price growth from 2014-2023 (+10.5 per cent), while other major destinations experienced more moderate growth.

In January, the global Viscose Staple Fiber (VSF) market experienced significant price volatility, causing disruptions across the textile industry and raising concerns about supply chain stability. This rise in prices, observed particularly in leading producing countries such as China, India, and Austria, has been fueled by several interrelated factors.

Drivers of price rise

The rise in VSF prices in early 2025 can be attributed to a convergence of factors. Following the holiday season, a resurgence in demand from the textile sector has intensified, creating a strong upward trend in prices. This heightened demand coincides with escalating costs of raw materials, primarily wood pulp, which have surged due to supply chain bottlenecks and increased demand from various industries. Moreover, the energy-intensive nature of VSF production has pushed up costs amid global energy price fluctuations.

Impact on the textile supply chain

The ripple effects of rising VSF prices are palpable throughout the textile supply chain. Garment manufacturers, grappling with increased raw material costs, are passing these expenses onto consumers through higher prices. This price hike risks dampening consumer demand for textiles, potentially impacting the broader industry.

Demand-supply dynamics

The current rise in demand for VSF has outpaced existing production capacities, creating a notable demand-supply gap. While some producers are poised to expand their capacities in the near future, these efforts may take time to materialize, further straining supply chains.

Regional focus, leading producers

China: As the largest global producer of VSF, China's production policies and environmental sustainability efforts have influenced market dynamics, including recent production cuts contributing to price increases.

India: Another significant producer, India faces competitive pressures exacerbated by recent price hikes, impacting local textile manufacturers.

Austria: Known for its high-quality VSF production, Austria continues to maintain a premium market position, driven by sustainable production practices.

Market analysis, January insights

United States: VSF prices in the US have steadily risen, buoyed by robust demand from apparel and textile sectors. Policy initiatives supporting domestic manufacturing and sustainable practices are expected to further bolster demand.

Germany: The German market reflects similar trends, with prices climbing amid anticipation of future demand growth.

Asia-Pacific (APAC) and China: China's VSF prices have seen significant increases driven by robust domestic demand and government support for market expansion.

The complex interplay of post-holiday demand spikes, supply chain challenges, and regional production dynamics underscores the interconnected nature of the global VSF market. While short-term uncertainties persist, the long-term outlook remains positive, driven by increasing demand for sustainable textile fibers. Looking ahead, planned capacity expansions may provide relief, potentially stabilizing prices in the latter half of 2025.

In today's consumer-driven world, the textile industry stands as a paradoxical cornerstone of the economy. While clothing and fabrics adorn millions, their production and disposal leave an indelible mark on our planet. Annually, a almost 92 million tonnes of textiles find their way into landfills or incinerators worldwide, revealing a looming environmental catastrophe. This crisis is not just about sheer volume but also the harmful chemicals leached into our ecosystems, perpetuating environmental degradation.

The scale of the problem

According to recent data from the World Economic Forum, North America, Europe, Asia Pacific, and the rest of the world collectively generate monumental amounts of textile waste. Despite the potential for recycling nearly all clothing and textiles, global recycling rates remain dishearteningly low, varying significantly across different regions.

Table: Global textile waste regionwise

|

Region |

Estimated textile waste generation (mn tons) |

|

North America |

13.1 |

|

Europe |

11.3 |

|

Asia Pacific |

40 |

|

Rest of the World |

27.6 |

(Source: World Economic Forum, 2023)

Technological advancements driving change

Mechanical recycling: Traditionally, this method involves shredding and respinning fibers to create new yarns. While effective for natural fibers like cotton and wool, it often results in lower-quality fibers suitable for applications such as furniture stuffing and insulation.

Chemical recycling: Emerging as a frontrunner, chemical recycling employs solvents or enzymes to break down textiles into their original building blocks, enabling the creation of high-quality fibers akin to virgin materials. Companies like Worn Again and Evrnu are pioneering this approach, aiming for a closed-loop system that drastically reduces water and energy consumption compared to traditional production methods.

AI-Powered sorting: Essential for efficient recycling, AI technologies are automating the labor-intensive task of sorting textiles by fiber type and color. Innovations by companies like Rester are improving accuracy and scalability, though challenges persist in handling complex blends and heavily soiled fabrics.

Limitations and challenges

Despite technological progress, recycled fibers often face limitations such as reduced strength, color vibrancy, and performance characteristics compared to their virgin counterparts. Factors like polymer degradation in chemical recycling and difficulties in achieving consistent quality for certain materials underscore the ongoing need for research and development.

Table: Limitations of recycled fibers

|

Technology |

Fiber Type |

Limitations |

|

Mechanical |

Cotton |

Reduced fiber length, strength, and dyeing potential |

|

Mechanical |

Wool |

Reduced fiber length and potential for felting |

|

Chemical |

Polyester |

Potential for polymer degradation with repeated recycling |

|

Chemical |

Nylon |

Challenges in achieving consistent quality and color |

(Source: Textile Exchange, 2023)

Overcoming hurdles to a circular economy

One of the most significant obstacles is contamination: textiles are frequently blended with non-recyclable components like zippers and dyes, complicating the recycling process. Moreover, the lack of dedicated recycling facilities and widespread consumer awareness further hinders progress towards a truly circular textile economy.

The promising future of textile recycling

Despite these challenges, the textile recycling market is poised for substantial growth, projected to reach $13.7 billion by 2026. This exponential rise reflects a growing commitment from brands, consumers, and governments to embrace sustainable practices and reduce environmental impact.

As we navigate towards a sustainable future, the evolution of textile recycling represents a pivotal opportunity. By harnessing technological innovations, fostering consumer awareness, and enhancing recycling infrastructure, we can transform today's waste into tomorrow's resources. The path to a circular economy requires collaboration and determination from all stakeholders—brands, consumers, governments, and innovators alike—to ensure a thriving and resilient textile industry for generations to come.