FW

Cotton importers in Bangladesh are facing problems due to port congestion. Spinners import cotton from India, the US, African countries and many other countries, and they have to wait for eight to 10 days for the cotton to be released from the port. Cotton is an essential raw material for the garment sector, the country’s main export earner.

Even six months ago the spinners could get the cotton from the port within three days. The longer waiting time at the port means paying fees as berthing charges. And the fees have increased the cost of doing business. In such a scenario, importers are bringing in more raw cotton than they need at present and stockpiling them at warehouses.

The problem has arisen because two gantry cranes at the Chittagong port have broken down. Repair might take six to seven months. Bangladesh is the world’s biggest cotton importer. In 2016, Bangladesh imported 6.5 million bales of cotton. Bangladesh's cotton imports will creep up to 7.1 million bales in 2017-18. Cotton growers in Bangladesh can only supply less than three per cent of the yearly demand. The 430 local spinning mills can supply nearly 90 per cent of the yarn for the knitwear sector and 40 per cent of the fabrics needed by the woven sector.

Bangladesh will remain the top apparel sourcing hotspot for international retailers and brands over the next five years followed by Ethiopia, Myanmar, Vietnam and India.

Being the second largest apparel exporter worldwide after China, Bangladesh exported garments worth $28.14 billion in the last fiscal year, registering 0.20 per cent year-on-year growth. However, with higher demand from retailers and brands, garment exports rebounded again and grew at 14.05 per cent year-on-year in the first two months of the current fiscal year.

The garment sector has improved workplace safety and other compliances after fixing the structural, electrical and fire loopholes. But it still needs to ensure shorter lead times, high standards of compliance, higher productivity and capacity at factory level and competitive prices for remaining the top choice of retailers and brands.

In addition Bangladesh needs to keep an eye on emerging competitors like Ethiopia and Myanmar since they are also coming up with big growth potential. Ethiopia is not a major competitor now. But it could pose a big challenge for Bangladesh in the future as it is receiving a lot of foreign direct investment for producing low-cost basic garment items. Also, while China appears to have passed its zenith as a low-cost sourcing country, it would remain indispensable because of its bigger export value.

The ongoing Avantex in Paris being held from September 18 to 21, 2017 is keeping its focus on high-tech fabrics. Believing that technology should not only enhance fashion, but that it should also serve the consumer, the textile fair attracts over 19,500 exhibitors and 4,77,000 visitors a year. Global fashion tech community gathers here every year to get connected and build relationships.

Avantex Paris’ innovative exhibitors are selected by the trade fair’s committee who are on the lookout for at least three innovative functions and/or unpublished patents from the applicants. Exhibitors highlight intelligent, connected fabrics and materials which combine nanotechnology.

Conquering new markets and leading a new revolution, Avantex Paris is now in its fifth session. The vision is to unite high-tech companies with fashion product designers and managers. The trends forum highlights textile production and know-how. A figurative assembly line illustrates the integration of innovative and futuristic materials into everyday technical consumption.

Among the showpieces are a revolutionary process that enables stylists and designers to test and place patterns on a product in 3D; a line of women’s ready-to-wear that uses textiles made from plant fibers and 100 per cent cruelty-free leather; and sensors that are integrated in fabrics to measure anxiety.

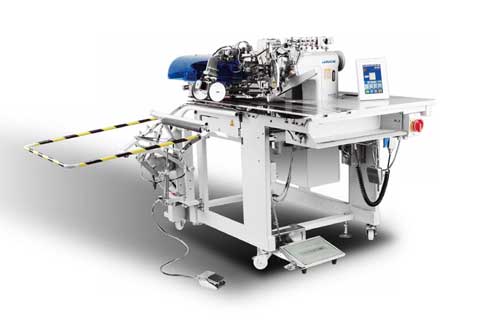

CISMA will be held in China, September 26 to 29, 2017. This is the world’s largest professional sewing equipment exhibition covering embroidery machines, spare parts, electronic control and other parts.

CISMA 2017 will have ten pavilions and an exhibition area of more than 1,10,000 square meters. It will display new developments in the sewing machinery industry in the world, new features and new trends in technology.

Over time the sewing machinery industry has continued to expand from clothing, shoes and hats, bags, furniture, home textiles and other traditional industries to automotives, construction, decoration, sports and cultural goods, industrial textiles as well as aerospace and other fields.

In addition, the industry has undergone a professional, personalized, precise product segmentation and service upgrade so that the connotation of sewing machinery products has changed radically.

CISMA will provide a one-stop business experience platform. The layout of the exhibition hall will be based on product category, the actual development of the industry and the entire industry chain. The exhibition will display different types and models of machines, differentiated brands, and distinctive products.

The sewing machine industry, after a sustained downturn, is once again facing a market demand, a huge customer base and is ready with innovation, thriving enterprises and exciting products.

Shima Seiki will exhibit at the China International Sewing Machinery and Accessories Show (CISMA 2017), September 26 to 29, 2017.

On display will be Shima Cutting Solutions, a fully integrated cutting system that incorporates the P-CAM182 multi-ply computerised cutting machine, the P-SPR2-16 fabric spreading machine, and the P-LAB16 automated labeling machine.

In addition, Shima Seiki will introduce new, updated PGM software on its 3D design system SDS-ONE APEX3. Applications of CAD/CAM systems for supporting areas other than fashion such as automotive and industrial textiles will also be shown.

Shima Seiki is a Japanese textile machine manufacturer.

APEX3 is also at the core of Shima Seiki’s Total Fashion System and is capable of realistic simulation that allows for virtual sampling, minimising the need for costly, time- and resource-consuming sample-making in a variety of industries such as circular knitting, flat knitting, weaving, pile weaving and printing.

Also featured will be knitwear produced on Shima Seiki’s latest line of computerised knitting machines. The new i-Plating option on the SVR SP-type computerised knitting machine, combined with sinker patterns produced with the patented moveable sinker system as well as inlay patterns using loop pressers, makes possible a whole new world of patterning. Hybrid knit-weave fabrics produced on the SRY-series computerised knitting machine will also be shown.

CISMA is a sewing machinery exhibition.

"Deloitte recently published a report on millennials and their attitudes and purchase motivations in the luxury market. ‘Bling it on: What makes a millennial spend more’ reported American millennials trailed far behind the other markets in their purchases of high-end fashion or luxury goods. Over one-fourth of the American millennials report no luxury purchases of $500 or more in the last 12 months, whereas the survey average was only 16 per cent."

Deloitte recently published a report on millennials and their attitudes and purchase motivations in the luxury market. ‘Bling it on: What makes a millennial spend more’ reported American millennials trailed far behind the other markets in their purchases of high-end fashion or luxury goods. Over one-fourth of the American millennials report no luxury purchases of $500 or more in the last 12 months, whereas the survey average was only 16 per cent. If 26 per cent of millennials who are interested in luxury goods haven’t purchased any recently, which was reported by the Bain Luxury Study, it certainly doesn’t go down well for the future of luxury brands in the US, which is the world’s largest luxury market. Credit Suisse reports that there are 13.6 million American adults with a net worth above $1 million. That is over 40 per cent of the world’s millionaires and more than the next eight countries combined.

Millennials, informed buyers

The survey points out that this generation, thanks to the internet and how it has uncovered the ‘smoke and mirrors’ on which the allure of luxury brands is based, are discovering they can acquire luxury-quality goods at significantly lower prices. Today, status symbols as represented by luxury brands don’t have the same meaning for millennials. They still value status, but for them it is status defined by who they are and what they have achieved, not how much money they spent buying some overly-expensive luxury brand. Luxury is a state of mind, not a brand or a price point. Millennials still want luxury, but luxury that is consistent with their personal values.

As a result, a gap is growing between what the customers believe luxury to be and what the industry thinks it is, as discovered in the most recent ‘State of Luxury’ study conducted by Unity Marketing and Luxury Daily. There is an opportunity for luxury brands to re-examine their roots and rethink their offerings and messaging to reflect what the consumer is looking for.

Shifts in the demography and mindset of today’s luxury consumers has brought about profound changes in the way they shop and buy and how luxury fits into their lifestyle. Not to mention new competitors are fast and furiously emerging which are not bound by the traditions prevalent in the luxury industry, and which hamper established brands in this increasingly disrupted luxury market.

Ways for luxury brands to get their mojo

The Deloitte study highlights it is no accident that most successful challenger brands in the industry have their roots in digital and/or social media marketing aimed at millennial consumers. This calls on luxury brands to downplay the negative connotations associated with luxury and play up the positive attributes of luxury in brand new style and through brand new mediums. Brands must find ways to make their luxury relevant to millennials, not just using luxury as a label they should aspire to own but to convey true meaning and value to the customers.

Secondly, the great challenge for brand owners seeking to capture millennials is how to communicate to a generation with shifting preferences and loose brand loyalties, and for whom no single channel appears to predominate. Yet amid this apparent uncertainty, one factor that plays a role in almost every aspect of millennial consumption is the rise of online. The internet has pulled back the curtain of the luxury industry and the brands that participate there. It has changed how customers get information and how they make decisions. A powerful e-commerce presence is no longer optional for luxury brands. But Deloitte report stresses that online sales alone do not capture the full significance of the rise of online interaction.

Further, Deloitte found millennials don’t have brand loyalty that previous generations had. Nearly, 36 per cent, say they will buy what they like regardless of brand. They are more than willing to pay attention to brands with new stories to tell that are more aligned with their personal values and the values of their social circle. This is how new emerging luxury brands have gained traction with this generation. These challenger brands talk to the millennials in ways that are more meaningful and valuable to them.

In conclusion, a rising tide of millennial wealth could result in a new luxury boom starting in the middle of the next decade, but only if brands meet this new generation with luxuries that reflect their values and world view. However, if luxury brands keep doing what they’ve always done, putting status before substance, they will miss the mark. The world has changed and luxury brands must change with it.

The US textile industry and their Indian counterpart have the potential to co-create $100 billion additional business in both countries, thereby strengthening bilateral trade. As far as India’s strengths are concerned, it has a strong base in fibres, spinning, etc, while finishing is the US’ strength. The US textile industry is one of the more important employers in the manufacturing sector, with 233,300 workers. The United States is a globally competitive manufacturer of textiles, including textile raw materials, yarns, fabrics, apparel and home furnishings, and other textile finished products. India’s strength lies in cotton, manmade fibers, and a wide variety of yarns and fabrics, including those for apparel and industrial end-uses.

The US industry is globally competitive, being third in global export value behind China and India. US exports of textiles increased 39 per cent between 2009 and 2015, to $17.6 billion. In 2015, the value of US man-made fibre and filament, textile, and apparel shipments was worth an estimated $76 billion. This is an increase of almost 14 per cent since 2009, points out Arvind Sinha, CEO & Chief Advisor, Business Advisors Group. Investment in textile mills and textile product mills has seen tremendous growth to register $1.8 billion in 2014, which is an increase of 87 percent.

Subsets capturing growth

Nonwovens are being used to make products lighter, more efficient, and cost effective. Many lighter and longer-lasting non-wovens are being introduced in a variety of fields including packaging and autos. Specialty and industrial fabrics serve an array of markets, everything from awnings to auto airbags. As the US specialty fabric business has continued to grow, some areas are seeing rapid advancement, for example, the base fabric used in road construction, erosion control, and spoil containment in landfills.

Medical textiles are one of the most important, continuously expanding and growing fields in technical textiles. The medical textile industry has been improving existing products and creating new ones with new materials and innovative designs. Some of these new products are being designed for less in various surgical procedures, infection control, and accelerated healing.

North America emerged a leading regional market for industrial protective apparel and accounted for over half of the total market volume in 2013. Stringent regulatory guidelines coupled with high levels of safety awareness in the industry are expected to drive the regional market growth over the next six years.

Textiles protect from harsh environment

A garment can be water-proofed coating it with polymers such as rubber, PVC, neonprene and acrylics or polyurethanes. These solutions furnish very low permeability vales (200 g/m2/24h) against the requirement of 2000-5000 g/m2/24h). Water repellent finishes are good for light showers but no adequate for prolonged exposure to heavy downpours which are not uncommon in a soldier’s life. The most effective solution is to laminate a nylon base fabric with a layer of microporous PTFE film, also known as Gore-tex membrane.

The US Army Natick Research, development and engineering Center has developed an Extended Cold Weather Clothing System to protect soldiers’ from extremely cold weather. It consists of polypropylene underwear, cold weather trousers, field jacket and trouser made with a semi-permeable film laminated fabric. This system performs well up to -25 F (-31.7 C). This range can be extended to – 60 F (-51.1 C) adding a polyester pile shirt and bib overalls. A lot needs to be done to develop better protective fabrics for the military personnel. Not only in terms of performance of individual aspects of protection but also integration of solutions into a protective system, which is economical, stress-free and performs optimally.

On an uptick

The value of shipments for US textiles and apparel was $74.4 billion last year, a nearly 11 per cent increase since 2009 while exports of fiber, textiles and apparel were $26.3 billion in 2016. From the figures, it is evident that both countries have tremendous potential, however, investment has to come in both the countries preparatory. Product will be made in USA which will make it eligible for US military and supplies to various garment manufacturers.

Indeed, this is not an easy task. Both the countries have to establish a working group under the direction of government in both countries and chambers such as Indo-American Chamber of Commerce, US Consulate in Mumbai should be the part of this team to create design and implementation papers on such a huge but not easy opportunity, there has to be very strict compliances as USA is a very high quality market and meeting compliances very essential. This will require big thinking, great implementation force and lot of support from all big players from America, US Defense Department and Indian Textile Industry also to meet the task.

Karl Mayer has been expanding its service operations in Asia. This targeted capacity expansion has focused on Vietnam, Bangladesh and India. Karl Mayer has taken on two service technicians to provide its Vietnamese warp knitting customers with technical support. The training was carried out by Karl Mayer in China. Karl Mayer also relies on its Chinese subsidiary for its operations in Bangladesh. From February to the end of May 2017, roughly 60 two-bar HKS machines were installed at the premises of a domestic producer of mosquito nets. More machines are to be sold in the middle of the second quarter.

As far as warp knitting machines are concerned, Bangladesh is a relatively new market for Karl Mayer, but one which is currently developing in a very promising way. India is seen as more as a market offering a great deal of potential. Karl Mayer is currently introducing its Karl Mayer Connect app on to the Indian market to effectively complement its technicians operating there. If required, customers can communicate with the Karl Mayer’s service organisation via mobile terminals. To send off a service request, all that has to be done is to scan in a QR code from the machine’s touch screen display, and the main machine data are transmitted in order to explain the problem.

The Indian Texpreneurs Federation (ITF) has appealed to the commerce ministry to include textile products while negotiating expansion of its preferential trade agreement (PTA) with the Mercosur trading bloc in Latin America comprising Brazil, Argentina, Uruguay and Paraguay and discuss ways to reduce duties on textile products in this region. ITF points out the region holds tremendous potential for India’s textile exports and the existing PTA does not include any textile item. The duty on most textile products in this region is very high — between 24 and 35 per cent — and the market share of Indian textile products there at present is negligible.

As China is gradually losing its competitive edge in textile trade, says ITF, if India can capture 15 per cent of China’s textile exports, it can double the country’s textile exports. Therefore there is a need to focus more on free trade agreements and market diversification for textile products.

A PTA is a limited FTA where partner countries reduce import duties on a few identified products for the other. India’s exports to the Mercosur bloc in 2015-16 were 3.4 billion dollars while imports were 6.6 billion dollars. This was just a fraction of the country’s bilateral trade with the United States valued at 68.6 billion dollars and the European Union at 115 billion dollars.

Indonesia’s Ministry of Industry (Kemenperin) projects believe the value of national textile and textile product (TPT) exports will grow rapidly in the next two years. This optimism is in line with various programs and incentives given by the government to boost the performance of leading sectors.

The textile industry is an export-oriented labor-intensive sector. In 2019, they are targeting exports worth $15 billion, says minister of industry (Menperin) Airlangga Hartarto. He further added that there will be additional production capacity of 1,638 thousand tons per year with an investment value of Rp 81.45 trillion and employment of 424,261 people. To expand their export market the government is working to establish cooperation agreements with the United States and the European Union. The import duty of Indonesian textile products is still subject to 5 to 20 per cent in the US, while Vietnam's exports to America and Europe are zero per cent, says Hartarto.

Hartarto is optimistic the national textile industry can compete globally because, this sector has been integrated from upstream to downstream and its products are known to have good quality in the international market.

To achieve the target, new investment and expansion in every sector of textile industry is needed. The government is focused on creating a conducive investment climate by issuing policies that could facilitate industry players in trying in Indonesia. For example, facilitating the provision of fiscal incentives in the form of tax allowance and tax holiday says Airlangga.