FW

Lenzing AG has named Georg Kasperkovitz as its new Chief Operations Officer (COO) and member of the Managing Board, effective June 1, 2025. With over 15 years of global leadership experience across Europe, North America, and Asia key regions for Lenzing’s operations Kasperkovitz is set to play a pivotal role in driving the company's operational transformation.

A mechanical engineer with a doctorate from TU Vienna and an MBA from Harvard Business School, Kasperkovitz has held senior roles at leading organisations including Mondi plc, Rail Cargo Austria AG, and McKinsey & Company. His expertise spans packaging, logistics, and strategic consulting, with a strong track record in performance improvement and operational leadership.

At Lenzing, he will oversee global fibre production, champion the ongoing performance program, and lead operations at the company’s main site in Upper Austria. His appointment expands Lenzing’s Managing Board to four members.

Chairman Patrick Lackenbucher noted that in light of macroeconomic pressures, including high energy costs and global competition, Lenzing must remain focused on profitability and operational efficiency. He emphasized that Kasperkovitz brings essential transformation skills and experience in the nonwovens sector.

CEO Rohit Aggarwal highlighted the company’s recent gains under its performance program and the need to enhance agility and resilience amid geopolitical shifts. He welcomed Kasperkovitz as a key driver in advancing operational excellence across Lenzing’s fibre production network and securing its leadership in sustainable cellulose fibres.

Europe is grappling with a colossal textile waste problem. Over 125 million tonnes of raw materials are devoured by the global industry each year, yet a mere fraction – less than 1% – of these fibres originate from recycled textiles. The majority faces an unsustainable fate in landfills, incinerators, or is exported. A pivotal new report by Systemiq, "The Textile Recycling Breakthrough," offers both a stark assessment and a strategic roadmap: Europe has the potential to amplify polyester textile recycling nearly tenfold by 2035, but this hinges on immediate, decisive action from policymakers and the industry.

The comprehensive study, backed by a 17-member Steering Group including industry giants like Arc’teryx, Eastman, Interzero, Textile Exchange, and Tomra, zooms in on polyester – a material constituting roughly 57% of global fibre demand. It champions advanced recycling technologies like depolymerisation, which can convert post-consumer polyester back into high-quality fibres with a reduced environmental impact compared to virgin material production.

The Steep Climb: Cost and accessibility challenges

Despite technological promise, the journey towards a circular textile economy is fraught with significant economic hurdles. The Systemiq report highlights a substantial "cost gap": producing recycled polyester via depolymerisation is currently estimated to be about 2.6 times more expensive than virgin polyester sourced from Asia. Shivam Gusain, Water Engineer, Dyestuff Chemist & LCA analyst in his linkedin post analysis suggests this gap could be even wider; with recent virgin PET prices in China hovering around €750-€800 per ton (lower than the report's €950 estimate), the premium for recycled content could be nearly threefold.

2025 Estimated Cost Comparison: Virgin vs. Recycled Polyester (per ton)

|

Feedstock Source |

Estimated Cost (Systemiq Report Basis) |

Potential Actual Market Cost Gap |

|

Virgin Polyester (Asia) |

€950 (report estimate) |

Base |

|

Recycled Polyester (T2T Depolymerisation) |

~€2,479 (implied 2.6x) |

Potentially >€1,600 (near 3x) |

(Note: This table contrasts the Systemiq report's cost gap with industry expert analysis suggesting a potentially larger current market gap.)

Critically, as the industry expert points out that the common assumption that scaling up T2T processes will dramatically lower costs is challenged by the report itself, which indicates that such scaling might only reduce costs by about 15 percent. This suggests that economies of scale alone may not be the panacea for the textile recycling cost dilemma.

Adding to the complexity, less than 1% of post-consumer textile waste is currently even suitable and accessible for these advanced recycling methods.

A Ten-Lever blueprint for a recycling revolution

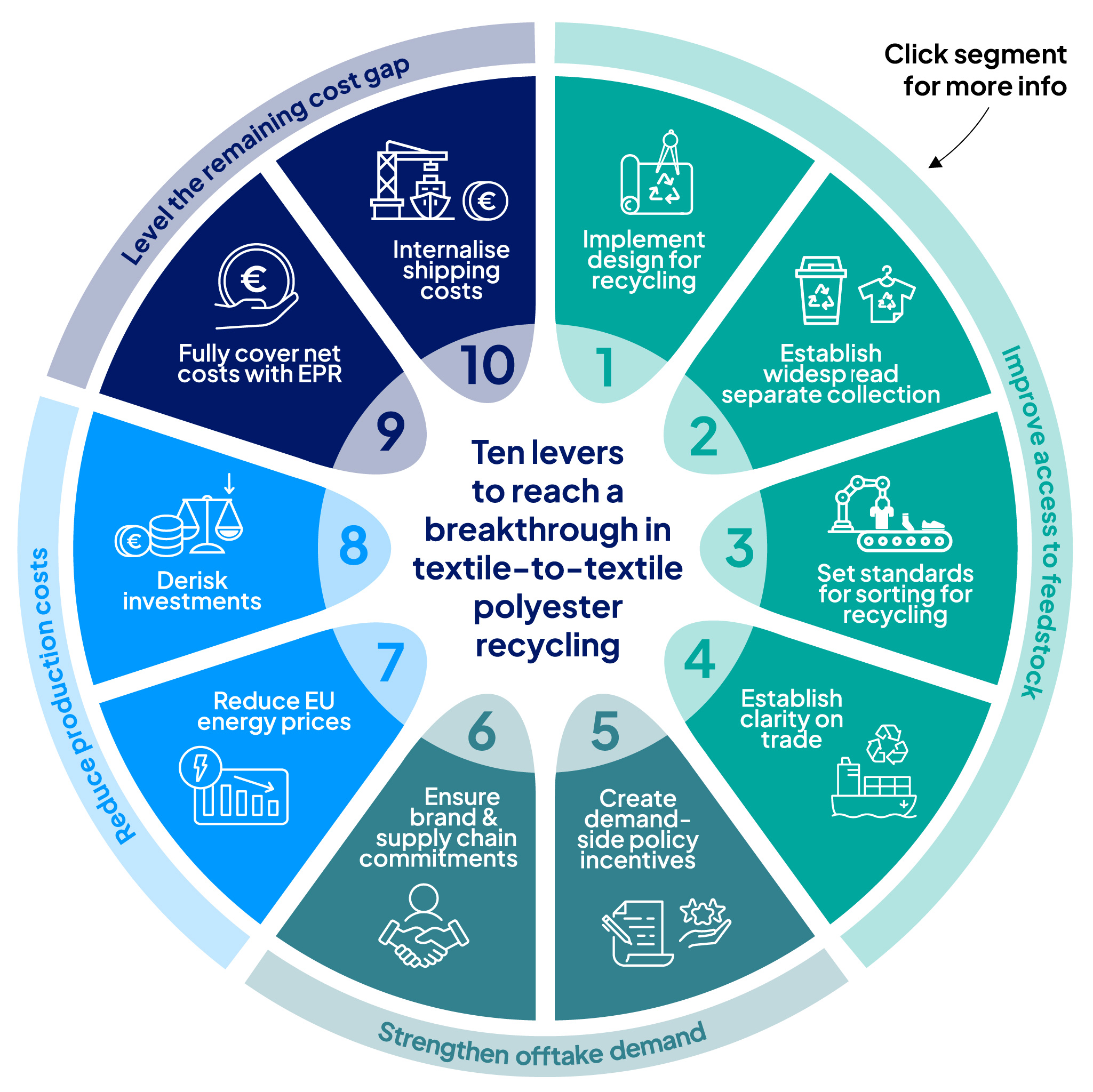

"The Textile Recycling Breakthrough" proposes a strategic ten-lever approach across four key intervention areas, designed to steer Europe towards a "tipping point" where recycled polyester becomes the more viable and attractive option:

I. Unlocking feedstock:

● Implement design for recycling: Mandating designs that simplify end-of-life processing.

● Establish widespread separate collection: Ensuring textiles are diverted from general waste.

● Set standards for sorting for recycling: Creating clear, harmonised guidelines.

● Establish clarity on trade: Implementing responsible policies for textile waste exports.

II. Bolstering demand:

● Create demand-side policy incentives: Driving market appetite for recycled content.

● Ensure brand & supply chain commitments: Encouraging industry pledges. As Kyle Wood, Senior Director Strategy at Arc'teryx, notes, the report "helps chart a path forward for brands... It's also a powerful reminder that design does not exist in isolation, and must proceed in partnership with long term commitments and policy frameworks."

III. Optimising production costs:

● Reduce EU energy prices: Addressing a key operational expense for recyclers.

● Derisk investments: Providing financial safeguards for new recycling infrastructure.

IV. Bridging the financial divide:

● Fully cover net costs with EPR: Implementing Extended Producer Responsibility schemes, with the report suggesting fees around €250–€330 per tonne of polyester.

● Internalise shipping costs: Potentially via a ~5% brand-level green premium to make virgin materials reflect their true costs.

Julia Haas, Head of Commercial Partnerships at Interzero, emphasized the collaborative effort required: "Through the interplay of both political and industry-driven levers, Europe has a great opportunity to make circularity in textiles a reality... Bold, long-term policy action is needed to help create stable market conditions and reduce investment risks."

Scrutiny and Questions: EPR burdens and environmental data

The report's reliance on EPR fees to cover a significant portion of the cost gap – roughly 55% (€829 of the €1,529 per ton difference) – has raised questions among some industry observers. A key concern is whether using EPR fees to subsidize recycled materials essentially reroutes costs that brands would have incurred anyway, ultimately passing them down to consumers. This could mean end-users footing the bill for scaling recycled fibres for years before substantial volumes become available, effectively pre-paying for future output.

Further Shivam debate surrounds the environmental impact data. The report references CO₂ savings from a 2023 JRC study which, according to some analysts, predominantly focuses on general plastics like bottles and packaging, not the more complex textile-to-textile recycling processes. Extrapolating data from bottle-to-bottle recycling to textiles is seen as a potential oversimplification, suggesting the true CO₂ impact of T2T recycled fibres might be higher than reported.

One specific figure drawing scrutiny is the 0.4 kilograms CO₂ equivalent per kilogram reported for glycolysis, a chemical recycling method. For context, mechanical PET recycling typically registers around 0.45 kilograms CO₂ equivalent per kilogram. The notion that a more energy and chemically intensive process like glycolysis could have a lower footprint than mechanical recycling is being questioned by some experts, who anticipate further exploration of this data.

Projecting the Future: A transformed textile landscape?

Despite these debates, Systemiq's projections, if the ten levers are effectively deployed, are ambitious: depolymerisation capacity in Europe could surge nearly tenfold by 2035.

Projected EU Textile Waste Recycling: 2035 Vision (with Levers)

|

Metric |

Impact by 2035 |

|

Depolymerisation Capacity |

Near 10x increase |

|

Overall Recycled Volume |

Substantial Growth |

|

Landfill/Incineration/Export |

Significantly Reduced |

|

Consumer Cost (400g jumper) |

Approx. €0.15 (for EPR & green premium) |

|

Annual Value Generation (2040) |

€5.5 billion (broader PET/polyester system) |

|

Net New Jobs (2040) |

28,000 (broader PET/polyester system) |

(Source: Systemiq, The Textile Recycling Breakthrough)

Eric Dehouck of Eastman Circular Solutions France remains optimistic about the technological readiness: "Europe has the opportunity to lead the transition to circular textiles, and technologies like depolymerization are ready to play a central role."

The Path Forward: Beyond recycling

The Systemiq report, while championing a recycling breakthrough, also underscores that recycling alone is not a silver bullet. A truly circular textile economy, as noted by the Ellen MacArthur Foundation's Matteo Magnani, requires "deeper changes in how we design, produce, consume, and value clothing," alongside scaling circular business models like resale, rental, and repair.

The critical analysis emerging alongside the report's launch suggests that while the proposed levers offer a direction, the financial mechanisms and environmental accounting will be key areas for ongoing debate and refinement. The overarching question posed by some experts is whether the current trajectory, with its potential consumer costs and debated environmental gains, represents the most effective multi-billion-euro investment for Europe's textile future.

"The Textile Recycling Breakthrough" has undeniably ignited a crucial conversation, providing a data-rich foundation for the complex journey ahead. The challenge now lies in navigating the economic realities, refining the impact assessments, and fostering the multi-stakeholder collaboration essential to turn Europe's textile waste into a sustainable resource.

US holding company and owner of brands like The North Face, Timberland and Vans, VF Corp forecasts revenues in Q1, FY26 to decline between 3 per cent-5 per cent. The company expects adjusted operating loss to range between $110 million and $125 million, significantly higher than the average analyst estimate of a $73 million loss.

In FY25, VF Corp registered a 4 per cent decline in net sales to $9.5 billion as against $9.92 billion in the previous fiscal year.

Marking a significant improvement in profitability, the company’s operating profit increased to $303.77 million during the year as against an operating loss of $143.93 million in 2024.

Performance among its diverse brand portfolio remained mixed. Revenues of its brand The North Face increased by 1 per cent to $3.70 billion while revenues of the brand Vans declined by 16 per cent to $2.35 billion. Timberland’s revenue rose by 3 per cent to $1.61 billion, while Dickies’ turnover contracted by 12 per cent to $542.1 million.

Geographically, the Americas region struggled with a 7 per cent decrease, totaling $4.83 billion. EMEA (Europe, Middle East, and Africa) also saw a decline of 3 per cent, reaching $3.25 billion. The APAC (Asia-Pacific) region was more stable, posting a 1 per cent increase to $1.42 billion.

In Q4, FY25 which concluded on March 29, VF Corp. fell short of revenue estimates. Concerns over tariffs introduced by the Trump administration led many retailers to scale back orders, resulting in a 5 per cent decline in revenue to $2.14 billion, below analysts' projections of $2.18 billion. The company reported an operating loss of $73 million, though its adjusted operating profit was $22 million.

Bracken Darrell, President and CEO, VF Corp, states, the company’s sales in Q4 aligned with its forecasts and, excluding Vans, showed an increase over the previous year, primarily driven by The North Face and Timberland. The company is well positioned to deal with the increasing volatility in the macroeconomic environment. The actions it takes will enable brands to return to growth and VF to generate solid and sustainable value, he adds.

A diversified textile manufacturer, Trident Ltd posted a net profit of Rs 133.42 crore in Q4, FY25. This marks a 126.1 per cent Y-o-Y increase compared to Rs 59.01 crore in the same quarter of FY24.

The company’s revenue for Q4, FY25 increased by 10.82 per cent Y-o-Y to Rs 1,864.34 crore from Rs 1,682.26 crore recorded during the corresponding period last year. Trident’s EBITDA for the quarter rose by 19.3 per cent Y-o-Y to Rs 245 crore with the EBITDA margin improving to 13.14 per cent.

By product category, the towel segment saw the most significant revenue growth, generating Rs 752.86 crore. The yarn division maintained stable performance, recording revenue of Rs 908.28 crore Y-o-Y. Meanwhile, the bedsheets category brought in Rs 315.14 crore in revenue for the quarter.

Trident operates across multiple segments, including Home Textiles, Paper, Chemicals, and Yarn, and continues to strengthen its position as a key player in the Indian and global textile industry.

To meet the growing demand for coordinated family occasion wear, menswear specialist Suit Direct has launched its first dedicated boys’ suits collection.

This launch marks the brand's entry into the children's formalwear market. The new collection is designed to ‘echo the style of its popular menswear lines while prioritizing comfort.’ The boys' range is specifically designed ‘to retain the premium quality and detailing Suit Direct is known for while addressing the unique needs of younger wearers.’

The collection is available for ages 4-14 years, both online and in select Suit Direct stores. To accommodate teens and older boys, the brand is also offering additional smaller sizes in men’s suiting, starting from a 34" jacket and 28" waist.

The new range features lightweight, breathable fabrics, wrinkle- and stain-resistant materials, and tailoring that allows for easy movement. This ensures children stay comfortable throughout the day, ‘whether they are walking down the aisle as a page boy or posing for family photos.’

Each suit comes as a three-piece set - jacket, pants, and waistcoat - and is available in a choice of navy check, dark green, tan check, and stone. Crucially, every design corresponds with one of Suit Direct’s menswear styles, making it ‘perfect to pair with dad.’ To support this new category, Suit Direct is also offering in-store fittings and styling advice.

A new venture from a Dutch engineering and fossil fuel company, Reju plans to build a polyester recycling plant in the Netherlands, aiming for an impressive annual output equivalent to 300 million articles of clothing.

In just 18 months since its launch, Reju has already established a ‘Regeneration Hub Zero’ demonstration plant in Frankfurt, Germany, slated for official operation this year. Patrik Frisk, CEO and former CEO, Under Armor, notes, the company has secured partnerships with textile collectors and sorters, and engaged with over 100 brands and retailers to cultivate interest in its ‘Reju Polyester’ product across both American and European markets.

The initiative addresses a critical environmental challenge: polyester, a fossil fuel-derived fiber, now accounts for two-thirds of new clothing. Annually, the world produces 33 million metric tons of plastic-based fibers, yet a mere 3 per cent is recycled, according to the Ellen MacArthur Foundation. This mounting waste problem is increasingly pressuring fashion brands and retailers, especially with the advent of extended producer responsibility (EPR) regulations in the European Union and California.

While several companies are investing heavily in creating a circular economy for polyester, Reju stands out due to its deep connection to parent company Technip Energies. With nearly 70 years in the polyester business, Technip Energies' technology is integral to 40 per cent of the world's steam crackers, which produce ethylene, a polyester building block. Reju leverages IBM’s VolCat technology, co-developed with Under Armor, capable of breaking down polyester molecules into monomers for rebuilding, even handling dyes and pigments.

Reju's efforts are a part of Technip Energies' broader transition towards a lower-carbon future. The startup is strategically targeting densely populated areas for post-consumer clothing waste, with plans for a new US plant and a garment recycling pilot with Goodwill and Waste Management. However, the company faces a key challenge to convince brands to pay a premium for recycled fibers until cost parity is achieved.

In a significant move to propel Uttar Pradesh towards a $1 trillion economy and establish it as a premier global investment hub, Invest UP and the Directorate of Handloom & Textiles, Uttar Pradesh, participated in Gartex Texprocess India 2025, held from May 22 -24, 2025 in Mumbai.

The event opened with Shashank Chaudhary, ACEO, Invest UP, highlighting Uttar Pradesh’s rapid economic transformation and its robust policy framework. He emphasized, under the visionary leadership of Chief Minister Yogi Adityanath, the state is steadily advancing towards its $1 trillion economy goal. With its investor-friendly policies, Uttar Pradesh has emerged as one of India's most attractive investment destinations. Chaudhary also highlighted the state's strategic advantages, including a skilled workforce, robust infrastructure, and a textile policy focused on innovation and job creation.

Rich in textile heritage from Banarasi weaves to Lucknow’s chikankari, Uttar Pradesh is now blending tradition with modernity, Chaudhary stated. He pointed to the upcoming PM Mitra mega textile park in Lucknow and various incentives offered through the UP Textile and Garmenting Policy - 2022 as factors making Uttar Pradesh a promising center for textile manufacturing.

The inauguration was attended by key industry leaders and dignitaries, including Sanjay Savkare, Minister of Textiles, Government of Maharashtra. As a part of the event, KP Verma, Joint Commissioner, Handloom & Textiles, Government of Uttar Pradesh; and Anuruddha Kshatriya, General Manager, Invest UP, delivered a detailed presentation highlighting the incentives available under the UP Textile & Garment Policy - 2022. They showcased Uttar Pradesh’s dedication to fostering growth and investment in its textile sector.

Throughout the three-day event, senior officials from Invest UP and the Handloom & Textiles Department focused on highlighting the state’s investor-friendly ecosystem and the abundant opportunities within the textile and garment sectors. A key objective of this event was to facilitate partnerships and demonstrate the ease of doing business through streamlined single-window clearances, aiming to enable seamless industry establishment in the state.

A leading trade show for garment and textile machinery, Gartex Texprocess India featured over 125 exhibitors and 300 brands. Uttar Pradesh’s participation in the 2025 event reaffirms its commitment to industrial growth, textile innovation, and solidifying its position as a national leader in garment manufacturing.

Dune London, the British footwear and accessories brand under Apparel Group, has launched an exclusive line of handbag charms available only at its Dubai Mall flagship store.

The playful summer collection blends elegance with individuality, encouraging customers to add a personal touch to their accessories.

Each limited-edition charm is designed with fine attention to detail, featuring gold-tone hardware, a signature logo emblem, rope tassel, and a whimsical zip-up pouch shaped like summer fruits.

These charms serve as stylish companions, allowing fashion-forward shoppers to customize their bags and express their personality with flair.

Perfect for mixing and matching, the charms invite creativity and self-expression, making them a must-have seasonal accessory. With their vibrant designs and chic accents, the charms elevate everyday style into a playful fashion statement.

China’s textile and apparel exports showed modest growth in April 2025 despite heightened trade tensions due to new “reciprocal tariffs” imposed by the United States.

According to the General Administration of Customs, textile and apparel exports reached $24.19 billion, up 1.5 per cent year-on-year and 3.4 per cent month-on-month.

Textile exports rose by 3.4 per cent to $12.58 billion, while apparel exports slipped 0.5 per cent to $11.61 billion.

From January to April, cumulative exports in the sector totalled $90.47 billion, a 1.1 per cent increase over the same period last year. Textile exports accounted for $45.85 billion, rising 3.8 per cent, whereas apparel exports fell 1.5 per cent to $44.62 billion.

In yuan terms, January-April exports stood at 649.54 billion yuan, up 2.2 per cent year-on-year. While textile exports climbed 4.9 per cent, apparel dipped by 0.5 per cent.

The uneven trend reflects lingering global trade uncertainty and pressure on China’s apparel shipments.

Pakistan’s textile exports rose by 8.41 per cent to $14,834.390 million during the first ten months spanning July-April 2024-25 as against $13, 683.247 million during the same period in 2023-24, as per a report by the Pakistan Bureau of Statistics (PBS).

During this period, Pakistan’s knitwear exports increased by 15.47 per cent to $4,118.227 million as against $3,566.624 million in the corresponding period last year. Bed wear exports by the country rose by 12.18 per cent to $2,569.214 million from $2,290.796 million.

Exports of other commodities including towels grew by 4.49 per cent to $903.331 million from $864.547 million. Meanwhile, exports of tents, canvas, and tarpaulin exports increased by 11.65 per cent to $109.002 million from $97.632 million. Readymade garments exports increased by 17.52 per cent to $3,394.188 million this year, compared to $2,888.177 million last year.

Similarly, exports of art, silk, and synthetic textiles grew by 9.74 per cent to $330.862 million from $301.496 million. Made-up articles (excluding towels and bed wear) exports increased by 9.10 per cent to $642.646 million from $589.025 million, while exports of other textile materials rose by 2.59 per cent to $610.866 million from $595.431 million.

However, exports of textile commodities including raw cotton plummeted by 98.45 per cent to $0.871 million from $56.086 million. Likewise, cotton yarn exports declined by 31.91 per cent to $576.016 million from $845.923 million, while exports of cotton carded or combed plunged by 99.28 per cent from $0.837 million to $0.006 million during the review period.

On a Y-o-Y basis, Pakistan’s textile exports decreased by 1.35 per cent to $1,220.655 million in April 2025 from $1,237.313 million in April 2024. On a month-over-month (M-o-M) basis, textile exports declined by 14.64 per cent in April 2025 compared to $1,430.003 million in March 2025, according to PBS data.