The Wazir Advisors, a leading financial advisory firm, released its latest textile and apparel sector performance report. The report, based on the Wazir Textile Index (WTI) and Wazir Apparel Index (WAI), reveals a mixed bag for the industry in the first nine months of FY24 (April-December 2023).

Textile sector sales decline, profit margin squeezed

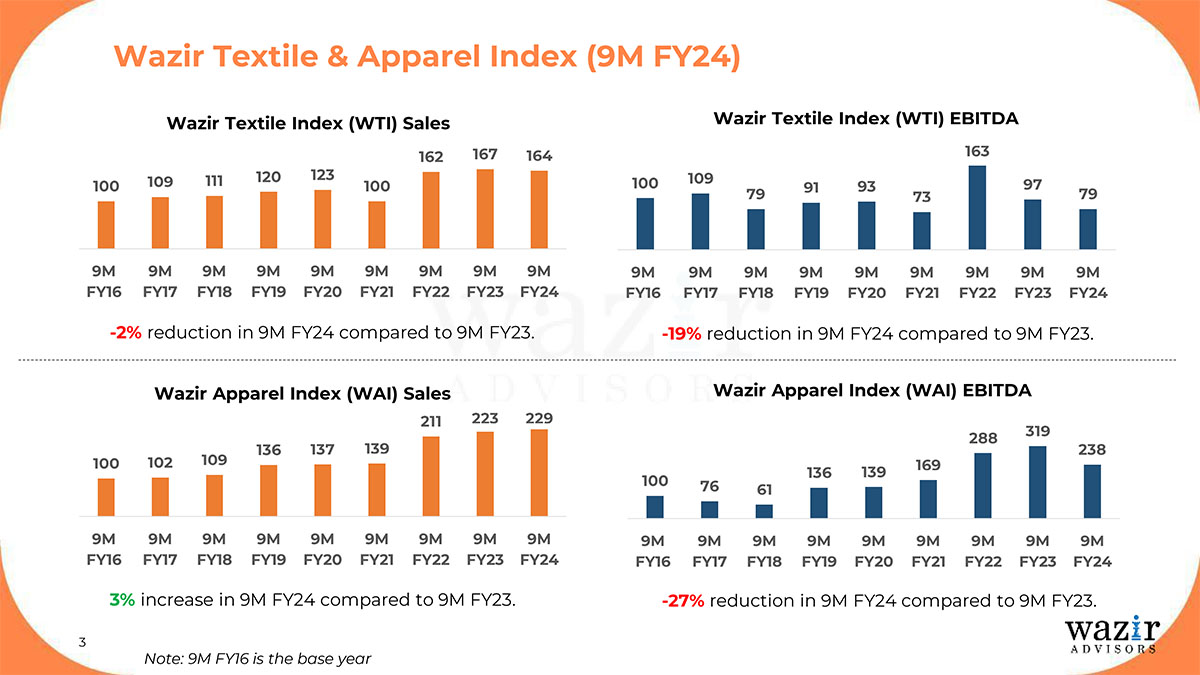

The WTI, which tracks the performance of top Indian textile companies, paints a concerning picture. Consolidated sales for top Indian companies including Vardhman Textiles, Arvind, Indorama Synthetics among others declined by 2 per cent on an average in the first nine months of FY24 compared to the same period in FY23. This drop in sales is accompanied by a sharper decline in profitability. The WTI EBITDA index, a measure of earnings before interest, taxes, depreciation, and amortization, fell by a significant 19 per cent year-on-year. This suggests that textile companies are struggling to maintain profit margins despite lower raw material costs (a trend observed in previous WTI reports).

While Vardhman Textiles saw its sales growth drop 7 per cent, Arvind’s dropped 14 per cent, KPR Mills saw 18 per cent drop. At the same time companies like Trident saw 18 per cent increase in sales growth, Wespun sa a 13 per cent increase and RSWM saw 2 per cent increase.

A consolidated analysis of major expenses reveals, the average cost of raw materials remained same in nine months of FY24 compared to the same period of FY23. Average employee expenses increased 2 percentage points same in nine months of FY24. At the same time other expenses remained the same in nine months of FY24 compared to the same period of FY23.

Apparel sector sales rise, but profits plummet

Interestingly, the Wazir Apparel Index (WAI) tells a different story for India’s apparel industry. While consolidated sales for leading apparel companies grew by a modest 3 per cent in 9M FY24 compared to 9M FY23, the WAI EBITDA index witnessed a steeper decline of 27 per cent year-on-year. Moreover, the consolidated EBITDA margin for apparel companies remained unchanged compared to the previous year. This suggests that apparel companies are managing to maintain profit margins despite lower sales growth, possibly due to cost-cutting measures. The companies under review in this category were: PDS, Pearl Global Industries, SP Apparels, Gokaldas Exports, Kitex Garments. Individually, only Pearl Global saw sales growth of 5 per cent while all the other under review saw negative sales growth.

Consolidated analysis of expenses for the top apparel players reveal the average cost of raw materials dropped by 5 percentage points in the first nine months of FY24 compared to the same period in FY23. Average employee expenses increase 3 percentage points in the first nine months of FY24. And other expenses went up 2 percentage points in the first nine months of FY24 compared to the same period in FY23.

Overall India picture

As per the report Index of Industrial Production (IIP) first nine months of FY24, remained the same for apparel but fell by 19 per cent compared to the same period in FY23. On the other hand the average Wholesale Price Index (WPI) for textiles decreased by -7 per cent and that of apparel increased by -1 per cent compared to nine months of FY23.

India’s overall T&A exports fell by -5 per cent first nine months of FY24. At the same time China’s cotton yarn imports from India increased from $53 million in nine months of FY23 to $554 million first nine months of FY24.

India’s T&A imports have gone down by -17 per cent nine months of FY24; home textiles imports have gone up 4 per cent nine months of FY24.

Overall growth in Q3 but concerns remain

The report offers a glimmer of hope with data for the most recent quarter (Q3 FY24). Consolidated sales for all listed textile and apparel companies combined actually increased by 5 per cent compared to Q3 FY23. Similarly, consolidated EBITDA for the combined sector witnessed a modest increase of 1 per cent in Q3 FY24. However, the performance of the first nine months raises concerns about the long-term health of the textile sector, particularly with regards to profitability.