Fast fashion is at risk of hitting a speed bump if a looming crisis sweeps Bangladesh’s banking sector. Financial institutions in the South East Asian nation face a credit crunch following mass deposit withdrawals in March and soaring levels of non-performing loans.

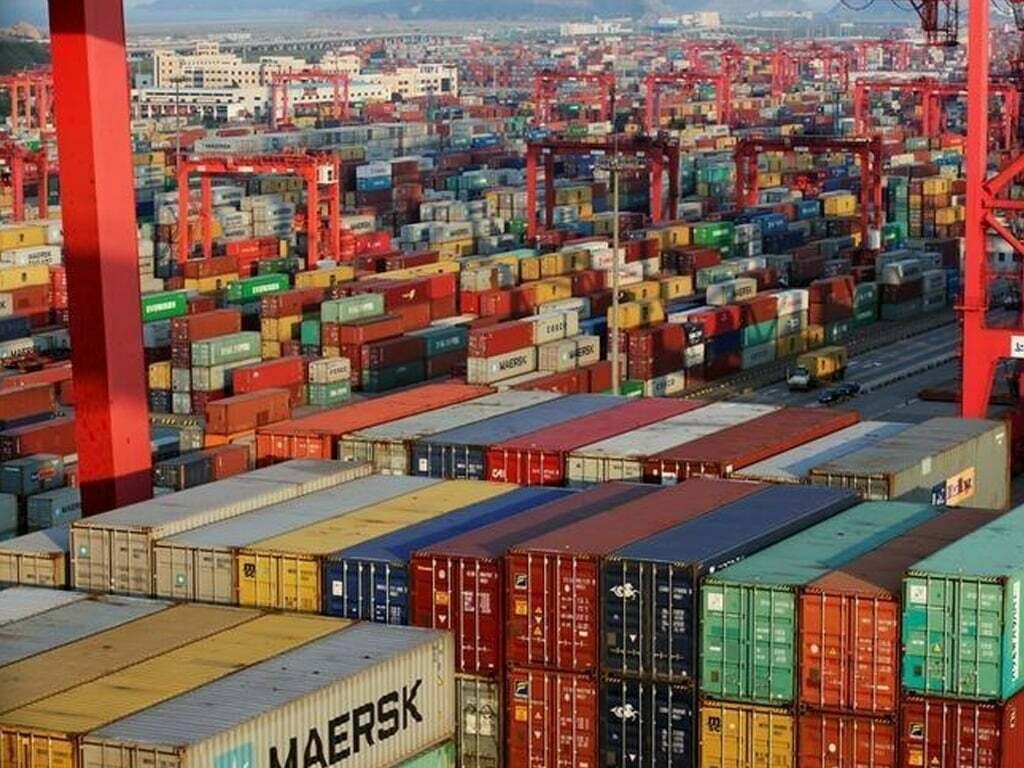

A full-blown crisis could spill over into Bangladesh’s strongest link to the global economy — the production of textiles and garments for fast fashion brands and retailers such as H&M, American Eagle Outfitters, Zara, Walmart and Target. A banking crisis would have a knock-on effect on global garment supply chain.

Garment factories’ inability to secure loans due to a banking crisis could possibly hold up the supply chain of global clothing retailers. Bangladesh is the largest exporter of readymade garments after China. Knitwear and woven garment exports between July and January accounted for about 83 per cent of its exports.

Loans from commercial banks remain a key source of working capital for many of the thousands of factories in Bangladesh. Years of corruption and poor lending practices have sent levels of bad debt at some banks above 20 per cent, while capital buffers are dangerously low. Irregularities uncovered at two large commercial lenders have sparked a broad run on national savings certificates, a retail savings product, further hurting banks’ balance sheets.

Loan shortage hits Bangladesh RMG businesses

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Nomura Report: Asian exporters absorb tariffs, rethink supply chains

As global trade enters a period of recalibration, Asian exporters are bearing the brunt of escalating US tariffs while simultaneously... Read more

Fashion's New Fit: Tailoring and alteration services stitch a story of growth

From the runways of Paris to the digital storefronts of global e-commerce, the fashion industry is changing. As consumers increasingly... Read more

Luxury brands swap leases for deeds as global real estate strategy shifts

Luxury fashion houses are increasingly choosing to buy, not rent, the world’s most coveted retail spaces, marking a sharp shift... Read more

STAR Network joins hands with Fashion Industry Charter for Climate Action to adv…

An inter-regional alliance of garment producer associations, The Sustainable Textiles of the Asian Region (STAR) Network, has reaffirmed its commitment... Read more

More than a lookalike, 'dupe' culture is forcing premium brands to innovate

The $4.5 trillion global luxury market is under siege, not just from the traditional counterfeiters operating in back alleys and... Read more

Recycling at Risk: How virgin polyester growth threatens fashion’s green goals

The global fashion industry is facing a sobering contradiction. Even as some of the world’s largest apparel brands proudly champion... Read more

Beyond the label, RepRisk flags human rights and environmental hazards in fashio…

The global apparel and textile industry, long celebrated for its role in democratizing fashion and creating jobs across continents, is... Read more

Made abroad, worn at home imports are replacing US garment production

The story of America’s clothing industry is one of contrast: booming demand from consumers but shrinking capacity at home to... Read more

Uniform GST rate ends duty anomalies, brings relief to textile manufacturers

When Finance Minister Nirmala Sitharaman rose to chair the latest GST Council meeting, few expected the sweeping changes that would... Read more

Renewables, recycling, and resilience, fashion’s blueprint for Net Zero

The mid-2025 stage is important. As the world inches toward 2030, the fashion industry finds itself at a crossroads between... Read more