China's dragon-size textile industry is valued at $870 billion (Rs 50,95,590 crores) and its exports are estimated at $280 billion (Rs 16,39,960 crores). In the next 10 to 15 years, prediction is that China will exit textile manufacturing business leaving a huge gap for countries like India to take advantage. The question is, whether India would be able to compete with rivals leveraging all its strengths while overcoming weaknesses?

China's dragon-size textile industry is valued at $870 billion (Rs 50,95,590 crores) and its exports are estimated at $280 billion (Rs 16,39,960 crores). In the next 10 to 15 years, prediction is that China will exit textile manufacturing business leaving a huge gap for countries like India to take advantage. The question is, whether India would be able to compete with rivals leveraging all its strengths while overcoming weaknesses?

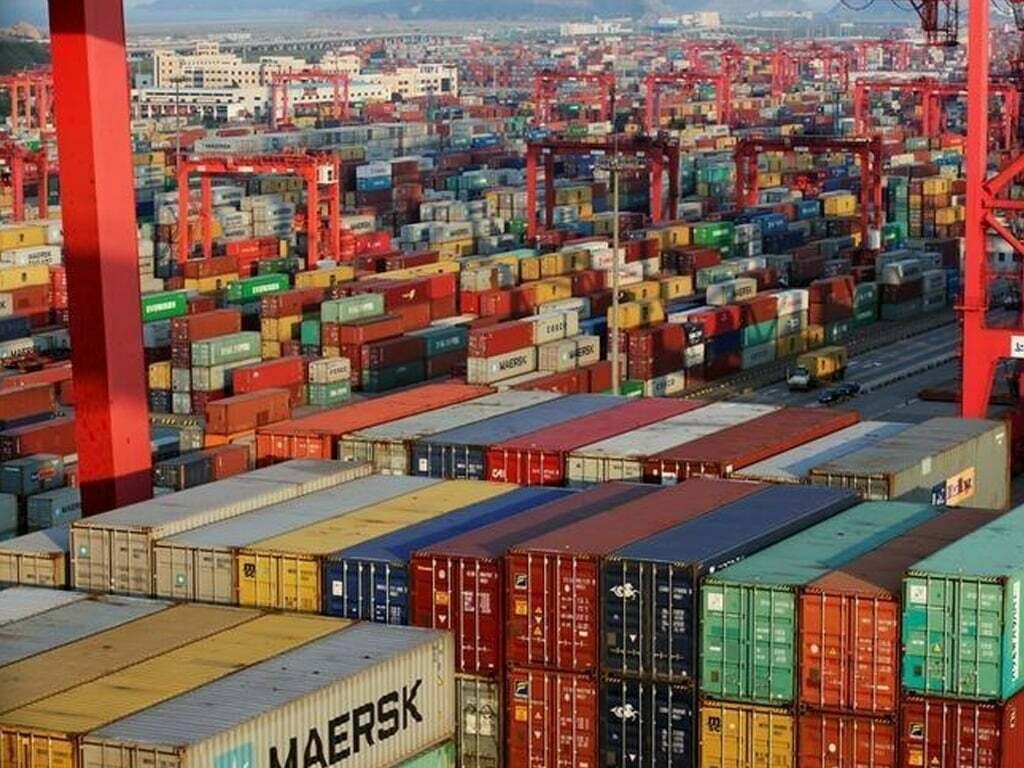

China, the textile manufacturing giant is showing all signs of moving ahead and away from being a manufacturing hub. In 2012, China’s share in the global textile and apparel trade dropped to $280 billion (Rs 16,39,960 crores) from $300 billion (Rs 17,57,100 crores) in the previous year. In 2013, growth in different textile segments, including yarn, fabric and apparel was down compared to the previous year. With a change in its famous cotton stockpiling policy, the country has decided to lower its cotton imports and clear the piled up stocks.

On the other hand, factors such as a rise in domestic consumption, Yuan going against the export sector and rising labour costs, are leading to importing countries looking at other sourcing options. And China is gradually losing its competitive edge. A country, like Japan, has already moved to producing more sophisticated products which require skilled labour and has begun outsourcing some of its basic textile jobs to Indonesia and Vietnam.

India needs to take a lead

Indian textile industry has everything going for it required to replace China, as a leading manufacturing hub. It has a wholly integrated industry from cotton production to manufacturing of yarn, fabric and garment, with its expertise not restricted to just cotton, but extending to silk, wool and synthetic fabrics as well.

leading manufacturing hub. It has a wholly integrated industry from cotton production to manufacturing of yarn, fabric and garment, with its expertise not restricted to just cotton, but extending to silk, wool and synthetic fabrics as well.

Experts point out that first and foremost, the industry should be able to push its $40 billion (Rs 2,34,280 crores) textile exports to $280 billion (Rs 16,39,960 crores) in the next 10 to 15 years. Since the textile industry is labour-intensive, manufacturing tends to get outsourced from countries having cheaper labour. So the big opportunity is knocking at the door for India.

If one looks back into the history of textile industry, the fact that always remained evident is that production always shifted from high-cost countries to low-cost countries. By the late 1980s, production of most textiles in the industrially developed countries, such as the United States, Western Europe, and Japan, became too expensive to compete with imports due to rising wages and production costs. A large portion of fibre, yarn, cloth, and garment production were relocated to less-developed countries with lower wages. When China exits manufacturing like other developed countries, India will have to competitively make headways into the emptied space.

Removing growth hurdles

To make sure, that everything works in its favour, India must keep tab of the potential of its competitors. While Turkey has integrated industry like India its production costs rising closer to European Union standards. Countries like Bangladesh and Sri Lanka are strong but only in specific segments like garments. Bangladesh, of late has been facing compliance issues, which may work in favour of Indian factories. Pakistan, on the other hand, despite having a large textile sector and GSP+ status from EU, is grappling with issues like power, adequate infrastructure, modern machinery, technology and skilled manpower as well as political instability and internal security concerns.

China is the largest buyer of Indian cotton and cotton yarn but when it cuts down purchases to consume piled up stocks, India will have to develop capacities in the upstream segments to absorb the produce so that the cotton and yarn producers will not have to face the fall in demand. India’s economic climate has not been favourable for investments. India does not even figure among the first 100 countries in the ‘ease of doing business’ list. European countries like Italy, Belgium and France which could have otherwise invested in advanced technologies, have stayed away from India. China too has started outsourcing parts of its production to other countries like Vietnam and Indonesia, but India has not yet benefited from this move. Issue of lack of skilled labour force also is another big issue. India is also a power-deficient country and the demand-supply gap has been widening every year.

Industry has also been demanding a technology mission for cotton to address issues related to better quality seeds, mechanisation at farm level and better agronomy research to help bring down the cost of production. Also increased investments are needed and TUFS has to restore the rate of interest reimbursement for spinners under the scheme to 4 per cent from the current reduced rate of 2 per cent to boost development of new factories. When the demand for cotton and yarn from China comes down, India will have to increase its cotton fabric production capacities. Also, compared to the garment sector in Bangladesh, India’s industry is highly fragmented with smaller-sized units. All these hurdles have to be overcome, for the industry to race ahead in the competition.