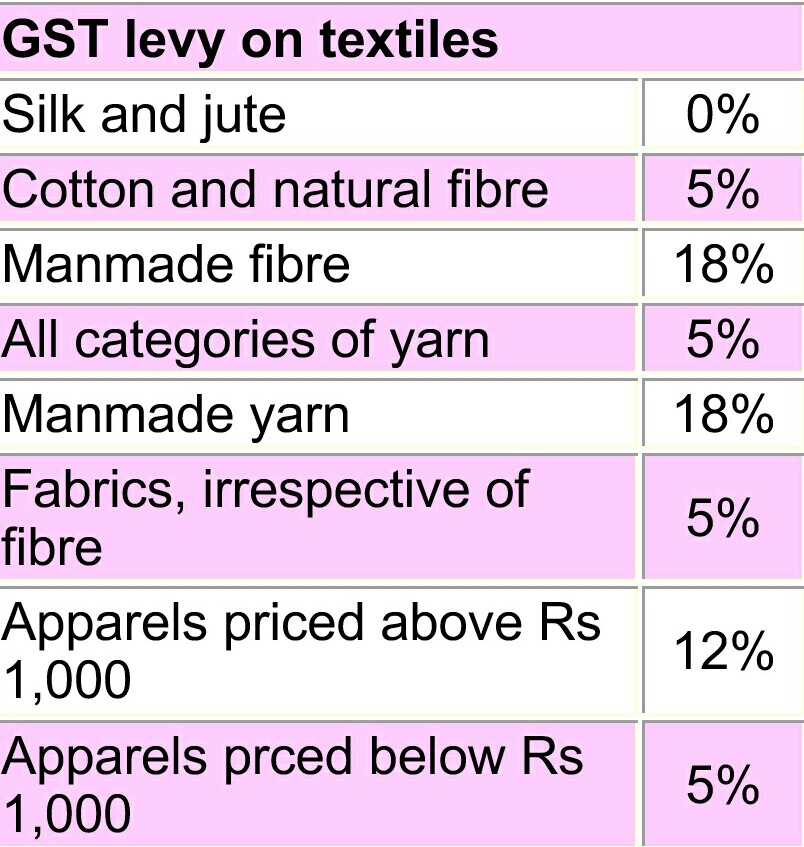

The Goods and Services Tax (GST) Council on Saturday cleared the pending rules for the rollout of the new indirect tax regime from July 1.Finance Minister Arun Jaitley chaired the 15th meeting of the GST Council, where the rates of tax and cess on gold, biscuits, footwear and textiles were decided:

Highlights of GST for various sectors of textiles, apparel and footwear:

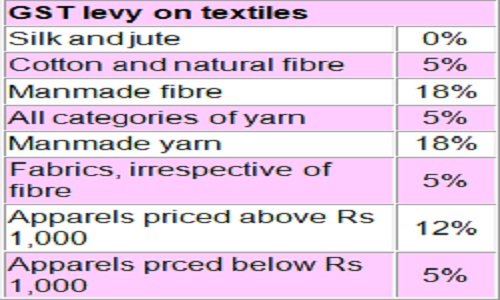

• GST council has levied tax on textiles such as yarn and fabric cotton at the lower slab of 5%

• GST of 12 per cent will be levied on readymade garments. However, apparel under Rs 1,000 will attract a 5 per cent levy.

• Manmade fibre will be taxed at 5 per cent, while synthetic fibre will attract an 18 per cent GST.

• Jute and Silk have been exempted from GST.

• The GST Council has fixed the tax rate on footwear worth up to Rs 500 at the lowest tax slab of 5% under the new GST regime, The GST tax rate on footwear costing more than Rs 500 is fixed at the higher 18%

• Other than this, it levied cess over and above the 28% tax on certain luxury goods and sin goods. A section of industry is saying that differential treatment for cotton and synthetic fibre on GST rate is an opportunity lost for a uniform rate for textile sector.

The government has fixed a 5 per cent GST rate on cotton fibre, yarn and fabric against the current prevailing rate of “nil”. This means, cotton yarn and fabric would now attract 5 per cent duty, which would make all products proportionately costlier. Some states, however, had levied value added tax on cotton yarn and fabric at 2-4 per cent. Overall, 5 per cent GST levy is higher than the existing levies on cotton yarn and fabric. Silk and jute have been kept under “nil” category under the GST. Man-made or synthetic fibre yarn will attract 18 per cent GST.

While all apparels would attract 12 per cent GST once the tax is rolled out, against the current levy of 6-7 per cent, apparels below worth Rs 1,000 would levy 5 per cent GST.

“We are happy with the government’s decision to keep fabric under 5 per cent and apparel under 12 per cent,” said R K Dalmia, President, Century Textiles.

While announcing these rates, the Finance Minister Arun Jaitley, however, clarified that textiles manufacturer would not given credit outflow. This means, an input credit above the prescribed limit would not be granted to textiles manufactures, said Jaitley.

He said this in the context of 18 per cent GST for man-made yarn, while fabric made from that will attract 5 per cent and hence full input credit will not be utilised.

S C Kapur, chairman of association of synthetic fibre industry said, "The government should have appiled a uniform rate to the textile industry which has been the global practice. Man-made fibre tax at cotton yarn level would have helped higher investment in the sector. Additional demand for fabric can be fulfilled by synthetic makers as there will always be an upper limit to produce more cotton."

Synthetic yarn and cotton yarn blended fabric constitutes 70-80 per cent of total fabric and hence mis-declaring synthetic fibre as cotton in blended fabric is not ruled out, say industry captains.

With this, readymade garments would become costlier proportionately. Had input credit been granted, garments manufacturers would get a breather in terms of taxes on raw materials.

“The 5 per cent GST levy on cotton yarn and fabric would make interstate movement of goods smoother and business would become transparent. A small increase in the product rate would become immaterial once business goes with uniform tax rates across the country. Meanwhile, the rate of 12 per cent for textiles is progressive and will lead to the growth and development of the entire value chain,” said Ujwal Lahoti, Chairman of The Cotton Textiles Export Promotion Council (Texprocil).

The GST rate for textiles will eliminate the cascading effect of duty/taxes which will reduce the costs and improve the competitiveness of the textiles exports.

“Five per cent GST on cotton yarn and fabrics would help producers with compliance and encourage farmers to grow more cotton, Lahoti added.

With this low rate, Indian producers would become competitive in the world which will help India’s textiles exports grow in coming years, a senior industry official said.

"A credit transfer document will be issued to the manufacturer. If the tax on the item is below 18 percent, 40 percent of the Central or State GST payable will be given as credit. For items with tax above 18 percent, 60 percent will be available as credit," said Revenue Secretary Dr. Hasmukh Adhia during the press briefing.

Southern India Mills Association (SIMA) today hailed the Goods and Services Tax (GST) rates announced for the textile industry. As the textile industry has been under the optional route since 2004 and the fabrics have been under zero VAT rate, the 5 per cent GST rate would bring substantial revenue apart from widely broadbasing the tax net across the textile value chain and ensuring compliance, SIMA chairman M Senthilkumar said.

The 5 per cent GST on readymade garments below Rs. 1000 would greatly benefit the common man across the country, being a mass consumption item.

SIMA chief has stated that 5 per cent GST rate on cotton fibre would sustain the competitiveness of over 20 million cotton farmers as this rate across the value chain would enable the cotton textile industry to remain globally competitive, achieve substantial growth rate and increase cotton fibre consumption and thereby increase the earnings of the farmers.

He expressed hope that the textile job work would be exempted from service tax which is essential to benefit the industry, especially the powerloom sector, knitting, processing and garmenting sectors.

Senthilkumar said that 18 per cent GST rate levied on man-made fibre and synthetic yarn would have inverted duty structure problem as the fabric would attract only 5 per cent GST rate.