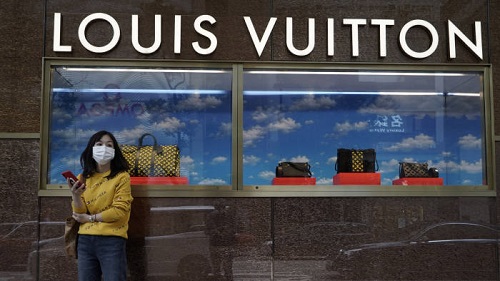

With the COVID-19 pandemic gaining momentum, the impact on fashion and luxury industry is likely to be more severe than was estimated earlier. As a recent analysis by Javier Seara, Partner and Managing Director, Global Sector Leader Fashion & Luxury, at Boston Consulting Group, reveals, compared to last year, global fashion and luxury sales are likely to drop by 25 to 35 per cent in 2020 as stores will remain closed, people will curtail purchases leading to a contraction of the global economy. To deal with this fallout, Seara recommends, besides working on short-term measures, brands need to plan their upcoming collections, stock allocations, purchasing, and supply-chain decisions.

With the COVID-19 pandemic gaining momentum, the impact on fashion and luxury industry is likely to be more severe than was estimated earlier. As a recent analysis by Javier Seara, Partner and Managing Director, Global Sector Leader Fashion & Luxury, at Boston Consulting Group, reveals, compared to last year, global fashion and luxury sales are likely to drop by 25 to 35 per cent in 2020 as stores will remain closed, people will curtail purchases leading to a contraction of the global economy. To deal with this fallout, Seara recommends, besides working on short-term measures, brands need to plan their upcoming collections, stock allocations, purchasing, and supply-chain decisions.

Sales drop to outpace 2009 recession

Seara believes a major impact of this pandemic will be on fashion sales which are likely to decline by around $600 billion worldwide from 2019 levels. That is a bigger drop than during the great recession a decade ago. However, this impact will not be the same everywhere. It will depend on how different countries and regions have reacted to the crisis so far and the effect of those actions on their retail spending. Some areas are likely to hit harder than the average, while others will escape with relatively less damage.

The four phases of Coronavirus

According to Seara, COVID-19 outbreak can be divided into four phases. These include the first appearance of the novel Coronavirus; lockdowns across countries to control its spread; growth in COVID-19 subsidies leading to a bounce-back of industry and recovery of manufacturing and increase in consumer spending to pre-outbreak levels.

countries to control its spread; growth in COVID-19 subsidies leading to a bounce-back of industry and recovery of manufacturing and increase in consumer spending to pre-outbreak levels.

Seara looks at the intensity of the crisis in each region, how it responded to it, and specific market conditions that affect the sector’s sales in that area. These conditions include the strength of local economy and the market share of its fashion industry. Seara believes overall sales will bottom out in March and April to bounce back with10 per cent to 15 per cent in December over last year.

Recoveries to differ by region

Recoveries from the outbreak will differ by region. Countries that faced a severe outbreak, and whose economy is not as solid as others, will have a harder time recovering. This can be seen from the example of Spain, where, a government-enforced shutdown has led to a more than 90 per cent drop in Spain’s fashion and luxury sales from last year. Shutdowns in such places will result in slower recovery that will be exacerbated by travel restrictions.

In contrast to Spain, China is in better shape to weather the crisis. Not only has the country passed the COVID-19 crisis point, it also has a solid pre-outbreak economy, which will help it recover fairly quickly. The country is likely to record fashion and luxury sales off only 5 per cent to 10 percent from 2019. North America falls in the middle range as a few US states have instituted shelter-in-place orders while others are yet to limit people’s movements. This is likely to affect the pace of the outbreak in the region and prolong its bounce-back period. By detailing these scenarios in each of these countries, Seara hopes that brands use this analysis to strategise their moves for the rest of the year.