FW

Federation of Gujarat Weavers’ Association (FOGWA) has urged the Union Minister of State for Road Transport and Shipping Mansukh Mandaviya to formulate a textile policy, similar to the one made by the Maharashtra Government ,to stop migration of power loom weavers from Surat. Reports suggest around 250 power looms in Surat have migrated to Navapur a border district in Maharashtra due to proactive textile policy of Maharashtra government. The units have been set up in Maharashtra Industrial Development Corporation (MIDC) estate in the last one year or so.

The benefits provided by Maharashtra government include cheap electricity tariff at less than Rs 3.5 per unit, 35 per cent subsidy on capital investment on bank loan and 50 per cent subsidy on own investment and cheap land prices. On the other hand, power loom units in Surat have been paying electricity tariff at Rs 7.30 per unit and the total subsidy on capital investment is just about 15 per cent.

The first US Footwear Innovation Summit by FMNII will display latest innovations in the technology and footwear sectors to 250 industry leaders from footwear brands, design institutes and factories, on October 2, 2018. The summit will be moderated by oth Natacha Alpert, founder of Miras3D, and Katherine Stein, Director of business at SGS. It will introduce advanced innovations in 3D design, sustainable innovation materials, 3D scanning and 3D printing for the footwear industry.

Brendon Marczan, Manager of leading digital creation enterprise Foundry, will present their in-house technologies Modo and Colorway. Chris Lane, CEO, 3dMD, will share developing technology in 3D scanning that will help shape the future of footwear designs. Dr Geoffrey Alan Gray, founder of footwear testing lab Heeluxe, will break down the new technologies like wearable sensors, 3D printing, and additive manufacturing to show how these are helping create more comfortable shoes for brands.

The event will attract enterprises from the US, Europe and Asia to exhibit their most innovative products, ranging from machinery to digital creation, from sole materials to sustainable textiles and more.

Pakistan’s textile exports fell 0.49 per cent in July 2018 compared to the same month a year before. Export of cotton cloth decreased by 9.94 per cent. Exports of bed wear decreased by 3.56 per cent. Tents, canvas and tarpaulin export declined 4.73 per cent. Exports of readymade garments decreased 0.46 per cent. Exports of art, silk and synthetic textiles contracted 16.02 per cent. Exports of made-up articles went down by 6.91 per cent.

However, there was an increase of 7.62 per cent in exports of cotton yarn. Exports of yarn other than cotton yarn increased by 73.74 per cent in July 2018 compared to July 2017. Exports of knitwear were higher by 7.78 per cent while exports of towels were higher by 0.51 per cent. Exports of other textile materials increased by 3.24 per cent in July 2018 compared to July 2017.

Textile exports make up around 60 per cent of the country’s total exports. The textile sector has the largest share in Pakistan’s exports. Pakistan’s competitors are upping the ante on textile exports to make inroads into newer global markets. While China’s share in global textile exports is 36 per cent, Vietnam contributes 12.4 per cent, and Pakistan seven per cent.

The volume of European Union clothing imports rose 6.62 per cent during the first five months of 2018. However, the value of imports fell 2.10 per cent. Bangladesh’s apparel exports to the EU rose 0.83 per cent year on year. Meanwhile, Turkey is impressively expanding its share in the European market due to its close proximity. Though volumes are not as high as Bangladesh’s, Turkey is shipping more value-added garments to the European Union.

Indian apparel exports to the EU fell 3.58 per cent in value terms and marked a marginal growth of 0.49 per cent in volumes. The country’s inability to take advantage of the rupee depreciation of around six per cent against the euro hurt exports big time. Further, the absence of a free trade agreement with the EU is clearly making products manufactured in India non-competitive as compared to countries like Bangladesh which get trade benefits by the EU.

Vietnam’s apparel exports to the EU are on the up but only in volumes. The value of exports declined massively by 26.09 per cent. However, growth prospects for Vietnam are bright due to the upcoming free trade agreement with the European Union.

The Turkish lira has slumped to a record low amid political and economic turmoil in the country. Turkish currency has fallen against the dollar by as much as 40 per cent this year. The drop makes Turkey a cheaper option than before, which may tempt new business. The price to import will become much cheaper, but there are risks associated with that because of the uncertainty in the economy.

However, it has pushed up the cost of any loans taken out by manufacturers denominated in US dollars by more than a third. A lot of Turkish businesses could go bust in the next two or three months. It’s a disaster for manufacturing – not just on clothing but all industries.

Although more expensive than their counterparts in Asia, Turkish manufacturers can offer faster delivery times and the flexibility to repeat in season, which has led to many UK retailers and brands to move some production to the country.

Political instability has deterred many UK companies from investing in ranges sourced from Turkey. Though such sourcing is cheaper, Turkey’s political instability may weigh on brands when deciding on their sourcing options. Turkey is high up on the scale of risk – as high or higher than Bangladesh.

Sourcing at Magic was held in the US from August 12 to 15. The aisles that led through international suppliers seemed quiet this year. Conversely, the Made in America area drew attention from designers seeking smarter pricing options. Its micro factory showcased domestic-production capabilities.

A film Riverblue revealed the damage caused to global water supplies by traditional apparel manufacturing. The event offered a source of inspiration, education and resources that keeps the fashion industry moving and drives businesses forward. Sourcing at Magic is the fashion industry’s link to the entire global supply chain and it attracts designers, brands and retailers alike. It takes a look at how US decisions may impact various free trade agreements and international trade relationships. Sourcing at Magic exhibits include: accessories, footwear, apparel, private labels, swimwear, outerwear.

Visitors included professionals, manufacturers, buyers, suppliers, traders, key decision makers, and much more. The owner of the New York–based mobile shop The Celebrities Boutique came thinking he was going to deal with Chinese manufacturers, because it’s cheaper, but after doing the math for the shipping, figured out it was almost the same amount. He found a domestic manufacturer.

The February 2017 show of Sourcing at Magic hosted an African pavilion which had over 11 countries represented.

The 2018 Nanjing Wool Market Conference will be held in China from September 11 to 13. This is a major conference for wool and early wool processing industry in China and is attended by executives of all major Chinese wool buying and processing companies. Participants include growers, traders, primary processors, spinners, weavers and garment manufacturers.

The conference, held every year in September, enables international delegates to meet with China’s biggest wool buyers and processors. It also offers exhibition space for companies wishing to exhibit their products and is open to delegates from all around the world.

Domestic consumption of woolen products in China has grown dramatically in the last five years. If previously most processing was for export, today at least 50 per cent is for domestic use, and this is growing year by year. Although wool only represents 15 per cent of fibers consumed in China, volumes are so large that even 15 per cent represents a huge quantity. Even in Mongolia, a remote part of the world, women wear woolen coats.

With increased affluence and a tendency towards leading healthier lifestyles, discerning Chinese consumers are now favoring natural, long-lasting garments, following latest trends in fast fashion.

Bangladesh’s exports of apparel accessories increased 10 to 15 per cent in the last financial year. Among these are woven labels, leather badges, stone and metal motifs, rubber patches, gum tapes, satin and cotton ribbon hangers, price tags, buttons and zippers.

The country exports accessories to countries like Sri Lanka, South Africa, Malaysia, Vietnam, Cambodia and Myanmar. These are used in the readymade garment, leather, pharmaceutical and other sectors. In the readymade garment sector, accessory makers and packagers supply 34 types of products.

With proper policy support and financial incentives, both indirect and direct, Bangladesh hopes to increase export earnings in the sector by up to three times over the next couple of years. China used to be the biggest source of accessory items, but it has shut down many of its accessory factories on account of environmental issues and is shifting to high-tech industries. This is the opportunity Bangladesh hopes to make use of. Accessory makers have boosted their capacities and can almost fully meet the demands of garment exporters. They anticipate growth in business as local and international buyers have evinced increased interest in the sector this year with the recovery of the global economy. The Asian garment accessories market is 24 billion dollars.

"Today’s consumers are concerned about their personal comfort, and that may be part of the reason why the current population has been dubbed the indoor generation. A survey by Velux, a window manufacturing company, says on average people spend 90 per cent of their day, or about 21 hours, indoors. According to Peter Foldbjerg, Head, daylight energy and indoor climate, Velux, today’s generation is of indoor people where the only time they get daylight and fresh air midweek is on the commute to work or school. If consumers are constantly in a 70-degree environment, it makes sense for retailers and brands to offer apparel that work at that temperature. And since consumers are avoiding outdoor heat, humidity, and bugs of summer, as well as the ice, snow, and cold of winter, it stands to reason they would want clothes that are just as comfortable indoors any time of year."

Today’s consumers are concerned about their personal comfort, and that may be part of the reason why the current population has been dubbed the indoor generation. A survey by Velux, a window manufacturing company, says on average people spend 90 per cent of their day, or about 21 hours, indoors. According to Peter Foldbjerg, Head, daylight energy and indoor climate, Velux, today’s generation is of indoor people where the only time they get daylight and fresh air midweek is on the commute to work or school.

Today’s consumers are concerned about their personal comfort, and that may be part of the reason why the current population has been dubbed the indoor generation. A survey by Velux, a window manufacturing company, says on average people spend 90 per cent of their day, or about 21 hours, indoors. According to Peter Foldbjerg, Head, daylight energy and indoor climate, Velux, today’s generation is of indoor people where the only time they get daylight and fresh air midweek is on the commute to work or school.

If consumers are constantly in a 70-degree environment, it makes sense for retailers and brands to offer apparel that work at that temperature. And since consumers are avoiding outdoor heat, humidity, and bugs of summer, as well as the ice, snow, and cold of winter, it stands to reason they would want clothes that are just as comfortable indoors any time of year. Compared to manmade fiber clothing, the overwhelming majority of consumers say cotton clothing is the best for T-shirts (90 per cent), underwear and intimates (83 per cent), childrenswear (82 per cent), and casual clothing (80 per cent), according to Monitor research.

Cotton the most favoured fiber

More than 4 in 5 consumers (82 per cent) say cotton is their favorite fiber to wear, according to the Cotton Incorporated Lifestyle Monitor Survey. This is followed by a distant 3 per cent who choose polyester, silk (2 per cent), then spandex, rayon, linen, and wool (all 1 per cent). Because cotton pieces are lighter and more breathable, they can easily be layered in cooler months, or worn alone in warmer, more humid seasons. Compared to manmade fiber clothing, more than 8 in 10 consumers say cotton clothing is the most comfortable (86 per cent), according to Monitor data. This is a significant increase from February 2017 (80 per cent). In further comparisons to synthetics, consumers say cotton clothes are the most sustainable (86 per cent), the softest (83 per cent), highest quality (78 per cent), and most versatile (63 per cent).

followed by a distant 3 per cent who choose polyester, silk (2 per cent), then spandex, rayon, linen, and wool (all 1 per cent). Because cotton pieces are lighter and more breathable, they can easily be layered in cooler months, or worn alone in warmer, more humid seasons. Compared to manmade fiber clothing, more than 8 in 10 consumers say cotton clothing is the most comfortable (86 per cent), according to Monitor data. This is a significant increase from February 2017 (80 per cent). In further comparisons to synthetics, consumers say cotton clothes are the most sustainable (86 per cent), the softest (83 per cent), highest quality (78 per cent), and most versatile (63 per cent).

Further, the majority of consumers are bothered when brands and retailers substitute synthetic fibres in apparel items they expect to be made from cotton. For example, 61 per cent (up significantly from 53 per cent in 2017) are bothered when brands use synthetics instead of cotton in T-shirts, according to Monitor data. Consumers are also bothered when synthetics are substituted for cotton in underwear (60 per cent, up significantly from 54 per cent in 2017), denim jeans (57 per cent, up significantly from 52 per cent in 2017), casual clothes (56 per cent, up significantly from 46 per cent in 2017), activewear (50 per cent), business clothes (47 per cent), and childrenswear (45 per cent).

Brands and retailers would benefit from the majority of consumers who would pay more money to keep cotton from being substituted with synthetics like polyester in everything from underwear and intimates (70 per cent) to tees (65 per cent), denim (62 per cent), businesswear (57 per cent), activewear (55 per cent), and children’s clothes (52 per cent), according to Monitor research.

Where’s the future headed

The concept of clothes that easily transit from one season to the next makes sense from a consumer standpoint as well as an environmental one. For consumers, it means buying key, quality pieces that can be worn virtually year round, both because their weight isn’t too light or heavy, and their colors can be mixed with others to bring an outfit into the next season. Keeping a certain number of items in the closet as a base, means less churn and overhaul each season.

Robert Babigian, key account executive – apparel, Timberland points out the company is focussing on casual, comfortable pieces heading into spring/summer 2019. The company is offering retro elements like track suits, color-blocking, and logo pieces for next season, and focusing on archival pieces heading into fall 2019. It is offering a lot of fleece and tees, mostly 100 per cent ring-spun cotton, and some cotton blends in its fleece. There is an aspect of the outdoor trend that’s more mainstream and it’s not as focussed on technical fabrics. These are pieces that can be worn anywhere and that resonate with the younger consumer.

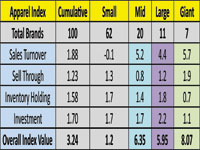

"Like previous quarters, the biggest brand group -- Giant brands are still growing the most, outgrowing recessionary trends. However, growth rate was moderate this quarter compared to previous quarters and in the same quarter previous year when it grew at 11.00 points. Small brands, at 1.20 points, seem to be pulling along and to an extent overall growth is being pulled down by smaller players, who are still not in a position to outsmart their business practices. In fact, Small brand’s dipping Sales Turnover (at -0.1 points) is certainly a cause of concern , however, they managed to grow at an index value of 1.2, riding on increased investments to hold inventories as lesser sales were recorded."

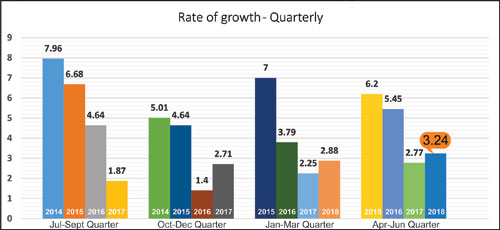

CMAI’s Apparel Index, as researched by DFU Publications for Q1 April-June FY 2018-19 reveals cumulative growth is at 3.24 points which is higher than 2.88 points last quarter; Big Brands (Mid, Large and Giant together) together clocked in growth at 6.55 points (less compared to 7.61 points last quarter); Small Brands in contrast are still lagging with low growth at 1.2 points (higher than last quarter’s 0.75 points).

CMAI’s Apparel Index, as researched by DFU Publications for Q1 April-June FY 2018-19 reveals cumulative growth is at 3.24 points which is higher than 2.88 points last quarter; Big Brands (Mid, Large and Giant together) together clocked in growth at 6.55 points (less compared to 7.61 points last quarter); Small Brands in contrast are still lagging with low growth at 1.2 points (higher than last quarter’s 0.75 points).

At 3.24 points, Q1 index is certainly better than previous quarter’s (Jan -March FY 2017-18) 2.88 points; and Q1 in previous year (April-June 2017-18) at 2.77 points. While Big brands together have grown at 6.55 points, individually Mid, Large and Giant brands have grown at 6.33, 5.95 and 8.07 points respectively (previous quarter figures were: 6.26, 8.50 and 10.00 points). In fact, Mid brands have shown slight buoyancy and Large and Giant brands grew lesser than previous quarter. Growth is mainly triggered by Big Brands expansion and them pumping in fresh Investments.

Like previous quarters, the biggest brand group -- Giant brands are still growing the most, outgrowing recessionary trends. However, growth rate was moderate this quarter compared to previous quarters and in the same quarter previous year when it grew at 11.00 points. Small brands, at 1.20 points, seem to be pulling along and to an extent overall growth is being pulled down by smaller players, who are still not in a position to outsmart their business practices. In fact, Small brand’s dipping Sales Turnover (at -0.1 points) is certainly a cause of concern , however, they managed to grow at an index value of 1.2, riding on increased investments to hold inventories as lesser sales were recorded.

Sales Turnover, Inventory Holding & Investments on the rise

Sales Turnover: Sales Turnover in Q1 reflected an Index growth of 1.88 (higher than previous quarters 1.6 points). Nearly, 53 per cent brands reported an increase this quarter. The highest percentage of brands that recorded 41 per cent or more growth, were in the Mid Brands group followed by Large Brands. Small Brands lost Sales Turnover by 0.1 points, the second time in last four years. As French menswear brand Celio’s CEO Satyen P Momaya says, “Increase in sales turnover is a combination of store growth and expansion. Our store growth has been between 0-6 per cent and overall growth is better.”

increase this quarter. The highest percentage of brands that recorded 41 per cent or more growth, were in the Mid Brands group followed by Large Brands. Small Brands lost Sales Turnover by 0.1 points, the second time in last four years. As French menswear brand Celio’s CEO Satyen P Momaya says, “Increase in sales turnover is a combination of store growth and expansion. Our store growth has been between 0-6 per cent and overall growth is better.”

Most have reported higher sales turnover riding on new store openings. “Our sales turnover is increasing as expansion is going on and more stores are being added. Around 10 to 12 new stores were added,” explains Deepak Singhla, Sales Head, Cantabil. Similarly, Bhushan Gupta, Head of Business Development, Breakbounce points out, “Our sales turnover increased as Breakbounce is a new brand with a rapid growth pattern. Every year, new sales points are being added and there is an increase in sales turnover.”

However, nearly 24 per cent brands said their sales turnover remained the same. As brand Era’s partner Nikhil Furia says, “We saw an increase in sales turnover by targeting a lot of new territories in Tier II, III cities.”

Sell Through: Recorded an index growth of 1.23 this quarter. Nearly 51 per cent brands reported an improvement in Sell Through. However, 42 per cent brands saw no change in their sell through as it remained the same; and around 7 per cent brands recorded a dip in sell through growth. “Our sell through rates have improved compared to last year over merchandises, which has led to faster realization of inventory and hence, expenditure has not increased much,” says Momaya.

Inventory Holding: Growth under this head is at 1.58 points in Q1, higher than 1.1 points recorded in the previous quarter. Almost 55 per cent respondents across brands have said their inventory holding moved north this quarter, a significant number, indeed. Increase in inventory holding impacts overall index negatively. Higher inventory holding indicates more leftovers on shop shelves or lower sales in previous quarter.

As Pepe Jeans’ regional manager Manish Kapoor says, “We have been prudent in our orders and accordingly since our input have increased inventory has gone down.” On similar lines Gupta explains, “Each year the number of customers we cater to is growing. Hence, stock holding and inventory holding is proportionate to the last year’s parameters.”

Investments: One positive aspect of Q1 is that fresh Investments have gone up nearly 1.70 as against 1.30 points last quarter. Overall nearly 77 per cent respondents reported a rise in investments which is much higher than 54 per cent in previous quarter, indicating most brands had to invest to manage and grow which means growth doesn’t seem to be coming easily. “We are exploring new markets and are on an expansion mode,” says Mayank Jain, Marketing Head, Monte Carlo.

‘Good to Excellent’ outlook for the festive quarter

Around 56 per cent brands say the outlook for next quarter is ‘Good’, while 11 per cent believe it will be a ‘Excellent’. Around 32 per cent feel the quarter will be average in terms of business however, only 1 per cent say, it will be ‘Below Average’. Comparatively the outlook recorded previous quarter was ‘average to good’. Generally, in Q2 of the financial year numerous festivals are lined up and sales picks up, so the overall mood is positive.

CMAl's Apparel Index

CMAl's Apparel Index aims to set a benchmark for the entire domestic apparel industry and helps brands in taking informed business decisions. For investors, industry players, stakeholders and policymakers the index is a useful tool offering concrete and credible information and is an excellent source for assessing the performance of the industry. The Index is analysed on assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building. The Apparel Index research is conducted by DFU Publications.