AEPC hopes the embedded taxes arising out of the inverted structure will be refunded to exporters through appropriate mechanisms. The duty structure remains inverted with fabric at five per cent GST. AEPC says the key issue of embedded taxes needs to be taken up to address the genuine concerns of exporters and export sentiments. Invisible taxes need to be considered for refund under drawback and Remission of State Levies (RoSL) schemes, so that the calibrated refund provided is representative of the tax incidences incurred by the industry.

In the absence of encouraging duty drawback and RoSL exports from the sector will further witness a sharp decline just ahead of the peak festival season. The appreciating rupee and new levies like GST on intra-company stock transfers, job work, freight and samples have led to cost escalation for exporters further narrowing their low margins in competitive global markets.

There has been a reduction in the rate of GST on man-made items including synthetic filament yarn such as nylon, polyester and acrylic, and artificial filament yarn, yarn of manmade staple fibers, real zari from 18 per cent to 12 per cent. There is a provision for refund of GST for the month of July by October 10 and for August by October 18, which will ease the working capital stress. A facility of e-wallet has also been introduced for addressing the refund issue.

AEPC wants embedded taxes refunded

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Amazon's algorithmic price-parity policies face fresh legal challenges in UK, Ge…

Amazon finds itself at the center of a new wave of legal and regulatory scrutiny in Europe, as two major... Read more

South Asia’s textile crossroads, India struggles, rivals rise amid US tariff sho…

The global trade stage has seen a reset this August with escalating US tariffs, creating a high-stakes, three-way competition for... Read more

Global supply chains scramble in 2025 as US tariffs drive frontloading and sourc…

Year 2025 has seen the global textile and apparel industry facing unprecedented volatility, largely because of the unpredictable US tariff... Read more

Yarn Expo Autumn 2025 to be the ‘Most Comprehensive Edition Yet’

Asia’s premier platform for the yarn and fiber industry, Yarn Expo Autumn will commence on September 2, 2025, at the... Read more

'The BRICS+ Fashion Summit & MSF: A New Era for Global Fashion

The global economic landscape is undergoing a dramatic shift, with the BRICS+ bloc leading the charge. With combined purchasing power... Read more

Made in America? Tariffs fail to spark a comeback in US apparel

The American fashion industry finds itself at a crossroads. What began as an attempt to ‘reshore’ production through punitive tariffs... Read more

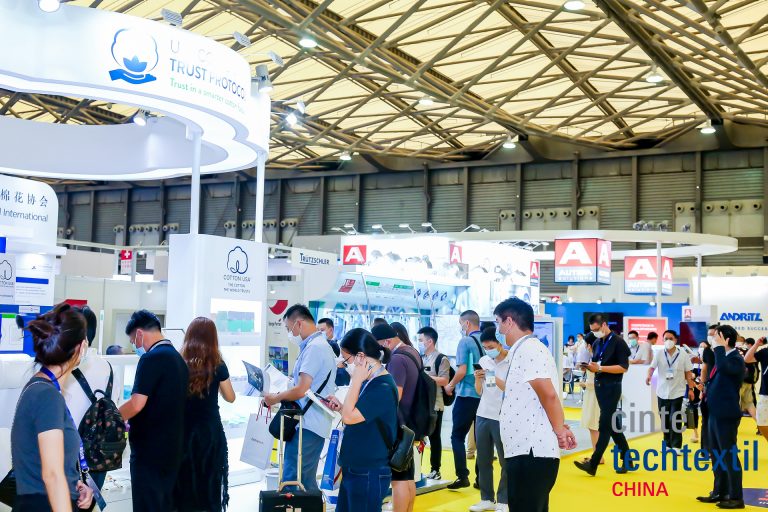

Cinte Techtextil China: Connecting Global Markets with Leading Innovations

Cinte Techtextil China is set to be a dynamic industry event in Shanghai, poised to bridge the gap between Asian... Read more

Cotton at a Crossroads: Geopolitics, trade shifts, and the global balancing act

The global cotton market in 2025 is passing through a period of shifting trade relationships, geopolitical tensions, and the rising... Read more

German textile and fashion industry grapples with persistent economic headwinds

The German textile and fashion industry continues to pass through a challenging economic situation. An anticipated recovery remains elusive amidst... Read more

French consumers blinded by fast fashion's allure: Study

A recent study on French consumer habits in the fashion industry throws up a concerning picture, suggesting that the allure... Read more