In a groundbreaking announcement at the Synthetic & Rayon Textiles Export Promotion Council's Export Awards function, Union Minister of Textiles & Commerce, Piyush Goyal, revealed India's ambitious project to establish 'Bharat Park' in the UAE. This initiative aims to house showrooms and warehouses for Indian goods, enabling countries worldwide to conveniently purchase Indian products with the assurance of secure payment systems in the UAE.

Focusing on future trends in textiles

Minister Goyal emphasized the future dominance of Man-Made Fibre Textiles (MMF) during his address. While speaking on Free Trade Agreements (FTA) with key nations such as Japan, Australia, UAE, and South Korea, he expressed concerns over India's underutilization of FTA benefits.

Investment in testing infrastructure

To ensure the quality and compliance of Indian products, Goyal announced a significant investment of Rs. 40 crore by the Bureau of Indian Standards (BIS). This fund will be allocated to establish 21 testing laboratories across various locations in India.

Challenges and prospects in textile exports

Chairman of SRTEPC, Bhadresh Dodhia, provided insights into the challenges faced by the Man-Made Fibre Textiles sector. The negative growth of (-) 15.3% in MMF exports in 2022-23 was a concern, along with a similar downturn in technical textiles at (-) 11.9%. However, Dodhia expressed optimism about the future, predicting that MMF exports would exceed US$ 6 billion and technical textile exports surpassing US$ 3 billion in the current fiscal year.

Addressing GST and inverted duty structure

Highlighting industry concerns, Dodhia addressed the inverted duty structure under the Goods and Services Tax (GST). The sector faces challenges with an 18% GST on fibres, 12% on yarns, and 5% on fabrics, resulting in accumulated input tax credits for manufacturers. SRTEPC advocated for a uniform GST rate across the entire value chain of MMF Textiles products.

SRTEPC rebranded as ‘MATEXIL’

In a strategic move, the Synthetic & Rayon Textiles Export Promotion Council has been rebranded as 'MATEXIL' - The Man-made And Technical Textiles Export Promotion Council. This reflects the council's commitment to promoting both Man-Made Fibre and Technical Textiles in the international market.

Honoring excellence in textile exports

The Export Awards ceremony recognized outstanding achievements in the industry. Notable awardees included Reliance Industries, which received six awards in various categories, alongside other industry leaders such as Dodhia Synthetics Ltd., Banswara Syntex Ltd., D’ Décor, Grasim, Vardhman Textiles, and RSWM Ltd. Rakesh Mehra received the Lifetime Achievement Award, and Neha Jhunjhunwala was honored with the Women Entrepreneur Award.

The event witnessed the presence of distinguished guests, including Roop Rashi, Textile Commissioner, Alexander - Poland Ambassador in Mumbai, and Suresh Kotak. The Export Award Committee's Convener, Dhiraj Raichand Shah, delivered the welcome address, while Shaleen Toshniwal, Vice Chairman of SRTEPC, extended the vote of thanks.

Manmade-fiber imports by Bangladeshi apparel exporters surged by over 13.39 per cent to 0.21 million during the period of Jan-Nov’23.

As per a report by the BTMA, use of manmade fibers is on the rise in Bangladesh though the percentage is yet to reach satisfactory levels.

Fazlee Ehsan Shamim, Vice President, Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), notes, the increase in MMF imports indicates an increase in production of new and value-added items.

However, to produce such non-cotton items, Bangladesh entrepreneurs need ‘supportive policy measures, adds Shamim.

Faruque Hassan, President, Bangladesh Garment Manufacturers and Exporters Association (BGMEA) recently reiterated Bangladesh’s vision to achieve $100 billion worth of garment export by 2030.

The trade body has demanded 10-per cent cash incentives for MMF-based garment manufacturing as it has made significant investments in high- value-added segments like active wear, outwear, denim, lingerie, suits, fancy dresses and formal wear.

The association is also developing luxury dresses using heritage jamdani and muslin fabrics besides focusing on capacity expansion and efficiency enhancement.

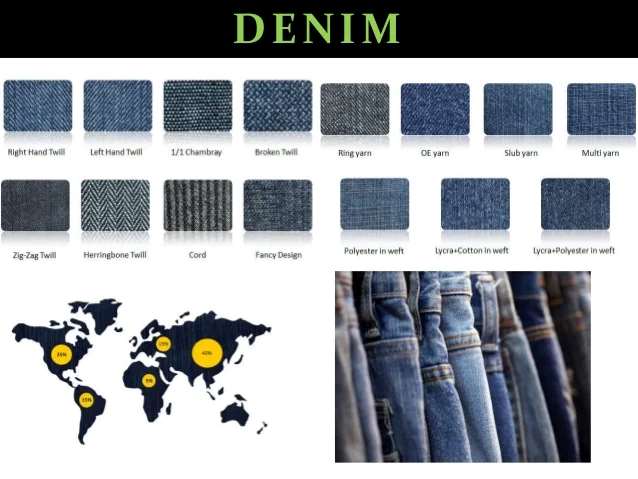

The insatiable appetite for denim took a surprising turn in 2023, as the global denim fabric trade wove a new narrative on the export and import scene. Some countries emerged as trendsetters, sporting vibrant threads of growth, while others faced a re-adjustment in their textile tapestry. Let's unravel the intricacies of this captivating story, revealing the winners and contenders who reshaped the denim landscape. We'll then peek into the looming threads of 2024, anticipating where the next twists and turns might lead.

Exporting Winners:

• India: The undisputed denim king held his crown tight, weaving a 10% export surge. Skilled workers, sustainable yarns, and smart deals kept the looms humming. 2024 Outlook: Watch India maintain its lead with a focus on ethical practices and innovative fabrics.

• Turkey: Making a powerful comeback, Turkey saw a dazzling 8% rise. Government initiatives and high-tech weaving revitalized the industry. 2024 Outlook: Expect Turkish threads to add even more sophistication with a focus on performance and eco-friendly options.

• Egypt: The surprise contender! Egypt's 7% jump was fueled by competitive prices, eco-conscious practices, and European partnerships. 2024 Outlook: Look for Egypt to continue its ascent by offering sustainable choices at attractive prices.

Exporting Losers

• China: The long-reigning king lost some shine, facing a 4% decline. Rising costs and Southeast Asian competition unraveled China's dominance. 2024 Outlook: China may focus on domestic production and homegrown brands, impacting exports.

• Pakistan: Facing economic headwinds, Pakistan's exports dipped by 5%. Inflation and supply chain disruptions dampened the industry. 2024 Outlook: Expect Pakistan to work on strengthening its hold by improving stability and competitiveness.

• Mexico: Despite its US proximity, Mexico's exports shrunk by 6%. Domestic market saturation and increased competition chipped away at its share. 2024 Outlook: Mexico may need to explore new markets and diversify its offerings to regain its export momentum.

Import Winners

• Bangladesh: The denim-hungry Bangladesh remained the import king, with a steady 5% rise. A thriving garment industry and diverse sourcing kept the engines running. 2024 Outlook: Expect Bangladesh to continue its import spree, embracing sustainable blends and unique denim fabrics.

• Vietnam: Seeking innovation and quality, Vietnam's imports jumped 7%. High-performance fabrics and strategic partnerships fueled this increase. 2024 Outlook: Look for Vietnam to stay on the cutting edge by embracing the latest denim trends and technologies.

• European Union: Europe's fashion capitals maintained their allure, with EU imports increasing by 4%. Functional yet stylish fabrics and European partnerships boosted their game. 2024 Outlook: Expect the EU to continue its focus on comfort and international flair, potentially exploring collaborations with new denim hubs.

Import Losers

• China: Domestic production and a focus on homegrown brands led to a 3% decline in Chinese denim fabric imports. 2024 Outlook: Chinese brands may continue to rely on local fabrics, impacting foreign imports.

• Brazil: Facing economic woes, Brazil's imports shrunk by 4%. Currency fluctuations and rising domestic costs made foreign fabrics less attractive. 2024 Outlook: Brazil may turn to locally-sourced denim alternatives unless economic stability improves.

• Russia: Geopolitical tensions and sanctions caused a 7% import plunge. Diversification towards alternative suppliers is underway. 2024 Outlook: Russia's denim scene may see a shift towards practical and durable fabrics from new sourcing partners.

The Change Drivers

Sustainability, ethical practices, and innovation are the new currency in the global denim trade. Evolving fashion trends, trade dynamics, and online shopping will continue to reshape the landscape.

2024 Outlook: Expect the denim dance to continue with even more surprises. Watch for emerging players, collaborations between unlikely partners, and a continued focus on eco-friendly and ethical practices. The future of denim promises to be as vibrant and intricate as the threads themselves!

In the aftermath of the devastating 2023 earthquake in Türkiye, a report reveals the shocking neglect of workers' rights by garment factories and brands. Interviews with over 100 workers underscore the dire situation as most were not fully compensated, forcing them back to unsafe workplaces without proper structural inspections.

The study, conducted between August and September 2023 in earthquake-affected cities, exposes the disregard for employee well-being by factory owners prioritizing international orders over safety. The Middle Eastern Technical University's previous survey aligns with these findings.

The report highlights adverse working conditions, including unsafe environments, low wages, and verbal harassment, exacerbated by the earthquake's impact. Financial distress, with 35% receiving no wages, compelled workers to return prematurely, facing threats of dismissal if they resisted.

Failure to return resulted in the loss of accrued termination benefits. The report urges the garment sector and global brands to prioritize worker safety, conduct building inspections, ensure financial protection, and address harassment.

Bego Demir of Clean Clothes Campaign Turkey emphasizes the need for new global agreements, citing the inadequacy of existing frameworks. The Pay Your Workers – Respect Labour Rights agreement proposes legal safeguards and a severance guarantee fund, demanding brands proactively uphold workers' rights during crises.

The report emphasizes the critical role of brands in maintaining sourcing relations and ensuring continued wage payments. Ultimately, the call for a binding agreement between brands and unions seeks to protect workers during times of crisis, distributing the burden more equitably.

The eagerly anticipated Pure London x JATC, the London Festival of Fashion, is set to make a grand return from the 11th to the 13th of February 2024 at the iconic Olympia London. The event will showcase a stellar lineup of internationally acclaimed brands, marking their return to the fashion extravaganza. Retailer favorites like Sugarhill Brighton, Henriette Steffensen, The Fika Edit, and more are making a comeback, signaling a robust resurgence in the UK fashion market.

Gloria Sandrucci, Pure London Event Director, expressed excitement about the growing strength of the UK fashion market and the confidence exhibited by returning brands. The first combined Pure London x JATC show promises a dynamic synergy, boasting a multitude of brands and attracting a diverse array of buyers.

Among the highlights, Sugarhill Brighton will showcase a vibrant collection embodying the brand's playful spirit, while Henriette Steffensen brings a timeless and versatile palette. Ethical and sustainable choices abound, with brands like Cara & The Sky, KOMODO, and BIBICO offering conscious fashion alternatives.

Scandinavian collections will also grace the event, with Costamani, Numph, and Noella bringing their unique prints and contemporary designs to captivate the discerning UK Fashion Market. Pure London x JATC, featuring over 300 curated brands, is poised to be a beacon of style and innovation from the 11th to the 13th of February 2024 at Olympia London.

In the 2022-23 seasons, Brazil witnessed a record-breaking increase in cotton production, propelled by higher cultivation and production, as reported by the Center for Advanced Studies on Applied Economics (CEPEA). During off-season, cotton prices in Brazil experienced a notable decline from January to May, influenced by weakened demand and optimistic expectations for a bountiful crop. Export activities slowed down in early 2023, attributed to prices that sellers found unattractive.

Monthly average prices exhibited stability between May and June, followed by reaching the lowest point of the year in July. Subsequently, fluctuations in monthly averages decreased as a result of rising exports, which helped alleviate the domestic surplus. The report highlighted challenges in 2023, including logistical issues and increased transportation costs due to declining product quality.

The CEPEA/ESALQ Index for cotton recorded a significant drop of 24.4 per cent in 2023. The cotton cultivation area expanded by 4 per cent, reaching 1.664 million hectares in the 2022-23 period, according to CONAB. Productivity experienced a notable increase of 19.5 per cent, reaching 1,907 kg per hectare. Overall production saw a substantial rise of 24.2 per cent, reaching 3.173 million tons.

Globally, supported by heightened supply from China, India, and Brazil, the USDA reported 1.8 per cent increase in global cotton production to 25.395 million tons in 2022-23. Notably, production in the US and Pakistan witnessed a significant decrease during this period, according to the association's findings.

Bestseller, a longstanding participant in the International Accord, has renewed its commitment alongside 56 other brands and retailers. The agreement, spanning another six years, aims to foster safer workplaces within the textile and garment industry in Pakistan and Bangladesh.

Felicy Tapsell, Head of Responsible Sourcing and a member of the Steering Committee at Bestseller, advocates widespread participation, urging all garment and textile companies to sign the accord. The collective objective is to establish a secure and sustainable environment for workers in the industry.

Bestseller emphasizes the need for a collaborative, multi-stakeholder approach, customized to the unique circumstances of each country. This, they believe, is key to ensuring the health and safety of textile workers.

In a move to enhance its European supply chain, Bestseller disclosed plans in December 2023 to establish a Dutch Logistics Centre West (LCW) near Amsterdam. The facility, set to be operational by the end of 2026, will incorporate automation technology from KNAPP to streamline tasks like pallet loading and will also contribute to job creation.

Additionally, Bestseller has joined forces with H&M Group, a Swedish fashion retailer, to spearhead an offshore wind energy project in Bangladesh. This initiative aims to accelerate the sector's shift towards renewable energy sources, showcasing Bestseller's commitment to sustainability.

Maharashtra is making grand plans to transform its textile industry, aiming to attract a staggering Rs 25,000 crore investments through a series of bold mergers and a focus on sustainability.

In a bid to streamline bureaucracy and foster a thriving textile ecosystem, the state will merge three existing corporations – the Maharashtra State Handloom Corporation, Maharashtra State Powerloom Corporation, and Maharashtra State Textile Corporation – into a single entity: the Maharashtra State Textile Development Corporation (MSTDC). Modeled after the successful MIDC, the MSTDC promises a fertile ground for textile businesses to flourish.

The state is also merging the Textile Commissionerate and Silk Directorate into the Textile and Silk Commissionerate, eliminating redundancies and creating a more efficient oversight body. These strategic moves are aimed at not just boosting cotton production capacity and attracting big-ticket investments, but also generating 5 lakh new jobs, weaving a brighter future for the state's textile sector.

With a clear vision and a focus on consolidation and sustainability, Maharashtra's textile industry appears poised to spin a golden thread of growth in the years to come.

Luxury fashion house Louis Vuitton has opened dazzling pop-up stores in Los Angeles, immersing Angelenos in the vibrant world of its men's Spring/Summer 2024 collection. Open until mid-March, the Pont Neuf-inspired space shimmers with gold, echoing the iconic Parisian bridge under an LA sun. Street lamps and architectural details transport visitors to the City of Lights, while a checkered floor pays homage to Louis Vuitton's signature Damier pattern.

But the real story lies behind a bookcase. Pull the right volume, and a secret room unveils a kaleidoscope of brightly-colored Speedy bags, the stars of the SS24 collection. This is just the first act. The pop-up offers the full breadth of Louis Vuitton's men's universe, from classic Horizon luggage and Keepalls to rugged backpacks and Soft Trunks, all adorned with bold Damoflage and LV Blason prints.

Shoe enthusiasts can revel in iconic LV Trainers alongside new arrivals like the Palace Slipper and Footprint Low Boot. Belts, hats, jewelry, and sunglasses complete the picture, while limited-edition pieces like a crystal-embellished Speedy 40 and an LV Blason Rolling Truck make unforgettable statements.

From February 8th the pop-up will unveil its second collection, ensuring a fresh wave of Parisian luxury in the heart of Los Angeles.

The Bangladesh Textile Mills Association (BTMA) is pushing for a major shift in the industry, transforming garment waste into recyclable materials. President Mohammad Ali Khokon believes this move could slash cotton imports by 15 per cent, a significant step towards self-sufficiency. While efforts are already underway, with 40 factories like Simco Spinning and Beximco actively involved, it's still a drop in the bucket. Only 5 per cent of garment waste is currently recycled for export-worthy products.

This initiative finds strong support from the Bangladesh Garment Manufacturers and Exporters Association (BGMEA). President Faruque Hassan has called for a ban on cotton waste exports, emphasizing the need to break dependence on imported cotton, which currently stands at 98 per cent.

However, challenges remain. Financing and taxation are major hurdles, particularly the 22 per cent VAT levied on garment waste collection and recycled yarn sales. BTMA and BGMEA leaders are urging the government for policy and tax support to incentivize recycling.

A proposed scheme providing low-cost financial assistance to the industry could be the key to unlocking its full potential. By tackling these obstacles and embracing garment waste conversion, Bangladesh can significantly reduce its reliance on foreign cotton and boost its textile industry's sustainability.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Trump's Tariff Shock: Indian apparel industry faces exodus as US buyers demand r…

In a dramatic reversal of fortune, India's apparel industry, once poised for growth amid a changing global trade landscape, now... Read more

From Texas to Dhaka, cotton’s route rewritten by trade and tension

In the sprawling fields of West Texas and the ginning factories of Gujarat, tremors of geopolitical unrest are being felt... Read more

Trump slams India with crippling 25% tariff over Russian oil, Indian textile ind…

In a dramatic escalation of global trade tensions, U.S. President Donald J. Trump today signed an Executive Order imposing an... Read more

Circularity in fashion hits a plateau, reveals Kearney's 2025 index

A new report from global management consulting firm Kearney suggests that while circular fashion has become a mainstream ambition, the... Read more

From Seoul to São Paulo: How Gen Z is driving a genderless fashion future

From the minimalist ateliers of Copenhagen to the neon-lit youth districts of Tokyo, unisex fashion is no longer a fringe... Read more

Time to Lead, Not Follow: Textile industry must become a national priority, says…

In a visionary address at the Textile Leaders’ Conclave 2025 in Ahmedabad, Kulin Lalbhai, Vice Chairman of Arvind Ltd., called... Read more

Fashion flows shift, Vietnam and UK drive growth as others stall

The global apparel trade and retail sector continues to evolve, balancing between post-pandemic recovery, macroeconomic uncertainties, and changing consumer behavior.... Read more

Inflation, wages, and green mandates, what’s unravelling Türkiye’s textile domin…

Once celebrated as a textile stronghold bridging East and West, Türkiye’s garment and textile sector now faces numerous crises. From... Read more

India's Textile Exports to US Face Tariff Shock: What gets hit, what holds groun…

In a significant trade development, the United States has imposed a 25% tariff on all Indian imports, effective from Aug... Read more

From Catwalks to Calculations: How KPIs are reshaping fashion in 2025

The global fashion industry is on the threshold to cross the $1 trillion mark by 2027. Yet beneath the glitter... Read more