India’s textile exporters hope, Donald Trump’s return to the White House as the new President-elect will significantly boost to their market share in the United States. Trump’s emphasis on reducing dependency on China is expected to open up new opportunities for Indian suppliers in the American textile and apparel (T&A) market, says Rakesh Mehtra, Chairman, Confederation of Indian Textile Industry (CITI).

Representing 27 per cent of the sector’s exports in 2023, the United States continues to be a critical market for Indian textiles As per recent data, in Oct’24, India’s textile exports to the US increased by 11.56 per cent Y-o-Y while apparel exports expanded by 35.06 per cent. From Apr- Oct’24, India’s total T&A exports to the US grew by 7.08 per cent compared to the same period in 2023.

This performance outpaces key competitors, notes Mehra, highlighting India's stronger gains compared to other nations. For example, China’s exports grew at a modest rate of only 2 per cent, while Vietnam’s exports rose by a mere 0.4 per cent and Bangladesh experienced a 2.2 per cent decline. India’s enhanced performance reflects its growing preference among US buyers, he adds.

However, despite these positive trends, high US tariffs remain a significant challenge for Indian exporters. Tariffs as high as 32 per cent on some Indian textiles and apparels continue to impact their price competitiveness. The new Trump administration is expected to engage in negotiations to reduce these tariffs, allowing India to strengthen its position as a leading supplier of high-quality textiles to the US market, hopes Mehra.

Emphasising on India’s expanding influence in countries with free trade agreements (FTAs), such as South Korea, Japan, and Australia, Sudhir Sekhri, Chairman, AEPC notes, international buyers view India as a stable and reliable alternative to traditional sourcing countries like Bangladesh and China.

Mithileshwar Thakur, Secretary-General, AEPC, emphasises, India needs ongoing investment, funding, and training to maintain a competitive edge amidst global trade disruptions and rising costs.

The MSME Pavilion at this year’s 43rd India International Trade Fair (IITF), being held in New Delhi, focuses on the Ministry’s commitment to adopt clean and sustainable technologies.

Featuring the PM Vishwakarma Scheme, the pavilion adopts the theme of ‘Green MSMEs. It has so far attracted 200 exhibitors from 29 states and Union Territories.

The pavilion features a s wide range of products from textiles, handooms, handicrafts to leather footwear, bamboo and cane crafts along with pottery, jewelry and mechanical items, etc. The fair provides a valuable platform to Micro and Small Enterprises (MSMEs), particularly those owned by women and SC/ST entrepreneurs, to showcase their products to a large and diverse audience.

Aligned with the Ministry’s focus on inclusive growth, 71 per cent of the Pavilion’s stalls have been allocated to women entrepreneurs, and 45 per cent to SC/ST entrepreneurs. Additionally, 35 per cent of the stalls are designated for entrepreneurs from aspirational districts, with over 85 per cent of the participants exhibiting for the first time.

During the inauguration, Manjhi engaged with several exhibitors, offering encouragement and support for their contributions to the fair. To raise awareness about the PM Vishwakarma Scheme, a ‘Nukkad Natak’ (street play) was performed, attracting attention and highlighting the scheme’s benefits for traditional artisans.

The MSME Pavilion showcases the Ministry's dedication to sustainability, inclusivity, and supporting small businesses, providing a significant opportunity for entrepreneurs to reach new markets and potential customers.

A coalition of 78 business associations from the EU and Mercosur has urged governments to finalize the EU-Mercosur Free Trade Agreement (FTA) negotiations. The joint statement, addressed to European and Mercosur leadership, highlights the agreement’s potential to enhance trade ties, bolster investment, and promote sustainable development.

In 2022, EU-Mercosur trade in goods and services exceeded €159 billion, with mutual investments nearing €380 billion, underpinning millions of jobs across both regions. The coalition emphasized that the FTA would address challenges such as geopolitical instability and supply chain disruptions while fostering economic recovery and growth.

The key benefits of the EU-Mercosur FTA include eliminating trade barriers to facilitate smoother exchanges of goods and services, thereby enhancing market access. It also aims to strengthen trade relationships, ensuring reliable access to critical resources and bolstering supply chain resilience.

Additionally, the agreement seeks to promote sustainability by advancing labor rights, improving environmental standards, and fostering sustainable development through deeper cooperation between the regions.

The associations view the FTA as a strategic opportunity to deepen ties and position both regions for competitiveness in the evolving global landscape. The statement calls for urgent action from policymakers to ratify the agreement, paving the way for a stronger economic partnership.

Signatories include prominent organizations like BusinessEurope, EURATEX, spiritsEurope, and Brazil’s CNI, among others. These groups collectively represent a diverse range of industries, including textiles, chemicals, automotive, and agriculture.

The coalition stressed that the agreement is essential for shared prosperity, urging swift political resolve to finalize and implement the deal.

A US-based fabric brand, Pallas Textiles has launched a new fabric collection made from recycled plastics collected from oceans and landfills. Titled, ‘In Good Company,’ the collection has been launched in collaboration with American design studio Limn & Loom and US-based textile manufacturer Valdese Weavers. Utilising Seaqual Yarn, this partnership aims to blend sustainability with innovative design.

A fabric known for its durability and eco-friendly composition, Seaqual Yarn is the major component of the ‘In Good Company’ collection made from recycled materials sourced from land and sea. Around 10 per cent of fabrics in this collection have been made from upcyled plastics sourced from European waterways including oceans and lakes, while the rest has been derived form post-consumer waste retrieved from landfills.

Launched by the organisation Seaqual, the collection is created by cleaning and transforming the discarded plastics into high-quality fibers to be further woven into textiles used by brands like Pallas Textiles.

The collection offers six distinct fabric ranges including Kai, a structured fabric with a heathered texture, featuring warp and weft yarns that create a sophisticated design; Hali, a plush, chunky textile made with bouclé yarn, perfect for furniture upholstery; Maren, a luxurious fabric that uses chenille and slub yarns to produce an elegant interplay of shades, creating a sense of movement; Isla, a serene fabric that captures the effect of light across surfaces with a palette inspired by scenic landscapes; Ahti, a uniform design with velvety, fine-spun yarns available in jewel tones for a pop of color and Llyr, a subtly aged look with a nuanced weave, adding depth and texture to interior spaces.

The collection aims to promote sustainable production and support Seaqual's ongoing efforts to clean up waterways. A portion of the proceeds from sales will be donated back to Seaqual, contributing to its environmental initiatives.

Following a declaration by the US International Trade Commission (USITC) saying, increased imports of fine denier Polyester staple fiber pose a substantial threat to the domestic industry, President Joe Biden has imposed a Section 201 safeguard measure to restrict these imports. This will help protect US producers of similar products from potential injury caused by surging foreign imports.

The measure will introduce a strict import quota on fine denier PSF from Nov 23, 2024. It will set the quota for the first year at zero to ban imports under certin conditions. The quota will gradually increase by £1 million annually in each of the subsequent three years. This regulation specifically targets fine denier PSF imported temporarily under bond, falling under tariff codes HTSUS 5503.20.00, 5503.20.0025, and 9813.00.0520.

Fine denier PSF is a versatile material used in producing yarn, clothing, sanitary items, non-woven fabrics (like wipes, suit interlinings, and mattresses), carpets, upholstery, and other goods. The restriction applies to fine denier PSF that is not carded or combed, with a diameter of less than 3.3 decitex (three denier), whether coated or uncoated.

Certain countries, including Canada, Mexico, Australia, Colombia, Israel, Jordan, Panama, Peru, Singapore, and the CAFTA-DR countries, along with those benefiting from the Generalised System of Preferences and the Caribbean Basin Economic Recovery Act, are exempt from this quota if they meet specific conditions.

President Biden chose not to implement a broader tariff-rate quota, aiming to balance the needs of domestic PSF producers with the interests of US manufacturers who depend on fine denier PSF for textiles, defense-related products, and consumer goods. This decision reflects a careful approach to safeguarding American industries without overly burdening downstream producers who rely on this essential material.

Denim brand Lee has launched an eight-piece collaborative menswear collection with Alpha Industries.

Offering a bomber jacker, denim jacket and quilted jacket along with a flight suit, pants, anoraks and a T-shirt, the collection is being retailed across Lee and Alpha-owned stores and websites across the US and a few select Asia markets,

Owner of the Lee and Wrangler brands, Kontoor Brands has been focusing on collaborations lately. The brand’s timeless styles offer a wide field for collaboration, says Joe Broyles, Global Vice President –Collaborations, Lee.

The company seeks partners having an authentic connection and appreciation for its heritage, and seek to re-interepret Lee’s iconic denim and workwear for their consumers, adds, Broyles.

Terming the collaboration as a reimaging of military inspired designs with a contemporary edge, the companies say, it combines the heritage of both brands.

In 1959, Alpha Industries entered into an agreement with the US Department of Defense to design and manufacture outerwear for military personnel. Since then, the company has been creating military-inspired clothing and design through both its own seasonal collections and through collaborations. It recently collaborated with Highsnobiety, Dr. Martens and J.Crew Group-owned Madewell.

Meanwhile, Lee collaborated with designer Paul Smith and footwear band Heydude this year. In its most recent quarter, the brand registered a 3 per cent decline in its revenue though revenues from the US increased by 1 per cent. However, the brand’s international revenues declined by 7 per cent during the quarter.

On the other hand, the parent company Kontoor has launched a new initiative called ‘Project Jeanius,’ to generate $100 million in profit improvement and savings. In Q3. FY24, the company’s revenue grew by 2 per cent, making it the first quarter to register revenue growth in fiscal 2024.

Showing a notable increase, Pakistan’s textile exports grew by 10.44 per cent to $6.146 billion in the first four months of FY’24-25, spanning July-Oct as against $5.565 billion in the same period last year, as per figures by the Pakistan Bureau of Statistics (PBS). This increase highlights the resilience of the country's textile industry despite facing difficulties in certain raw material exports.

In Oct’24. Pakistan’s textile exports increased by 13.11 per cent to $1.625 billion as against $1.437 billion in Oct’ 23. On a M-o-M basis, textile exports rose by 1.30 per cent from $1.604 billion in Sep’ 24.

However, Pakistan’s cotton yarn exports contracted by 45.59 per cent during the first four months of FY25 to $221.76 million from $240.76 million in the same period last year. Although cotton yarn exports increased by 13.83 per cent M-o-M in Oct’24 to $59.18 million compared to $51.99 million in Sep’ 24, the Y-o-Y decline widened to 35.79 per cent compared to $92.16 million in Oct’ 23.

Key textile commodities exported by Pakistan in Oct’ 24 included knitwear with exports worth Rs 136.36 billion, RMG with exports of Rs. 100.55 billion and bedwear with Rs. 76.28 billion exports. The strong performance in these value-added products compensated for the challenges in raw material exports like cotton yarn, reinforcing Pakistan's competitive edge in the textiles sector.

The consistent growth trend in Pakistan's textile exports, particularly in garments and value-added products, reflects the sector’s adaptability and strategic shift towards high-value commodities, despite ongoing challenges in the raw material segment.

Following recent political changes in the country, India’s RMG exporters are urging the Central Government to negotiate a Free Trade Agreement (FTA) with the United States,

A Sakthivel, Head-Apparel Export Promotion Council (Southern Region) and Chairperson, Apparel Made-ups and Home Furnishing Sector Skill Council (AMHSCC), says, by leveraging the current favorable positive relationship between the US President-elect Donald Trump and the Indian government, exporters aim to secure a favorable trade deal.

Emphaisisng on the significance of the US market for India’s RMG exports, Sakthivel notes, despite their exports reaching $2,568 million between Apr-Sep’2024, Indian exporters do not have an FTA with the United States. A free-trade agreement would help facilitate these exports, he adds.

From Apri-Oct’24, India’s total RMG exports to the US increased by 7.28 per cent to $468.27 billion from the $436.48 billion during the same period last year. Particularly in Oct’24, India’s total RMG exports to the US rose by 35.06 per cent, from $0.91 billion in October 2023 to $1.23 billion. Cumulative RMG exports from Apr-Oct’24 expanded by 11.6 per cent to $8,732.6 million.

This consistent month-on-month growth highlights the strength of India’s RMG exports, opines Sakthivel. The sector can achieve a further 15 per cent-20 per cent growth by this fiscal-end with exports from Tiruppur' reaching Rs 40,000 crore this year, he adds.

Echoing this sentiment, KM Subramanian, President, Tiruppur Exporters’ Association, adds, with 30 per cent Tiruppur’s knitwear exporters destined for the US, an FTA will allow Indian RMG exporters to better compete with other countries and secure more orders.

A new wave of research is exposing a stark reality: our wardrobes are overflowing with unworn clothes, a testament to the rise of fast fashion and a ‘buy now, wear once’ mentality. This global phenomenon is not only draining our wallets but also contributing significantly to environmental damage.

Cluttered wardrobes and unworn clothes

As per the first national survey of clothing use and disposal habits in Australia conducted by the Royal Melbourne Institute of Technology (RMIT), Australians acquire an average of 27 kg of new clothes annually, discarding around 23 kg. The average Australian owns 118 garments but has 26 per cent of their wardrobe going unworn for at least a year. This pattern of fast fashion consumption is mirrored worldwide, with alarming statistics emerging from various studies. A study by WRAP in the UK found similar results, with the average person keeping 118 items in their wardrobe and a quarter remaining untouched for a year.

Here are some interesting facts. The average garment is worn merely seven times before being discarded reveals Ellen MacArthur Foundation findings. In the UK, wardrobes hold an estimated 1.6 billion items of unworn clothing, reveals a WRAP study. And 30 per cent of donated clothes end up in landfills or incinerated, highlights a study by Hot or Cool Institute. While data varies across countries, the underlying narrative remains consistent: overconsumption and underutilization.

Table: The state of unworn clothes globally

|

Country |

Average items in wardrobe |

% clothes unworn for a year |

Source |

|

Australia |

118 |

26% |

RMIT University |

|

UK |

118 |

26% |

WRAP |

|

USA |

- |

20% (estimated) |

ThredUp Resale Report |

|

China |

- |

10% (estimated) |

Greenpeace East Asia |

The environmental cost of closet clutter

The implications of this ‘wearability crisis’ extend far beyond overflowing closets. The fashion industry is a major polluter, accounting for around 10 per cent of global carbon emissions. Producing clothes that are barely worn intensifies the strain on resources and contributes to textile waste.

The RMIT study highlights the need for greater awareness and behavioral change. As Alemayehu, lead researcher emphasizes, "We need to shift our mindset from disposability to longevity. This involves buying less, choosing quality, and caring for our clothes."

Various initiatives are being taken up across the world as a step towards greater sustainability. For example, the growing movement ‘One Year, No New Clothes’ challenge has participants commit to not buying any new clothing for a year, forcing them to re-evaluate their consumption habits and rediscover the potential of their existing wardrobes.

And initiatives like clothing swaps and rental services promote collaborative consumption and extend the lifespan of garments, offering alternatives to constant purchasing. Meanwhile brands too are focusing on ethical production and durable designs, encouraging consumers to invest in quality over quantity.

Indeed, the wearability crisis is a wake-up call and it's time to rethink our relationship with fashion, embrace sustainable practices, and ensure our wardrobes reflect our values, not just fleeting trends.

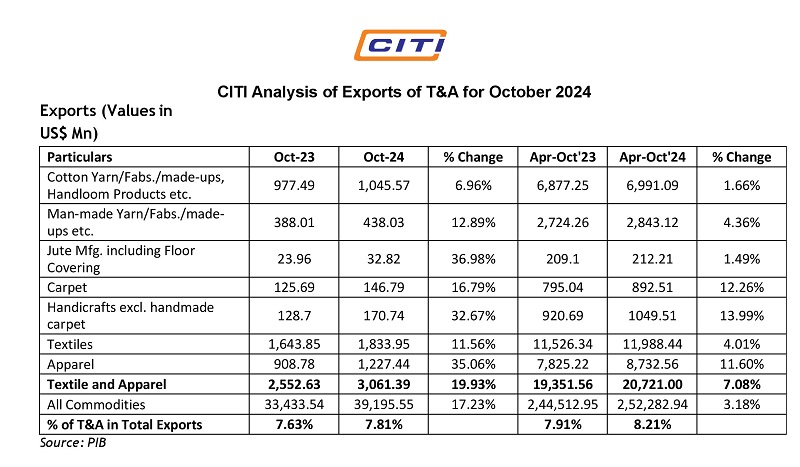

India's textile and apparel (T&A) exports registered a remarkable growth of 19.93% in October 2024, reaching US$ 3.06 billion compared to the same period last year. This positive trend is reflected in the cumulative figures for the April-October period, where exports grew by 7.08% to US$ 20.72 billion.

Key Highlights

• Overall Exports: India's total merchandise exports for October 2024 amounted to US$ 39.2 billion, an increase of 17.23% year-on-year.

Sector-wise Performance:

• Cotton Yarn/Fabs./Made-ups, Handloom Products etc.: Exports grew by 6.96% in October 2024 and 1.66% for the April-October period.

• Man-made Yarn/Fabs./Made-ups etc.: Exports witnessed a robust growth of 12.89% in October and 4.36% for the April-October period.

• Jute Mfg. including Floor Covering: Exports surged by 36.98% in October and 1.49% for the April-October period.

• Carpet: Exports increased by 16.79% in October and 12.26% for the April-October period.

• Handicrafts excl. handmade carpet: Exports grew by 32.67% in October and 13.99% for the April-October period.

• Apparel: Exports witnessed a significant surge of 35.06% in October and 11.60% for the April-October period.

Industry Optimism

Rakesh Mehra, Chairman of CITI, expressed optimism about the sector's sustained growth. He attributed this positive trajectory to several factors, including increased market share in the USA, supportive government policies like RoDTEP and IES, and the industry's focus on quality, innovation, and sustainability.

Looking Ahead

The textile and apparel sectors are poised for further growth, driven by increasing global demand, favorable government initiatives, and the industry's commitment to quality and innovation. India's strategic focus on sustainable practices and its emergence as a preferred sourcing destination are expected to further strengthen its position in the global market.

More...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Peeling Back the Fabric: Glimpact study gives true ecological threads of apparel…

A groundbreaking new study by Glimpact, has pulled back the curtain on the often-obscured environmental footprint of the apparel industry,... Read more

Embracing Innovation: The rise of sustainable fibers in a changing world

The quest for sustainable and high-performance alternatives to traditional resources has sparked a revolution in fiber use. According to the... Read more

Garment Tech Istanbul to showcase cutting-edge apparel technology and drive glob…

A global hub for apparel innovation Istanbul will welcome leading global players in garment, embroidery, and textile machinery from June 25... Read more

From discarded threads to global trends, Panipat's recycled yarn revolution

Panipat, a city synonymous with textiles, is rapidly evolving from a traditional weaving hub to a powerhouse of sustainable yarn... Read more

Bangladesh emerges strong in global RMG exports as China's loses ground

Bangladesh is rapidly strengthening its position as a major player in the global apparel export market, capitalizing on a shift... Read more

Blossom Premiere Vision returns in June to support luxury fashion's shifting nee…

As the global luxury goods market grapples with a prolonged slowdown, an industry once resilient to crises is now undergoing... Read more

Monforts technologies power sustainability showcase at Kingpins Amsterdam

Denim mills using Monforts systems dominate eco-focused fabric displays At the recent Kingpins Amsterdam exhibition held on April 16-17 at the... Read more

Bangladesh RMG exports navigate new skies amid cost concerns post India's trans-…

Bangladesh's RMG export is adapting to India's revocation of trans-shipment services, marked by maiden freighter flight carrying 60 metric tons... Read more

A stitch in time, fashion's 1% solution to a carbon crisis

The fashion industry, built on trends and textiles, is facing a stark reality: its environmental footprint is unsustainable. Hidden deep... Read more

Threadbare Foundations: Bangladesh’s RMG boom hangs by Indian yarns

Bangladesh’s ready-made garment (RMG) industry is a global juggernaut. Second only to China in apparel exports, the sector is the... Read more