Textiles (142)

Cotton is a wonderfully versatile, all-natural fabric and is present in everything from bath towels and bed sheets to underwear, T-shirts, and socks. But cotton production is a mess. Fairtrade International argues that there’s such thing as better cotton, and shoppers should know the difference.

Fairtrade aims at reducing the social and environmental costs of cotton production. At a social level, genetic modification of cotton seeds has wreaked havoc in traditionally agrarian communities. In India, the second biggest cotton producer in the world after China, there has been a surge in farmer suicides. These tragic deaths are linked to genetically modified cotton and the ugly cycle of dependence on special seeds and chemicals. It’s estimated that, every 30 minutes, one farmer in India commits suicide, deep in debt and unable to provide for his family.

Environmentally, cotton growing is a disaster. Cotton accounts for 24 per cent of global sales of agricultural insecticides and uses a huge amount of water – approximately 20,000 liters of water are needed to produce one kilogram of cotton. Cotton production is linked to the destruction of the Aral Sea, the Indus River in Pakistan, the Murray-Darling Basin in Australia, and the Rio Grande in the US and Mexico.

Turkish textile company Birlesik Tekstil is planning to open a factory in Belgrade, Serbia by the end of this year. This was announced by Belgrade Mayor Sinisa Mali. The proposed factory will come up in the city’s Lazarevac municipality. Birlesik Tekstil has acquired a factory of insolvent local textile company Beko and is looking to appoint 600 employees by the end of 2017 and another 600 at a later stage to do business.

Serbia imports $180 million worth of textile from Turkey annually which is the reason why Serbia should attract Turkish investors here says Ljajic. Serbia plans to promote a model that involves the reconstruction of old and abandoned halls where interested investors could install machinery and immediately start production. The country’s exports to Turkey rose by 10.8 per cent to 30 billion dinars in 2016, while imports from Turkey increased 18.1 per cent to 74.3 billion dinars, according to data from Serbia’s statistical office.

Total yarn production in India is likely to remain flat in 2016-17. This is on account of an estimated 2.1 per cent fall in cotton yarn output. However, synthetic yarn output is expected to grow by 3.4 per cent due to a healthy demand for the yarn in the domestic market as well as overseas markets.

In 2016-17, high cotton prices drove yarn manufacturers towards synthetic fibers which were priced lower. Demand for cotton yarn from China, the largest buyer of Indian cotton yarn, declined. Demonetisation also affected yarn output during the year. Total yarn production is likely to increase in 2017-18. During the year, total yarn output is likely to grow 3.8 per cent. Production of cotton yarn is expected to rise by 4.8 per cent. Synthetic yarn output is likely to grow by 2.3 per cent during the year.

In 2017-18, demand for yarn in the domestic market is expected to be healthy. This is likely to be backed by an increase in yarn purchases by manufacturers of apparels, home textiles and fabrics. Factors such as urbanization, rise in per capita income, favorable demographics and a shift in preference for branded products will boost the demand for these products in the domestic market.

The US is the largest exporter of cotton, accounting for 29 per cent of global exports. Exports for 2016-17 is forecasted to increase 53 per cent year-on-year. This is mainly driven by higher demand from Taiwan and China.

As a result, the US share of global cotton exports is set to reach 39 per cent, the highest level seen in six years. Prices shot up in July after Chinese cotton stocks were forecast to fall by 1.9 million tons y-o-y to touch 11.3 million tons in 2016-17, raising concerns over low supply. These speculations caused panic buying in the market, which saw prices rise. In fact, Chinese cotton stocks have been revised down further, currently forecast at 10.7 million tons, down 15 per cent y-o-y.

For the upcoming 2017-18 season US cotton planted area is expected to rise by over 20 per cent y-o-y. As long as the weather remains favorable, production would be expected to rise. This is the second consecutive year that global ending stocks have fallen. Ending stocks are forecast down six per cent y-o-y for the current 2016-17 season and down 19 per cent since the 2014-15 season. This is mainly driven by reduced ending stocks in China, as well as global consumption outweighing production.

Thai chemicals producer Indorama Ventures (IVL) has entered into a definitive agreement to acquire Glanzstoff Group, a major European manufacturer of tyre cord fabrics and single-end-cords (SEC) for high performance tyre applications.

Glanzstoff offers a broad range of solutions in tire cord fabrics and single-end-cords in high-performance rayon, aramid, nylon 6.6 and polyester in addition to hybrid filament yarns for the high-growth and high-performance automotive applications. Glanzstoff is Europe’s largest converter for tire cord fabrics and a global leader in SEC and is vertically integrated into high tenacity Rayon technology. It has manufacturing sites in Luxembourg, Italy and the Czech Republic.

Aloke Lohia, Group CEO of Indorama Ventures says the acquisition provides a unique opportunity for Indorama Ventures to consolidate its leadership position in the tire cord business and strengthens our high value-added (HVA) portfolio.

IVL entered the high-growth tire cord business following the acquisition of PHP fibers in 2014. Thereafter, it acquired Performance Fibers in 2015 and created a global scale as a result of these acquisitions. The company continues to invest and announced sizeable expansion of its tire-cord manufacturing line at Performance Fibers in Kaiping, China in January. On a pro forma basis, the combined revenue of PHP Fibers, Performance Fibers and Glanzstoff in 2016 was $602 million. On an all-inclusive basis, the HVA segment of IVL achieved sales revenue of over $2 billion in 2016.

Lohia says the company continues to pursue a transformational journey to consolidate our leadership position and pursue profitable growth opportunities in the high value-added segment. The Glanzstoff platform will expand the footprint beyond polyester and nylon 6.6 by entering into rayon technology. It focus remains on delivering best-in-class propositions, while driving our global innovation agenda to strengthen the company’s capabilities in the value chain in which we are present.

India may be the world’s number one home textile supplier in the coming years. Right now China is the world’s largest home textile producer. India’s home textile industry is expected to grow at a CAGR of eight per cent to reach $5.29 billion by the end of 2018. Curtains and upholstery, rugs and carpets will be some of the top growing home textile categories in the coming year, posting a CAGR of eight per cent and 9.4 per cent.

India is responsible for almost 21 per cent of towels in the global market and has a 19 per cent share in the global bed linen market. India is also one of the top suppliers for the world’s biggest home textile consuming market, the US. Increasing efforts in quality improvement, innovations through R&D and value-added features have helped India’s home textile products become more popular in the global market.

The home textile sector in India is the second largest employer in the country’s textile industry after the apparel sector. The made-up sector includes products like towels, bed sheets, blankets, curtains, crochet laces, pillow covers, embroidery articles and other home textile products. This sector gets production incentives and subsidies similar to what the garment sector gets.

The VDMA Textile Machinery Association will host B2B forums and technology conferences on November 6, 2017 in Charlotte (NC), USA, and on November 8-9, 2017 in Mexico City. Experts from well-known VDMA member companies will be present practice-oriented technology topics to decision-makers from the local textile industry.

Germany holds the top position in Europe and world-wide with €13 billion in annual sales in technical textiles. The this event is aimed at technical management, production managers, quality and maintenance managers as well as mill owners, among other decision-makers. The event will also focus on sustainability and recyclability.

This year's partner countries are Austria and Switzerland; and the host city for this important European textile conference is Dresden, which is Germany's center for lightweight engineering and one of the leading German locations for new materials. The event will have presentations along the entire textile chain will show how to increase competitiveness by innovative technology, higher productivity, resource efficiency, higher value-added textiles and industrial internet. The networking will be supported by B2B, interactive discussions with the professional audience and by a conference dinner in a comfortable atmosphere.

After a disappointing end to 2016 and a sluggish beginning to 2017, spinners in India are finally beginning to regain some optimism. They have been getting a steady stream of orders for the past five or six weeks and enquiries are on the rise.

Ring-spun and air-jet yarns are getting a lot of attention. Positions are beginning to get a little tight again. Orders for open end yarns, in general, are still a bit light, but are improving. Interest is particularly high in specific categories like organic products, fire retardant yarns and products used for filtering. As the oil industry continues to recover, these categories may continue to grow.

One area that has not revived much, however, is home furnishings. But even here spinners expect business to pick up substantially in the near future. Despite renewed optimism among spinners, there are still a few concerns. Pricing and margins top the list. They feel selling all the yarn they can make is of no use, if profits are low. Margins continue to be a lot thinner than they would like. Spinners are doing everything they can to keep prices as low as possible but in a lot of cases, they have to rely on value-added advantages to create differentiation — quality, delivery and service.

New manufacturing yarn processes and finishes are pushing towards a more sustainable delivery with a reduction of water. The textile industry uses billions of liters of water throughout all processing from dyeing to specialty chemical finishes that are applied to textiles in water baths to scouring, bleaching and softening. Through the Detox campaign Greenpeace has highlighted the damage of water pollution and use from the textile chain has had on the environment.

Greenpeace is campaigning to stop industry poisoning our water with hazardous, persistent and hormone-disrupting chemicals and the textile industry is embracing change in eco-friendly chemical use as well as water conservation. The importance of sustainability was featured at ISPO Texttrends in February and is now become a custom than a passing fad as the textile industry looks to new processes in reducing water and energy.

Textile manufacturer Schoeller and auxiliaries and dyes specialists at Textilcolor have developed Ecodye, a new auxiliary concept used, in particular, in polyester dyeing processes. The technology accelerates the dyeing process and contributes to cutting costs, while at the same time helping to preserve the environment with a low level of demand on resources. Ecodye also improves the dyeing levelness in polyester textiles. Spots and dye agglomeration are almost completely avoided, and the precipitation on the goods that arises as a result of polyester oligomers are no longer evident. On the other hand Ecodye provides good shade stability and avoids reproduction problems from batch to batch, reducing the rate of double staining and increasing the capacity utilization and productivity of the dyeing mill on a long-term basis.

SpinDye, which is a new company exhibits at ISPO this year, the company offers a different approach in the production of synthetics, in particular nylon and polyester. Final laundering of fabrics is becoming a process of the past. An innovative collaboration held at the recent Kingpins Show in Amsterdam for denim highlighted the company’s technology in this area, in creating finishes that have now water or chemicals involved. The Laser Blaze machine creates graphics on surfaces using light, whilst NoStone is a system that create stonewash effects with the use of pumice stones through ozone finishing.

Italian company specialising in high-end fabrics Brugnoli, has launched a new high-quality, zero-kilometer fabric line based on recycled yarn called B.Recycled. In order to guarantee fabrics with exceptional quality and undisputed performance, Brugnoli has a partnership with the Italian company Fulgar.

This zero-kilometer product line means the supply chain is monitored and certified throughout. The creation of B.Recycled by Brugnoli starts with a raw material recycling process carried out entirely at Fulgar laboratories and mills. Work then continues at the Brugnoli plant, where all the fabrics are created, produced and dyed in the same location.

In 2015 Brugnoli broke new ground with the launch of its Br4 technology for the creation of bio-based fabrics. The eco-sustainable production process enables the creation of extremely high-quality fabrics made using Evo by Fulgar, a bio-based yarn obtained from castor bean. Evo by Fulgar is an eco-friendly yarn that aims to provide total comfort and technical performance combined with light weight, stretch, breathability and fast drying, plus naturally thermo regulating and bacterio static properties.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

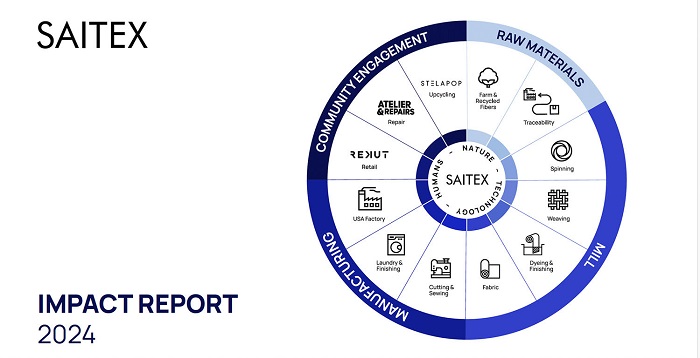

SAITEX releases ‘2024 Impact Report’, demonstrating decarbonization at scale and…

Saitex, a leader in sustainable apparel and denim manufacturing, has released its 2024 Impact Report, showcasing significant progress in its... Read more

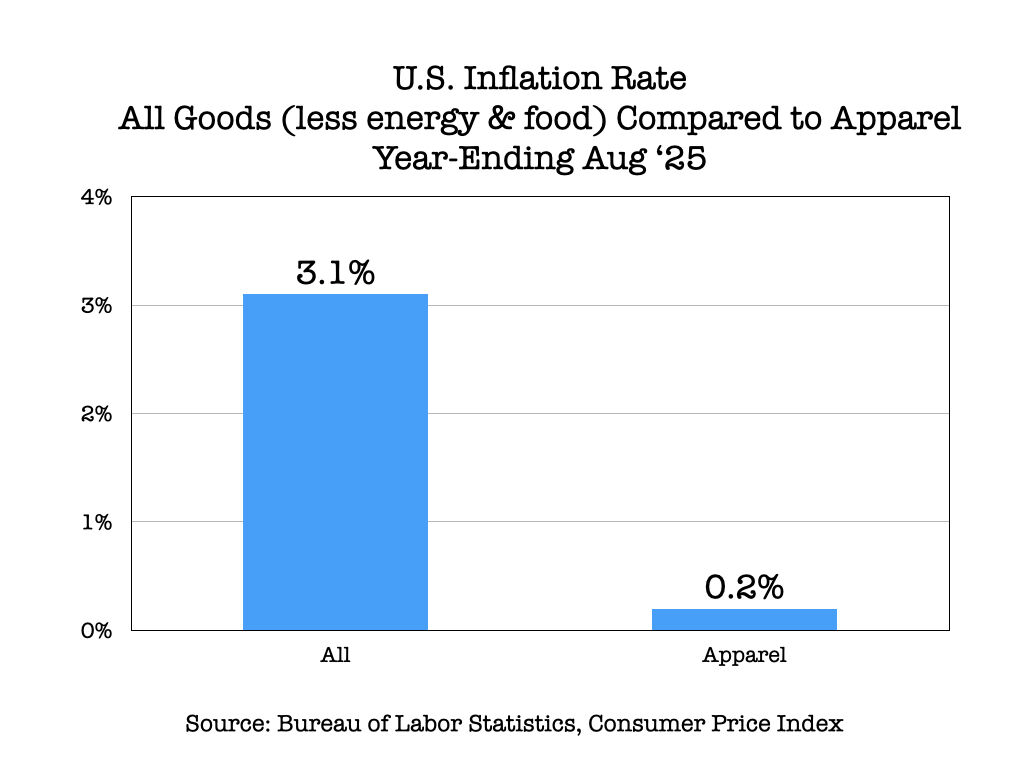

US apparel prices show muted growth, but a shift may be underway

The latest data from the Bureau of Labor Statistics (BLS) indicates that while overall US inflation remains high, the apparel... Read more

Clothes don’t last forever, debunking the surplus garment narrative

For years, a statement has been echoed across fashion panels, sustainability forums, and viral social media posts: “We already have... Read more

EU’s landmark EPR law to revolutionize fashion industry, focus on textile waste …

The European Union has officially adopted its highly anticipated Extended Producer Responsibility (EPR) law for textiles, a groundbreaking measure that... Read more

New EU EPR rules shake up global textile industry

A major shift in European Union policy is set to redefine the global apparel and textile landscape. The EU is... Read more

From Tariffs to Textiles: Dornbirn GFC highlights strains and solutions in globa…

The just concluded annual Global Fibre Conference in Dornbirn put forth a complex picture of the synthetic fibre industry. While... Read more

The end of de minimis, small businesses face a trade shock in America

When the US government moved to terminate the long-standing de minimis exemption, the duty-free threshold for low-value imports, it sent... Read more

Rise of Regional Fashion: BRICS+ Summit signals shift in global fashion power

The recently concluded BRICS+ Fashion Summit in Moscow was more than just a series of runway shows; it was a... Read more

Nomura Report: Asian exporters absorb tariffs, rethink supply chains

As global trade enters a period of recalibration, Asian exporters are bearing the brunt of escalating US tariffs while simultaneously... Read more

The Soul of Style: BRICS+ Fashion Summit weaves a new narrative of ‘Culture, Cra…

In a world where fast fashion often dominates, a different conversation took center stage in Moscow. The recently concluded BRICS+... Read more