FW

The recently concluded BRICS+ Fashion Summit & Moscow Fashion Week ( Aug 28 to September 2, 2025) has solidified its position as a key global forum, moving the fashion conversation beyond seasonal trends and into the realms of economic policy and cultural diplomacy. It serves as a platform, a global stage for shifting industry to foster professional dialogue, cultural exchange, and international cooperation within the fashion industry. Organized by the Cultural Fund for the Development of Fashion and Design with support from the Moscow Government, gathered officials, designers, and industry experts from over 60 countries to discuss the shifting landscape of a new, polycentric fashion world. The forum set out to challenge the traditional dominance of Paris, Milan, London, and New York — positioning emerging markets as co-authors of fashion’s next chapter.

Fashion as an economic engine

The summit's opening plenary session, "Fashion 360°," underscored fashion's role as a major economic driver. Speakers repeatedly called fashion “a serious driver of growth, not just a seasonal indulgence.” Officials highlighted how the industry stimulates growth in related sectors, from textiles to digital technologies. According to Anton Alikhanov, Minister of Industry and Trade of the Russian Federation, "Over the past five years, the fashion market has more than doubled and is now estimated by experts at 500 billion rubles... we will grow in the range of 5% to 7% annually up to 2036."

The industry's increasing potential is attracting significant investment. Yana Komarova, CEO of Zerno Ventures, noted, "Investors focus on validated concepts, sustainable business models, and capable development teams. We’re seeing increased interest in retail, the rehabilitation industry, and functional textiles." Technological innovation is also driving this momentum, with Natalia Popova of Innopraktika highlighting that "fashion is becoming high-tech," from smart fabrics to big data solutions.

The Protectionism Debate: Local pride vs. Global ambition

A key theme was the strategic pivot toward local brands and the debate over national market protection. The session "Protectionism or Free Trade" brought to light a new reality where nations are increasingly supporting their domestic industries. The BRICS+ Fashion Summit tackled the central question of whether national clothing markets should be protected. The debate brought to light a new reality where governments are increasingly supporting their domestic industries to promote a "buy local" ethos, but without a full-blown protectionist approach.

Alexei Fursin, a Moscow Government Minister, explained that Russia's primary focus has been to promote local brands, stating, "First and foremost, the consumer must be local." While the potential return of Western brands was discussed, Kirill Dmitriev, Special Presidential Representative for Investment and Economic Cooperation, assured that Russia would prioritize its own businesses. He added that a "thoughtful approach will be taken to determine the conditions under which they can return," noting that "complete protectionism would hinder competition."

For nations in the Global South, the challenge often lies in accessing international markets. Aurea Yamashita of Brazil's ABEST highlighted that high tariffs are a "big problem" and that "reducing tariffs would help our companies access new markets and become more competitive."

Meanwhile, this emphasis on local identity is gaining cultural traction. Mikhail Khomich of ASI noted a growing sense of pride among Russian consumers, stating that "Today, declaring 'I wear everything Russian' is not a source of shame. On the contrary—it has become a point of pride."

Fashion as a tool for diplomacy

Beyond its economic role, the BRICS+ Fashion Summit highlighted fashion as a powerful instrument of cultural diplomacy. As the industry shifts from universal design standards to a new global "polycentrism," fashion weeks are becoming strategic platforms for dialogue.

Zainab Saidulaeva, Creative Director of Measure, argued that "fashion has emerged as diplomacy’s new language," noting its unique capacity to "intensely export regional culture." This sentiment was echoed by Ozlem Sahin Ertas, founder of Think Fashion Global, who described her organization's mission to "celebrate the richness of all cultures and articulate their authenticity through fashion."

The summit served as a "borderless global dialogue," with designers from over 60 countries using Moscow's catwalks to prove that cultural exchange can thrive even amid geopolitical tensions. Inclusivity was equally central. Ozlem Sahin Ertas, founder of Think Fashion Global, spoke of “celebrating the richness of all cultures and democratizing fashion,” highlighting initiatives like Modest Fashion Week that widen access and visibility.

Rewriting the fashion map

By blending investment dialogue, trade policy, and cultural storytelling, the BRICS+ Fashion Summit positioned fashion as both marketplace and meeting ground. It invited rising economies to move from the margins of style to its command centers — and to use clothes not only to dress bodies, but also to shape economies and diplomacy.

As one participant summed up: “Fashion is no longer about who walks the runway; it’s about who shapes the world economy and cultural conversation.” In Moscow, that message rang clear.

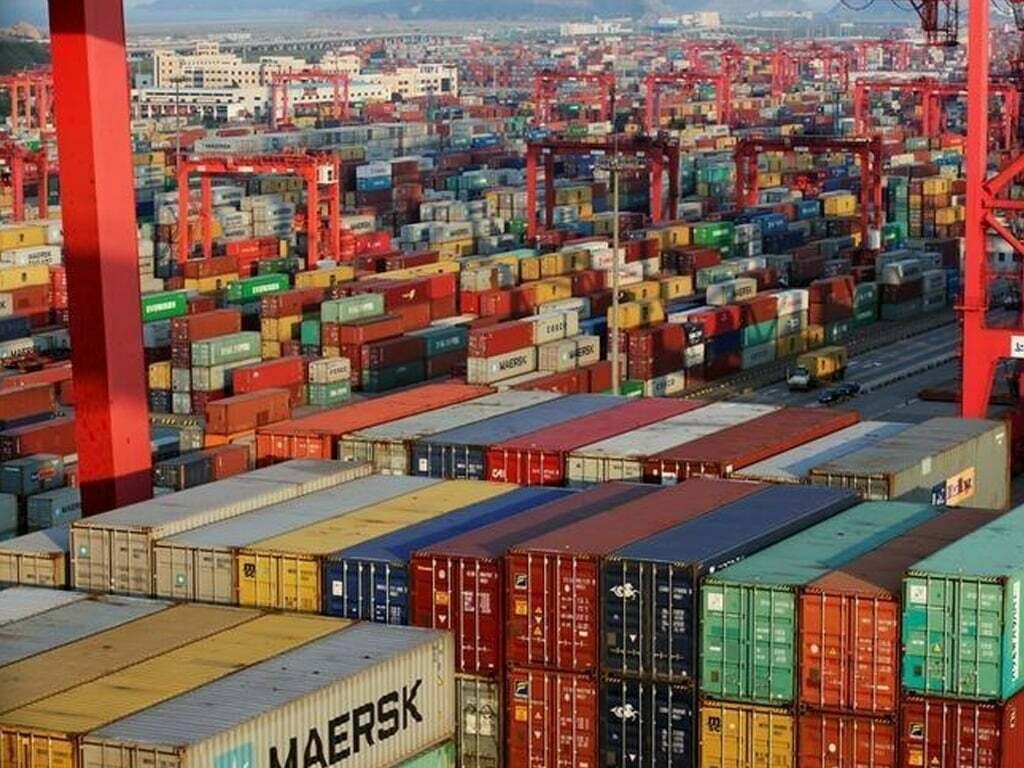

As global trade enters a period of recalibration, Asian exporters are bearing the brunt of escalating US tariffs while simultaneously rethinking their supply chain strategies. Nomura’s latest report reveals a telling picture: Asian exporters are absorbing nearly 20 per cent of US tariff costs, while passing on the remainder to American consumers. The implications stretch far beyond balance sheets, shaking the foundations of global supply chains, particularly in the apparel and textile industry.

The tariff shockwave

The US-China trade war of the late 2010s set the stage for today’s tariff regime, but the geopolitical climate of 2024-25 has intensified the disruption. Tariffs have become a tool of political negotiation as much as economic strategy. For Asian exporters, many of whom serve as critical nodes in global manufacturing networks the immediate question is how much of these tariffs they can afford to absorb without eroding competitiveness. As per Nomura’s findings, exporters across Asia are responding differently depending on the nature of their exports, cost structures, and market strategies.

Table: Country-wise strategy shifts and tariff impact

|

Country |

Share of tariff costs absorbed |

Strategy |

Sectoral impact |

|

Singapore |

>20% |

Leveraging high-value, advanced manufacturing exports |

Electronics, precision instruments |

|

China |

<10% |

Utilizing economies of scale, tech upgrades |

Electronics, apparel, machinery |

|

Vietnam, Cambodia, Thailand |

~0% (passed fully to consumers) |

Limited margin flexibility |

Garments, footwear, basic textiles |

|

India |

Tariff rate >50% (including penalties) |

Diversification & export incentives |

Textiles, garments, engineering goods |

Singapore, leveraging value over volume

The reports reveals Singapore’s high-tech and high-value manufacturing base has allowed it to absorb over 20 per cent of tariff costs, cushioning the impact for US buyers. “Singapore’s export ecosystem is less price-sensitive and more quality-driven,” notes the Nomura report. As a result, sectors like semiconductors, precision engineering, and medical devices remain resilient despite tariff pressures.

China, playing the long game

China, still the world’s factory floor, has absorbed less than 10 per cent of tariff costs a deliberate move to protect margins. Instead, it is doubling down on technological differentiation and economies of scale, offsetting tariff shocks through efficiency gains. This strategy is making Chinese textiles and apparel increasingly competitive compared to ASEAN peers, where tariffs are raising costs. As Wei Zhang, Trade Economist, Beijing University says, “China has the scale and the technological base to blunt tariff impacts, unlike smaller economies that rely purely on low-cost labor.”

Vietnam, Cambodia, Thailand, consumers pay the price

In Southeast Asia, labor-intensive economies such as Vietnam, Cambodia, and Thailand have no room to absorb tariffs. With razor-thin margins in garments and footwear, exporters have passed on the full burden to US consumers. This has caused export prices to increase, undermining the competitiveness of ASEAN-made apparel.

India, struggling, focusing on relief

India presents a more complex picture. Facing 50 per cent tariffs pushed up by a 25 per cent penalty on imports of Russian oil, exporters are under acute pressure. India’s textile exports, worth $17.6 billion in FY25, are vulnerable. Apparel and textile exporters are already squeezed by high raw material costs and global competition. To offset this, the government is charting a multi-pronged response. The focus now is on diversification of export markets targeting Africa, Latin America, and the Middle East. Various incentives for exporters are also being offered including subsidies, interest relief, and duty drawback schemes. Relief packages are being given in the form of fiscal cushion for export-oriented industries, especially textiles and garments.

Table: India’s textile exports

|

Metric |

Value ($ bn) |

|

Total Textile Exports |

17.6 |

|

Share to US Market |

6.3 |

|

Projected Impact of Tariffs (FY26) |

-15% to -18% |

Sunil Khandelwal, President, Confederation of Indian Textile Exporters points out the government is aware of the risks and is working on a relief package. But exporters must also innovate diversification is no longer an option, it’s a necessity.

Apparel and textile sector epicenter of turbulence

The apparel and textile sector is emerging as the most vulnerable. While ASEAN producers have raised export prices, inadvertently boosting China’s cost advantage, South Asian hubs such as Bangladesh and India are positioning themselves as viable alternatives. Meanwhile Vietnam’s apparel exports is up in value but falling in competitiveness. China’s apparel exports is stabilizing due to relative cost advantage. Bangladesh on the other hand is emerging as a low-tariff production hub, attracting investment. As for India struggling with tariff penalties, yet poised to benefit from diversification.

Supply chain rewiring resilience over cost

Nomura’s report highlights a shift in supply chain philosophy. For decades, cost efficiency drove decisions; now, resilience, market access, and geopolitical risk management are paramount.

• South Asia (India, Bangladesh): Attractive due to low costs and market diversification.

• Central & Eastern Europe (Poland, Romania): Gaining as near-shoring hubs for Western markets.

• Middle East (UAE, Saudi Arabia): Rising as logistics and re-export hubs.

Table: Shifting supply chain hubs

|

Emerging supply chain hubs |

Competitive advantage |

|

Bangladesh |

Low tariffs, strong apparel ecosystem |

|

India |

Scale, incentives, government support |

|

Poland |

Proximity to EU markets |

|

UAE |

Logistics, re-export capability |

The report concludes with a note for global investors: the winners in this new trade order will be those who combine strategic alignment with technological agility. Sectors such as textiles, electronics, and semiconductors are under intense transformation, with regional winners determined by their ability to innovate and withstand tariff shocks.

Thus the tariff battles of 2025 are not merely raising export costs they are redrawing the map of global manufacturing. For Asian exporters, the challenge lies in balancing short-term survival with long-term repositioning. While Singapore and China absorb costs strategically, ASEAN exporters pass them on, and India struggles under punitive tariff regimes. Yet, the broader narrative is one of adaptation: supply chains are rewiring, new hubs are emerging, and resilience is becoming the new mantra of global trade.

Premium consumer brand investor, Scope Capital has acquired a majority stake in the Dutch outwear apparel company, Stone Fashion Group. This deal kicks off a new growth phase for the Stone Fashion Group and its portfolio of brands.

Scope Capital partnered with the Stone Fashion Group's management team to buy a 60 per cent stake in the company. The founders will keep a significant minority share and will remain involved in the business.

The Stone Fashion Group is the parent company of several brands, including the popular ski and activewear brand Goldbergh, and outerwear brands like Beaumont, Reset, District, and Creenstone.

The new partnership involves accelerating Stone Fashion Group's growth by focusing on digital and geographic expansion, especially in the Asian and US markets. Scope Capital plans to use its expertise in digitalization and brand building to strengthen relationships with customers and expand the company's global presence.

The acquisition comes at a great time for the Stone Fashion Group, which is projecting a turnover of €90 million and an EBITDA of €19 million, showing a solid base for future growth.

Scope Capital has a strong track record of investing in and growing premium consumer brands, with past investments in companies like Happy Socks and Klattermusen. The firm’s strategy is to actively team up with entrepreneurs to help them fully realize their brand's potential.

This deal is a smart move for both companies, allowing the Stone Fashion Group to break into new markets with the support of a specialized investor, while Scope Capital adds another successful brand to its collection.

In a move to strengthen its ready-made garment (RMG) sector under the One District One Product (ODOP) initiative, the Uttar Pradesh government is constructing a new ‘flatted factory’ in the Gorakhpur Industrial Development Authority (GIDA) area. Designed as a ground-plus-three-floor facility, this multi-story building will house 80 fully equipped units for garment manufacturers.

The plug-and-play design of the factory allows entrepreneurs to start operations immediately with just their machinery and raw materials. The 30,000-sq m complex will also include an exhibition hall for showcasing products, a marketing outlet, a daycare for employees' children, fire-fighting systems, and dedicated elevators.

Valued at $4.79 million (Rs. 42.36 crore), the project is expected to create around 2,000 jobs, both directly and indirectly. According to RN Singh, President, Chamber of Industries, 80 per cent of the units will be reserved for garment businesses, while the remaining 20 per cent will be available to other entrepOne District One Product (ODOP) reneurs.

Approved by the Ministry of MSME two years ago, this initiative complements the development of a garment park that is also underway in Gorakhpur. Together, these two projects are expected to position the city as a major hub for India’s ready-made garment industry.

In a move to strengthen its ready-made garment (RMG) sector under the One District One Product (ODOP) initiative, the Uttar Pradesh government is constructing a new ‘flatted factory’ in the Gorakhpur Industrial Development Authority (GIDA) area. Designed as a ground-plus-three-floor facility, this multi-story building will house 80 fully equipped units for garment manufacturers.

The plug-and-play design of the factory allows entrepreneurs to start operations immediately with just their machinery and raw materials. The 30,000-sq m complex will also include an exhibition hall for showcasing products, a marketing outlet, a daycare for employees' children, fire-fighting systems, and dedicated elevators.

Valued at $4.79 million (Rs. 42.36 crore), the project is expected to create around 2,000 jobs, both directly and indirectly. According to RN Singh, President, Chamber of Industries, 80 per cent of the units will be reserved for garment businesses, while the remaining 20 per cent will be available to other entrepOne District One Product (ODOP) reneurs.

Approved by the Ministry of MSME two years ago, this initiative complements the development of a garment park that is also underway in Gorakhpur. Together, these two projects are expected to position the city as a major hub for India’s ready-made garment industry.

Kenya faces a major threat with the expiry of AGOA this September, and buyers taking advantage of the duty-free access before it ends. The looming expiration could lead to business disruptions and job losses for the over 66,000 workers directly tied to AGOA.

Adding to the problem is a new 10 per cent flat reciprocal tariff on Kenyan imports from the US, which undermines the years of preferential treatment and adds costs for exporters. This change in market access terms puts years of investment in skills and logistics at risk. In response, Kenya has reportedly stepped up its lobbying efforts in Washington to secure a favorable trade deal that could extend or replace AGOA. Without a clear path forward, Kenya’s textile industry and the thousands of livelihoods it supports are at a critical crossroads.

For centuries, Kenyan communities have been making textiles, but in recent decades, the country has transformed into a major force in global apparel manufacturing. This shift was largely driven by the Export Processing Zones Authority (EPZA), which attracted manufacturers with tax breaks and business-friendly policies. As a result, Kenya has seen a significant rise in foreign investment and exports, establishing itself as a key player in the textile industry.

A major reason for this growth was the African Growth and Opportunity Act (AGOA), a US law from 2000 that gave eligible African nations duty-free access to the American market. Kenya became the second-largest exporter of textiles and apparel to the US among all AGOA participants, fueling explosive export growth and job creation, especially for women and young workers.

According to the 2025 Economic Survey by the Kenya National Bureau of Statistics (KNBS), employment in AGOA-accredited firms increased by 15.18 per cent in 2024, reaching 66,804 workers, up from 58,002 the previous year. Over 70 per cent of Kenya’s textile and apparel exports go to the US market, highlighting the direct link between trade preferences and job creation.

From April 21–24, 2026, the Techtextil and Texprocess trade fairs will be held together at Messe Frankfurt, offering an integrated event for technical textiles and flexible material processing. The schedule for the fairs was announced at a press conference in Istanbul, The conference was attended by Sabine Scharrer, Trade Fair Director, Techtextil and Texprocess; Elgar Straub, Managing Director, VDMA and TFL; Murat Şahinler, Board Member, İTHİB; and M Can Yümer, Sales and Marketing Director, Messe Frankfurt Istanbul.

Speaking about Messe Frankfurt’s Texpertise network, Scharrer highlighted, it serves as a global meeting point for the textile industry, organizing over 60 fairs in 13 countries. She noted, Turkey is one of the top countries for both visitors and exhibitors at Techtextil and Texprocess. The Turkish textile industry needs to invest more in new processes and technologies to meet necessary standards, said Scharrer. While this might increase product costs, it will also create new market advantages, she added,

Scharrer mentioned, visitors can attend both fairs with a single ticket, allowing them to see the entire textile value chain, from fiber to a finished product. This setup encourages high cross-visitation and maximizes business potential. She expects exhibitors from more than 100 countries to present their new products.

Shairing more details about the fairs, Scharrer informed, Techtextil is transforming the industry with innovations across 12 application areas. Performance Apparel Textiles will be a major focus in Hall 9.0, featuring functional materials for everything from aviation safety gear to sportswear. The Nauter Performance area in Hall 9.1 will showcase solutions for the automotive and construction sectors, with a growing demand for natural materials. For the first time, textile chemicals and dyes are also being included in the product portfolio.

Regarding Texprocess, Scharrer reported, 30 new exhibitors had already signed up as of September, and the fair is expected to attract over 200 participants from 24 countries. She emphasized that Texprocess is important not just for its size, but for bringing together key decision-makers. Seventy-six percent of exhibitors have a say in purchasing decisions, she explained.

Renewed optimism for a stronger trade relationship between the United States and Indiaa is growing as two leading textile organizations, the American Association of Textile Chemists and Colorists (AATCC) and The Textile Association-South India Unit (TAI-SIU), are co-hosting the International Textile Conference from November 21-22, 2025, in Coimbatore, India.

The conference aims to address both the opportunities and challenges in the textile sector's technical and trade aspects. It will focus on topics such as cotton, synthetic textiles, supply chain developments, and new marketing opportunities.

This event comes at a crucial time. With ongoing tariff tensions between the two nations, recent social media posts by President Donald Trump and Prime Minister Narendra Modi have expressed hope for a ‘win-win’ bilateral trade agreement to be reached soon. This potential deal is expected to foster renewed cooperation and boost trade.

Stakeholders are being encouraged to engage positively to create new opportunities. As India's textile sector holds a leading position in global exports and provides widespread employment, the Indian government views it as a critical part of the country's economic growth.

Gregg Woodcock, Executive Director, AATCC, says, AATCC is proud to partner with The Textile Association (India) in support of the international conference in Coimbatore. With members including global brands like Under Armour, Nike, and Patagonia, AATCC hopes to assist the Indian textile industry with standards, testing, and educational resources to support sustainable manufacturing.

Leaders from TAI also see the event as a timely opportunity to rebuild confidence in the industry and create new opportunities in textile trade, notes R Seenivasahan, Vice President, TAI-SIU.

The conference is the first of its kind to bring together key stakeholders from both nations to a major textile region. It will be attended by participants from Europe and other countries, providing a global platform to strengthen friendships and explore business opportunities. This event is seen as a vital step to rebuild confidence and engage with India, a central hub in the global textile industry.

Syed Fasihuddin Bukhari, Representative, Interloop Group has signed an agreement with Walid Gamal El-Din, Chairman, Suez Canal Economic Zone (SCZONE) to set up a ready-made garment manufacturing facility in the Qantara West Industrial Zone.

The deal covers a 60,000-sq-m plot with an investment of $35.2 million (EGP 1.67 billion). The new plant will create more than 1,000 direct jobs and will export its entire production to foreign markets - highlighting the SCZONE’s growing importance as a hub for apparel manufacturing and international trade.

Gamal El-Din says, the Interloop project is the first industrial investment from Pakistan in the SCZONE, marking a major step in strengthening industrial cooperation between the two countries.

He emphasizes, the project reinforces Qantara West's standing as one of the most promising global destinations for apparel and accessories manufacturing, thanks to its strong appeal to investors and a fully integrated industrial ecosystem.

Interloop’s decision to dedicate all production for export shows foreign investors’ confidence in the competitive environment of the SCZONE, notes Gamal El-Din. The project will not only support Egypt’s export growth but also boost the zone’s contribution to global supply chains in the ready-made garment industry, he adds.

With this agreement, the total number of projects in the Qantara West Industrial Zone has now reached 39, with total investments of about $1.0435 billion. These projects collectively provide almost 55,700 direct jobs across a total area of 2.44 million square meters.

Founded in Pakistan in 1992, Interloop Group has become one of the world’s top textile and apparel manufacturers, producing socks for global brands as well as denim and sportswear. The company currently operates in six countries including Pakistan, the United States, the Netherlands, Sri Lanka, China, and Japan.

Currently valued at $179 billion with exports of $37.75 billion, India’s textile sector aims to increase the value of the domestic market to $250 billion and boost exports to $100 billion by 2030.

Highlighting the sector’s importance in the country during a meeting with micro, small, and medium (MSME) exporters, Giriraj Singh, Textile Minister, called it a symbol of India's economic strength and cultural heritage. The industry contributes nearly 2 per cent to India's GDP and ranks as the sixth-largest global exporter with a 4.1 per cent share of world trade, he added.

With exports reaching over 220 countries and activity spanning more than 520 districts, Indian textiles truly embody the vision of ‘Atmanirbhar Bharat’ (self-reliant India) and the spirit of ‘Swadeshi; (self-sufficiency), Singh noted.

Despite facing global instability and steep tariffs from some trading partners, India’s textile exports have shown resilience. In July 2025, India’s textile exports grew by 5.37 per cent to reach $3.10 billion. For the April-July 2025 period, exports increased by 3.87 per cent Y-o-Y to $12.18 billion.

Certain segments are performing particularly well, with ready-made garments increasing by 7.87per cent, carpets growing by 3.57 per cent, and jute products rising by 15.78 per cent. Handicrafts and man-made fiber (MMF) textiles are also maintaining steady performance.

Singh emphasized, positive trends in countries with which India has free trade agreements (FTAs) prove the country's ability to capture a larger share of the $590 billion global textile market. To achieve this, he stressed the urgent need for strategic diversification into 40 new global markets while simultaneously strengthening domestic demand.