FW

In the past two years, Egypt has taken measures to restore seed purity and cotton quality. Egyptian cotton’s reputation and quality had deteriorated significantly due to the seed companies’ lack of effective quality assurance systems that resulted in inferior, mixed-variety output.

Egyptian cotton’s length, strength, firmness, color, trash count and maturity have all improved in 2016-2017 compared to 2015-2016. This development has increased demand and the prices for Egyptian cotton in local and international markets. Egypt’s cotton exports jumped 63.9 per cent during the first quarter of the planting season of 2016-17.

Internationally, retailers have begun to more closely monitor their products labeled as 100 per cent Egyptian cotton, many requiring manufacturers to provide attestation for products labeled as such. About 90 per cent of global supplies of Egyptian cotton last year were fake.

In an effort to crack down on fraudulent practices and ensure quality, the Cotton Egypt Association started licensing the use of the Egyptian cotton logo to suppliers and manufacturers all over the world. Carrying the logo means that the association certifies the authenticity of the Egyptian cotton. If Egypt’s cotton industry returns to its previous glory, the economy would flourish, the spinning and textile industries would boom, and stalled factories would reopen.

Australian Wool Innovation is set to undertake a major strategic research direction change to address rapidly rising wool harvesting costs. Only about 10 per cent of AWI’s annual harvesting investment portfolio is currently spent on alternatives to manual shearing and in-shed sheep handling. Shearing costs are rising faster than efficiency gains from in-shed shearer training.

AWI also wants to use savings achieved in a recent round of staff redundancies to explore alternatives to the manual shearing of sheep. Additional research in wool harvesting could involve combining robotic, chemical and previous platforms or chain shearing technology to provide cost-saving in-shed alternatives for growers and shearers.

AWI will look at some of the industry’s bigger problems, such as the issue of shearing heavier sheep efficiently and safely. Shearing costs continue to rise while increasing numbers of growers are shearing sheep twice a year or every eight months to assist cash flow, minimise flystrike and cut crutching costs.

More than 80 potential harvesting technologies have been assessed by AWI, identifying promising areas for development including hand piece technology, parallel, modular, upright shearing platforms and alternative shearing technologies.

The aim is to find a replacement for manual shearing like robotics, laser and deal with the cost of shearing.

Pakistani markets are awash with low-cost Chinese products. What is significant from Pakistan’s perspective is that China is fast developing Xinjiang into a major textile exporting hub. Xinjiang is China’s top cotton-growing area, producing between three to four million tons, or 60 per cent of the seven million tons of cotton produced by China.

China is already Pakistan's major competitor in global trade, particularly in the textile and garment segments, and with the establishment of a textile park in Xinjiang, its textile exports are anticipated to increase manifold. The textile park in Xinjiang will be a heavy blow to Pakistani textile exports. Already being high value added and low in cost due to high technology, superior production efficiency, subsidised manufacturing and cheap labor, China’s textile exports from Xinjiang passing through CPEC to the Middle East-North Africa region will experience a further reduction in costs in terms of transportation.

On the other hand, Pakistan’s exports are already facing a decline in global markets owing to a host of factors, two of which are high production costs and lack of incentives in the sector. Although a $1.7 billion textile package has recently been announced by Pakistan, it is no match with the incentives provided by China to textile exporters in Xinjiang, and Pakistan will not be able to compete with Chinese exporters.

As a part of Messe Frankfurt’s renowned Intertextile brand, Intertextile Pavilion at the Shenzhen International Trade Fair for Apparel Fabrics and Accessories (Intertextile Pavilion Shenzhen) has a distinctive focus on the South China market, benefitting from this region’s promising market conditions and providing huge opportunities for exhibitors at this year’s fair.

Given its solid industrial bases and favourable geographic locations, the South China region is at the heart of China’s garment industry. Moreover one of its two major cities, Shenzhen, has a reputation as the nation’s garment and fashion capital. Currently, the city houses over 2,000 garment companies, 30,000 fashion designers and more than 1,000 fashion brands. In 2016, total sales from the Shenzhen garment industry exceed 200 billion RMB, accounting for over 60 per cent of the market of shopping malls in China’s Tier I cities. As per Hong Kong Trade Development Council’s study ‘China Garment Industry’, with growing spending power, these two markets are projected to continue their strong growth. While men’s garments segment is seeing growth with retail sales expected to grow at a compound annual rate of 11.8 per cent between 2015 and 2020, some domestic women’s wear brands have started forging into the mid-range to high-end women’s garment segments. The research also stated most enterprises which own women’s garment brands such as Ellassay, Marisfrolg, Yinger and Koradior, are located in South China.

Positive exhibitor experience

Positive exhibitor experience

Showcasing this positive data are testimonies and insights shared by overseas exhibitors at last year’s Intertextile Pavilion Shenzhen. As Hiroshi Kawabata, Sales Manager – International Sales Department of Japan’s Sunwell says they see the strong potential in South China market because this is the hub for ladieswear. Given the large population in China, this market is stable and demand will continue to grow. John Lee, Director–Exhibition Project Division of Korea Pavilion’s organiser DGTIA points out, “Shenzhen is a fast-growing city being a Special Economic Zone. More than 3,000 garment factories are located here, which creates enormous demand for apparel fabrics and accessories.” Moreover, Taiwan Pavilion’s organiser Taiwan Textile Federation (TTF) conducted its own research on the South China fashion market and found, “more than 75 per cent of fashion brands in South China are keen to purchase high-quality overseas products,” Petra Peng, representative of TTF explained.

Meeting point for high quality buyers

Along with favourable market conditions the fair’s ability to attract high quality buyers is also a key factor. In 2016, visitor numbers jumped 15 per cent to 17,019 buyers from 36 countries and regions, easy commuting distances between Hong Kong and other major cities in Southern China ensured numerous international and domestic fashion brand buyers such as Brooks Brothers, Combi, Descente, Diesel, etc, utilised the fair as their key sourcing platform in the region.

As Diesel’s senior merchandiser (Knit – R&D) Janice Liu observes, “The date of the fair is good for our sourcing because brands like us are always developing new products and consistently sourcing new materials at different time of the year. Therefore, although we also attend the Shanghai fair (Intertextile Shanghai Apparel Fabrics), this fair is still very important for us. We did find some potential overseas and domestic suppliers this time.” Hong Kong ladieswear brand Kinji’s fashion designer Wing Cham agrees and says, “The fair is close to Hong Kong and covers a good range of products, so I plan to invite my boss to come with me next time.”

Country pavilion added attractopm

The 2017 edition of Intertextile Pavilion Shenzhen will be held from July 6 to 8 in Halls 6, 7 and 9 of the Shenzhen Convention & Exhibition Center, with some key country and region pavilions set to return to feature an array of high-quality fabrics for ladieswear, casual wear, lingerie & swimwear and suiting, the latest knitting fabrics, as well as accessories, lace & embroidery, and yarns & fibres. Among these are:

Korea Pavilion: Organised by Korea Fashion Textile Association (KFTA) and Daegu Gyeongbuk Textile Industry Association (DGIA), will showcase a variety of knitted and man-made fabrics for ladieswear, as well as functional fabrics

Taiwan Pavilion: Organised by Taiwan Textile Federation, will feature the latest collections of lace & embroidery and knitted fabrics

Fine Japan Zone: Formed by leading Japanese companies to highlight Japanese-quality cotton and man-made fabrics for ladieswear as well as casual wear with small order quantity

Shengze Pavilion: Representing the Eastern Silk Market from Suzhou, China, will display an array of man-made and silk-like fabrics for ladieswear.

The fair will also have valuable opportunities to learn next year’s trends through the Spring/Summer 2018 Trend Forum in Hall 9, and a series of seminars during the first two days. Together with Intertextile Pavilion Shenzhen 2017, the 17th China International Fashion Brand Fair – Shenzhen (halls 1 & 2) and a fashion show (hall 5) are held concurrently from 6 – 8 July in the same venue.

Bangladesh clothing manufacturers are facing tough times demanding fair price for clothing supplied by them. Additionally, they are in tremendous pressure from global buyers to improve conditions at workplace, after the Rana Plaza building collapse in 2013. Local apparel makers say, over $1 billion has been invested so far to renovate and retrofit their factories as per the demand of Western buyers, retailers and brands. Yet, retailers and brands have not increased the price. Buyers are still paying the traditional low prices for products and earning huge profits. A shirt costing $3 or $5 is being sold between $25 and $30.

The same is the case with high-end value added products, which is 30 per cent of the total volume of garment items exported per annum from Bangladesh. MNCs pay between $8 and $12 to local manufacturers for purchasing a piece of value added high-end shirt and retailers sell the same shirts at $100 sometimes even at $150, garment makers said. According to manufacturers and economists, the faulty global supply chain is to be blamed. Economist Rehman Sobhan, highlighting this very point says the current business model forces suppliers to squeeze their workers as much as they can because they have to produce the shirt at $5. There needs to be investigation into this matter to resolve issues faced by manufacturers.

The Western view

Offering another perspective, European brands say brands and store owners also do not always make profit as they can sell the highest 60 per cent of the items at tagged prices. Of the remaining 40 per cent, 20 per cent are sold at discount prices and the rest 20 per cent are sold at clearance outlets or donated. Mahmud Hasan Khan Babu, VP, Bangladesh Garment Manufacturers and Exporters Association, too echoed the view of the merchandiser. Retailers have the target to sell 75 per cent of the RMG items at tagged prices and the rest are sold at discount prices. Moreover, the companies annually pay millions of dollars to high-ups, he said. Internal unhealthy competition among manufacturers is also responsible for low prices.

Need of the hour

There needs to be an end to such a plight of manufacturers. The low price of garments will continue until manufacturers say no to it. Retailers are getting the products at lower prices because manufacturers are ready to supply them products at the said price point, opines Kutubuddin Ahmed, Chairman of Envoy Group, which exports garments worth a millions dollars every year. Bangladesh should manufacture high-end items apart from basic items for receiving higher prices.

Trade analyst say, apparel exports is buyer-driven and global brands dictate the market. If producers can come to an understanding they will sell a certain product at certain price, they can get a fair price. But that doesn't happen due to intense competition. There are efforts at the international level to bring global brands under the fair trade system but it is not working well. Also, some trade unions and NGOs are trying to set a standard on Asian wage level for apparel workers and if it can be set, producers will get higher prices.

Cotton is a wonderfully versatile, all-natural fabric and is present in everything from bath towels and bed sheets to underwear, T-shirts, and socks. But cotton production is a mess. Fairtrade International argues that there’s such thing as better cotton, and shoppers should know the difference.

Fairtrade aims at reducing the social and environmental costs of cotton production. At a social level, genetic modification of cotton seeds has wreaked havoc in traditionally agrarian communities. In India, the second biggest cotton producer in the world after China, there has been a surge in farmer suicides. These tragic deaths are linked to genetically modified cotton and the ugly cycle of dependence on special seeds and chemicals. It’s estimated that, every 30 minutes, one farmer in India commits suicide, deep in debt and unable to provide for his family.

Environmentally, cotton growing is a disaster. Cotton accounts for 24 per cent of global sales of agricultural insecticides and uses a huge amount of water – approximately 20,000 liters of water are needed to produce one kilogram of cotton. Cotton production is linked to the destruction of the Aral Sea, the Indus River in Pakistan, the Murray-Darling Basin in Australia, and the Rio Grande in the US and Mexico.

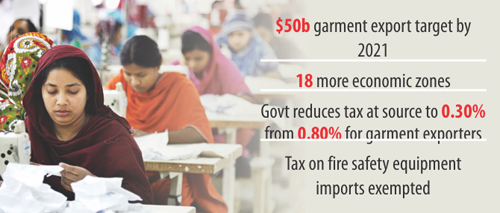

Set by the garment industry of Bangladesh in 2014, the slogan to reach ‘Fifty by Twenty One’ has gained momentum. In December 2016, at a seminar organised by BGMEA titled ‘Taking Bangladesh Apparel Sector Forward’, the state minister for foreign affairs Shahriar Alam had shared this statement. Last fiscal, from July 2015 to June 2016, the country’s garments exports touched $28.09 billion whereas in the calendar year ending in December 2016, exports were $28.67 billion. To reach the target of $50 billion in 2021, the export rate needs to grow at a 12.25 per cent cumulative rate. Past growth rates have been in double digits, but given the current global economic and trade environment, whether it is possible for Bangladesh to continue notching up double-digit growth rates is doubtful.

Growth impediments

A ESCAP report say, price growth of export goods of Bangladesh will decline in 2017 compared to the current year but volume will increase significantly. While this report, Asia-Pacific Trade and Investment Report 2016, considered all exports, the prospect for RMG falls into the general mould of declining prices. At a recent conference at Harvard organised by ISDI, all stakeholders including representatives from buyers and labour unions agreed the price of clothing has been declining in recent years. And, the downward pressure on price, from the demand side, has been two-fold: consumers are now buying more high-end products and apparel and footwear sellers are losing consumer dollars to healthcare, rent, home-related products, electronics and cars. Another reason for the lower price is with greater prosperity, it basic needs such as food and clothing have low income and price elasticity.

Measures to boost exports

There are many aspects, which include marketing, engineering, management, and economic tools, to raise the price of RMG and are well-known, the ultimate goal is not easy to accomplish. In line with this, commerce minister Tofail Ahmed last month urged labour bodies to press buyers to raise RMG prices. Ahmed urged union leaders to connect with their counterparts in importing countries to use their influence on buyers and consumers. He said labour organisations of the RMG sector should tell buyers to raise product prices, which would help increase labour wages in the sector. There are four economic ways to boost exports: quantity, price, changing product mix and exchange rate manipulation.

The industry can also boost of profitability, without increasing prices, by increasing productivity and efficiency. Ironically, readymade garments exporters have recently demanded higher cash incentives and devaluation of taka against the US dollar. The association also demanded apparel factories should be exempted from 1as price hike that the government planned to implement from January 2017. A lower cost of borrowing will also help exporters improve profit margins.

In the years to come, to retain market share in the low-cost-and-high-efficient region, the path to profitability and export growth is increased efficiency, higher productivity, and quality management. The global apparel market is valued at $3 trillion, and between 2007 and 2013, the market increased with average annual growth of 5.1 per cent. Year 2017 is expectd to be a stable year for apparel retail. A report released by Moody's in mid-December said, the sector can expect sales growth of 6 to 8 per cent, led primarily by direct-to-consumer channels and international growth. However, the same report anticipates apparel and footwear sellers will lose consumer dollars to healthcare, rent, home-related products, electronics and cars. In addition, traffic is expected to be weak throughout the year, with department stores and larger retailers such as Walmart bearing the brunt of that decline.

To channelise efforts in the right direction, BGMEA and Danish Fashion and Textile Industry Associations recently launched the ‘Step Up Project’ to improve productivity and address social and environmental challenges in the country's RMG sector. A similar initiative is needed to move up the value chain by using business processes and resources to export higher-margin products. There is a need to explore new markets in Latin America, Africa and the Commonwealth countries.

When it comes to Islamic fashion apparel, Pakistan is one of the top 10 consumer markets. The rise in Pakistan’s fashion retail industry in recent years has been huge, creating space for local as well as global brands which feed the lifestyle needs of the affluent and the rising middle class.

This is especially the case in the women’s apparel category with long shirts, colorful hijabs and the like. Small and medium enterprises have the required potential to streamline operations and offer products to local as well as global markets. However, with Pakistan being a Muslim country, there is scope for modest fashion.

Rabia Z is a global pioneer in the modest fashion category and has chosen Pakistan’s lucrative market as its next destination after dominating markets in the Middle East, Europe and the United States. In Pakistan, the formal launch will be held this summer. The brand plans to establish a proper retail set-up and is interested in starting production in Pakistan and then sourcing all the natural fabrics from Pakistan. It might delve into the franchise model in collaboration with some of the leading textile groups of the country. The brand already has a presence in Pakistan with the company selling its products via e-commerce.

In general, Muslim countries already spend billions of dollars on apparels and global Islamic fashion clothing is among the top three segments after halal food and Islamic finance.

Turkish textile company Birlesik Tekstil is planning to open a factory in Belgrade, Serbia by the end of this year. This was announced by Belgrade Mayor Sinisa Mali. The proposed factory will come up in the city’s Lazarevac municipality. Birlesik Tekstil has acquired a factory of insolvent local textile company Beko and is looking to appoint 600 employees by the end of 2017 and another 600 at a later stage to do business.

Serbia imports $180 million worth of textile from Turkey annually which is the reason why Serbia should attract Turkish investors here says Ljajic. Serbia plans to promote a model that involves the reconstruction of old and abandoned halls where interested investors could install machinery and immediately start production. The country’s exports to Turkey rose by 10.8 per cent to 30 billion dinars in 2016, while imports from Turkey increased 18.1 per cent to 74.3 billion dinars, according to data from Serbia’s statistical office.

Turkey’s exports to Russia declined to $1.4 billion in the first three months of 2014 from $1.7 billion in the same period of the previous year. They fell to $912 million in the first quarter of 2015 and to $353 million in the first quarter of 2016. Exports reached $498.1 million in the first quarter of this year, soaring by 40.9 per cent compared to the same period last year.

Imports from Russia to Turkey neared $6.2 billion in the first quarter of 2013 and rose to $6.7 billion in the same period of 2014. They dropped to $3.9 billion in the first quarter last year from nearly $6 billion in the same period of 2015. Imports from Russia neared $4.4 billion in the first quarter of this year with an 11.5 per cent increase compared to the same period last year.

There was also a significant increase in the amount of Turkey’s exports to Russia in apparel, boilers and machines, electric machines and motor land vehicles.