FW

Sri Lankan apparel exports may receive a significant boost through a European Union (EU) decision to permit sourcing of fabric from Indonesia, Thailand and Malaysia as the industry targets $ 5 billion in earnings this year. Sri Lanka Apparel Exporters Association (SLAEA) chairman Felix Fernando, speaking at the 35th Annual General Meeting, said the industry was ‘grateful’ and ‘delighted’ with the restoration of GSP+. Fernando urged the gathering, to maximise the use of GSP+, SLAEA with JAAF requested the Department of Commerce to explore the possibilities of identifying the possibility of making a joint request to the EU between Sri Lanka and selected ASEAN countries to agree on cross regional accumulation of fabric.

From 2004 to 2011 apparel exports grew 50 per cent but over the last six years it has stagnated following the loss of GSP+, noted Fernando, however, in July, August and September 2017 exports have been robust and it is clear that GSP+ is having an effect. Overall exports are expected to surpass the $5 billion mark for the first time due to the boost given by preferential access to the European Union, he added. As the industry will have GSP+ for the entire 2018, an additional increase is expected. Fernando also called for assistance to link Sri Lanka’s apparel industry with the fashion and import industries in Germany to boost engagement and increase exports.

As per the proposals outlined in Budget 2018, the government has realised the limitations in the domestic market and looking at positioning Sri Lanka as an export-oriented hub at the centre of the Indian Ocean. He also hailed shipping liberalisation and said the SLAEA and JAAF publicly support Finance Minister Mangala Samaraweera’s stand. Amendments to the Shop and Office Act were also praised.

On November 25th 2013, H&M released a ‘new roadmap’ designed to start implementing a fair living wage as a part of the company’s corporate social responsibility. The company’s plan is to encourage suppliers to pay employees a ‘fair living wage’ by 2018. This move would benefit around 8,50,000 garment workers. Four years down the line, from a pledge to ensure all workers in its supply chain were paid a ‘fair living wage’, H&Ms pledge is still on the anvil.

The release of the road map coincided with claims that as of 2014 the retailer would develop a pricing methodology to ensure it meets the actual cost of labour. As per the company’s manifesto for improvements to workers’ lives, the firm stated, “By doing this, we secure that we pay a price which enables our suppliers to pay their textile workers a fair living wage and reduce overtime.” However, research from the Clean Clothes Campaign reveal, average wages at H&M supplier factories in Bangladesh, Myanmar, Cambodia and India are marginally higher than national minimum wages. This has led to some claims that H&M is unlikely to fulfil its pledge to pay at least 80 per cent of its garment workers the so-called ‘fair living wage’ by 2018.

H&M certainly has the financial means to ‘walk the talk’ and has stated time and again they want to be a leader in this issue. H&M's net profit for 2016 was over $2 billion and based on calculations from the Clean Clothes Campaign, 1.9 per cent of the company’s net profit from 2016 would pay all its workers in Cambodia the additional $78 every month to receive the ‘fair living wage’.

“We have looked at the numbers and if H&M were to reallocate just one year of its annual advertising budget towards wages, they could pay their Cambodian workers a living wage for 6.5 years," said Ineke Zeldenrust of Clean Clothes Campaign.

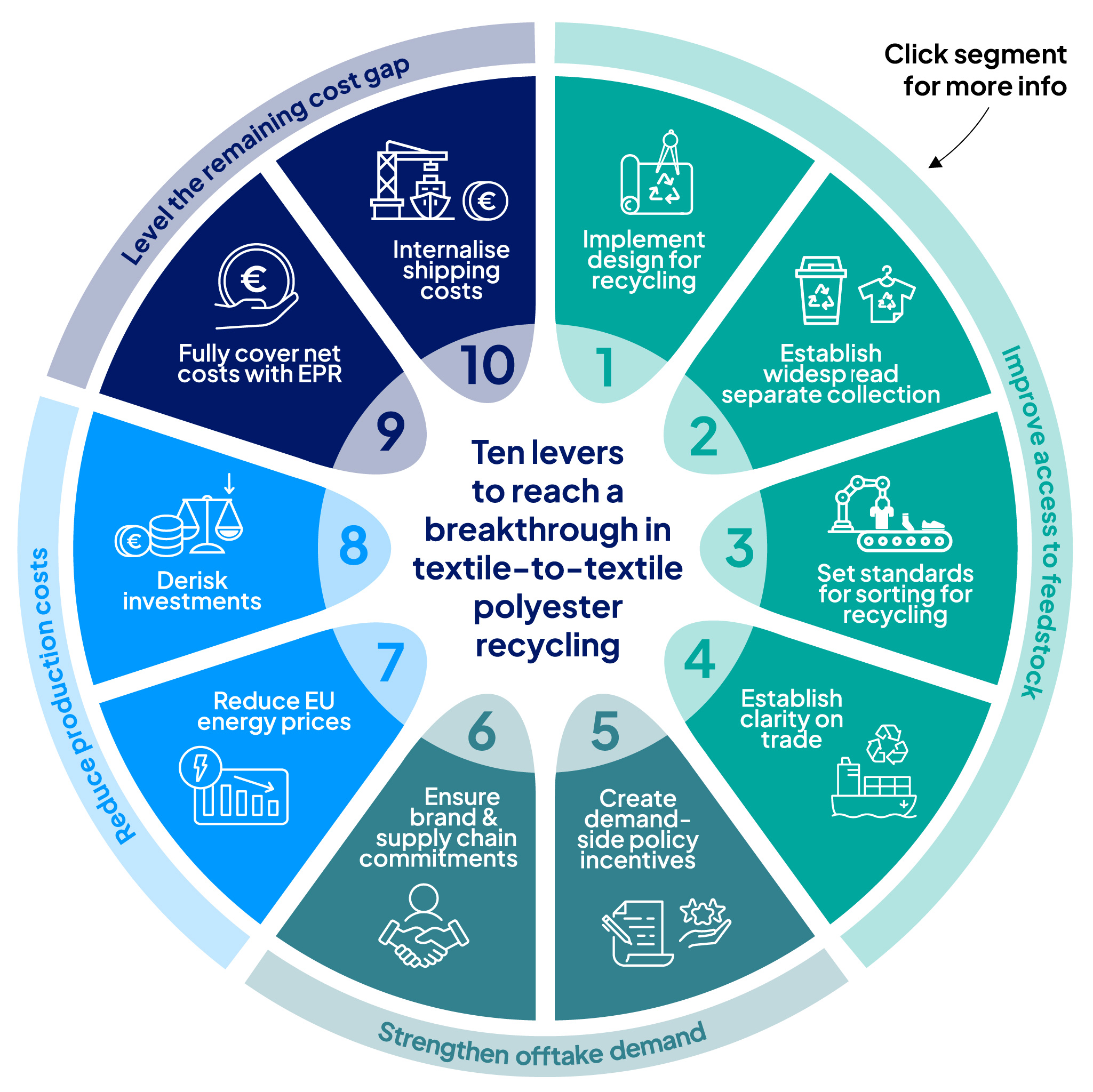

The Relooping Fashion Initiative has published a report which explains the principles of a circular economy in the textile industry. The report reveals ways to maintain the value of materials, while keeping its impact on the environment to a bare minimum. It covers repair and maintenance; re-use as a product; re-use as material and recycling related activities; and business models for post-consumer/user textiles along the entire value chain.

Relooping Fashion is of the view that different business models need to work together to ensure that a textile circular economy is effective. It further points out that new recycling technology is at the centre of this move to replace virgin materials like cotton. The ecosystem modelling sees a key role in a share system level to include retailers, suppliers, non-profit organisations and governmental departments.

Relooping Fashion said in a statement, “Collaboration is crucial, so that necessary investments can be made to scale up the actions towards a circular economy. Consumers are ready, brands are interested and several parts of the puzzle are being solved. It is our planet that can no longer wait. We hope that this report will give more courage to the growing number of stakeholders to take the necessary next steps and speed up the development of truly circular textile products available to all.”

VF Corporation is changing the leadership structure of its jeanswear portfolio for Europe, Middle East and Africa (EMEA) region. The company announced that Johan De Niel and Peter Kats have been promoted to VP, Brand Wrangler EMEA and VP, Brand Lee EMEA, respectively and created two new positions: Senior Sales Director of VF Jeanswear EMEA and Senior DTC Director of VF Jeanswear EMEA will be held by Daniel Larsson and Johan Vercammen, respectively.

De Niel and Kats will lead respective design, product, merchandising and marketing teams and will report to Massimo Ferrucci, President, VF Jeanswear EMEA, who will continue to lead the company’s Jeanswear portfolio in Europe. De Niel joined VF in 1981 and has held several leadership positions at Lee. Most recently he served as VP, Product and Marketing. Kats has spent less time at VF, having joined the company in 2013 as VP, Sales at Vans. He joined the Lee team in 2016 as VP, Sales.

Larsson, who joined VF in 2007 and previously served as Strategic Key Accounts Director at The North Face, will lead a unified team for both Lee and Wrangler across the EMEA region as Senior Sales Director of VF Jeanswear. Vercammen will be responsible for direct-to-consumer development in his new role. Vercammen joined VF in 2010 and previously served as DTC Director at Kipling.

Massimo Ferrucci says they are continuously working within the VF global organisation to draw on synergies across brand portfolio. The newly announced management structure will position VF to realise its strategic imperative across our jeanswear brands, bringing them closer to consumers and establishing an stronger foundation for the future of both brands in EMEA.

MYR, is a software that aims to simplify denim design—to reduce waste, foster collaboration and most importantly nurture creativity. MYR is a digital platform dedicated to fashion design and fashion designers, conceived by Umberto Brocchetto in collaboration with his life-long friend Valter Celato and a close-knit team of professionals and creative developers with 30 years of experience in the fashion industry in enriching fabrics such as Denim.

The software simplifies the design process, permitting visualisation of various elements, with tools that show the effects of fabrics, accessories, labels, yarns, trimmings, chemicals and prints with an archive of wash and laser effects continually updated to reflect recent market trends. This software includes technological innovations which are developed in the laundry lab and have been tested in MYR’s development centres, run with latest technologies and supported by suppliers, including chemical products, special machinery used by laundries, laser, digital printing machines, embroidery, and printing.

MYR is more than its wide array of multi-purpose tools, however, the platform facilitates communication between users and suppliers and is a place where creators and makers can meet and exchange ideas. Both users and suppliers are able to get in touch with MYR’s teams and share their feedback and their needs, fostering opportunities for bespoke denim design solutions. In addition to its industrial applications, the software is also useful in design education.

The company plans is to test 3D visualisation that will be added to the package soon. MYR will be able to dialogue with the different CAD 3D programs and they hope to open new fit categories like shirts, T-shirts, jackets etc as well as opening it to new fabric categories like RFD, wool, nylon and more.

India’s textile exports are likely to decline 10 to 12 per cent for the fiscal following the reduction in tax exemptions granted to exporters; appreciation in the Indian rupee against the dollar; and moving of import orders to competing countries. In an alarming situation, the country’s readymade garments exports, which are a part of the textiles segment, fell by 41 per cent in October to Rs 5,398 crore ($830 million) as against Rs 9,111 crore ($1.4 billion) in the corresponding month last year. Exports of manmade yarns, fabrics and made-ups also fell by 8.3 per cent to Rs 2,310 crore for October 2017 when compared to Rs 2,518 crore in the same month last year.

The country’s overall exports of locally made retail and lifestyle products have grown at CAGR of 10 per cent during FY2012-13 to FY2015-16, mainly led by bedding bath and home decor products and textiles. The government set a target for textile and garment sector exports at $45 billion for FY2017-18 as against total exports valued at $38.6 billion and $40 billion for FY2016-17 and FY2015-16, respectively.

The fall in exports of readymade garments only goes to show the country’s failure to ensure international market share, mainly when the world leader China (around 42 per cent of global market share) has closed of a number of textile units following environment issues. Indian textile exporters are working hard to fill in the gap, but unfavourable government policies with reduction in overall duty exemptions may push Indian exporters on the back burner, analysis of industry experts say.

“India’s overall textiles exports are likely to decline by at least 10-15 per cent this year due to the reduction in overall tax exemptions. While the government has increased the Merchandise Exports from India Scheme (MEIS), the Remission of State Levies (RoSL) remains far below our recommendations. Unfortunately, the government did not consider central tax rebate at all. Overall, textile exporters are witnessing a shortfall of 2.7 per cent in incentives now compared to the pre-Goods and Services Tax (GST) era. Also, appreciation in the rupee has hit exporters’ receivables,” explains Ashok Rajani, chairman, Apparel Exports Promotion Council (AEPC).

Siyaram Silk Mills (SSML), reported good numbers on an operational basis in for Q2FY18. EBITDA margins expanded by 270 bps to 15.2 per cent, following lower raw material cost (down 592 bps y-o-y to 43.1 per cent of sales. Revenue was flat at Rs 423 crore, showing slow pick-up in consumer demand (following GST). Good operational performance and lower interest cost (down 23 per cent to Rs 7 crore) resulted in net profit growth of 19 per cent to Rs 31 crore.

As of Sept’17 SSML’s debt stood at Rs 435 crore. SSML has launched various brands from value for money (Siyaram’s, Mistair, Oxemberg, MSD) to premium brands (J Hampstead, Cadini, Zenesis, Moretti and Royale Linen).

SSML has been focusing on brand building exercise, which is expected to ensure high brand recall and help demand. Contribution of readymade garments business is expected to increase to 27 per cent in FY19E vs 21 per cent in FY17. Increasing focus on premium brands and high margin readymade garments segment is likely to bode well for the company.

Apparel exporters gained over others in during Q2 of this financial year. KPR Mill, Kitex Garments and Gokaldas Exports, where exports are the mainstay of their business, have seen revenue/profit improving or steady over both the June quarter (Q1), which was just before GST, as well as Q2. Raymond recorded profits of Rs 62 crore when compared to a net loss of Rs 7 crore in the pre-GST quarter of April-June. On the other hand, Page Industries and Arvind, whose garment business is equally focused on the domestic market, felt the impact of GST rollout of 28 per cent on branded apparel, with their Q2 bottom line declining over Q1 this year.

Analysts say there was slightly reduced domestic demand in the month post GST, despite a marginal rise in export. Wazir Advisors says sales for exporters had increased with a rise in capacities and utilisation of specific companies (KPR, Kitex and Gokaldas). KPR Mill saw its garment production increase year-on-year from 30.48 million units in Q2 last year to 39.41 million this year. As Prashant Agarwal, Joint MD, Wazir Advisors points out India’s apparel export to the US grew 6 per cent in Q2 from a year ago. However, for overall top textile players, consolidated sales fell by five per cent and EBITDA margins fell by an average of four per cent. Ebitda margin remained the same or fell for most companies. A rise in net profit of some, such as Raymond, Kitex and Gokaldas Exports, was largely due to higher other income. While KPR Mill posted growth in net profit from Rs 62.8 crore in Q2 last year to Rs 63.2 crore this time, Kitex Garments rose from Rs 13.1 crore to Rs 24.1 crore.

The recently concluded 19th edition of the Performance Days trade fair for functional fabrics and sport accessories has achieved new top ratings in all areas, say the organisers. “The halls of the MTC were filled to maximum capacity and recorded significantly more visitors than the previous fair last April and even more than the fair in November 2016,” they report.

Performance Days is the functional fabric fair for the sourcing of fabrics and accessories in functionnal sports, work- and corporate wear as well as sportive fashion. The number of trade visitors rose from 1,868 in November 2016, to 2,001 breaking the 2,000 mark for the first time. This growth records a 7.1 per cent increase as against the previous year, the number of exhibitors was also greater in autumn 2017, registering a 9.9 per cent increase.

A total 177 exhibitors from 23 countries filled all of the halls to capacity, confirming the decision to relocate to the halls of Messe München, which is scheduled for November 2018. “Even now, shortly after opening the exhibitor registration period, demand is already higher than the number of available spaces,” say organisers.

Next Performance Days to be held from November 28-29, 2018, will be celebrating its 10th anniversary. It will also be the first edition of Performance Days at the new location. In the future, one of the large halls on the exhibition grounds in Munich-Riem will be provided twice a year for functional fabrics.

For one last time at MTC Munich, there will be a ‘farewell event’ from April 18-19, 2018. All latest trends for Kick Off Sommer 2020 and Update Winter 2019/20, plus the Focus Topic in addition to the Performance Forum and the coveted awards will be presented. All the highlights and important information like the presentations, as well as all the fabrics at the Forum will be available online. Samples of all featured Performance Forum fabrics can also be ordered online.

LVMH, the world’s biggest luxury goods company, will do “a bit better” in 2018 than this year, the group’s managing director disclosed recently. In October, the group, which owns fashion brands such as Louis Vuitton, Christian Dior and Moet & Chandon champagne and Hennessy cognac - reported a higher-than-expected 12 per cent rise in like-for-like sales during Q3 of 2017. Revenues were £26.89 billion. “I think that in 2018 (LVMH) will do a bit better than in 2017,” disclosed Antonio Belloni on the side lines of the opening of the group’s first vocational training programme in Italy, in Florence.

Belloni said the group, which has invested €150 million in Italy this year, would “continue with this trend”, adding it had just bought a former furnace just outside Florence, close to where the group already produces high-end accessories for its brand Fendi.