FW

The global fiber sector is in a state of volatility with considerable ups and downs, significant overcapacity in a number of fiber segments and the backlash from slowing global demand at retail. The fiber market is in need of greater transparency and improvements along the textile value chain. Though synthetic fiber growth is up, and cellulosic fibers are enjoying strong growth, polyester saw the slowest growth in 80 years, and natural fibers are stagnating.

There is a global shift towards manmade fibers while natural fibers, mainly cotton, have lost market share. Manmade fibers occupy 70 per cent of the global fiber market versus 55 per cent some ten years ago, and this trend may continue for years. Between 2006 and 2016, synthetics occupied 51 per cent of the global market share, and now that number is 64 per cent.

When it comes to cellulosics in particular, like lyocell, the fibers have seen above average production growth of six per cent. China has lifted its volume of stable fibers by two per cent, due only to gains in manmade fibers. In India, output advanced two per cent thanks to increases in all categories. Bangladesh is fully focused on cotton products and as of today is not able to supply manmade products. But in time manmade fibers may have a growing share in Bangladesh.

North Korea exported about $725 million worth of clothing last year, according to South Korea’s trade-promotion agency, making it a significant source of income for the cash-strapped country. With the United Nations Security Council prohibiting North Korea from exporting labour and textiles, things will turn bad for the textile industry and more so for workers. As per economists, the country will be lose revenues to the tune of $800 million.

North Korea does not export fabrics instead produces labour-intensive articles of clothing, essentially it would be a garment ban that the country would face in times to come. Countering the decision, Paul Tjia, a Dutch consultant who helps businesses operate in North Korea, especially in the garment industry, said when you make simple clothes like T-shirts, the machinery is important. The labour is not so important, so it makes no sense to do things like this in North Korea. But for garments that require a lot of manual work, like bras or winter sports clothes, it makes a lot of sense to make those in North Korea because the price-to-quality ratio is very attractive.

It’s a known fact that all of North Korean-made clothes are exported through China, the onus lies on Beijing to enforce it. As Andray Abrahamian, a visiting scholar at University of California at Berkeley’s Center for Korean Studies, says if a container coming from North Korea says it contains sweet potatoes, is the Chinese customs department going to crack it open to check that it does not contain underpants? If Beijing is serious about stopping North Korea’s exports of apparel and workers to sew garments in Chinese factories, it would have a significant impact on the North’s economy. The reason this is important is not only because apparel exports are a significant number but because it’s the one non-resource area that’s really growing.

Six major fashion brands have joined the SBTI, which seeks to reduce greenhouse gas emissions and bring global warming to below 2°C. The SBTI now has over 300 companies signed up to the initiative, and claims the fashion brands have the potential to reduce their 750 million tonnes of emissions per year, in line with the goals of Paris agreement.

So far, the fashion brands to have completed their targets are: Kering and Marks & Spencer. Kering commits to reduce emissions from upstream transportation and distribution, business air travel, and fuel and energy use by 50 per cent per unit of value added by 2025, from a 2015 base-year. The company says it is also committed to curb emissions from purchased goods and services by 40 per cent per unit of value added within the same timeframe.

Marks & Spencer has committed to reduce emissions from operations by 80 per cent by 2030, and has a longer-term vision to achieve 90 per cent emissions reductions by 2035, from a 2007 base-year. In addition, the company commits to reduce value chain emissions by 13.3 megatonnes of CO2 between 2017 and 2030. According to SBTI scientists identifying the reduction goal in line with a notion of keeping global temperature increases below 2°C. 71 of over 300 SBTI companies have already had their targets independently verified.

Cynthia Cummis, Member of the Science Based Targets Initiative steering committee says the fashion industry is known for innovation and these companies are using that spirit to tackle climate change. Setting ambitious value chain targets will open up a great deal of opportunity for collaboration, innovation and efficiency across the industry.

UN Global Compact chief of programmes, Lila Karbassi adds more and more companies see the advantages of setting science-based targets, the transition towards a low-carbon economy is becoming a reality. Businesses now working towards ambitious targets are seeing benefits like increased innovation, cost savings, improved investor confidence and reduced regulatory uncertainty.

Fashion group Esprit’s full-year profit saw a threefold rise. The Europe-focused clothing retailer is undergoing a multi-year revamp that includes store closures, trimming operating costs, price adjustments, new return policies, and technology and distribution upgrades.

The company expects controlled retail space to shrink by single digits in percentage terms in the new financial year, while revenue is seen falling marginally.

Growth is expected only progressively as the group still faces a downsizing process in its wholesale and retail space as loss-making retail stores still need to be closed. However, the retailer forecasts an improvement in gross profit margin as it continues to cut down on discounts and promotions. Operating expenses are expected to come down by single digits in percentage terms. Shares of Esprit have fallen more than 20 per cent so far this year.

Esprit earns the bulk of its revenues in Europe. Its largest market is Germany. It feels the operating environment appears challenging amid volatile financial markets and economic uncertainty that might dampen consumer sentiment. The company remains confident of heading in the right direction and is laying the necessary foundation to restore competitiveness and long term growth. Esprit offers high quality fashion for men, women and children as well as the latest fashion accessories and furnishings.

Cotton importers in Bangladesh are facing problems due to port congestion. Spinners import cotton from India, the US, African countries and many other countries, and they have to wait for eight to 10 days for the cotton to be released from the port. Cotton is an essential raw material for the garment sector, the country’s main export earner.

Even six months ago the spinners could get the cotton from the port within three days. The longer waiting time at the port means paying fees as berthing charges. And the fees have increased the cost of doing business. In such a scenario, importers are bringing in more raw cotton than they need at present and stockpiling them at warehouses.

The problem has arisen because two gantry cranes at the Chittagong port have broken down. Repair might take six to seven months. Bangladesh is the world’s biggest cotton importer. In 2016, Bangladesh imported 6.5 million bales of cotton. Bangladesh's cotton imports will creep up to 7.1 million bales in 2017-18. Cotton growers in Bangladesh can only supply less than three per cent of the yearly demand. The 430 local spinning mills can supply nearly 90 per cent of the yarn for the knitwear sector and 40 per cent of the fabrics needed by the woven sector.

Bangladesh will remain the top apparel sourcing hotspot for international retailers and brands over the next five years followed by Ethiopia, Myanmar, Vietnam and India.

Being the second largest apparel exporter worldwide after China, Bangladesh exported garments worth $28.14 billion in the last fiscal year, registering 0.20 per cent year-on-year growth. However, with higher demand from retailers and brands, garment exports rebounded again and grew at 14.05 per cent year-on-year in the first two months of the current fiscal year.

The garment sector has improved workplace safety and other compliances after fixing the structural, electrical and fire loopholes. But it still needs to ensure shorter lead times, high standards of compliance, higher productivity and capacity at factory level and competitive prices for remaining the top choice of retailers and brands.

In addition Bangladesh needs to keep an eye on emerging competitors like Ethiopia and Myanmar since they are also coming up with big growth potential. Ethiopia is not a major competitor now. But it could pose a big challenge for Bangladesh in the future as it is receiving a lot of foreign direct investment for producing low-cost basic garment items. Also, while China appears to have passed its zenith as a low-cost sourcing country, it would remain indispensable because of its bigger export value.

The ongoing Avantex in Paris being held from September 18 to 21, 2017 is keeping its focus on high-tech fabrics. Believing that technology should not only enhance fashion, but that it should also serve the consumer, the textile fair attracts over 19,500 exhibitors and 4,77,000 visitors a year. Global fashion tech community gathers here every year to get connected and build relationships.

Avantex Paris’ innovative exhibitors are selected by the trade fair’s committee who are on the lookout for at least three innovative functions and/or unpublished patents from the applicants. Exhibitors highlight intelligent, connected fabrics and materials which combine nanotechnology.

Conquering new markets and leading a new revolution, Avantex Paris is now in its fifth session. The vision is to unite high-tech companies with fashion product designers and managers. The trends forum highlights textile production and know-how. A figurative assembly line illustrates the integration of innovative and futuristic materials into everyday technical consumption.

Among the showpieces are a revolutionary process that enables stylists and designers to test and place patterns on a product in 3D; a line of women’s ready-to-wear that uses textiles made from plant fibers and 100 per cent cruelty-free leather; and sensors that are integrated in fabrics to measure anxiety.

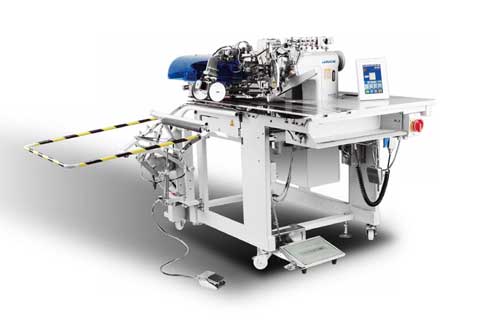

CISMA will be held in China, September 26 to 29, 2017. This is the world’s largest professional sewing equipment exhibition covering embroidery machines, spare parts, electronic control and other parts.

CISMA 2017 will have ten pavilions and an exhibition area of more than 1,10,000 square meters. It will display new developments in the sewing machinery industry in the world, new features and new trends in technology.

Over time the sewing machinery industry has continued to expand from clothing, shoes and hats, bags, furniture, home textiles and other traditional industries to automotives, construction, decoration, sports and cultural goods, industrial textiles as well as aerospace and other fields.

In addition, the industry has undergone a professional, personalized, precise product segmentation and service upgrade so that the connotation of sewing machinery products has changed radically.

CISMA will provide a one-stop business experience platform. The layout of the exhibition hall will be based on product category, the actual development of the industry and the entire industry chain. The exhibition will display different types and models of machines, differentiated brands, and distinctive products.

The sewing machine industry, after a sustained downturn, is once again facing a market demand, a huge customer base and is ready with innovation, thriving enterprises and exciting products.

Shima Seiki will exhibit at the China International Sewing Machinery and Accessories Show (CISMA 2017), September 26 to 29, 2017.

On display will be Shima Cutting Solutions, a fully integrated cutting system that incorporates the P-CAM182 multi-ply computerised cutting machine, the P-SPR2-16 fabric spreading machine, and the P-LAB16 automated labeling machine.

In addition, Shima Seiki will introduce new, updated PGM software on its 3D design system SDS-ONE APEX3. Applications of CAD/CAM systems for supporting areas other than fashion such as automotive and industrial textiles will also be shown.

Shima Seiki is a Japanese textile machine manufacturer.

APEX3 is also at the core of Shima Seiki’s Total Fashion System and is capable of realistic simulation that allows for virtual sampling, minimising the need for costly, time- and resource-consuming sample-making in a variety of industries such as circular knitting, flat knitting, weaving, pile weaving and printing.

Also featured will be knitwear produced on Shima Seiki’s latest line of computerised knitting machines. The new i-Plating option on the SVR SP-type computerised knitting machine, combined with sinker patterns produced with the patented moveable sinker system as well as inlay patterns using loop pressers, makes possible a whole new world of patterning. Hybrid knit-weave fabrics produced on the SRY-series computerised knitting machine will also be shown.

CISMA is a sewing machinery exhibition.

"Deloitte recently published a report on millennials and their attitudes and purchase motivations in the luxury market. ‘Bling it on: What makes a millennial spend more’ reported American millennials trailed far behind the other markets in their purchases of high-end fashion or luxury goods. Over one-fourth of the American millennials report no luxury purchases of $500 or more in the last 12 months, whereas the survey average was only 16 per cent."

Deloitte recently published a report on millennials and their attitudes and purchase motivations in the luxury market. ‘Bling it on: What makes a millennial spend more’ reported American millennials trailed far behind the other markets in their purchases of high-end fashion or luxury goods. Over one-fourth of the American millennials report no luxury purchases of $500 or more in the last 12 months, whereas the survey average was only 16 per cent. If 26 per cent of millennials who are interested in luxury goods haven’t purchased any recently, which was reported by the Bain Luxury Study, it certainly doesn’t go down well for the future of luxury brands in the US, which is the world’s largest luxury market. Credit Suisse reports that there are 13.6 million American adults with a net worth above $1 million. That is over 40 per cent of the world’s millionaires and more than the next eight countries combined.

Millennials, informed buyers

The survey points out that this generation, thanks to the internet and how it has uncovered the ‘smoke and mirrors’ on which the allure of luxury brands is based, are discovering they can acquire luxury-quality goods at significantly lower prices. Today, status symbols as represented by luxury brands don’t have the same meaning for millennials. They still value status, but for them it is status defined by who they are and what they have achieved, not how much money they spent buying some overly-expensive luxury brand. Luxury is a state of mind, not a brand or a price point. Millennials still want luxury, but luxury that is consistent with their personal values.

As a result, a gap is growing between what the customers believe luxury to be and what the industry thinks it is, as discovered in the most recent ‘State of Luxury’ study conducted by Unity Marketing and Luxury Daily. There is an opportunity for luxury brands to re-examine their roots and rethink their offerings and messaging to reflect what the consumer is looking for.

Shifts in the demography and mindset of today’s luxury consumers has brought about profound changes in the way they shop and buy and how luxury fits into their lifestyle. Not to mention new competitors are fast and furiously emerging which are not bound by the traditions prevalent in the luxury industry, and which hamper established brands in this increasingly disrupted luxury market.

Ways for luxury brands to get their mojo

The Deloitte study highlights it is no accident that most successful challenger brands in the industry have their roots in digital and/or social media marketing aimed at millennial consumers. This calls on luxury brands to downplay the negative connotations associated with luxury and play up the positive attributes of luxury in brand new style and through brand new mediums. Brands must find ways to make their luxury relevant to millennials, not just using luxury as a label they should aspire to own but to convey true meaning and value to the customers.

Secondly, the great challenge for brand owners seeking to capture millennials is how to communicate to a generation with shifting preferences and loose brand loyalties, and for whom no single channel appears to predominate. Yet amid this apparent uncertainty, one factor that plays a role in almost every aspect of millennial consumption is the rise of online. The internet has pulled back the curtain of the luxury industry and the brands that participate there. It has changed how customers get information and how they make decisions. A powerful e-commerce presence is no longer optional for luxury brands. But Deloitte report stresses that online sales alone do not capture the full significance of the rise of online interaction.

Further, Deloitte found millennials don’t have brand loyalty that previous generations had. Nearly, 36 per cent, say they will buy what they like regardless of brand. They are more than willing to pay attention to brands with new stories to tell that are more aligned with their personal values and the values of their social circle. This is how new emerging luxury brands have gained traction with this generation. These challenger brands talk to the millennials in ways that are more meaningful and valuable to them.

In conclusion, a rising tide of millennial wealth could result in a new luxury boom starting in the middle of the next decade, but only if brands meet this new generation with luxuries that reflect their values and world view. However, if luxury brands keep doing what they’ve always done, putting status before substance, they will miss the mark. The world has changed and luxury brands must change with it.