The stock of Siyaram Silk Mills has jumped 23 per cent in the past three months, a rise that can be attributed to catching up of valuation.

Siyaram is a fabric-to-readymade garment manufacturer.

Even after the sharp run-up in the stock price, it is still trading at 13 times its earnings multiple, when it should trade in the price-to-earnings multiple range of 18 to 20, given its strong financials.

In the past five years, the company has demonstrated a steady 10 to 15 per cent sales growth, consistent operating margin of 12 to 13 per cent, and return on equity of around 20 per cent. Besides it has regularly paid dividends.

Such consistent financial performance can be attributed to a shift in Siyaram’s model over the past few years, which has helped the company move up the textile value chain. From being a pure fabric manufacturer, the company stepped into manufacturing of readymade garments with brands such as Oxemberg and J Hampstead.

At present, its readymade garment segment contributes 16 per cent to the company’s total revenues from 10 per cent in financial year ’11. In the same period, the company’s revenues share from the fabric segment fell to 75 per cent in financial year ’15.

Siyaram stock up 23 per cent

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

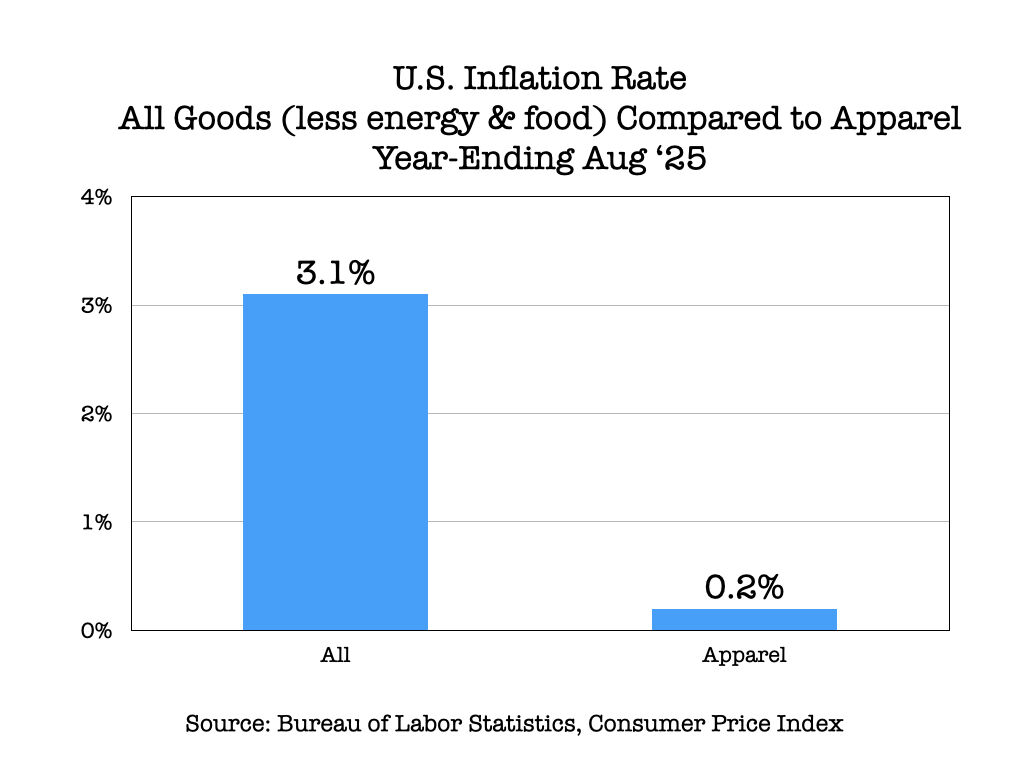

US apparel prices show muted growth, but a shift may be underway

The latest data from the Bureau of Labor Statistics (BLS) indicates that while overall US inflation remains high, the apparel... Read more

Clothes don’t last forever, debunking the surplus garment narrative

For years, a statement has been echoed across fashion panels, sustainability forums, and viral social media posts: “We already have... Read more

EU’s landmark EPR law to revolutionize fashion industry, focus on textile waste …

The European Union has officially adopted its highly anticipated Extended Producer Responsibility (EPR) law for textiles, a groundbreaking measure that... Read more

New EU EPR rules shake up global textile industry

A major shift in European Union policy is set to redefine the global apparel and textile landscape. The EU is... Read more

From Tariffs to Textiles: Dornbirn GFC highlights strains and solutions in globa…

The just concluded annual Global Fibre Conference in Dornbirn put forth a complex picture of the synthetic fibre industry. While... Read more

The end of de minimis, small businesses face a trade shock in America

When the US government moved to terminate the long-standing de minimis exemption, the duty-free threshold for low-value imports, it sent... Read more

Rise of Regional Fashion: BRICS+ Summit signals shift in global fashion power

The recently concluded BRICS+ Fashion Summit in Moscow was more than just a series of runway shows; it was a... Read more

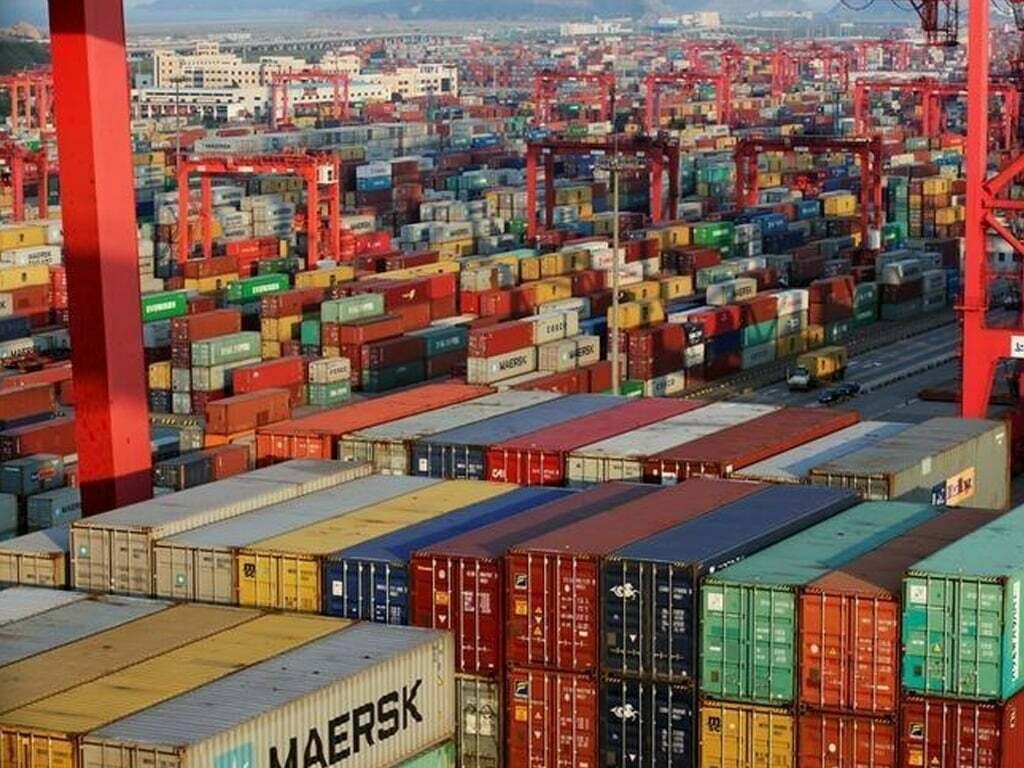

Nomura Report: Asian exporters absorb tariffs, rethink supply chains

As global trade enters a period of recalibration, Asian exporters are bearing the brunt of escalating US tariffs while simultaneously... Read more

The Soul of Style: BRICS+ Fashion Summit weaves a new narrative of ‘Culture, Cra…

In a world where fast fashion often dominates, a different conversation took center stage in Moscow. The recently concluded BRICS+... Read more

Fashion's New Fit: Tailoring and alteration services stitch a story of growth

From the runways of Paris to the digital storefronts of global e-commerce, the fashion industry is changing. As consumers increasingly... Read more