Textile producers in Kenya want EPZ firms to be barred from selling their products tax-free in the local market since it poses unfair competition to non-EPZ firms. EPZ firms in Kenya are permitted to offload 20 per cent of their annual production duty-and-VAT free in the domestic market.

Non-EPZ manufacturers find it difficult to compete with the highly incentivised products from EPZ manufacturers. Among other incentives, firms operating under EPZ enjoy a 10-year corporate income tax holiday and a 25 per cent tax rate for a further ten years thereafter, a ten year withholding tax holiday on dividends and exemption from VAT and import duty.

These incentives are not available to other manufacturers who have to pay corporate taxes at the standard rate of 30 per cent and VAT at 16 per cent. Exports of non-EPZ firms to East African Community markets have fallen. EPZ-based manufacturers employ 52,000 people while the local sector directly employs about 21,000 people in the formal sector and more than 30,000 informally.

Illicit trade is a major threat to the textile and apparel market in Kenya. One suggestion for combating illicit trade is by introducing a blanket taxation for 20-foot containers and 40-foot containers of textile and apparel products.

Kenyan textile units want a bar on EPZ firms

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

CMAI FAB Show 2024 wraps up successfully, boosting textile industry

The Fabrics, Accessories & Beyond Show 2024 (FAB Show 2024), organized by the Clothing Manufacturers Association of India (CMAI), concluded... Read more

US retail sales on the rise, but fashion sector growth murky

American consumers are opening their wallets again, with retail sales experiencing a modest uptick in recent months. According to the... Read more

The Fast Fashion Conundrum: Profits soaring, sustainability stalling

The story of Shein's soaring profits in 2023 presents a fascinating paradox. While a growing number of consumers, particularly millennials... Read more

Wall Street and the Seduction of Sexy Calvin Klein Ads: Hype or performance boos…

The recent Calvin Klein campaign featuring Jeremy Allen White in his skivvies has set the fashion world abuzz. But can... Read more

Looming Iran-Israel conflict threatens to unravel global apparel trade

The already fragile global garment industry faces fresh challenges as tensions escalate between Iran and Israel. This adds another layer... Read more

Fabric Stock Services: A rising trend but not a replacement

The fashion industry is notorious for waste. Unsold garments and excess fabric often end up in landfills. Fabric stock services... Read more

CMAI’s FAB Show 2024 inaugurated with industry giants

The 4th edition of the Fabrics Accessories & Beyond Show 2024 (FAB Show), hosted by the Clothing Manufacturers Association of... Read more

Asian Apparel Exports: A tale of four tigers, one lagging behind

The apparel industry in Asia presents a fascinating picture of contrasting fortunes. While Bangladesh, Vietnam, and Sri Lanka have seen... Read more

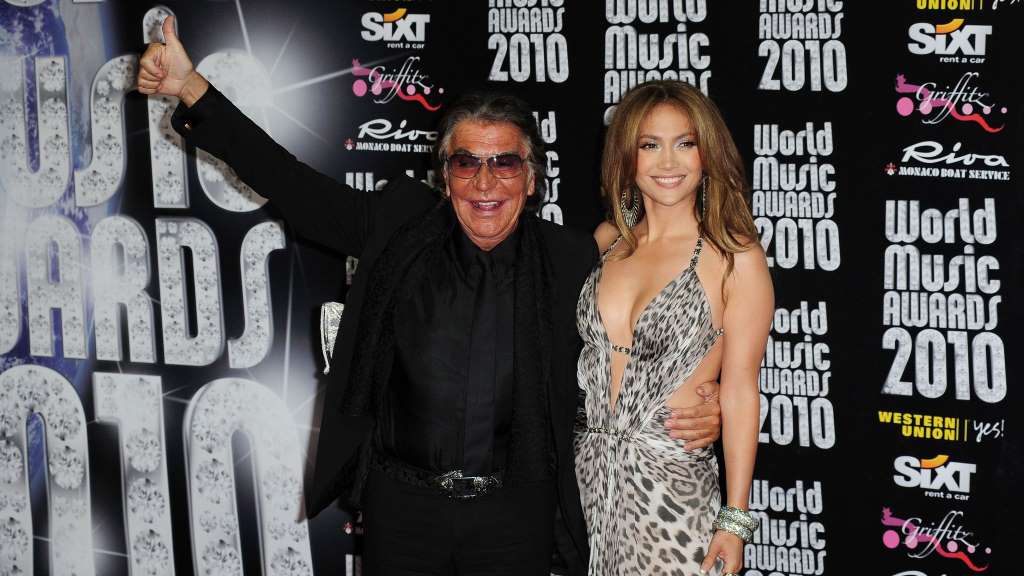

Roberto Cavalli: A legacy of bold prints and unbridled glamour

Roberto Cavalli, the iconic Italian designer who passed away on April 12, 2024, leaves behind a rich legacy. Cavalli was... Read more

Candiani & Madh unveil first regenerative cotton jeans

In a move towards sustainable fashion, Swedish denim brand Madh has partnered with Italian producer Candiani Denim to introduce the... Read more