"As per CMAI's annual Apparel Index for FY2018-19, research conducted by DFU Publications on Indian apparel industry reveals, growth has been falling continuously for the past five years. In fact, except the first quarter of FY2018-19, the index values were much lower than comparable quarters in previous fiscal (FY2017-18). The Annual Index value of FY 2018-19 dipped to 1.71, the lowest ever in five years. Comparatively, the Annual Index in FY-2017-18 was 2.56; in FY-2016-17 it was 3.43 points similarly in FY-2015-16 it was 5.32 points and in FY-2014-15 it was 7.28 points."

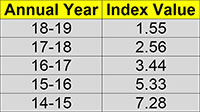

As per CMAI's annual Apparel Index for FY2018-19, research conducted by DFU Publications on Indian apparel industry reveals, growth has been falling continuously for the past five years. In fact, except the first quarter of FY2018-19, the index values were much lower than comparable quarters in previous fiscal (FY2017-18). The Annual Index value of FY 2018-19 dipped to 1.71, the lowest ever in five years. Comparatively, the Annual Index in FY-2017-18 was 2.56; in FY-2016-17 it was 3.43 points similarly in FY-2015-16 it was 5.32 points and in FY-2014-15 it was 7.28 points. In fact, the index has been continuously falling over the years. FY2018-19 was marked by low business sentiment even during the festive season, perceived as the best time to make up for turnover losses, as buying is high at that time of year.

As per CMAI's annual Apparel Index for FY2018-19, research conducted by DFU Publications on Indian apparel industry reveals, growth has been falling continuously for the past five years. In fact, except the first quarter of FY2018-19, the index values were much lower than comparable quarters in previous fiscal (FY2017-18). The Annual Index value of FY 2018-19 dipped to 1.71, the lowest ever in five years. Comparatively, the Annual Index in FY-2017-18 was 2.56; in FY-2016-17 it was 3.43 points similarly in FY-2015-16 it was 5.32 points and in FY-2014-15 it was 7.28 points. In fact, the index has been continuously falling over the years. FY2018-19 was marked by low business sentiment even during the festive season, perceived as the best time to make up for turnover losses, as buying is high at that time of year.

The onus for fall in the last three years could be attributed to demonetization and the implementation of GST which have disrupted market sentiment and overall growth and the market has not yet recovered from their effects.

Q4 index growth dips across brand groups

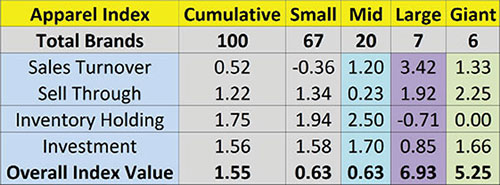

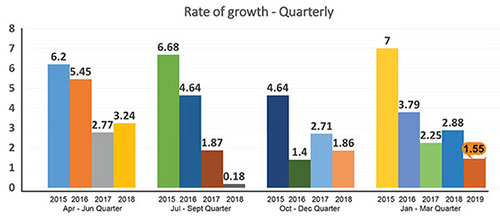

In the fourth quarter, CMAI's Apparel Index touched 1.55 points a clear reflection of low growth compared to previous quarter. In fact, Q4 (Jan-Mar FY 2018 -19) figures are lower than previous quarter’s 1.87. Like earlier, small brands sales dipped this quarter, and Giant brands at 5.25 points reported a drop in growth, compared to last quarter’s index figure of 6.00 and Q2s (July-Sept FY 2018 -19) impressive growth of 8.36. Except Large brands skyrocketing growth from 2.06 points in previous quarter to 6.93 points in Q4, all other brand groups reported a dip over last quarter.

previous quarter. In fact, Q4 (Jan-Mar FY 2018 -19) figures are lower than previous quarter’s 1.87. Like earlier, small brands sales dipped this quarter, and Giant brands at 5.25 points reported a drop in growth, compared to last quarter’s index figure of 6.00 and Q2s (July-Sept FY 2018 -19) impressive growth of 8.36. Except Large brands skyrocketing growth from 2.06 points in previous quarter to 6.93 points in Q4, all other brand groups reported a dip over last quarter.

CMAl's Q4 Apparel Index recorded a growth of 1.55 points, which is almost 2.5 times higher than the Index for Small brands (turnovers of Rs 10 to 25 crores) and Mid brands (turnover of Rs 25-100 crores) both at 0.63 points each. Large brands growth at 6.93 points, almost 4.5 times that of overall Index was the highest; at 5.25 points Giant brands’ growth is 3.38 times that of overall Index. In fact, this quarter it is the Large brands which recorded better growth. And, even though Giant brand’s rate of growth this quarter is much higher than others it is not as high as last quarter. At 1.55 points, overall Q4 index is lower than previous quarter’s Q3 Index at 1.86 points.

While Big brands (Mid, Large and Giant together) have grown at 6.08 points, much more than 3.52 points of previous quarter, individually Small and Mid brands dipped badly both to 0.63 from their previous quarter index values. Giant brands too have lost growth at 5.25 from 6.00 points previously. Only Large brands have pushed ahead to reach 6.93 (over three times) from their previous quarter’s 2.06 points.

Giant brands lost their highest growing group position to Large brands this quarter, however, both groups are still leading, outgrowing recessionary trends. Mid brands join Small brands this quarter failing to manage even moderate growth. Overall growth Index has been pulled down by these brand groups.

If Sales Turnover was to be considered as the only parameter for determining Apparel Index, this quarter then overall Index would have reflected a growth of 0.52 which is higher than previous quarter’s 0.88.

Sales Turnover down as Inventory Holding goes up

Cumulative Sales Turnover in Q4 is 0.52 a figure that is much lesser than that Q3’s 0.88. Around 39 per cent brands reported an increase in Sales Turnover this quarter compared to 48 per cent in previous quarter. “The decrease in sales turnover was mainly due to a slowdown in business due to a slowdown in the market post-Diwali. There was a substantial decrease in demand also,” explains Paresh Dedhia, Owner, Dare Jeans. On the contrary French menswear brand Celio reported positive sales turnover as Satyen Momaya, CEO, Celio points out, “The increase in sales turnover was due to our quality and we worked on an auto replenish model across our channels.” Similarly, lifestyle brand Monte Carlo gave a positive feedback as Mayank Jain, General Manager for the brand explained, “The reason for an increase in the sales turnover is we had a strong and good winter. Weather conditions were good and winter lasted for a longer period.” Adds Shitanshu Jhunjhunwala, Director, Turtle, “The increase in sales turnover was due to better work allocation. We had better sizes and availability of these sizes.”

brands reported an increase in Sales Turnover this quarter compared to 48 per cent in previous quarter. “The decrease in sales turnover was mainly due to a slowdown in business due to a slowdown in the market post-Diwali. There was a substantial decrease in demand also,” explains Paresh Dedhia, Owner, Dare Jeans. On the contrary French menswear brand Celio reported positive sales turnover as Satyen Momaya, CEO, Celio points out, “The increase in sales turnover was due to our quality and we worked on an auto replenish model across our channels.” Similarly, lifestyle brand Monte Carlo gave a positive feedback as Mayank Jain, General Manager for the brand explained, “The reason for an increase in the sales turnover is we had a strong and good winter. Weather conditions were good and winter lasted for a longer period.” Adds Shitanshu Jhunjhunwala, Director, Turtle, “The increase in sales turnover was due to better work allocation. We had better sizes and availability of these sizes.”

Almost 25 per cent brands reported a loss in Sales Turnover compared to 26 per cent in previous quarter. Except Large and Giant brands, other two groups this time reported sales losses. “The reason for the decrease in sales turnover was mainly due to closure of our stores,” observes Shyam, President 109° F.

Sell Through recorded an Index growth of 1.22 this quarter compared to 0.96 of previous quarter, still showing pressure on fresh good sales. Maximum growth in Sell Through was reported by Giant brands. Mid brands however, clocked in the lowest value of 0.23. As Shyam opines “The main reason for decrease in sell through is the online business has taken over a lot and has hampered business. It has actually killed it.”

Nearly 49 per cent brands reported an improvement in Sell Through, higher than 46 in Q3. “The major reason for an increase in sell through is the discounts given by brands before season and comparative price of the product. Imports from China is also a factor,” opines Rakesh Jain, CEO, Miss Grace.

Inventory Holding in Q4 is 1.75 points, this is higher than 1.6 points in Q3. Almost 61 per cent respondents across brands said their Inventory Holding moved north this quarter higher than 58 per cent in Q3, a very high number and they were responsible for pulling down overall apparel index value. Increase in Inventory Holding impacts overall index negatively. Higher Inventory Holding indicates more stocks in warehouses or shop shelves. Maximum increase in Inventory Holding was among Mid brands causing low index value; Giant brands on the other hand showed zero change in Inventory Holding. As Deepak Singhla, Marketing Head of Cantabil says “The decrease in inventory holding was because there was an increase in sale. Stock also sold off easily as well.” Agreeing on this point Jain says “Inventory holding decreased as store level sales have gone up, hence, there was no dead stock.”

However as per Momaya, “Inventory holding has actually not increased but has moved. There was more productivity and hence, inventory holding has gone down due to replenishment schemes.” However, Dedhia points out, “Increase in sales turnover and increase in inventory goes hand in hand. Payment cycles have stretched. There is less rotation of funds in the market.”

Investments, however, are low for the overall apparel segment, fresh Investments decreased to nearly 1.56 points, as against 1.62 points last quarter. Highest investments were done by Mid brands followed by Giant brands. Overall nearly 73 per cent respondents reported a rise in investments which is lower than 81 per cent in previous quarter. High investments in last quarter indicate most brands had to invest to manage albeit small growth which means growth is not coming easily.

An average outlook for next quarter

Around 58 per cent (last quarter 52 per cent) brands say the outlook for next quarter is ‘Average’. Generally, Q1 of the new fiscal, should be better as fresh summer sales picks up and prior to EOSS in July. However, there is no such excitement as the market has still not recovered from the earlier slowdown. Another factor could possibly be the Lok Sabh elections in Q2 this year which may have resulted in tepid response.

CMAl’s Apparel Index

CMAl’s Apparel Index aims to set a benchmark for the entire domestic apparel industry and helps brands in taking informed business decisions. For investors, industry players, stakeholders and policymakers the index is a useful tool offering concrete and credible information, and is an excellent source for assessing the performance of the industry. The Index is analysed on assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building.

The Apparel Index research is conducted by DFU Publications.