GST on textile products may be reworked. The move is expected to help the sector be more competitive in the global market. The main reason is the labor-intensive nature of the sector. As of now, barring raw silk, khadi yarn and some other items, there are three rates — 5, 12 and 18 per cent — for various textile items. Though there is a refund mechanism for exporters, it takes time and affects exporters’ efficiency. In countries such as China, Indonesia, and Thailand there is a single rate. It is 16 per cent in China, 10 per cent in Indonesia and 7 per cent in Thailand, making them more competitive.

There are issues with customs duty. India has more than 300 tariff lines for textiles items, making things more complex for global buyers. For example, Bangladesh imports yarn, fabric etc from China as it is cost effective and then produces readymade garments for the export market in a big way.

However, any work on trade tariff will be watched very carefully by global trade partners and there could be allegations of WTO norms violation. The foreign trade policy allows fulfillment of export obligations under various schemes through third party exports. Such a provision of getting exports goods without payment of GST from textile manufacturers will lead to ease of doing business and also a seamless flow of credits.

GST on textiles may be tweaked

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

CMAI FAB Show 2024 wraps up successfully, boosting textile industry

The Fabrics, Accessories & Beyond Show 2024 (FAB Show 2024), organized by the Clothing Manufacturers Association of India (CMAI), concluded... Read more

US retail sales on the rise, but fashion sector growth murky

American consumers are opening their wallets again, with retail sales experiencing a modest uptick in recent months. According to the... Read more

The Fast Fashion Conundrum: Profits soaring, sustainability stalling

The story of Shein's soaring profits in 2023 presents a fascinating paradox. While a growing number of consumers, particularly millennials... Read more

Wall Street and the Seduction of Sexy Calvin Klein Ads: Hype or performance boos…

The recent Calvin Klein campaign featuring Jeremy Allen White in his skivvies has set the fashion world abuzz. But can... Read more

Looming Iran-Israel conflict threatens to unravel global apparel trade

The already fragile global garment industry faces fresh challenges as tensions escalate between Iran and Israel. This adds another layer... Read more

Fabric Stock Services: A rising trend but not a replacement

The fashion industry is notorious for waste. Unsold garments and excess fabric often end up in landfills. Fabric stock services... Read more

CMAI’s FAB Show 2024 inaugurated with industry giants

The 4th edition of the Fabrics Accessories & Beyond Show 2024 (FAB Show), hosted by the Clothing Manufacturers Association of... Read more

Asian Apparel Exports: A tale of four tigers, one lagging behind

The apparel industry in Asia presents a fascinating picture of contrasting fortunes. While Bangladesh, Vietnam, and Sri Lanka have seen... Read more

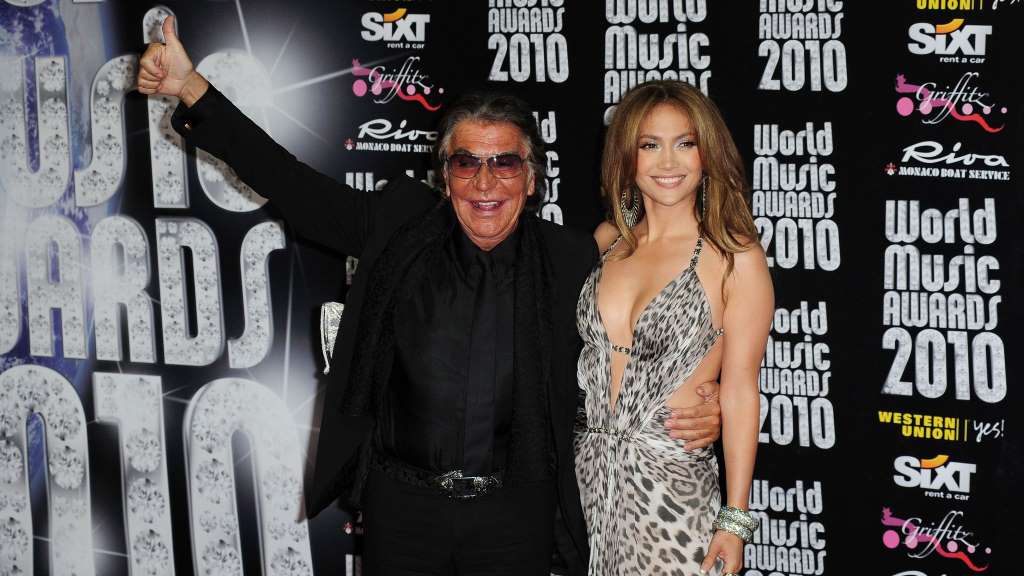

Roberto Cavalli: A legacy of bold prints and unbridled glamour

Roberto Cavalli, the iconic Italian designer who passed away on April 12, 2024, leaves behind a rich legacy. Cavalli was... Read more

Candiani & Madh unveil first regenerative cotton jeans

In a move towards sustainable fashion, Swedish denim brand Madh has partnered with Italian producer Candiani Denim to introduce the... Read more