China's deepening economic ties with Pakistan are sending ripples through the South Asian textile industry, particularly impacting India, a long-standing competitor in the global market.

Collaboration that fosters growth

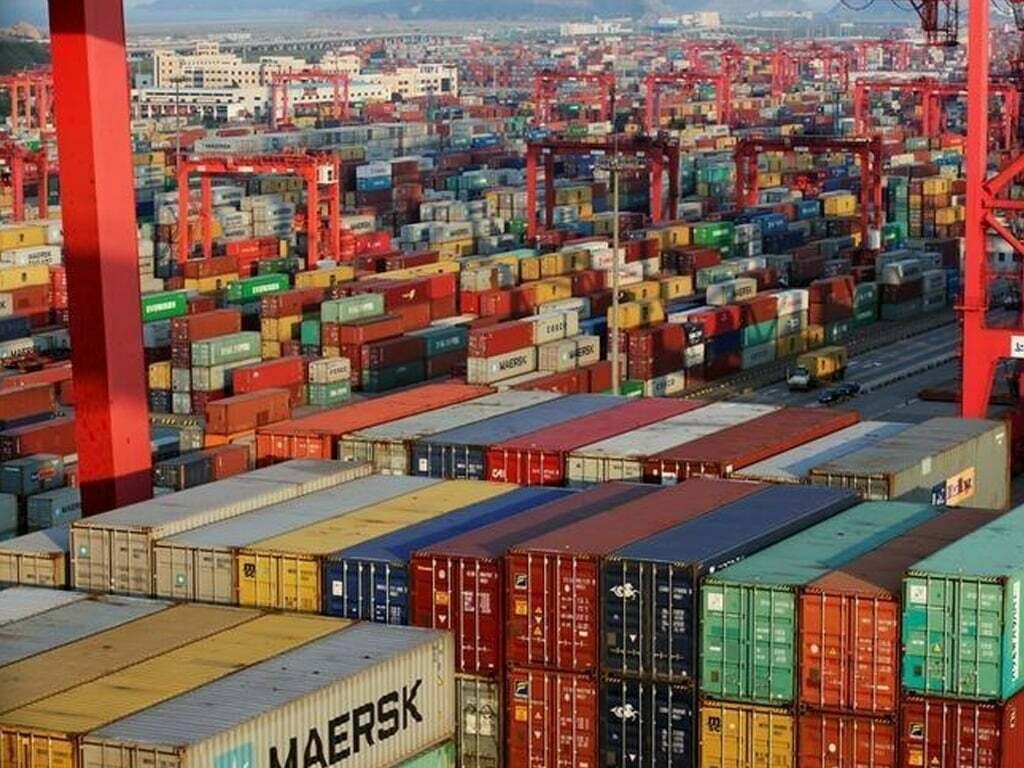

As per WTO, China is the world's largest textile and apparel exporter, accounting for over 33 per cent of global textile exports in 2022. India meanwhile is the second-largest exporter, holding a 13 per cent share. Though smaller, Pakistan holds a significant 4 per cent share in global textile exports. : As per Pakistan Bureau of Statistics the country’s textile exports have been steadily increasing, reaching $35 billion in 2023. This growth is partly due to the China-Pakistan Economic Corridor (CPEC) initiative, which has seen significant Chinese investments in Pakistani infrastructure and textile production facilities. As per CPEC Authority, China has invested over $25 billion in Pakistan's textile sector since 2015. This investment is expected to create numerous textile zones and modernize Pakistan's textile infrastructure.

Indeed, China's strategic investment in Pakistan's textile sector, through the China-Pakistan Economic Corridor (CPEC) initiative, is fostering closer collaboration. Existing FTAs between China and Pakistan allow duty-free movement of raw materials and finished goods, making Pakistan a competitive production hub for Chinese companies. Also, CPEC projects are improving transportation and logistics networks within Pakistan, facilitating faster movement of textiles between China and global markets.

Sector-wise scrutiny

Fiber: India enjoys a natural advantage in cotton production, a key textile fiber. However, China's dominance in synthetic fibers like polyester could pose a threat if Pakistan leverages Chinese technology and lower production costs. Pakistan signed a $1.5 billion deal with China in 2023 to import high-yielding cotton seeds, potentially reducing reliance on Indian cotton. The Spinners' Association of India (SAI) has expressed concerns about rising yarn imports from China into Pakistan, which could be re-exported to other markets at lower prices. India however, can focus on specialty fibers like organic cotton or high-performance fibers to cater to niche markets.

Yarns: Both India and China are major yarn producers. Increased competition from China-Pakistan collaboration could put pressure on Indian yarn exports, particularly in low-cost segments.

Fabrics: Here, the story is nuanced. India has a strong reputation for high-quality fabrics like silk and cotton. China excels in mass-produced, cheaper fabrics. Pakistan can potentially bridge the gap, offering a mix of quality and affordability. This could create a three-way competition, potentially benefiting consumers. However, India's strength lies in diverse fabric production. Focusing on traditional textiles and value-added fabrics can create a unique market position.

Apparel: China is a powerhouse in ready-made garments. While Pakistan has growing apparel industry, India boasts a strong domestic market and established brands. The impact on India's apparel exports hinges on Pakistan's ability to scale and cater to international markets. Joint ventures between Chinese and Pakistani apparel companies could lead to increased competition for Indian garment exporters, especially in low-cost segments. In Tirupur, the knitwear hub for example, while some fear job losses due to rising competition, others see it as an opportunity to innovate and focus on high-value knitwear segments. In Surat, the MMF hub of India, the industry acknowledges the challenge but emphasizes the need for skill development and technological advancements to stay competitive.

Indeed, China's growing presence in Pakistan's textile sector presents both challenges and opportunities for India. While competition might intensify in certain segments, India can leverage its strengths in diverse fabric production, skilled labor, and a large domestic market to carve a niche in the global textile landscape. Investing in research & development, technological advancements, and brand building will be crucial for India's textile industry to thrive in the face of this evolving dynamic.