FW

Redesigning Value, the updated theme for Copenhagen Fashion Summit 2020will navigate the current and future realities facing the industry as it weathers the storm of a global health and economic crisis. The event will be held from October12¬ to 13, 2020.

This new theme aligns with emerging realities and will further explore the negative impact of fashion, which have undeniably become more visible in recent weeks and months. The theme will prompt companies to create more resilient businesses by bringing sustainable practices to the core of the business models. By re-examining how they can strengthen their relationships with their supply chain partners, their own employees and also their customers, they can help brands discover a newfound purpose and a willingness to emerge on the other side more resilient than ever.

In a letter to Prime Minister Narendra Modi, Apparel Export Promotion Council (AEPC) Chairman A Sakthivel said the industry employing 12.9 million workers would die a slow death unless the government immediately announced an economic package for apparels.

AEPC has asked most of the sector are operating under extremely competitive margins in the range of 3-4 per cent, and are completely dependent on export benefits granted by the government. Given the disruptions in imports, the Council has requested for the extension of validity period of unutilised entitled value under export promotion schemes by six months. It also asked for the extension of the validity period of Advance Authorisation to two years from the existing one year along with the period for fulfilment of export obligations being increased to 3 years from the existing 18 months.

Exporters have pointed to detailed, industry specific measures taken by other governments as necessary cues for India to adopt immediately. AEPC says the government needs to help labor and industry both as flow of funds from either the banks or the customers have stopped

As the rapid spread of Covid-19 in all the countries has led to a cancellation of apparel export orders in China’s factories, the country’s cotton consumption is likely to decline by 0.6-1 million tonne in 2019-20. This was reflected in the cotton futures market in China. The most actively traded May cotton contract dipped below 10,000 yuan/mt on Zhengzhou Commodity Exchange in the afternoon of March 24, once to the lowest of 9,935 yuan/mt, which was close to the historical low of 9,890 yuan/mt and has declined by 4,515 yuan/mt from 14,450 yuan/mt appeared on January 14 before the Chinese Lunar New Year.

Affected by the export orders, China’s domestic cotton consumption is expected to fall by nearly 1 million tons soon. If the state cotton reserves do not prolong, the stock/consumption ratio is forecast to 55 per cent, up 7 per cent from previous season. Global cotton consumption may also see large reduction with the ongoing pandemic.

The Centre reimburse Rs 1,061 crore to Cotton Corporation of India (CCI) and its sub-agent in Maharashtra for procuring cotton at the minimum support price in the state since 2014. The decision to give post facto approval to the MSP operations was taken by the Cabinet Committee on Economic Affairs.

The approval will help in price support operations to stabilise cotton prices, and is primarily aimed at safeguarding the interests of farmers and controlling any distress sale, the statement said. Maharashtra is the country’s second largest producer of cotton. The MSP operations were carried out by the CCI’s sub-agent, Maharashtra State Cooperative Cotton Growers Marketing Federation Limited (MSCCGMFL).

The Centre will spend Rs 312.93 crore to reimburse the losses to the CCI and the MSCCGMFL on sale of cotton procured during the cotton years (October-September) 2017-18 and 2018-19, and incur an additional expenditure of Rs 748.08 crore for 2014-15 and 2015-16.

American Eagle Outfitters (AEO) has alleged that Walmart is selling women’s jeans with the brand’s distinct back pocket design. According to legal documents obtained by the Pittsburgh Post-Gazette, AEO claims its reputation for high-quality denim is being threatened by Walmart, which is selling similar jeans at a lower price than the original. The case, which claims violation of trademark law, was filed on March 25 at the US District Court for the Western District of Pennsylvania, where AEO is headquartered.

In the lawsuit, the company notes that Walmart’s design is already causing confusion, with influencers and consumers explicitly calling out the similarities on social media. AEO stated that it has spent millions of dollars on branding to establish its rank in the industry. The company is asking Walmart to stop selling the jeans, destroy any remaining inventory and hand over the money generated from the alleged knockoffs.

Walmart responded to the allegations, stating that it did not create the design and that it plans to fight the case.

Six major buyers/brands including H&M, Inditex, M&S, PVH, Target and KIABI have assured to support Bangladesh’s RMG manufacturers in these tough times of COVID-19 by not cancelling their orders. On the other hand, India is not so lucky in this regard as so far only H&M has assured similar support to Indian apparel exporters. It is imperative to note that all the aforementioned six brands/ companies are also sourcing from India in a big way and cancelled existing orders have created panic among Indian apparel exporters.

H&M has assured its Bangladeshi vendors that they will receive payment for orders that have already been manufactured. The brand sources around S $ 4 billion of apparels from more than 225 manufacturing facilities of Bangladesh.

Inditex is also not walking away and are taking all that’s being produced. PVH has sent a clear confirmation of taking everything. Target confirmed with full assurance and reiterated that they would work as partners to come out of the crisis and they had no intention of cancelling any order.

R D Udeshi, President, Polyester Chain, Reliance Industries

“Once the country opens up after the lockdown, at the onset, we will face severe worker issues. Textile industry is a labour-intensive industry and with large number of workers having returned to their native bases before and during the lockdown, availability of labour would be scarce. This is generally noticed after festivals and we are likely to face a greater challenge in bringing them back to work. However, we expect things to normalize by May, assuming that the lockdown is partially and reasonably eased by April. Some units will restart aiding workers to return back to their manufacturing hub and situation would gradually stabilise”

“Once the country opens up after the lockdown, at the onset, we will face severe worker issues. Textile industry is a labour-intensive industry and with large number of workers having returned to their native bases before and during the lockdown, availability of labour would be scarce. This is generally noticed after festivals and we are likely to face a greater challenge in bringing them back to work. However, we expect things to normalize by May, assuming that the lockdown is partially and reasonably eased by April. Some units will restart aiding workers to return back to their manufacturing hub and situation would gradually stabilise”

India is going through very challenging times What do you think will happen to the garment and textile industry post lockdown?

Let me begin with Reliance Industries, the Leadership strongly believes that the organizational family is more important than trade or business. We have around 1,70,000 employees and considering the average size of a family, about half a million people will be our criteria. We have our own hospitals at various places to provide medical aid. We have our own units manufacturing PPE1 kits and masks, and we also outsource them. The Prime Minister’s initiative and strict compliance of the lockdown will help India come out of this sooner as compared to other countries.

Presently there is a vacuum in the downstream industry, with the shelves across retail stores going empty. This will encourage revival of production and stabilize markets. Secondly, there has been a rise in the requirement for medical textiles. We are looking at PPE1, PPE2 kits in large quantity, a few billion are required to meet the needs of doctors, nurses and common people. Both types of kits are being manufactured by RIL and many others. N-95 masks will be required more for the PPE2 kit, whereas PPE1 kit will need typical masks made of polypropylene and nonwoven fabric.

Various steps taken by the government will support industrial activity in a big way, RBI has also announced various steps like EMI deferment and has issued guidelines for incremental credit during the next quarter. This will help the industry survive for three months, gear up activity and tide over the immediate financial crunch.

The acute volatility in the oil prices is a pressing issue for the global textile industry. While, two months ago crude oil was around $50 a barrel, it touched levels of $ 20 a barrel recently. A drop of $30 a barrel has an impact of $240 in the downstream industry. The impact on NAPHTHA is around $240/ton; on paraxylene $250/ton; on PTA $150/ton; and on polyester by $120 to $130 /ton. Consequently, players face huge stock losses, within a month stocks in warehouses lost almost 30 to 40 per cent. Recently, President Trump has advised Saudi Arabia and Russia to come together and curtail production by 20 to 25 million barrels a day and bring stability to oil prices. This will help the industry and bring some stability. If oil prices go up to $30 to $35 dollars in the short run, it will reduce stock losses and revive business sentiment.

Many top textile and garment industry leaders have said they have to now think year 2020 never existed in account books. Comment.

One can take this as a threat or opportunity. Threat because we will see some onslaught from China in the coming days as they have an imbalance in their industry structure. They have continued production in the upstream, which needs lesser labour, while the downstream industry requiring more workforce is still slow to revive back.

This will create an imbalance where you have surplus in the upstream. This will give an opportunity to some Chinese manufacturers to export products into India. We need to protect the domestic industry and have been taking up this issue with the government of India to give reasonable protection. As you know the whole world is going down and China is increasing their production capacity. We have spoken to DCPC and different ministries to protect the domestic industry from this onslaught.

As far as demand and supply is concerned, export is not the only avenue open for Indian industry. Out of $140 billion textile only $30 to $35 billion is for exports the remaining $100 to $105 billion is for domestic industry. That will continue operating without much hurdle, once there is little stability. What the industry needs to learn is to survive in every environment and create agility within their system to adapt to the new environment. That is my advice to the industry. Adaptability to accept and move ahead with CHANGE!! I remember the story of WHO MOVED MY CHEESE!!

Given that we are highly dependent on China for the garment and textile industry, do you think this is an eye opener for our country not to depend only on one country?

This is the biggest lesson we have learnt. The industry depended on China purely for economic reasons and has ignored the likelihood of such events taking place. Not developing an alternative source became a big issue. The time has come where we as an industry need to look at alternative sourcing and maximize usage of our resources internally.

How can the government help the textile and garment industry tide over this crisis?

The time has come for the ministry to recommend some special incentives for garment exports. China has already increased the VAT rebate from 9 to 13 per cent. This allows the Chinese industry to become more economically viable, plus the depreciation of Yuan against the dollar from 6.9 to 7.1 allows local manufacturers to incentivize the drop in price and still make money. So, some incentives from the government as required, as duty drawbacks or enhancement of ROSL benefit for a temporary period of three to six months till the market tides over the dull market conditions. I am sure the government would come out with some incentive plans very soon.

What is your advice to the garment and textile industry?

My advice is that human life is more important so let us follow the lockdown without any hesitation. Once we start after April 15, incentivize workers to come back towork so that we can get the wheels moving. Concentrate on medical textiles which is the need of the hour and encash the opportunity while various parts of world are under lockdown and may need medical textiles. With reservations around Chinese sourcing, I think this is a great opportunity for us to enter the market vacated by China. Take it as an opportunity and try to spend little more money on the processing industry to meet the global standards.

China National Textile and Apparel Council (CNTAC), the voice of the textile industry in China, issued a survey report on Friday April 3 for a close look at the reignited production status due to the impact of coronavirus outbreak this year. CNTAC organized a series of online surveys to monitor the production graph, and this new report covers the period from March 3 on the onset to April 1 , after the previous report that was shared in February.

Nearly all the big companies fully operational now

The situation in the latest week (March 25-April 1) is given as bellows:

On company fronts, the 193 member companies responded to the online survey, 1.3 percent higher than its previous week with 98.4% of them starting up their production. There are 293,000 workers already at work in 190 companies, accounting for 94.6 percent of total employment in pre-crisis period, 3.2 percent more than that reported the week before.

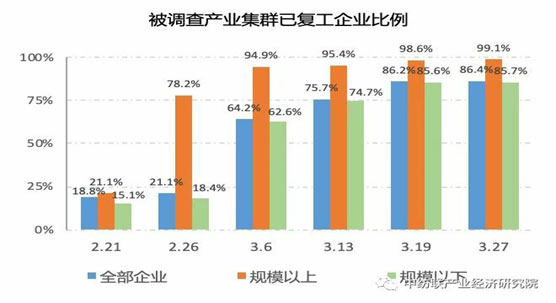

On industrial cluster fronts, there were 28 important manufacturing clusters in 13 provinces responding to the survey. According to the questionnaire, there were 66,000 companies inside these clusters already at work, representing 86.4 percent of the number of companies in total textile and apparel manufacturing clusters. Out of which, there were 3954 above-designated-scale companies (Chinese statistics system considers a company with its annual income amounting to 20 million Yuan or more, as big scale company, any companies above this designated scale are taken into national statistical system for understanding economic performance in the country) reported that the production has restarted across the board at 99.1 percent rate.

Over 71 percent workers operational at SMEs

(Note: Blue color for all companies, orange for big companies, green for SMEs)

There are 62,000 SMEs in these 28 important manufacturing clusters already in operation with 1.01 million workers busy on streamline, taking up 71.2 percent of the total number of employees in these production hubs, 5.2 percent point over that recorded in its foregoing week.

A quarter of units face half their business volumes

So, what do we know from the online survey? They are confronted with problems as it goes without saying. In the above-mentioned 190 companies that already restarted operations, only 33.7 percent out of these companies have their business orders at 80 percent of their normal business level while 23.2 percent of them ran into a poor business volume at the level below 50 percent of their normal business orders. So far as export business is concerned, the international orders that fall short of 50 percent or more have happened to 61.2 percent of all the companies surveyed, only 9 percent of all the companies have 80 percent of their normal business volume from their international clients.

Exports to the USA hit hard

The COVID-19 ballooned into global pandemic at an amazingly fast rate and the important markets for China’s export shipments are all hit hard, and the United States is one of them, which resulted in a plummet in importing textiles and apparel from China as is seen from the import data sheet –Major Shippers Report provided by Textile and Apparel Office, Department of Commerce, U.S.A..

In January 2020, the United States import of Chinese textiles and apparels decreased by 31.68 percent with $2472.293 million as against $3619.914 million in January last year and apparel import dropped by 36.09%.

It is not a surprise to see a global slowdown in export business while the number of people infected with the virus is breaking through a million in no time, and it is most likely that it has already outnumbered one million cases at the time when this news is posted on line and it is spreading far and near to affect more than 200 countries, regions and sovereignties. There is no question striving to fight the coronavirus in a way that is properly guided by the government and practically executed by the companies, and the question is how to react to the export situation that goes pretty sure to get worse than that in the years already gone by?

Contributed by Mr. ZHAO Hong

He is working for CHINA TEXTILE magazine as Editor-in-Chief in addition to being involved in a plethora of activities for the textile industry. He has worked for the Engineering Institute of Ministry of Textile Industry, and for China National Textile Council and continues to serve the industry in the capacity of Deputy Director of China Textile International Exchange Centre, V. President of China Knitting Industry Association, V. President of China Textile Magazine and its Editor-in-Chief for the English Version, Deputy Director of News Centre of China National Textile and Apparel Council (CNTAC), Deputy Director of International Trade Office, CNTAC, Deputy Director of China Textile Economic Research Centre. He was also elected once ACT Chair of Private Sector Consulting Committee of International Textile and Clothing Bureau (ITCB)

Debabrata Gosh, Oerlikon, General Manager India

“Once everything normalizes there will be a big momentum. The advantage is that we have a huge potential and such big domestic market hence we are not dependent on exports alone. I don’t see any threat for the textile industry. As for opportunities, we are expecting more export orders in future because the same has happened in the yarn segment and it will happen in the fabric segment also and the world will take India more seriously as a manufacturer. So far everybody was dependent on China. Since they offered cheaper rates, people switched to China but now the world will think in a different way to keep the supply chain active from India.”

“Once everything normalizes there will be a big momentum. The advantage is that we have a huge potential and such big domestic market hence we are not dependent on exports alone. I don’t see any threat for the textile industry. As for opportunities, we are expecting more export orders in future because the same has happened in the yarn segment and it will happen in the fabric segment also and the world will take India more seriously as a manufacturer. So far everybody was dependent on China. Since they offered cheaper rates, people switched to China but now the world will think in a different way to keep the supply chain active from India.”

How do you foresee your business prospects in India?

Most customers have closed their plants except bottle grade polyester units, which is an essential item. So they are still operative and a lot of PTA and MHE raw material stock is getting piled up and there is no movement of finished products, which is affecting adversely. Most knitting and weaving units, MSME’s, SME’s have closed. Garment manufacturers are facing order cancellations both in India and Bangladesh. Of course it is challenging and once the situation normalizes demand will very high and everything will start in full gear. Hopefully by June-July things will improve and definitely textiles being such a big industry will start producing in full capacity both in India and Bangladesh. We also foresee a lot of foreign companies and other garment brands coming to India, making the country their second manufacturing base and not depend only on China. So, for the Indian textile industry there will be significant change in the next two to three years.

Since most countries are dependent on China for their economic load and raw materials is the current situation an eye opener to look for other partners and not to depend on China alone?

This is definitely going to happen but as of today, all industries in China are doing well. Oerlikon factories in China are working at 100 per cent capacity and all our Chinese orders are on schedule. So, China is actually doing very well at their end but definitely many other countries who source from China will definitely think of a second supply source and hence, India has good advantage.

With abundant raw material, is India in a position to compete with China in terms of pricing and product quality?

Definitely, it will take some but India’s product quality, especially in textile is also equally good, only volumes are lacking. The quality of Indian textile is at par with the world but volumes are less and products are not as diversified as China. Moreover, China’s raw material capacity, spinning capacity is 10 times that of India. So there is no comparison.

With the ongoing lockdown in India what are the threats and opportunities from the current situation?

Many of our small customers are facing difficulties. However, some small knitters and weavers in Kolkata running small factories at home among them 20 per cent are still running and buying yarn but of course 80 per cent don’t have their operators and are facing problems. Once everything normalizes there will be a big momentum. The advantage is that we have a huge potential and such big domestic market hence we are not dependent on exports alone. I don’t see any threat for the textile industry. As for opportunities, we are expecting more export orders in future because the same has happened in the yarn segment and it will happen in the fabric segment also and the world will take India more seriously as a manufacturer. So far everybody was dependent on China. Since they offered cheaper rates, people switched to China but now the world will think in a different way to keep the supply chain active from India.

Indian government has been extending support to entrepreneurs in a fractional manner in different sectors. Do you think the government has really come all out for the textile industry and given required benefits?

Indeed, the government has done a lot. They have given a lot of support to the industry but our entrepreneurs and businessmen need to be more responsible in utilizing funds and perform their duties. They also have to work on developing better quality and in-house R&D and not just copy products and utilize our own strengths and not keep blaming the government for everything. Every industry is asking for support from the government at present and some are more affected than the manufacturing industry.

At this point, what is Oerlikon foreseeing in 2020? How are you responding to this?

Fortunately most of our manufacturing facilities worldwide are totally booked. We have big orders from China and other parts of the world and our factories in China and Germany are running in full capacity. Oerlikon has developed a fantastic machine for non wovens to manufacture masks at this critical time. It is very high quality non woven which will be used to manufacture effective and functional masks. We have brought this technology to the market now and it will help in mass production of masks. Oerlikon as a group is doing very well and is not affected by the pandemic.

Last month, the European Commission partially withdrew tariff preferences granted to Cambodia under the EU’s ‘Everything But Arms” (EBA) scheme. EBA grants least developed countries such as Ethiopia, Bangladesh and Myanmar, duty- and quota-free access to the European single market. According to Drapers, this withdrawal will affect a few garment and footwear products in the country. However, these preferences will soon be replaced with EU standard tariffs from August.

Last month, the European Commission partially withdrew tariff preferences granted to Cambodia under the EU’s ‘Everything But Arms” (EBA) scheme. EBA grants least developed countries such as Ethiopia, Bangladesh and Myanmar, duty- and quota-free access to the European single market. According to Drapers, this withdrawal will affect a few garment and footwear products in the country. However, these preferences will soon be replaced with EU standard tariffs from August.

Withdrawal to result in job losses

Tristan Haddow, Chief Executive of clothing supplier Haddow Group points out, withdrawing tariff preferences will pose serious problems for the Cambodian economy. Thousands of workers are likely to lose their jobs, warned Garment Manufacturers Association in Cambodia (GMAC). The association believes this decision will incentivise buyers to source from countries with far weaker legacies of trade union rights. It will increase poverty in the country and make it more difficult to improve wages and benefits for other workers.

Exports to suffer most

The impact is likely to be further worsened by the current COVID-19 pandemic. As Cambodia’s Labor Ministry spokesman Heng Sour said, Cambodia’s garment sector is either suspending operations or slowing production as nearly 200 factories face a shortage of raw materials from China. One of the biggest casualties of the tariff changes will be Cambodia’s clothing export sector warns Leonie Barrie, apparel analyst at GlobalData, as retailers will move their production to other countries that still benefit from duty-free access – for example, Bangladesh and Vietnam.

garment sector is either suspending operations or slowing production as nearly 200 factories face a shortage of raw materials from China. One of the biggest casualties of the tariff changes will be Cambodia’s clothing export sector warns Leonie Barrie, apparel analyst at GlobalData, as retailers will move their production to other countries that still benefit from duty-free access – for example, Bangladesh and Vietnam.

Consequences of this decisions are already been seen as high street heavyweight H&M recently announced a decision to review its sourcing strategy in the country. The retailer has sourced from Cambodia since the 1990s, and currently works with around 50 factories and suppliers based in the country.

An opportunity in disguise

However, Laura Moroll, Senior Manager at consultancy BearingPoint, who specialises in retail, opines retailers currently sourcing from Cambodia can take this opportunity to streamline their own processes in order to mitigate the cost impact of higher tariffs – as long as they ensure working conditions are up to scratch. They can also identify the areas where they are eroding margins and quite quickly recoup some of the higher tariff costs.

These price-conscious retailers can also look to shift production to other sourcing hubs, such as Vietnam – which agreed a free trade deal with the EU in February – and Bangladesh. The top priority for them currently is to ensure a fair and ethical treatment of factory workers besides making working practices more efficient.