FW

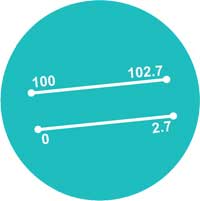

"CMAI’s Q1 Apparel Index for April-June FY 2017-18 reflects positivity is in the air. At 2.77 the index value for the quarter has moved up compared to previous quarter, Q4 (Jan-March FY 2016-17) when it was 2.25 points. The market recovered after ‘demonitisation’. However, the industry faced yet another tight spot in the form of GST in June. And most players paused deliveries, as buyers were uncertain about post GST inventory implications. They focused more on clearing inventories before buying fresh goods."

CMAI’s Q1 Apparel Index for April-June FY 2017-18 reflects positivity is in the air. At 2.77 the index value for the quarter has moved up compared to previous quarter, Q4 (Jan-March FY 2016-17) when it was 2.25 points. The market recovered after ‘demonitisation’. However, the industry faced yet another tight spot in the form of GST in June. And most players paused deliveries, as buyers were uncertain about post GST inventory implications. They focused more on clearing inventories before buying fresh goods.

Giant Brands’ perform best, record highest index value

Meanwhile some players took this opportunity to clear inventory, especially big retailers and brands associated with them. This is evident in the apparel index of various brand groups. Giant Brands, mostly the ones with widest retail network clocked in 11.00 points, followed by Large Brands at 4.25 and Mid Brands 3.71 points; Small Brands with least retail control mostly dependent on trade recorded lowest apparel index of just 1.47 points.

Giant Brands also took this opportunity to facilitate recovery with a fabulous 11.00 points growth, with fast clearance of goods that increased Sales Turnover to 7.40 points. Comparatively, Large Brands sales turnover grew 2.00 points and Mid Brands sales turnover grew 2.30, Small Brands, the laggards, clocked in a mere 1.00 points this quarter. Overall the Index Value this quarter saw more impact and dynamism from sales turnover. Moreover inventory holding was much less compared to earlier quarters as the emphasis was on liquidation rather than inventory building.

Q1 Apparel Index clearly indicates Giant Brands have outdone Large, Mid and Small Brands. Small, Mid and Large Brands could manage small growth in sales turnover, perhaps due to stalled or reduced deliveries during the month of June. Giant Brands being connected with organized retail through MBOs, EBOs and large format stores managed their business and sales turnover well. Moreover, they took the discounting route which stimulated sales to clear off inventory at store and company level. This is clearly reflected in their increased sales turnover which was 7.40 points.

High sales turnover, low inventory holding works best

There is a strong correlation between sales turnover and inventory holding, and this is clearly evident this quarter. Organized companies and brands understand boosting sales leads to lower inventory holding, relieving cash for the company which boosts fund circulation. Since Small and Mid Brands are more dependent on trade and have less control on retail, they are not in a strong position to push up sales. At the same time, Large and Giant Brands are using this tool successfully to stimulate sales turnover, thereby restricting inventory holding.

As Sanjay K Jain, Managing Director, TT Ltd points out, “We managed to reduce inventory by using MIS and forecasting tools effectively. Instead of monthly monitoring, we shifted to weekly monitoring of sales trends.” Agreeing with this point of view Kapil Gupta, Director, Toppler goes on to add, “We focused on increasing sales and decreasing inventory holding. Inventory holding was low because we produced only those goods which were pre sold. We also stopped purchasing new fabrics and focused on clearing our stock. This helped us liquidate our fabric stock, and reduce inventory holding.”

Positive outlook for next quarter

With festivals and weddings lined up in the upcoming quarter there is a sense of positivity about business, around 55 per cent brands feel the outlook for next quarter is ‘Good’, another 10 per cent say the outlook is ‘Excellent’. Nearly 33 per cent foresee an average outlook and 2 per cent feel it will be ‘Below Average’. Generally, Q2 of the financial year 2017-18, is seen as the best quarter as most festivities fall during this period, brands expect a good season, coupled with almost dry supply chain and shelves in quest of fresh goods. Consumers too are expected to return to stores, GST and new processes would be settled especially by beginning/mid August and this augurs well for business.

CMAl's Apparel Index aims to set a benchmark for the entire domestic apparel industry and help brands in taking informed business decisions. For investors, industry players, stakeholders and policymakers the index is a useful tool offering concrete and credible information, and is an excellent source for assessing the performance of the industry. The Index is analysed by assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building. The Apparel Index research is conducted by DFU Publications.

"As per recent data released by the Union Textiles Ministry, textile and clothing industry has been seen a decline in exports. Exports fell marginally by 0.2 per cent to $36639.4 million (FY 2016-17) over the previous fiscal. In the exports segment, textiles and clothing accounts 13 per cent of the country's total exports in the last fiscal, where in 2015-16 and 2014-15, the sector accounted for 14 per cent and 12 per cent respectively. Presently apparels are ruling the export basket with a 48 per cent stake in the total T&C exports with a growth of 6.6 per cent in 2016-17."

As per recent data released by the Union Textiles Ministry, textile and clothing industry has been seen a decline in exports. Exports fell marginally by 0.2 per cent to $36639.4 million (FY 2016-17) over the previous fiscal. In the exports segment, textiles and clothing accounts 13 per cent of the country's total exports in the last fiscal, where in 2015-16 and 2014-15, the sector accounted for 14 per cent and 12 per cent respectively. Presently apparels are ruling the export basket with a 48 per cent stake in the total T&C exports with a growth of 6.6 per cent in 2016-17. After seeing this trend, the government has cut down export target to $45000 million for the current fiscal.

Country wise, the US is the largest export market for India. Exports to the US grew 1.1 per cent to $7604.38 million in the last fiscal, accounting for 21 per cent share in India's total T&C exports. Apparel exports to the US totaled $3861.96 million, thereby accounting for 50 per cent share from the total T&C export to the US. Cotton exports to the US decreased by 5.5 per cent to $116.31 million in the last fiscal. Other large export markets are UAE, UK, Bangladesh, Germany, China, Spain, France, Italy and the Netherlands.

Cotton export trends

In FY 16-17, cotton exports registered a decline of 9.2 per cent to $6637.63 million as compared to the previous fiscal FY15-16. Bangladesh has taken up the spot of China by becoming the largest importer of Indian cotton owing to continued low demand from China. Exports to Bangladesh were valued at $1602.53 million with a share of 24 per cent from the total cotton exports, while exports to China closed at $1348.43 million. Though registering decline, Pakistan still managed to retain its third position while cotton exports to Vietnam registered growth of 7.5 per cent to $281.81 million.

Yarn exports

Overall cotton yarn exports witnessed negative growth of 7.15 per cent to $3350.2 million in FY 16-17. Though China was the top importer of Indian cotton yarns, volume reduced 29 per cent to $1048.83 million. If Bangladesh's demand catches up in the future, there are chances of Indian yarn exports registering an upswing again.

c

Apparel exports registered 6.6 per cent growth to $17478.97 million in 2016-17. In the apparels, woven apparels led the pack with 53 per cent share. In this section, women/girls suit, jacket, dresses, skirt, blazers etc., were the highest exported products from India, valued at $2422.02 million in the last fiscal. Knitwear apparel exports also registered impressive growth of 7.8 per cent to $8266.95 million in the last fiscal year. UAE took over US as India's leading market for knitwear exports, totaling at $2131.66 million in 2016-17. The other top knitwear export markets are USA, UK, Germany, France, Spain, Italy, Saudi Arab, Netherland and Poland.

Man-made fibres

This segment has been registering negative growth for the past three years. In 2016-17, the MMF exports fell by 3.1 per cent to $ 1995.05 million compared to the previous year. The commodity accounts for 5 per cent share from the total T&C exports of the country. Under MMF section, synthetic filament yarn is the main commodity exported with value of $ 1041.34 million with growth of 10 per cent in the last fiscal. As per the statistics, Turkey is the biggest market for India's MMF exports. India has exported $256.18 million of MMF commodity to Turkey in 2016-17. Brazil, being the second largest model, witnessed 69.8 per cent growth to $201.46 million.

Import scenario

As far as imports are concerned, cotton imports ruled with 19 per cent share from the total T&C imports of the country. The cotton imports have witnessed a growth of 88.8 per cent to $ 1132.09 million in 2016-17. India has imported most of the cotton from USA and Australia. India's imported cotton from US totaled $289.51 million in the last fiscal. China stands at third position in the cotton imports of India, witnessing a negative growth of 4.2 per cent to $124.37 million.

"Technology is dramatically changing every aspect of life and that’s true for fashion industry as well. It took the industry about 50 years and $10 billion to change the game in fast fashion, where the 18-months cycle became 1 to 2 months. The year 2050 will witness an extension of the on-demand economy for fashion, ‘I need it fast and I need it now’. As per recent research future fashion will be all about 3D printing, holographic fashion shows, faster merchandising from ramp to rack and Virtual Reality (VR)-based entities with innovations in fabric and other materials."

Technology is dramatically changing every aspect of life and that’s true for fashion industry as well. It took the industry about 50 years and $10 billion to change the game in fast fashion, where the 18-months cycle became 1 to 2 months. The year 2050 will witness an extension of the on-demand economy for fashion, ‘I need it fast and I need it now’. As per recent research future fashion will be all about 3D printing, holographic fashion shows, faster merchandising from ramp to rack and Virtual Reality (VR)-based entities with innovations in fabric and other materials.

3D Printing

While 3D printing has become a part of many industries’ and their changing fortunes, it’s slowly making its presence felt in the apparel industry as well. Consumers will soon get the option to customise their wardrobe by printing clothes that suit an individual’s shape, style and personal preferences. Rapid prototyping is another option that can be explored, and print anything from essentials to accessories in the future, along with creating embellishments using innovative designs. It would also help in reducing supply chain wastages.

Growing retail start-ups

Technology will be the mainstay in retailing. Big Data and machine learning will drive the industry to help analyse parameters like inventory, buyer measurements and locations etc. which will in turn disrupt and optimise traditional fashion retail operations. For online retail, concepts like visual trial rooms and endless aisle will aid in driving traffic. All these aspects would help in reducing the number of returned items and logistical conveniences with delivery at any part of the globe in just a few hours. Technology would help companies manufacture products depending on demand. In the fashion industry, such tools will guide companies on preferences and trends, by predicting what will be in style for the next season. It will help in customer tracking around outlets and send them push notifications on the mobile phone. Hyper local targeting is already a widely emerging trend for attracting customers.

Innovative materials

New materials will take shape such as polymer threads, which are five times thinner than human hair. Sustainable materials would be grabbing attention of companies and fabrics such as Pinatex (leather made of pineapple fiber), and materials made from milk, tea, and coffee beans, would find greater acceptance. Self-repair clothing research is already underway which will dramatically transform the apparel dynamics.

Wearable technology integration

With technology, one would be able to change the colour and design of the garment at the touch of a button. There will be fabrics responding to changes in light, water or temperature. Clothes will have built-in sensors projecting data, which can later be used for analysis by retail companies.

Telangana is unveiling a bouquet of incentives for the textile and apparel sector. The incentives will cover fiber to fabric and cover capital and operational assistance, infrastructure support; capacity building and skill development. The proposed incentives aims to create an environment to encourage investments in downstream processing activities, mainly focusing on spinning, weaving, knitting, processing and garment manufacturing, including made-ups.

Besides encouraging new units across the value chain, the incentives will also support existing units to modernise and expand and undertake marketing and promotion activities. Units having investments over Rs 200 crores and/or providing employment to more than 1,000 people would be treated as mega projects and considered for special tailor-made incentives, if need be.

While the emphasis is on encouraging industry, to attract investments and generating employment opportunities for the local population, the industry is expected to provide fair and decent wages to the workforce. In doing so, the focus would also be on ensuring against exploitation of the workforce by the enterprises.

Though the state produces about 60 lakh bales of cotton, processing and value addition are largely limited to ginning and pressing. Roughly 10 lakh bales are utilised by the 35 spinning mills in the state that have a capacity of 9.3 lakh spindles.

Denim, a fixture of the apparel industry and a wardrobe staple for millions around the world has become an area of concern linked to a number of sustainability issues. Water is extensively used in the supply chain, beginning in the fields where cotton, denim’s raw component, is grown. It takes over 20,000 liters of water to produce a kilogram of cotton, roughly equivalent to just one T-shirt and a pair of jeans.

Denim production often involves the use of chemicals. Irresponsible use and disposal of dyes or chemicals used in the production process can have devastating environmental consequences. Chemicals that have not been properly treated before disposal can lead to serious pollution problems. Rivers in China have turned blue due to wastewater from dyeing being dumped directly into the water.

Denim has also been associated with labor injustices along the entire supply chain. On the production floor, sandblasting—a process used to make denim look more worn and faded—can seriously damage workers’ health and lead to silicosis, a potentially lethal pulmonary disease. This risk becomes even greater when sandblasting is performed without proper equipment. While Turkey banned the practice in 2009, sandblasting has since moved to less regulated countries such as Bangladesh, China, Pakistan, and Egypt.

US retail sales were up 3.9 per cent during the first half of 2017. Still consumers are measuring their dollars. Most people were not frequenting traditional mall stores. Instead, during the first quarter of this year, online sites and off-price retailers were gaining retail territory.

Store traffic dropped 8.3 per cent in June over last June. This was the largest decline in three months. E-commerce will see double-digit growth with back-to-school sales jumping nearly 16 per cent this year, which makes up about 8.6 per cent of total back-to-school sales. Last year e-commerce sales for the back-to-school season rose 7.8 per cent.

Purchases of clothing and accessories may rise 10 per cent over last year. Hot items are expected to be casual wear, school uniforms, handbags and accessories. Stores missing their earnings estimates for the first quarter were Macy’s, Abercrombie & Fitch, Urban Outfitters, Kate Spade, American Eagle Outfitters, Chico’s and Express.

Consumers plan to shop at mass merchants more and less at department stores and specialty retailers. The unemployment rate in the United States was at a very low 4.4 per cent in June, up slightly from a 16-year low of 4.3 per cent in May. Private sector wages rose by 2.5 per cent this June compared to the same month last year and housing prices continued to rise with low supply and high demand.

Standard Textile and Vestagen Protective Technologies have entered a strategic partnership to market Vestex garments that are designed to minimize the risks to healthcare workers associated with unexpected exposures to body fluids during everyday use. The co-exclusive sales and marketing agreement covers acute and post-acute healthcare facilities in the US and Canada. Standard Textile healthcare sales representatives will be supported by Vestagen personnel, who will also take the lead on working with institutional customers during the implementation process.

Vestex fabric is breathable and contains an EPA-registered antimicrobial agent shown in controlled conditions in laboratory and hospital settings to inhibit the growth of certain bacteria on the fabric. Healthcare uniforms made with Vestagen’s unique Vestex active barrier fabric are increasingly being adopted by healthcare leaders. This partnership with Standard Textile now gives Vestagen the reach to bring Vestex garments to healthcare workers throughout the US and Canada.

For over 70 years, Standard Textile has been synonymous with innovation in the hospitality, healthcare, work wear and consumer sectors. Vestagen is a pioneer in the development of active barrier fabric that incorporates multiple technologies. Workers and patients in the healthcare setting face environmental risks. Vestex offers breakthrough technology for healthcare workers that complements Standard Textile’s existing specialty product lines designed to address the unique needs of healthcare institutions.

Tirupur hosted a knit show from August 11 to 13, 2017 which saw the participation of almost 200 exhibitors from the textile and apparel industry. Screen printing, sublimation printing and garment manufacturing machines were the show’s major highlights. Ink manufacturers and traders, and accessories companies were also seen in good numbers at the show.

The main items on exhibit included: yarns, laces, textiles, dyes, embroidery machines, zippers, fabrics, sewing threads, pouches, hangers and laser tools. Office automation systems, gen sets, safety appliances, pantone books, heaters, cyber promotion solutions and many other related items were also exhibited at the show. Buttons, weighing machines, packaging equipments, material testing devices, flock prints, heaters, material handling tools, bamboo, melanges, strapping equipments, fusing devices, rubber patches, holograms, laboratory supplies, oils, lining tables, stain removing equipments and processing machines were also displayed.

Tirupur is the knitwear manufacturing hub of India. The Tirupur textile hub has recorded a rise in revenue of Rs 2,000 crores in the past year. Export revenue in 2016-17 was Rs 26,000 crores against Rs 24,000 crores in 2015-16. The target was Rs 30,000 crores but that could not be achieved because of Brexit and the fall in the euro.

Cotton production in India is likely to increase 3.76 per cent compared to the last year. Better yield is expected even though the area under cultivation has dropped significantly. The cotton marketing year runs from October to September. Production is also expected to increase as there were fewer pest attacks, including white fly in Punjab and Haryana and pink ball worms in Gujarat.

The area under indigenous variety has increased and the acreage under Bt cotton has slightly declined. Meanwhile the Indian Council of Agricultural Research has come up with more native varieties, which are equally good in yield. Once they are commercialised in 2017-18, the area under the indigenous variety will grow even more. Total yield is estimated to grow by almost 20 per cent in 2016-17 from 2015-16. The yield is estimated to be better in almost all cotton producing regions, except Tamil Nadu, where it has declined significantly due to moisture stress.

Total exports are estimated to have declined to 60 lakh bales in 2016-17 from 69.07 lakh bales in 2015-16. Till May, shipment to Bangladesh was 40 per cent of total exports while it has shrunk drastically to Pakistan, which witnessed a bumper crop.

HanesBrands Japan is now working with Polygiene to offer Japan’s consumers in odour-free apparel in its iconic Champion 2017/18 fall-winter athletic wear collection in 70 different products for basketball, golf, training as well as practice wear and socks.

To strengthen the brand’s appeal to consumers who want more comfort and functional wear, Hanesbrands in Japan is introducing Polygiene permanent odor control technology to its 2017/18 Champion athletic wear collection. Champion apparel treated with Polygiene stay fresh and odour free. Sweat itself is odourless but it creates the conditions that bacteria need to multiply on fabrics, and some of those bacteria produce odour, the manufacturer explains. Polygiene stops the growth of odour-causing bacteria on fabrics, making it possible for people to wear Champion clothing longer and wash it less.

As many as 70 different Polygiene-treated products will be featured in the Champion 2017/18 athletic wear collections branded C-ODORLESS by Polygiene. Hanesbrands Japan is also introducing Polygiene odour control technology to Champion practice wear and Champion Block Logo Series, Champion practice wear and Champion socks.