FW

Bangladesh’s apparel exporters are hoping US retailers and brands pay a fair price for their products. For one, exporters say, they have spent huge amounts on beefing up workplace safety and that has increased the cost of production 25 to 30 per cent. Their complaint is buyers always demand higher compliance at the factory level but do not want to increase the price of products. The US is the single largest export destination for Bangladesh.

Factories in shared or non-purpose built premises need to relocate. Firms in such premises which were not able to meet the new standards had to move and often ended up in more remote regions. Such factories have to bear the relocation costs and do not receive financial support from buyers, the government or their industry associations.

Another reason Bangladesh’s exporters do not get fair and reasonable prices for their products is lack of negotiation skills. Exporters get lower prices for readymade garment products than what Cambodian and Vietnamese exporters get from global buyers. Buyers do not want to pay higher prices, although the cost of production will go up further with wage hike, port congestion and higher transportation cost.

As per report by Ethiopian Ministry of Trade & Industry (MTI) and the Industrial Parks Corporation (IPC), Ethiopia continues to miss export targets for textiles due to a shortage of raw materials – including cotton – hampering output. Ethiopia’s export performance was $135 million less than the previous year for the same period. The export target for the past six months was U$1.21bn – well below the US$1.96 billion target set.

The IPC presented a performance audit report for the period 2015-18. According to the evaluation in 2015-16, exports of products originating at the Bole Lemi industrial park – a significant garment hub on which the government had pinned high hopes – was about $16.9 million. The original plan was to export products worth $130 million from the park, which offers an indication of the extent to which targets are being missed.

Similarly, for the fiscal year of 2016-17 export from the Bole Lemi Park was expected to be $40 million while actual export was $23.8 million. For 2016-17 exports from Hawassa Industrial Park – another major textile hub was $1.4 million against a planned performance of $50 million.

Ethiopia has pinned huge hopes on its textile and apparel export sectors and created a number of major industrial parks to attract inward investors. However, the rate of progress so far is far slower than had been anticipated.

Management of the Liberty Fashion Wears a forcibly shut Bangladeshi apparel maker has asked the Accord on Fire and Building Safety to withdraw unsafe tag as the factory building is termed safe by BUET engineers. The factory is in operation but due to Accords’ embargo, buyers cannot buy products from the factory neither can it produce apparel goods for the European brand. In last couple of years, the factory has incurred production losses worth Tk490 crore due to the unethical shut by the Accord

After Rana Plaza incident that killed over 1,135 workers in 2013, Tesco, one of Liberty Fashion Wears buyers hired Medway Consultancy Services (MCS) to assess the structural design of the building. In May 2013, the MCS conducted a visual and observational inspection and made a report identifying the building with “Red” mark stating that the building would collapse within 60 hours. Aftermath of the report, the factory was declared unsafe for workers by the Accord.

Later, based on MCS’ report, Accord, a platform of European Union apparel buyers to improve safety standard in the apparel sector, served letter to its signatory brands not to buy products from the factory terming it unsafe to workers safety.

Cambodia could be the biggest sufferer among developing economies as a result of Brexit. Cambodia’s garment industry is a major supplier to the UK fashion industry and it has favorable entry terms. But with the UK being one of the top three economies in the EU and a huge consumer market for fashion, tariff-free access to its roughly 60 million people will be cut off at least temporarily in the event of a no-deal Brexit.

Cambodia has the biggest trade with the UK of all the 49 least-developed countries that can export to the EU without any tariffs and 7.7 per cent of its exports go to Britain. So the UK has to reach some kind of agreement with the 49 countries as not doing so could seriously disrupt its own economy.

However, it’s unlikely any agreement will be reached fast enough to completely remove the chance of damaging disruption either to the UK or to the millions of workers in Cambodia’s garment sector. The European Union accounts for 40 per cent of all Cambodian exports. These exports have risen sharply in recent years, increasing by 227 per cent between 2011 and 2016.

The EU is Cambodia’s main export destination. Of Cambodia’s garment exports, 46 per cent goes to Europe, 24 per cent to the United States, 16 per cent to Japan and nine per cent to Canada.

With the potential to automate production, reduce labor and inventory costs, and localize production, 3D knitting is changing the way shoes are made.

In recent years, consumer preferences have quickly swayed towards knitted shoe uppers due to two different, yet related phenomena. First, as environmental consciousness penetrates societies around the world, demand for leather shoes is also declining considerably, resulting in a subsequent increase in demand for textile-based shoes. Second, an acute cultural shift towards athleticism and wellness has manifested itself in rising demand for athletic footwear. In response, manufacturers began focusing even more heavily on knitted shoe upper production.

In recent years, consumer preferences have quickly swayed towards knitted shoe uppers due to two different, yet related phenomena. First, as environmental consciousness penetrates societies around the world, demand for leather shoes is also declining considerably, resulting in a subsequent increase in demand for textile-based shoes. Second, an acute cultural shift towards athleticism and wellness has manifested itself in rising demand for athletic footwear. In response, manufacturers began focusing even more heavily on knitted shoe upper production.

In 2012, Nike and Adidas both launched a line of virtually seamless, knitted shoes, and were met with incredible success. Not only does the seamless design provide an almost “second-skin” feel, but removing cutting from the production process has significantly cut down on waste – 60% in the case of the Nike FlyKnit – while simultaneously reducing labor hours and environmental impact, improving inventory management, accelerating to market time, and allowing for ultimate customization.

However, there are still distinct limitations to the current seamless knitting technology. First, while the process is markedly less labor intensive than the traditional cut-and-sew methods, it is not yet fully automated. In search of a more perfect solution, shoe upper manufacturers are looking to 3D knitting, which promises to all but eliminate human labor from the production process and break through the seamless knitted shoe bottleneck.

Fully automated production

At present, a factory with 100 flat knitting machines will need at least 200 people to handle subsequent finishing work, because current production processes continue to rely on labor-intensive cutting and sewing steps. As such, labor costs for global shoe manufacturers remain stubbornly high.

While the seamless knitting production method demonstrated by Nike and Adidas has eliminated cutting from the post-production process, significantly reducing labor, it is not yet fully automated. After a seamless shoe upper is knitted, each shoe upper still needs to be individually heat-set and then sewn to the insole. This labor-intensive post-production process presents a considerable obstacle towards further developing seamless shoe upper manufacturing.

3D seamless knitting technology may be exactly what the industry needs to solve this problem. This new technology enables flat knitting machines to produce a complete shoe upper, ready to be directly connected to the sole, with a single machine. This leap in knitting technology presents an exciting possibility of completely eliminating labor-dependent cutting, sewing and heat-setting from the shoe production process – and fully automating shoe upper manufacturing.

flat knitting machines to produce a complete shoe upper, ready to be directly connected to the sole, with a single machine. This leap in knitting technology presents an exciting possibility of completely eliminating labor-dependent cutting, sewing and heat-setting from the shoe production process – and fully automating shoe upper manufacturing.

Raw materials also represent a considerable expense in the shoe manufacturing process, which is only aggravated by extreme fabric waste. Warp knitting machines, for example, waste around 20-25% of fabric during production (an equivalent of approximately 132.6 tons per million pairs). Using 3D knitting solutions, each upper is completed individually and requires no cutting or sewing post-production, resulting in a completely seamless shoe upper — and reducing waste by as much as 60%, in the case of the Nike FlyKnit.

Furthermore, replacing leather with textiles has a positive impact on the environment. While leather shoes only account for a quarter of overall footwear production, they are responsible for an estimated 30-80% of global impacts on all metrics, including climate change, resource use and freshwater withdrawal. This is in stark contrast to textile shoes, which only represent 6-21% of total impact in the same categories.

Faster to market time

Matt Powell, a well-known sneaker expert and Vice President of the market-research firm NPD, believes traditional marketing and distribution plans are unable to keep pace with modern consumer preferences. In an interview with Quartz, he noted that the average concept-to-market time is approximately 18 months if everything goes smoothly (which it rarely does). At the same time, fashion cycles are compressing. He provides the notable example of performance basketball shoes, which began to catch on in early 2012 and died by mid-2015.

If the lifecycle of modern trends has been compressed to just 3.5 years, the concept-to-market process will need to be adjusted accordingly. The Adidas Speedfactory is one attempt to close this gap. By bringing production closer to consumers, Adidas has managed to accelerate to market time by a factor of 3. In the future, Adidas hopes their Speedfactory will be able to complement their original production lines by quickly producing limited runs of customized products, or replenishing certain products that are selling more quickly than expected. 3D knitting opens the possibility of streamlining concept-to-market time by implementing a realistic local production solution.

On an average, inventory costs generally represent 20-30% of the total inventory value. Even the most accomplished inventory managers are unable to bring inventory costs down to zero, partly because it’s so difficult to accurately predict how well or poorly a certain item will sell. Overstocking unpopular items is a big source of loss for many retailers, and is a pain point many are looking to resolve.

3D knitting offers a solution to the inventory problem. Rather than estimate consumer demand months ahead of time – and risk losses due to unsold inventory – 3D knitting opens the possibility to manufacture locally according to real-time demand. While this particular solution is still in its infancy, there is plenty of potential for 3D knitting to begin developing in this direction.

As professional service companies Deloitte, McKinsey and Company, and PWC all indicate global consumers are demanding more personalization. As such, manufacturers the world over are finding ways to deliver customized products, which has led to new sales models such as PAM, speed factory, and in-house production – all of which emphasize local production and faster distribution.

This is one of the major advantages of 3D knitting. Because 3D knitting solution offers a local production option, customers can order customized shoes and have them delivered within a few days, cutting down manufacturing and distribution time from several months to just a few days. The Adidas Speedfactory is beginning to realize this concept on a smaller scale; in the future, they are hoping to equip each retail store with a 3D knitting machine so customers can take their foot measurements and order customized shoes in store.

The future of 3D knitting

Although the entire shoe manufacturing industry is marching towards 3D knitting solutions, they still have a long way to go before they develop a comprehensive solution. For a 3D knitting solution to truly become practical, it needs to be able to knit a double-sided upper while maintaining the versatility and flexibility of shoe uppers. The seamless shoe uppers that are in existence today have been manufactured using a slightly improved sock machine, producing an end product that is much too thin, ‘tongue-less’, and rather limited in terms of design possibilities. As such, current technologies still require a certain amount of processing post-production. There is still a lot of room for improvement, but it’s certainly an exciting industry to watch.

Pailung products and solutions

Pailung, an internationally renowned knitting machinery company, is one of the first brands in the world to launch a 3D seamless knitting technology that can truly meet industry’s growing need for a fully automated shoe production line. They are one of the only companies that currently provides a full 3D knitting solution that can knit the entire shoe structure, ready to be attached to the sole.

Their ShupperKnit featuring 3D knitting solution is quite straightforward. The operator can easily load the desired parameters into the program, after which a single, seamless shoe upper, including the insole, with be produced immediately in a process that is as seamless as the shoes themselves.

Asia Print Expo is the destination in February for promises to be the region's leading exhibition for screen, textile and digital wide-format print, from 21 to 23 February 2019 at the BITEC exhibition centre in Bangkok, Thailand.

Over the course of three days, Asia Print Expo 2019 will provide print service providers (PSPs) and sign-makers a valuable  opportunity to discover the latest products and technologies from leading players in the speciality print market with more than 50 companies exhibiting.

opportunity to discover the latest products and technologies from leading players in the speciality print market with more than 50 companies exhibiting.

Meanwhile, Fespa will take place from 14-17 May at Messe Munich, Germany. It marks 20 years since its first appearance in the city in 1999. It has subsequently returned to Munich in 2005, 2010 and 2014, a destination which consistently ranks highly in visitor feedback.

Fespa Global Print Expo 2019 will cover six halls of Messe Munich and more than 700 exhibitors are expected to take up stands. It will be co-located with the European Sign Expo 2019, continuing a partnership from last year.

In other Fespa news, the show is returning to China this year, with the re-launch of Fespa China 2019. The new event will take place from 8 to 10 November 2019 at the Canton Fair Complex, Guangzhou, China, where it will be co-located with ISLE Autumn (International Signs & LED Exhibition).

Fespa previously hosted FESPA China events from 2012 to 2015, alternating location between Shanghai and Guangzhou. The last Fespa China event to take place in Guangzhou was in 2014 and attracted 11,667 individual visitors, with total attendance of 15,166 including re-visits. Delegates travelled from 91 countries, both within Asia and further afield.

Fespa China will occupy hall 1.1 of the Canton Fair Complex, equivalent to 70% of the show floor, with ISLE Autumn taking the remaining 30%. Fespa China exhibitors will be focused on speciality print - screen printing, digital printing, textile printing and printed signage - whereas ISLE Autumn addresses non-printed signage, including LED display and lighting.

Meanwhile Fespa is using findings of its annual Print Census, which collates the thoughts of more than a 1,000 printers and signmakers across the world, to scope out the trends, markets and technologies at the forefront of visitors minds.

Fespa events in 2019

Asia Print Expo 2019, 21-23 February 2019, BITEC Exhibition Centre, Bangkok, Thailand

Fespa Brasil, 20-23 March 2019, Expo Center Norte, São Paulo, Brazil

Fespa Global Print Expo, 14-17 May 2019, Messe München, Munich, Germany

European Sign Expo, 14-17 May 2019, Messe München, Munich, Germany

Fespa Mexico, 22-24 August 2019, Centro Citibanamex, Mexico City, Mexico

Fespa Africa, 11-13 September 2019, Gallagher Convention Centre, Johannesburg, South Africa

Fespa China, 8-10 November 2019, Canton Fair Complex, Guangzhou, China

Fespa Global Print Expo, 24-27 March 2020, Fiera de Madrid, Madrid, Spain

One of the most talked about growth areas in the speciality print sector in recent years has undoubtedly been textile printing. Sean Holt discusses how digital technology in textile printing is enabling even more agile production models

Reflecting on 2018, it’s not hard to see why – both the 2018 FESPA Print Census and attendance at the FESPA Global Print Expo 2018 in Berlin revealed that many of those already in textile printing are making investments to increase capacity and boost productivity, while many businesses not yet operating in textile printing are seriously considering adding it to diversify their service offerings.

Expo 2018 in Berlin revealed that many of those already in textile printing are making investments to increase capacity and boost productivity, while many businesses not yet operating in textile printing are seriously considering adding it to diversify their service offerings.

Almost one in five visitors to last year’s FESPA event had a specific interest in garment decoration and 17% of exhibitors showed textile production solutions. In addition, 39% of graphics producers surveyed in the Print Census reported that they are looking for textile printing capabilities when they make investments; a significant increase from the 21% who reported looking for these capabilities in 2015.

Recognising textile printing’s significance as a growth opportunity for the industry, last year we launched Print Make Wear – an interactive fast fashion factory experience – at FESPA Global Print Expo. The reception the feature had from visitors was very enthusiastic and the first-time exhibitors it attracted found the event extremely successful. Indeed, more than 2,000 visitors took advantage of the expert-guided feature tours and delegates included senior managers from sportswear, clothing and promotional apparel brands, many of whom were planning to invest within six months.

The feature showcased end-to-end garment production workflows, enabling visitors to evaluate both screen and digital technologies and identify opportunities to optimise their own operations. What was clear from visitor feedback was that there is a great deal of interest in how to enable faster and more streamlined production that reduces waste and increases flexibility.

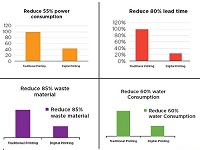

With this in mind it is hardly surprising that, while the majority of garment and textile production is currently still analogue, 56% of the businesses surveyed in the Print Census have already invested in digital wide format technology and a further 19% plan to do so in the next two years. While 69% list faster production speeds as their top investment priority, what is even more telling is that screen and textile printers expect the digitally produced portion of their textile printing revenues to grow by an impressive 12% over the same period. Garment products dominate across the screen printers, textile producers and direct-to-garment print businesses surveyed in the Print Census, with sports apparel, textiles for garments and fast fashion being the fastest growing applications. The supply chains within these market segments are undergoing considerable change as the market shifts from a supply-led history to a demand-centric future and with this in mind, the reasons for digital technology’s growing appeal for textile printing become clear.

It enables the fast, lean and flexible production that brand owners are looking for to optimise response times to seasonal peaks and reduce time to market. Not only this, it also enables immense creativity in terms of colour and materials. For example, 55% of textile print businesses surveyed in the Print Census are looking at digital solutions primarily for the ability to print directly onto untreated materials. Equally importantly, digital technology allows for the customisation that is becoming so important in every industry driven by consumer demand.

With technology enabling ever more agile production models, I believe that this is an exceptionally exciting time for garment producers, textile printers and even those PSPs still investigating whether to leap into the world of textile printing. It feels like we are at the forefront of something big and this will make Print Make Wear at this year’s FESPA Global Print Expo one of the event’s must-attend features, with designers, brand owners, production teams and technology experts all coming together to exchange knowledge and explore new possibilities for a more sustainable fashion value chain.

The textile industry has taken an immense leap in the digital printing sector. One of the utmost promising developments in the textile industry is digital fabric printing. It has unlocked the doors for numerous prospects to enhance the quality and sustain the growing demands of textile printing. Worldwide market value for digital textile printing expanded to CAGR (Compound annual growth rate) of $1.88 billion in 2018.

Specialists have forecast that global digital textile printing production will be around 1.6 billion square meters annually by 2019. Digital systems are set to continue this fascinating prospect as the products of the fashion, signage and home-made industries add new business models and value to the industry. This will upsurge the total value of the market by $3.75 billion in 2023 and will grow to consume over 2.70 billion m².

Specialists have forecast that global digital textile printing production will be around 1.6 billion square meters annually by 2019. Digital systems are set to continue this fascinating prospect as the products of the fashion, signage and home-made industries add new business models and value to the industry. This will upsurge the total value of the market by $3.75 billion in 2023 and will grow to consume over 2.70 billion m².

Dye-sublimation printing, in particular, has seen dramatic growth in the past several years, and direct-to-fabric printing is poised to displace some of the “traditional” transfer-based dye-sublimation printing. Improved print head design and higher-quality substrates are also strong drivers of growth of digital textile printing. Complement on top of that the phenomenal growth of “soft signage,” and it is hard to find a pessimistic forecast.

Digital Textile Printers are seeking more precise ways to determine the type of equipment and determine the length of time for printing. It has been revealed that print service providers are focusing on their printing technology for digital textile printing automatically. Worldwide, 22.2% of the Digital Textile Printing Market of the Polyester segmented to register the CAGR. The most frequently used digital textile printing are Direct to Fabric (DTF) and Direct to Garment (DTG) segment by printing process accounting more than 80% of the market portion of digital textile printing market.

Electronics for Imaging, Inc. is a leading international company based in Silicon Valley that specializes in digital printing technology, believes that digitally printed textiles will grow at 10-15% in the next several years.

“Mimaki” is another foremost manufacturer equipped with a wide range of solutions for textile printing. Yuji Ikeda, General Manager of global marketing at Mimaki Engineering, recently said to Textile Today that the market is growing and believes it will continue to do so at an extraordinary pace.

Eco-friendly mechanisms, high design flexibility, low-cost ornaments are the main motives for the growth of digital printing technology. The traditional textile printing process takes approximately 6-8 weeks to take 3-10 days through digital printing technology.

technology. The traditional textile printing process takes approximately 6-8 weeks to take 3-10 days through digital printing technology.

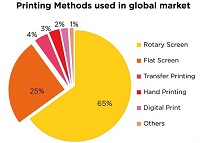

Difference between traditional digital printing

China produces nearly one-third of all printed textile in the world. Likewise, currently, the market segment of digital textile printing is only one to two percent. Compare to that 65% of the rotary screen printing is made, 25% by flat screen printing and made by handprint. Contrary to expectations, digital printing has scarcely any impact on the traditional printing process.

Printing Methods global market

Bangladesh’s 86% of exports emanate from textile and textile products. In the field of digital printing, Bangladesh factories are doing significantly well. According to the data of BTMA (Bangladesh Textile Mills Association), Bangladesh has 240 dyeing-printing-finishing mills.

Bangladesh’s 86% of exports emanate from textile and textile products. In the field of digital printing, Bangladesh factories are doing significantly well. According to the data of BTMA (Bangladesh Textile Mills Association), Bangladesh has 240 dyeing-printing-finishing mills.

YPRES, Belgium — January 29, 2019 — Techtextil 2019 will take place February 26-28, 2019, in Raleigh, N.C., and Picanol will be present with an information booth — Booth 1636.

The history of Picanol is clearly intertwined with that of the American textile industry. Picanol set up its own organization — Picanol of America — on February 1, 1966. Since then, America has always proven to be a market of great strategic importance as Picanol has installed tens of thousands of weaving machines at American weaving mills. Over the years, the technical fabrics segment has become a very dominant area, which makes Techtextil an important fair for Picanol.

Picanol will not only promote its rapier and airjet weaving machines at Techtextil 2019, but also the extensive range of services and support that it provides to its many customers from its 18,000 square foot facility: training, electronic repairs, new machines installation & start-up, textile technical support, spare parts, and weave-up upgrades are among the most critical services that the Picanol team will discuss with visitors.

During fiscal 2018, total sales of Rieter, a textile machinery company, were CHF 1,075.2 million, 11 per cent higher than CHF 965.6 million in the last fiscal. The company's net liquidity also increased to CHF 150.3 million over CHF 130.5 million in fiscal 2017. However, the order intake was down 17 per cent year-on-year to CHF 868.8 million.

In the Asian countries excluding China, India and Turkey, Rieter increased sales in the reporting year by 36 per  cent to CHF 433.9 million, of which Uzbekistan contributed CHF 144.1 million. In 2018, sales in China fell by 19 per cent to CHF 148.6 million. With the phasing out of the subsidy programme in the western province of Xinjiang, the demand for machinery declined. Sales in India fell by 16 per cent to CHF 146.2 million. In Turkey, Rieter has achieved sales of CHF 154.8 million in a difficult market environment, due to the introduction of the new ring and compact spinning machines. Sales in North and South America amounted to CHF 108.6 million

cent to CHF 433.9 million, of which Uzbekistan contributed CHF 144.1 million. In 2018, sales in China fell by 19 per cent to CHF 148.6 million. With the phasing out of the subsidy programme in the western province of Xinjiang, the demand for machinery declined. Sales in India fell by 16 per cent to CHF 146.2 million. In Turkey, Rieter has achieved sales of CHF 154.8 million in a difficult market environment, due to the introduction of the new ring and compact spinning machines. Sales in North and South America amounted to CHF 108.6 million

In the Europe region, Rieter increased sales 3 per cent to CHF 47.3 million. Sales in the Africa region amounted to CHF 35.8 million.

The Machines & Systems business group has posted an order intake of CHF 468.3 million, a reduction of 30 per cent compared to the previous year. Demand in the new machinery business was characterised by uncertainties in Asia and Turkey as well as the tense financing situation for emerging market customers. Both factors had a negative impact on the investment sentiment in the spinning industry. This was especially evident in the fourth quarter of 2018, which with an order intake of CHF 34.9 million was very weak in all regions.

In the Components segment, order intake was CHF 260.1 million, around 14 per cent above the previous year. Due to weaker macroeconomic conditions, order intake in the fourth quarter of 2018 amounted to CHF 55.0 million which was lower than in the previous quarters. This decline can be attributed to a low propensity for investments by customers.

With an order intake of CHF 140.4 million, the After Sales segment has recorded a year-on-year decline of 9 per cent. Order intake of CHF 29.1 million in the fourth quarter of 2018 was lower than in the previous quarters. This is due in particular to the lower order intake for installation services for new Rieter machines.