FW

Pakistan’s total exports to the EU increased by 38 per cent from 4.25 billion Euros in 2013 to 6.28 billion in 2016.The country’s garment exports to the European Union increased by 75 per cent.

Trade incentives extended to Pakistan under GSP Plus played a positive role in boosting Pakistan’s exports to the EU.

Duty free access is helping Pakistani products to compete with products originating from Bangladesh, Vietnam and Turkey and many other countries.

Under GSP Plus Pakistani goods have duty free access to 28 EU member states. Out of these 28 EU countries, Pakistan’s exports have registered an increase in 26 countries. Out of these 26 countries, Pakistan’s exports have risen by 50 per cent or more to ten EU member countries while eight countries are such where Pakistani exports have risen by 25 per cent.

The textile sector has been a major beneficiary of GSP Plus. Pakistan’s exports of textiles have increased by 55 per cent in value terms in 2016 over 2013 and Pakistan’s exports also registered an increase of 33 per cent in terms of quantity during the same period.

Pakistan’s garment and hosiery exports to Europe have increased by 75.7 per cent. Likewise home textile exports to the EU have increased by 60 per cent.

Overall GST seems to be in line with the expectations industry had envisaged, except for the fact, that man made fibres/synthetic fibre andyarns have not been treated at par with cotton and other natural fibres, giving scope of some kind of misrepresentation, play in invoicing and boost to cotton value chain instead of synthetic value chain, perhaps that was the need of the hour and government of India seems to have missed an opportunity .

Some of the feedbacks and early reactions to GST and its implementations are as:

Prashant Agarwal, Co. Founder & Jt. Managing Director, Wazir Advisors on Entire Value Chain Impact of GST:

1. Based on industry experience, following conversion ratios are used

a) From fiber to yarn , conversion factor of 2 is taken for cotton yarn

b) From manmade fiber to manmade yarn , conversion ratio of 1.4 is taken

c) From yarn to fabric conversion factor of 2 is taken

d) From fabric to garment at manufacturing stage, conversion of 2 is taken

e) From garment manufacturing stage to garment retail stage, conversion factor of 2 to 3 is considered for cotton garment and 1.5 to 2 is taken for manmade garment

Impact of GST in cotton value chain:

• As in value chain on cotton, GST is 5%, net impact will be positive, with more companies coming in organized value chain, paying GST, to take credit in whole vale chain.

• The impact will be nullified to a larger extent, because of input credit from previous value chain and also credits taken from other inputs in the manufacturing process like, oil, dyes and chemicals, logistics etc.

• In garments sold above MRP of Rs 1000, an impact of 2-3 % price will come, which can be absorbed by branded players in present prices points

Impact of GST on synthetic value chain:

• The taxes remains same as cotton in whole value chain accept at fiber and yarn stage, where GST is 18%

• This higher GST at fiber and yarn stage will increase the price points by another 2-3 %

• But the major issue in not adopting fiber neutral policy, the investments needed by Synthetics industry will take slight hit in short term, but will be taken care in long term by increase in synthetics demand in market

“In totality GST and rates decided will be good for industry and will move industry towards more organized status and increased entry of bigger corporates in business in long term, which is needed to create jobs for the country.”

Ashok Chaudhry, Independent Consultant on Implementation

My opinion is based on a general view. Since the textile industry, starting from fibre to fashion, is very competitive and low margin products whether intermediate or finished, people associated with this industry are very innovative and hard working. These people have already started taking necessary steps to combat the impact of GST, after studying the details published. This industry would quickly adapt to changes coming without much impact.

K. D. Singh, CEO, Kanchan Textiles on Composite Mills vs Independent Units

Composite mills would stand to gain, where all tax credits are pooled at one point...even service tax paid on telephone bills, transport, hotels etc, will come handy while discharging final GST on finish fabric i.e.5% unlike independent processors where ST is 18%....there won't be any adverse revenue impact on composite mills

Now there will be arm twisting on standalone units..like independent weavers and processors, being basically in unorganised sector and catering to job work...processors will try to take advantage of 18% service tax levied on textile processing...

R S Singh, Business Head, Blue Blends on Cotton Value Chain

We probably couldn't have bargained any better. 5% uniform rate in yarn, fabrics and 1000 Rs garments will mean no change in prices for the consumers too. Majority of output in unorganised garmenting sector falls in this MRP range. Yarn and fabrics' prices will be unaffected too. I expect that compliance rate will improve significantly in unorganised sector.

Garments' manufacturing in organised sector too will look up. Of course net tax rates have gone up here but it will be partly compensated by reduction in input costs and the resultant impact will be marginal.

This will of course help composite sectors, There had been an army of merchant manufacturers and unorganized players in Ahmedabads and Mumbais of India, they will be impacted severely by this.But just thinking loudly, the tax paid on processing job can be taken a credit off by the merchant manufacturers and can be utilised in payments of GST on fabric sales. Thus it may not harm at all. The catch is "value addition". If it is not adequate, they may face a situation where the entire amount of credit is not utilised. Otherwise, this should not have any impact at all.

To conclude, I am very happy about the provisions for the cotton textiles value chain.

Govind Sharda, CEO, Vishal Fabrics on Cotton vs Manmade

Tax slab on man made fibre will tilt manufacturing in favour of cotton fabric. There is a possibility of shrinkage of man made fibre spinning where India remains uncompetitive as compared to Chinese scales. On the cotton yarn front, disparity between the yarn producing states and consumers could create further employment opportunities in otherwise deprived states. However, value added functions like job work based textile operations need be checked into. Overall, the fabric industry would be forced to go for higher value additions to neutralize the costs whereas middlemen for apparel could be squeezing some of their margins to insulate end prices. Yes, the composite apparel manufacturers could have NIL impact. We need to examine the total provisions and for sure, many of the existing business strategies would call for re-structuring.

Pankaj Sharma, Sr VP Mktg, Spentex Industries Ltd on Yarn

Yarn business was already under tax regime so major fireworks will be watched in fabric business, Job work business of weaving, yarn dyeing, processing, embroidery etc.

However govt has been smart enough in creating the GST narrative around business circles in such a way that everyone has conceived this concept and is ready to undergo the labor pains of implementation

Yogesh Gaikwad, Dir, Society of Dyes & Chemicals (SDC), UK on Manmade Value Chain

I personally expected that GST would help doing business in India simpler. I have reasons for being disappointed. 18% tax on man made fibers would lead to confusion about what exactly is man made especially in blended fabric. A common slab of 5% across the textile value chain would have helped to ease the burden on already troubled business due to the 'adventurous' demonitisation . Business will now have to focus on getting invoices correct every time and avoid the vat liabilities which could be more than the profit they earn.

Pankaj Tibrewal, VP ( Exports), RSR Mohota Spg & Wvg Mills Ltd on ValueChain

From above apparently, it looks that excise duty + vat or s.tax has been added in most cases to arrive at GST , and by bringing fabrics under GST shall make this business recordable.

Rajeev Kathuria CEO, HUG Clothing LLP on Fabrics to Apparel and Retail

For textile value chain it is inflationary in its impact. Also various rates at different level only means resorting to malpractice to keep tax incidences lower .Tax on fabric stage in cotton value chain will increase input cost of garment manufacturers..and they will pass it on to retailers / wholesalers ... Tax of 12% on MRP over Rs 1000 MRP provides better competitive environment to corporate and mid size brands compared to unorganised players in this price band ....high rate will work as disincentive for tax compliance in this segment ....

Any small player working on mills fabrics can't keep MRP level below Rs 1000/- in today's economy

( even though they avoid marking MRP , as per governing rules , 50% mark up is considered for calculating MRP ...so any manufacturers selling over Rs 700/- is required to charge 12% ....more clarity required than available right now on this ) .This seems to be a half measure with an eye on uniform rates over 3-5 years horizon …Yet more info required to understand and reflect on its implication

K D Singh Tanwar, MD, Shree Sai creation on Twisting, Texturising and Dyeing of Synthetic Yarns

1) Input credit for packing material or coal or dyes & chemicals, may not be more than 3 to 4%.

2) That means we have to pay additional 9 to 10% out of GP.

3)Now under invoicing may come but even the consumer may not accept it.

4) Everyone will try to get over invoicing in buying and under invoicing in selling, which is a jam like situation.

5) Increasing rates may look like a mirage like solution.

Amit Jain, Consultant, on Home Textiles

Domestic Home Textiles has mainly 3 products, Bedsheet, Towels and Blankets.

1. In case of Bed sheets, the 100% cotton bed sheets will be marginally affected, as 80% are of MRP below 1000/-. The artificial or perceived pricing of bed sheets will become detrimental due to 12% GST instead of 5%. Fair pricing shall prevail. Higher GST of 18% on MMF, instead of 5% on cotton, should reduce sale of micro and pc bed sheets.

2. In case of towels, there shall be marginal benefit on price. Bulk of towels are below MRP of 1000/- and current VAT ranges from 0 in Maharashtra, Tamilnadu and West Bengal and bulk of other states having 5.5%.

3. The Blankets are mainly of 100% polyester. With 18% GST on fibre and 5% GST on Blanket below 1000/- and 12% above 1000/-, the prices shall increase or profit of Brands/ Manufacturers shall go down.

Overall it seems to make MMF costlier and reduce it usage.

Subhash Bhargava, MD, Colorant Limited on Dyes & Chemicals

18% of GST slab for dyes and chemicals is fine with our sector and we look at this as a positive step for organized industry, being part of textile value chain as the entire chain has come in GST net.

But in terms of textile, I think government has missed an opportunity to bring both cottons and synthetics to bring at par, giving possibility of misrepresenting blends. In any case, more details and notifications are expected to have more clarity on blends

Rajiv Varma, MD, DURST, Digital Printing Machines

All raw material for digital printing ink , paper , printer pre post treatment chemicals are under 18% gst .

If end product is under 12% then will job worker get credit back?

Ajay Kanwar, LCI Textile Solutions Pvt LTD , Director, Ex-MD Huntsman India on Dyes & Chemicals

Sir, mostly on dyes and chemicals, it's 18% and I think there is no major impact overall

Tarun Baxi, Independent Consultant on Exports

I am very positive about GST, yes there will be confusion for exporters till the notification come into force, but for export you have long period, Government must come out with clarification for exporters.

GST RATE final on GST Council Meeting held on 3rd June, 2017

Chapter No: 52, Cotton: 0%

Gandhi Topi, Khadi yarn

Chapter No: 52, Cotton: 5%

*Cotton, Cotton waste, Cotton sewing thread, Cotton yarn, other than khadi yarn, Cotton fabrics (5201 To 5212 )

Chapter No: 53, Other vegetable textile Fibres; paper yarn, woven fabrics of paper yarns

*Coconut, coir fibre [5305], Jute fibres, raw or processed but not spun : 0%

*All other vegetable fibres and yarns such as flax, true hemp, paper yarn, etc. [5301, 5302, 5303, 5305, 5306, 5307, 5308] Fabrics of other vegetable textile fibres, paper yarn [5309, 5310, 5311] : 5%

EDANA, the global association serving the nonwovens and related industries, has announced its new board of governors for 2017 - 2018.

Returning chairman Martin Rapp (vice-president and general manager at Glatfelter) will again provide leadership, supported by re-elected vice-chairs Mikael Staal Axelsen (Fibertex) and Pieter Meijer (McAirlaid’s).

Paul Eevers’ (Unilever) position as treasurer was also renewed for another one year term.

The newly elected board will begin its term on July 1, 2017.

In addition to his long-standing support of the association as a board member, Martin Rapp is the chair of the Communications Steering Group, and has ensured widespread member backing for a broad range of EDANA initiatives throughout his tenure.

His ongoing focus will be to ensure that the group’s activities meet the strategic interests of stakeholder engagement, global outreach, and sector expansion.

This year’s review of strategy and objectives featured update presentations from key EDANA working groups and committees.

EDANA provides a comprehensive range of services and supplies its members with the information and data necessary for them to enhance the industry goals and performance.

Formed in 1971, and unifying the diversified interests of over 220 member companies in a unique vertically integrated structure along the supply chain, EDANA is the single, powerful voice of nonwovens, representing, protecting and actively promoting the common interests of nonwovens and related industries throughout the world, with a particular focus on Europe, Middle East and Africa.

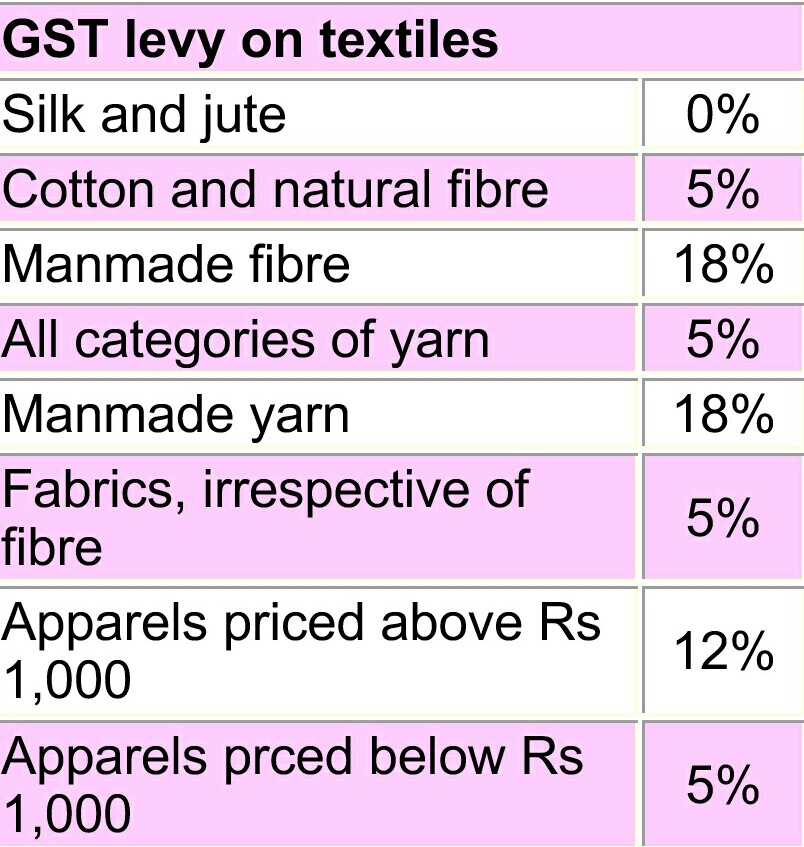

The Goods and Services Tax (GST) Council on Saturday cleared the pending rules for the rollout of the new indirect tax regime from July 1.Finance Minister Arun Jaitley chaired the 15th meeting of the GST Council, where the rates of tax and cess on gold, biscuits, footwear and textiles were decided:

Highlights of GST for various sectors of textiles, apparel and footwear:

• GST council has levied tax on textiles such as yarn and fabric cotton at the lower slab of 5%

• GST of 12 per cent will be levied on readymade garments. However, apparel under Rs 1,000 will attract a 5 per cent levy.

• Manmade fibre will be taxed at 5 per cent, while synthetic fibre will attract an 18 per cent GST.

• Jute and Silk have been exempted from GST.

• The GST Council has fixed the tax rate on footwear worth up to Rs 500 at the lowest tax slab of 5% under the new GST regime, The GST tax rate on footwear costing more than Rs 500 is fixed at the higher 18%

• Other than this, it levied cess over and above the 28% tax on certain luxury goods and sin goods. A section of industry is saying that differential treatment for cotton and synthetic fibre on GST rate is an opportunity lost for a uniform rate for textile sector.

The government has fixed a 5 per cent GST rate on cotton fibre, yarn and fabric against the current prevailing rate of “nil”. This means, cotton yarn and fabric would now attract 5 per cent duty, which would make all products proportionately costlier. Some states, however, had levied value added tax on cotton yarn and fabric at 2-4 per cent. Overall, 5 per cent GST levy is higher than the existing levies on cotton yarn and fabric. Silk and jute have been kept under “nil” category under the GST. Man-made or synthetic fibre yarn will attract 18 per cent GST.

While all apparels would attract 12 per cent GST once the tax is rolled out, against the current levy of 6-7 per cent, apparels below worth Rs 1,000 would levy 5 per cent GST.

“We are happy with the government’s decision to keep fabric under 5 per cent and apparel under 12 per cent,” said R K Dalmia, President, Century Textiles.

While announcing these rates, the Finance Minister Arun Jaitley, however, clarified that textiles manufacturer would not given credit outflow. This means, an input credit above the prescribed limit would not be granted to textiles manufactures, said Jaitley.

He said this in the context of 18 per cent GST for man-made yarn, while fabric made from that will attract 5 per cent and hence full input credit will not be utilised.

S C Kapur, chairman of association of synthetic fibre industry said, "The government should have appiled a uniform rate to the textile industry which has been the global practice. Man-made fibre tax at cotton yarn level would have helped higher investment in the sector. Additional demand for fabric can be fulfilled by synthetic makers as there will always be an upper limit to produce more cotton."

Synthetic yarn and cotton yarn blended fabric constitutes 70-80 per cent of total fabric and hence mis-declaring synthetic fibre as cotton in blended fabric is not ruled out, say industry captains.

With this, readymade garments would become costlier proportionately. Had input credit been granted, garments manufacturers would get a breather in terms of taxes on raw materials.

“The 5 per cent GST levy on cotton yarn and fabric would make interstate movement of goods smoother and business would become transparent. A small increase in the product rate would become immaterial once business goes with uniform tax rates across the country. Meanwhile, the rate of 12 per cent for textiles is progressive and will lead to the growth and development of the entire value chain,” said Ujwal Lahoti, Chairman of The Cotton Textiles Export Promotion Council (Texprocil).

The GST rate for textiles will eliminate the cascading effect of duty/taxes which will reduce the costs and improve the competitiveness of the textiles exports.

“Five per cent GST on cotton yarn and fabrics would help producers with compliance and encourage farmers to grow more cotton, Lahoti added.

With this low rate, Indian producers would become competitive in the world which will help India’s textiles exports grow in coming years, a senior industry official said.

"A credit transfer document will be issued to the manufacturer. If the tax on the item is below 18 percent, 40 percent of the Central or State GST payable will be given as credit. For items with tax above 18 percent, 60 percent will be available as credit," said Revenue Secretary Dr. Hasmukh Adhia during the press briefing.

Southern India Mills Association (SIMA) today hailed the Goods and Services Tax (GST) rates announced for the textile industry. As the textile industry has been under the optional route since 2004 and the fabrics have been under zero VAT rate, the 5 per cent GST rate would bring substantial revenue apart from widely broadbasing the tax net across the textile value chain and ensuring compliance, SIMA chairman M Senthilkumar said.

The 5 per cent GST on readymade garments below Rs. 1000 would greatly benefit the common man across the country, being a mass consumption item.

SIMA chief has stated that 5 per cent GST rate on cotton fibre would sustain the competitiveness of over 20 million cotton farmers as this rate across the value chain would enable the cotton textile industry to remain globally competitive, achieve substantial growth rate and increase cotton fibre consumption and thereby increase the earnings of the farmers.

He expressed hope that the textile job work would be exempted from service tax which is essential to benefit the industry, especially the powerloom sector, knitting, processing and garmenting sectors.

Senthilkumar said that 18 per cent GST rate levied on man-made fibre and synthetic yarn would have inverted duty structure problem as the fabric would attract only 5 per cent GST rate.

Genetic engineering, innovations in tillage, and changes in farm size and efficiency have combined to reduce cotton’s impact on the environment over the past 35 years.

Cotton farming has evolved from horses to robots and drones. Great improvements have been made in reduced soil loss, water use, and pesticide use.

Measuring evapo transpiration offers real-time information to help schedule irrigation.

Plus these environmental improvements have not been at the expense of production. From the ‘60s until now, cotton farmers have almost doubled the amount of cotton they grow with no more acreage.

Commercial cotton breeding has created new varieties that produce more lint. Integrated pest management programs allow producers to be more precise in targeting insect pests. And those pesticides are more selective, targeting specific insects, diseases or weeds. Now, selective pesticides preserve beneficial insects like lady bugs.

Reduced tillage systems are helping conserve moisture, increase organic matter in the soil and limit water and wind erosion.

Biotechnology now protects plants from insect damage. Herbicide tolerant varieties also allow a more efficient weed management system. Cotton farmers also reduce energy consumption because of biotech.

Genetic engineering has improved varieties in other ways. Cotton is already known for drought tolerance. It requires significantly less water than corn, wheat or rice.

Domestic prices of cotton in Brazil have oscillated in May, but ended the month with a slight increase.During the month, the CEPEA/ESALQ Index, eight-day payment terms, for cotton type 41-4, delivered in São Paulo, increased 0.52 per cent.

In general, liquidity was low in May. Quotes were underpinned by the firm position of sellers in the off-season period and by the devaluation of the currency against the dollar, mainly in the second fortnight of the month.

In addition to lower cotton availability in the spot market, the gap between asking and bidding prices also contributed to limited trade.

Based on estimates for a good 2016-17 harvesting, some processors expect prices to drop and hence were interested in buying only small volumes to meet their short-term needs.

For the anticipated trade of the new season, the gap between asking and bidding prices has been wide as well.

However, the pace of export trade was faster in May, mainly for shipments in 2018 (2017-18 crop). International price rises, mainly in mid-May, encouraged agents to close new contracts and/or fix prices for open contracts.

Brazilian cotton prices climbed in the first fortnight of January 2017, primarily driven by low availability, coming from the failure of the 2015-16 crop and since most production from that crop was traded in advance.

A&E makes continued improvements, specifically in global water reduction and zero-waste-to-landfill efforts. The group has recycled and reused over 1.1 billion liters of waste water since 2013. Nearly one million liters of waste water are recycled and reused each day of operation. There has been a 41 per cent reduction in global water consumption since 2006 in its operations.

American & Efird is a manufacturer of industrial and consumer sewing thread, embroidery thread, and technical textiles.

A core part of its business strategy is to operate all of its global facilities in a sustainable manner. The group has managed a six per cent reduction of global carbon footprint since 2006 while 44 per cent of the fuels used to create steam at A&E dyeing operations were renewable and carbon neutral in 2016. There has been a ten per cent reduction in global power consumption at the group since 2006.

A&E continues to focus on energy conservation and has increased its use of bio fuels and clean fuels, resulting in reductions in greenhouse gas emissions. In addition, A&E has grown its number of global operations and support facilities to 16 in achieving zero-waste-to-landfill status.

A&E regularly evaluates all of the global yarn spinning, dyeing and finishing facilities in which the company has ownership.

"DMA Textile Care, Fabric and Leather Technologies to extend its support for one of the leading International Trade Fair for Technical Textiles and Nonwovens -Techtextil India. It will work up to increase its scope into the garment machinery segment this year. Working together with the VDMA Textile Care, Fabric and Leather Technologies, the organizer plans to capitalize on this market need and deliver a specialized platform that is completely focused on business requirements of the Indian market."

DMA Textile Care, Fabric and Leather Technologies to extend its support for one of the leading International Trade Fair for Technical Textiles and Nonwovens -Techtextil India. It will work up to increase its scope into the garment machinery segment this year. Working together with the VDMA Textile Care, Fabric and Leather Technologies, the organizer plans to capitalize on this market need and deliver a specialized platform that is completely focused on business requirements of the Indian market.

This launch has even drawn attention of the buyers from India’s largest garmenting associations Apparel Export promotion Council and Clothing manufacturing of India both of these have shown their support to this plan. These associations are planning to visit the fair to recognize the developments and get new technologies to their members.

The support demonstrates the hugeprospective for trade and technology transfer between Indian and German companies they will target the increasing demand and manufacturing emphasis of the garment and textiles industry in India.

India being one of the major producers of garments international, the demand for automation solutions is increasing says Elgar Straub, Managing Director of VDMA Textile Care.

India is the second major textile manufacturing capacity globally with the textile machinery sector witnessing a growth of 8-10 percent year on year leading in apparel consumption as well as inexports. It is definitely, giving growth to computerization garmenting processes to move in the Indian market.

Giving importance to the launch of Texprocess Pavilion has increased with themajor machinery importers IIGM and E H Turel, Mehala already on board. According to the Pavan Kapoor, Managing Director, IIGM India's diverse markets are rightly positioned to manufacture, consume and export non-traditional textile products. Products that are not related to apparelhave diverse applications in geo thermal, wind, automotive, process industries, health care and technical textile etc compared to the traditional methods of manufacturing adissimilar technologies is needed for such industry related products.

He further adds that besides leaning about the applications of these newer technologies, these segments of business would surpass the requirement of traditional textile and leather products.

Discussions are also under-way with a lot of companies to bring in a mix of international expertise in technical textiles and technologies on one platform.

Texprocess and Techtextil in India will bringanoutstanding showcase that will cover the completeprice chain in the fields of technical textiles, nonwovens, apparel textiles and apparel and textile technology. The market for technical textiles is growing and demand for processing technologies is also increasing.

Digital Print Week US will be held June 5 to 9, 2017.It will feature Digital Textile Printing US, slated for June 8 to 9, 2017. Digital Textile Printing will bring together an audience that will span the entire supply chain, including a range of textile printers, end users and a supporting supply chain in technology providers.

Discussion at the conference will focus on the drivers for digital textile printing, including sustainability, personalization and mass customization, while exploring additional applications for digital textile printing and technical advances in the market.

Digital Print Week US will bring together a lineup of more than 50 presentations from nearly 60 experts across five days of case studies, four panel discussions and networking opportunities.

Digital Print Week US will focus on the latest innovations and applications for 3D printing, new case studies and examples in commercial scale digital package printing and exciting new developments in the high-growth digital textile industry.

Smithers Pira has been running the Digital Print for Packaging US conference since 2010. Given the event’s growth, the company is expanding into the tangential market of digital textiles.

The digital textile industry is forecast to become a 2.6 billion dollar market by 2021.

Brand licensor Marquee Brands is leading a consortium that is preparing a bid for BCBG Max Azria, which would allow the US fashion house to exit bankruptcy with a footprint of 15 to 20 stores.

The move could spare BCBG the fate of other bankrupt retailers who have completely gone out of business and sold their brands, such as The Limited Stores, American Apparel and Wet Seal.

BCBG, which is owned by investment firm Guggenheim Partners, filed for bankruptcy in March after it fell behind in rent payments and struggled with a debt load of about 485 million dollars.

Marquee has partnered with Global Brands Group Holding, a spin-off of global exporter Li & Fung, which already has a licensing agreement for some of BCBG's brands.

The consortium plans to make a stalking horse bid for BCBG that would set the floor for any other proposals in a bankruptcy auction for the retailer to be held as soon as this month.

Marquee owns British menswear brand Ben Sherman, surf line Body Glove and Bruno Magli, an Italian fashion line.

Global Brands in April sold a majority stake of The Frye Company brand, known for its cowboy boots, to brand licensor Authentic Brands Group for 100 million dollars. Global Brands continues to operate Frye’s retail stores and e-commerce.