FW

Speed is a key component of luxury fashion as big brands such as Gucci, Ralph Lauren, Coach, Helmut Lang, Burberry and Rag & Bone are picking up the pace of production cycles, adopting new strategies focused on increased flexibility and faster-paced production cycles to adapt to increasing competition and demanding customers.

Karin Tracy, Head of fashion, luxury and beauty industries at Facebook points out, “Speed is everything right now. For luxury brands, whoever is the fastest right now will have competitive advantage, full stop. They need to step out of the comfort zone of perfection, think about how to move fast and build things to let them do so.”

Experts say fast-fashion brands like Zara releases new items around five times faster than a traditional retail brand and online-only retailers like Boohoo, who can refresh their sites with hundreds of new styles daily, who are spearheading the quickened pace of trends as well as customers’ need for newness.

Having more control over the production process ensures that brands can better control the timing and frequency of new product launches. That is the reason how big brands such as Burberry and Tommy Hilfiger were able to seamlessly switch their production schedules to an in-season model within weeks.

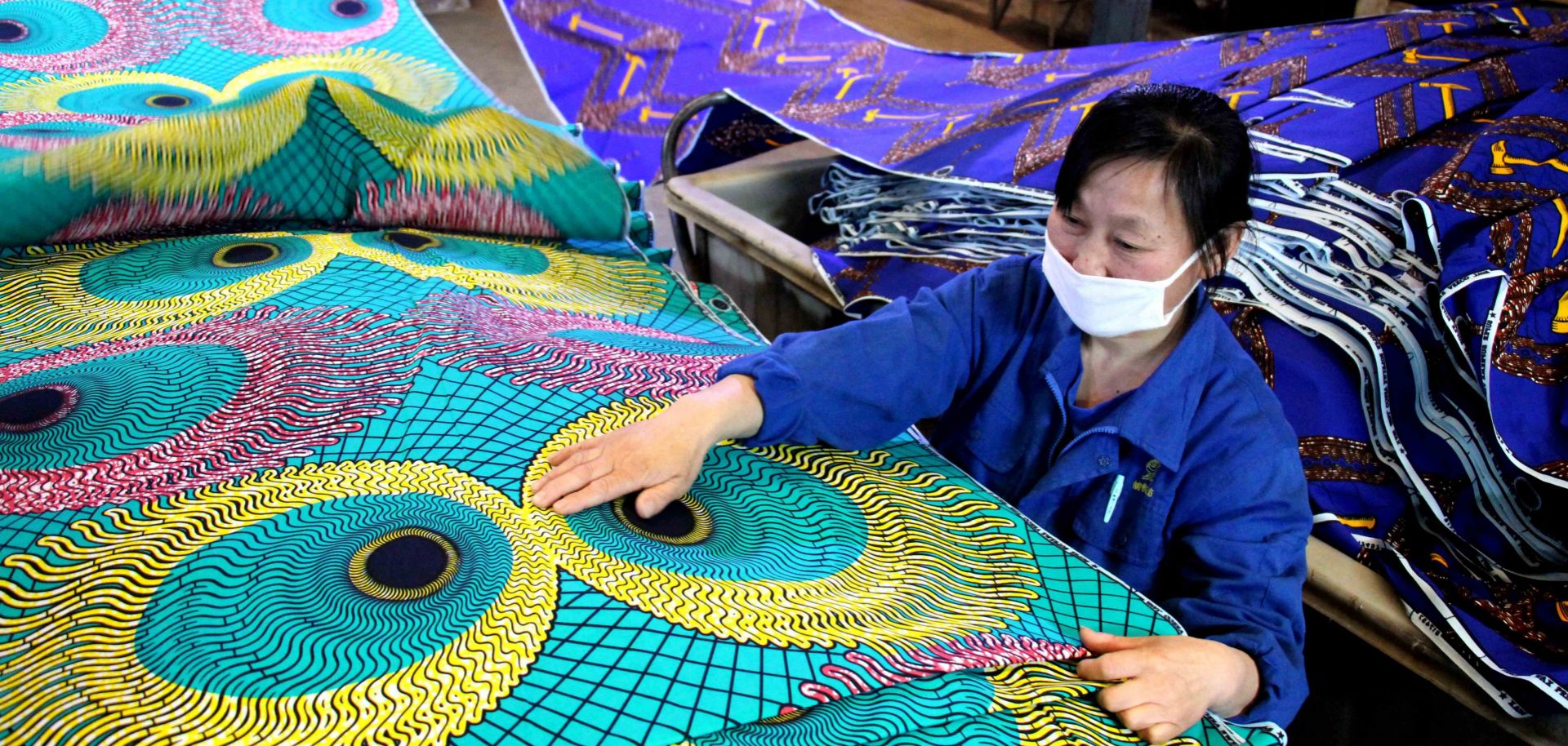

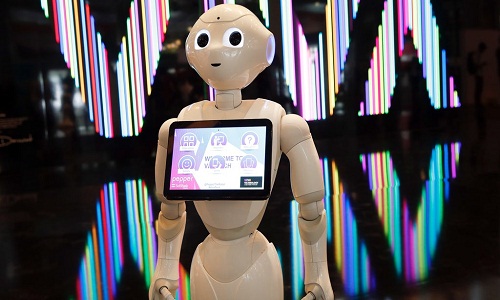

To help speed up the production process, brands must continue to invest in technology that will use tools like 3D design, automation and robotics to eliminate inefficiencies and reduce turnaround time in the supply chain which will help keep new collections in line with customer trends. Millennials have become known for less brand loyalty and an unwillingness to pay luxury prices. Besides, millennials, as a group, don’t seem to value brands in the same way their parents might have. That’s a threat to big brands.

Across the board, luxury brands are looking to get closer to customers through their owned channels, not only to stay relevant, but to make faster decisions. Antony Karabus, CEO of HRC Retail Advisory was of the view that, “Luxury retail needs to get a much closer and tighter understanding of the customer, including the ones buying, what’s being bought and how they want to interact with you. Then they can react.”

Peru's Exports and Tourism Promotion Board (PromPeru) disclosed the country’s textile exports grew by 5.71 per cent in the January-November period of 2017, largely due to higher exports of carded fine alpaca hair. Thus Peru's textile exports value increased from $1.090 billion (Jan-Nov 2016) to $1.153 billion (Jan-Nov 2017). This was the result of combed fine alpaca hair sales has seen an exponential rise of 109.58 per cent, going from $32.574 million (Jan-Nov 2016) to $68.271 million (Jan-Nov 2017).

As per PromPeru’s data, exports of undershirts and cotton T-shirts (for men and women) also contributed to the good performance of Peru's textile exports in 2017's January-November period. Thus, undershirt exports totalled $57.340 million, a 17.16 per cent rise as against the same period in 2016 ($48.940 million). Similarly, cotton T-shirt exports grew by 13.53 per cent from $118.931 million (Jan-Nov 2016) to $135.021 million (Jan-Nov 2017). In the period under analysis, wool yarn and knitted cotton shirt shipments also grew by 10.57 per cent and 10.42 per cent, respectively. The US, Brazil and Ecuador were key destinations for Peruvian textile products.

Textile exports to the US amounted to $571.919 million between January and November 2017, recording a 3.23 per cent growth as against the same period the previous year ($554.047 million). Peru's textile sales to Brazil rose by 19.51 per cent from $42.953 million (Jan-Nov 2016) to $51.333 million (Jan-Nov 2017). Textile exports to Ecuador saw an 18.61 per cent growth by rising from $48.115 million to $57.070 million. Al in all, textile exports accounted for 2.91 per cent of the country's total shipments overseas in the January-November period in 2017.

How can consumers determine the real sustainability of brands? It is only if they demonstrate that they are actively making an effort to green their supply chain. Numerous industry-specific scoring systems have emerged in recent years to help in the Sustainable Apparel Coalition’s Higg Index which delivers methodology to evaluate companies and supply chains within their markets.

The Corporate Information Transparency Index (CITI), with a list of 267 brands and 3,292 suppliers, was developed jointly by the Institute of Public and Environmental Affairs (IPE) and the Natural Resources Defense Council (NRDC), rates brands that have manufacturing centres in China as per the their sustainable practices. The group conducted over 1,400 audits with real-time assessments of companies’ green manufacturing processes, publishing the track record of those that have worked hard to ensure their suppliers are just as environmentally conscientious as they are.

The importance of IPE’s approach is that it utilises supply chain data for some of the biggest international manufacturers, also like other rating systems, the CITI doesn’t just look at the inner-workings and testimonies of the brand’s factories, but evaluates the corporations’ environmental impact in the supply chain.

This year the IPE and NRDC took another step towards improving the environmental track record of the world’s largest manufacturers. Their Green Supply Chain Map, now on IPE’s website, is a visual, real-time mapping of companies that are willing to support supply chain transparency. The map is based on publicly available information from China’s government databases and manufacturers’ disclosures. As of date, six companies have agreed to be featured on the map: Gap, Puma, Espirit, New Balance, Inditex and Target. The mapping tool is in its trail stage, with some data only in Chinese and other sections lacking clarity in English. But it offers a insights that up to now, required consumers and companies to search across industry-specific websites, call manufacturers and look out for other sources for information.

The IPE is the result of efforts of renowned Chinese environmentalist Ma Jun, whose extensive research has helped reveal the kinds of environmental pollution that China is struggling with. His work has also forced multinational corporations with manufacturing ties in China to step up their sustainability efforts.

Exports of synthetic and rayon textiles has registered growth since the start of this financial year and this trend is recording a growth of 7 per cent in dollar term during April – November, 2017. Sri Narain Aggarwal, Chairman of The Synthetic & Rayon Textiles Export Promotion Council (SRTEPC) said this year seems to be a successful one unlike previous year in terms of achievement of growth in this segment.

Aggarwal asserts the main category of fabrics, yarn and made-ups have shown a growth at Rs.20239.69 crores in terms of value and man-made staple fiber has also shown a growth of Rs.2679.28 crores during April-November 2017 period.

Chairman SRTEPC extended his thanks to our Union Textile Minister Smriti Irani for her deep understanding of the problems faced by the MMF segment. He also thanked the Union Commerce and Industry Minister Suresh Prabhu for his support and encouragement for MMF Textile industry. It was due to their continued support and cooperation exports of manmade textiles could grow and achieve its true potential, he said.

Aggarwal attributed this marginal growth of exports to the members of SRTEPC for contributing towards the achievement of an increase in exports. He was aware that the textile industry is striving hard to promote exports of MMF Textiles globally despite the tremendous hardship faced by them by the roll-out of GST from July, 2017 and seeks future co-operation from members to achieve a higher growth in exports for survival of MMF Textile Industry.

Candiani Denim, the greenest mill in the blue world, and Denham, one of the most important jeanswear brands in the world, celebrate their respective anniversaries in Florence Pitti Immagine Uomo. Candiani Denim, launched in 1938 in Robecchetto with Induno in the Park of Ticino, and Denham, launched in 2008 in Amsterdam thanks to the great talent of Jason Denham, will be the protagonists of Pitti Immagine Uomo .

The celebrations of their anniversaries will last a whole year but Florence will inaugurate them with special presentations and exclusive events. For the occasion Candiani Denim has created the Cimosa d'Oro, a canvas dedicated to two iconic models of Denham, the Razor and the Monroe. Thanks to the use of its historic shuttle looms, the most heritage production of Italian manufacture, Candiani Denim has been able to supply, in a limited edition, the canvas for these special jeans that have a gilt selvedge and which, after the Florentine presentation, will be sold by Denham worldwide and that will allow some denim fans to visit the Italian weaving during the year.

Denham will present the collectible book "A Decade of Denham" simultaneously with a photographic history of the brand from birth to the present day, a long and special journey within the manufacture of jeans. "The book A Decade of DENHAM is the best and wonderful tribute to our anniversary," says Jason Denham. "A collectible book that explores the spirit of our brand: people, values and ethos that make us unique. We have completed the narration with pages and pages of extraordinary images, glossy photos of denim, stores and scissors that will amaze you ". The meeting between Candiani Denim and Denham is a demonstration of how the industry of excellence and the creativity of a brand, together, can make the history of fashion, telling quality, passion and ethics.

Chairman of CSB KM Hanumantharayappa says the Central Silk Board (CSB) has set aside Rs 6.3 crore for development of the silk industry in Odisha in the current fiscal. They have already approved Rs 94 lakh and asked the state to send them more proposals under the Central Sponsored Schemes (CSS). Hanumantharayappa said Odisha has so far been provided 106 Buniyad machines. The machines have been distributed among women reelers in Fakirpur and Ata areas of Keonjhar district. Following this bonanza they can extract high quality silk yarn through the newly developed machine. There is a high demand for an additional 400 machines which will hopefully be provided soon.

Odisha is largely a tussar silk producing state but mulberry and eri silk are also grown marginally. The rich forest, hilly terrains and tribal population enhance the state’s agro-climatic condition for tussar silk forestry. The CSB chairman noted emphasis has also given to increase mulberry silk in the state. Two cluster-based programmes are being implemented in Ghatgaon block of Keonjhar and Kashipur in Rayagada district, he disclosed.

The CSB has provided Rs12.3 crore for implementation of Vanya Cluster Promotion Programme (VCPP) besides Promotion of Tasar Culture under Tribal Sub Plan (TSP) in Mayurbhanj and Keonjhar districts where around 1,500 farmers have benefited. The beneficiaries have been provided 90 per cent assistance as subsidy, he enthused.

Through capacity building and adoption of new technologies, Superintendent (Technical) and CSB Regional Office In-Charge Dasharathi Behera said that there was increase in the productivity of tussar resulting in economic gain of farmers. With the allotment of Rs 94 lakh, they have implemented Schedule Caste Special Plan in Bhuasuni area of Mayurbhanj where 300 families will benefit. Besides, for Buniyad machines, costing about Rs10,000 each, a subsidy of Rs 9,000 has been provided to women reelers.

About 20,000 tribal families in the state are practicing sericulture of which, more than 16,000 are tasar farmers. Last year, the atate produced 125 tonne of silk, including 115 tonne of tussar silk. Major tussar is produced in Mayurbhanj, Keonjhar and Sundargarh districts.

Bangladesh’s apparel manufacturers say vested interests are working hard to create unrest in its garment industry and this is part of a conspiracy to blacken the reputation of the industry. Siddiqur Rahman, President of Bangladesh Garment Manufacturers and Exporters Association (BGMEA) says appealed to garment workers “not to heed” to the “call of the conspirators” and that it would “harm the workers more than it would the industry.” The BGMEA chief was speaking at a programme, which was arranged at BGMEA auditorium in Dhaka, to compensate workers who died during work at various garment manufacturing factories in Bangladesh. 150 families were paid BDT 2,00,000 each, sourced from a Group Insurance fund that all BGMEA-enlisted factories have to comply with for the security of their workforce.

This was just one of the many compensation provided over a period of time to the family of deceased workers. These families are not victims of industrial disasters. The programme was also attended by Mohammed Nasir, Vice President (Finance), BGMEA, Atiqul Hassan and Ashiqur Rahman, Directors of the governing body of the trade association. Bangladesh government had also stated in the past that vested quarters are out to tarnish the image of Bangladesh’s biggest export sector the readymade garments segment. The administration too is keeping a close watch on NGOs that are working in the apparel sector, to see if they are inciting unrest in any way.

Bangladesh has posted growth in export earnings for the third consecutive month, in December, a feat credited to political stability and the rise in value of US Dollar against Taka. In the first half of the current 2017-18 fiscal year, the country earned $17.91 billion with a year-on-year rise of 7.15 per cent and crossing the target by .05 percentage points.

In December, export earnings grew over $3.35 billion with an 8.42 per cent year-on-year rise, but missed the target of $3.41 billion by 1.84 per cent. Mohammed Farashuddin, former governor of the Bangladesh Bank, stated year 2017 was good for Bangladesh in all aspects. He gave credit for the rise in export earnings to the devaluation of taka against the dollar.

The rise in exports in July and August helped Bangladesh post a 7.23 per cent growth in the first quarter of 2017-18 fiscal year, but missed the target by around 3 per cent, dragged down by a 10 per cent year-on-year slump in September. In the first half of the current financial year, readymade garment manufacturing contributed to around 82.5 per cent of total exports, with a 7.75 per cent year-on-year growth.

Bangladesh Garment Manufacturers and Exporters Association’s says exports dropped in September because factories were closed for eight to 10 days during the Eid-ul-Azha. Exports in the last financial year amounted to $34.59 billion, which was 3.39 per cent more than the previous year, but against a target of $37 billion.

"The McKinsey Global Fashion Index estimates the global fashion industry sales to grow by 3.5 to 4.5 per cent in 2018. But this growth is not spread evenly across all regions or segments. Economic growth is shifting from mature regions in the West to emerging markets in the South and East. As per the McKinsey FashionScope, by 2018 over half of apparel and footwear sales will originate outside of Europe and North America. Rapidly growing cities in emerging markets are particularly important growth centres for the fashion industry."

The McKinsey Global Fashion Index estimates the global fashion industry sales to grow by 3.5 to 4.5 per cent in 2018. But this growth is not spread evenly across all regions or segments. Economic growth is shifting from mature regions in the West to emerging markets in the South and East. As per the McKinsey FashionScope, by 2018 over half of apparel and footwear sales will originate outside of Europe and North America. Rapidly growing cities in emerging markets are particularly important growth centres for the fashion industry.

Adoption of disruptive technologies such as advanced robotics, mobile internet, advanced analytics, virtual- and augmented reality and artificial intelligence is accelerating, with the potential to disrupt entire industries, including fashion.

Online sales of apparel and footwear is projected to grow rapidly not the least in emerging markets. On average, consumers in Southeast Asia spend about eight hours a day online; from social media to video streaming and shopping amongst other things.

With information and the ease of comparison at their fingertips consumers are becoming less brand loyal: among millennials, two-thirds say they are willing to switch brands for a discount of 30 per cent or more.

Top 10 Trends: 1. Predictably unpredictable: Geopolitical turmoil, economic uncertainty and unpredictability are the new normal. 2. Globalisation reboot: A new phase of globalisation characterised by the exponential growth of cross-border bandwidth, connectivity and digital data flows will alter the global playing field and give certain players a competitive edge. 3. Asian trailblazers: Asian players will assert their power and leadership even more through pioneering innovations and global-scale investment and expansion. 4. Getting personal: Personalisation will become more important to the customer. 5. Platforms first: Consumers will increasingly look to online platforms as the first point of search, attracted by their convenience, relevance and breadth of offering. 6. Mobile obsessed: With an overabundance of mobile payment solutions already available globally, consumers will expect fashion companies to cater to increasingly convenient mobile transactions. 7. AI gets real: Leading innovators will reveal the possibilities of artificial intelligence across all parts of the fashion value chain, blurring the line between technology and creativity. 8. Sustainability credibility: More fashion brands will plan for recyclability and genuine ethical upgrades. 9. Off-price deception: As Europe and Asia get hooked on the myth of an off-price ‘panacea,’ the fashion industry could be put at risk of margin erosion. 10. Startup thinking: A growing number of fashion companies will aim to emulate the qualities of startups such as agility, collaboration and openness along with new ways of working, new kinds of partnerships and new investment models.

US company Boardriders, which owns the Quicksilver brand, is acquiring Australian rival Billabong, merging two major names in sportswear. The combination of Boardriders and Billabong will create the world's leading action sports company.

Both companies, which are well-established in the world of skiing, surfing and skateboarding, will together have 630 retail stores in 28 countries and over 7,000 retail customers in 110 countries. Boardriders is controlled by the Oaktree Capital investment firm, which already owns 19 per cent of Billabong.

Under the deal it will buy the remaining shares of Billabong at one Australian dollar per share, a premium of 28 per cent over the stock price on November 30 when the buyout bid was unveiled. Billabong's board members unanimously recommended the deal to shareholders and the firm's shares were 2.60 per cent higher at 98.5 Australian cents (77 US cents) in afternoon trade in Sydney.